Why Do I Have To File Form 8862

Why Do I Have To File Form 8862 - You may be asked to. Taxpayers complete form 8862 and attach it to their tax return if: You must file form 8862. Your eic or another listed credit was reduced or disallowed on a tax return for a year. You only need to file form 8862 if both of the following apply: You must attach the applicable schedules and forms to your return for each credit you claim. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),.

Taxpayers complete form 8862 and attach it to their tax return if: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You must attach the applicable schedules and forms to your return for each credit you claim. Your eic or another listed credit was reduced or disallowed on a tax return for a year. You may be asked to. You only need to file form 8862 if both of the following apply: You must file form 8862.

Your eic or another listed credit was reduced or disallowed on a tax return for a year. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You may be asked to. You must attach the applicable schedules and forms to your return for each credit you claim. Taxpayers complete form 8862 and attach it to their tax return if: You only need to file form 8862 if both of the following apply: You must file form 8862.

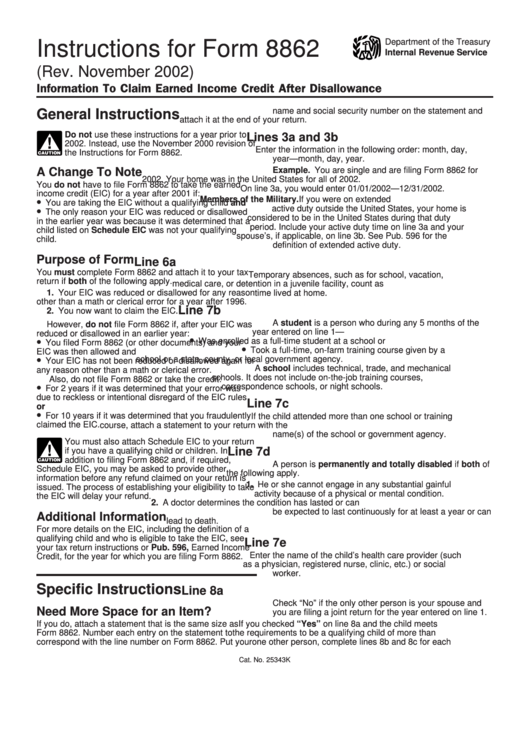

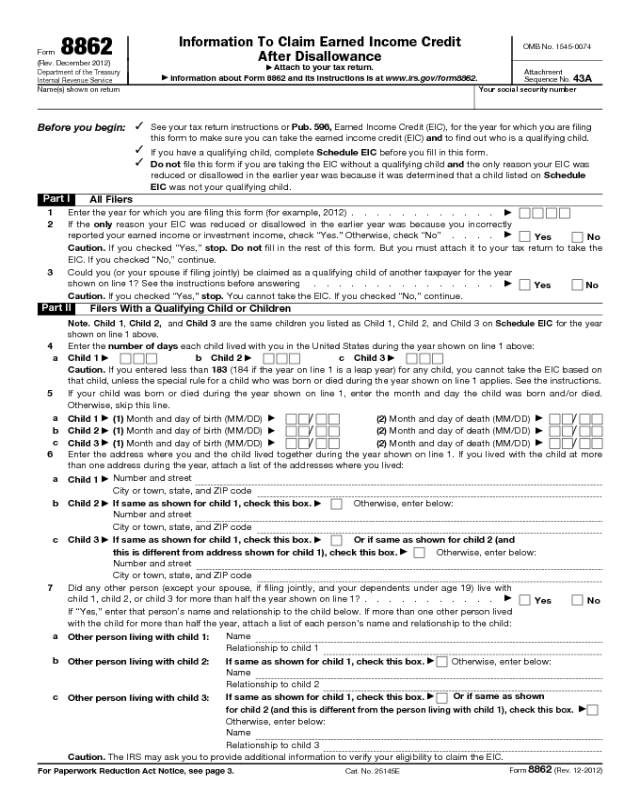

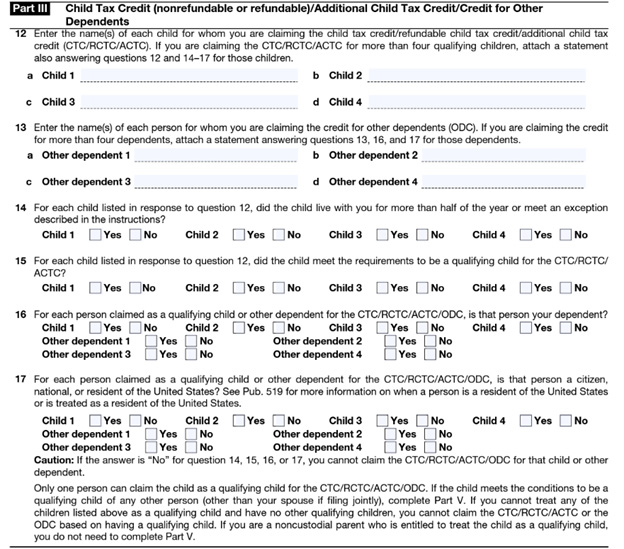

Instructions For Form 8862 Information To Claim Earned Credit

Taxpayers complete form 8862 and attach it to their tax return if: You must file form 8862. You only need to file form 8862 if both of the following apply: You must attach the applicable schedules and forms to your return for each credit you claim. You may be asked to.

IRS Form 8862 Diagram Quizlet

You must file form 8862. Taxpayers complete form 8862 and attach it to their tax return if: You only need to file form 8862 if both of the following apply: You must attach the applicable schedules and forms to your return for each credit you claim. Your eic or another listed credit was reduced or disallowed on a tax return.

What Is An 8862 Tax Form? SuperMoney

You must attach the applicable schedules and forms to your return for each credit you claim. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You must file form 8862. Taxpayers complete form 8862 and attach it to their tax return if: You may be asked to.

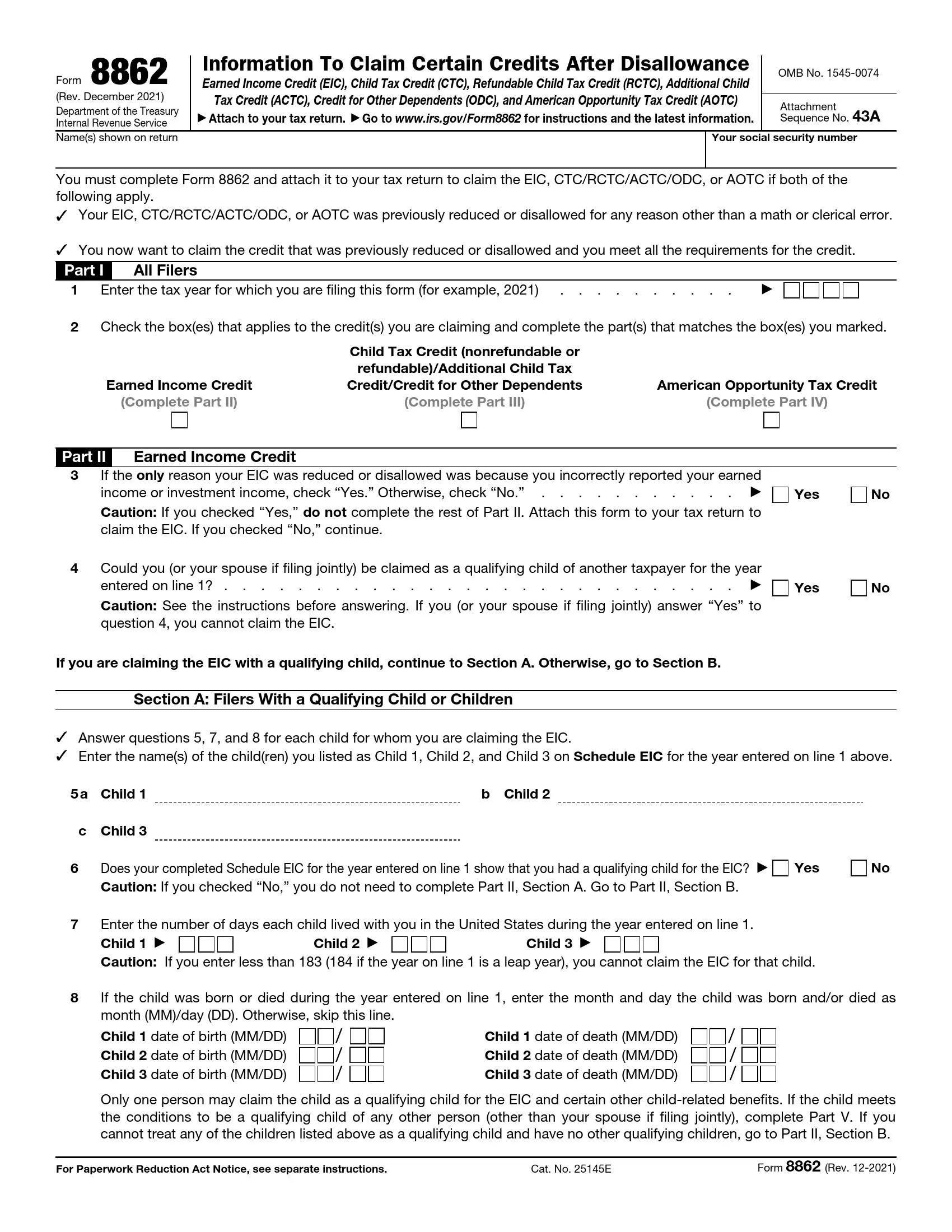

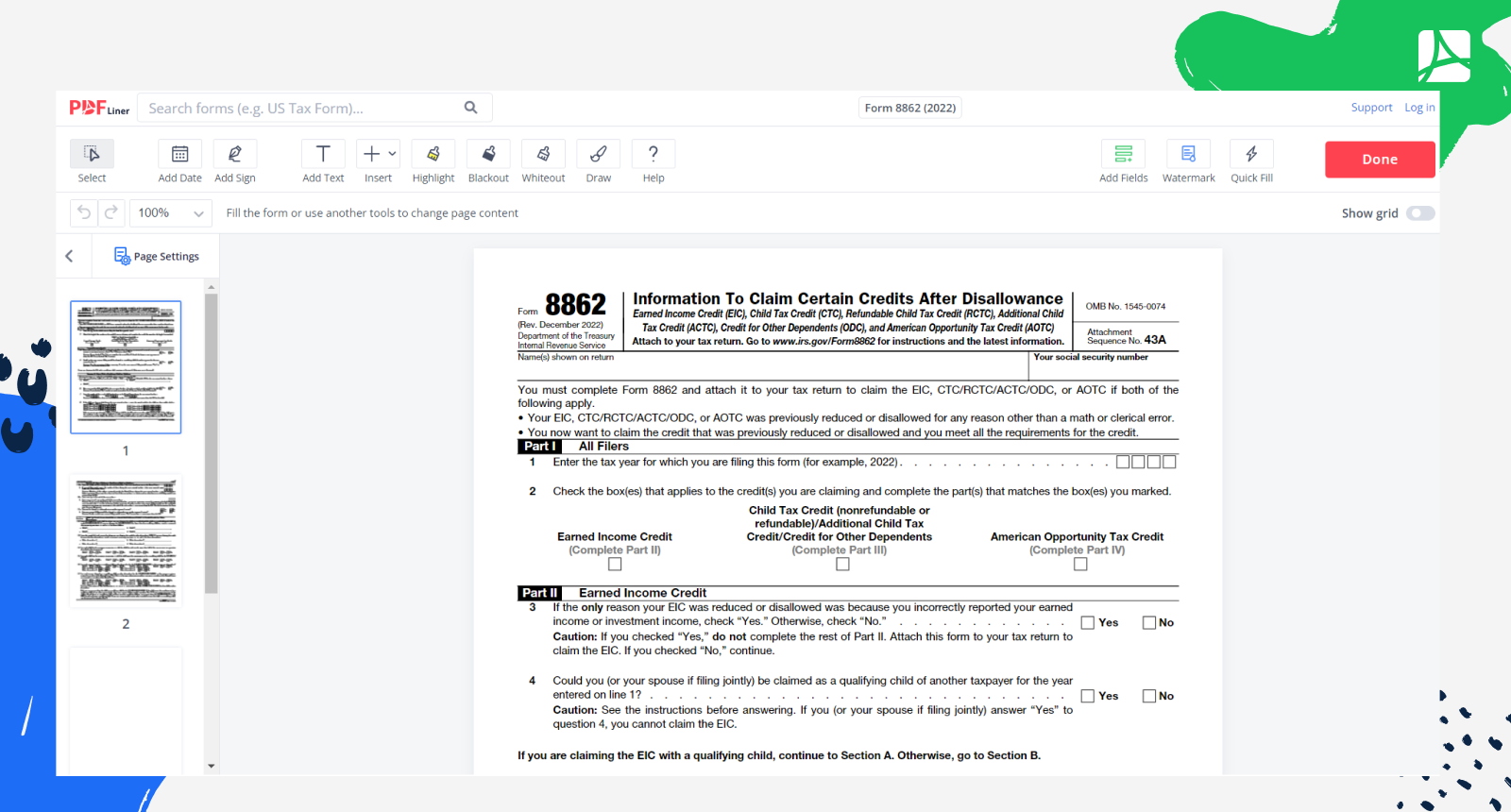

IRS Form 8862 ≡ Fill Out Printable PDF Forms Online

Your eic or another listed credit was reduced or disallowed on a tax return for a year. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You may be asked to. You must file form 8862. You must attach the applicable schedules and forms to your return for each credit you claim.

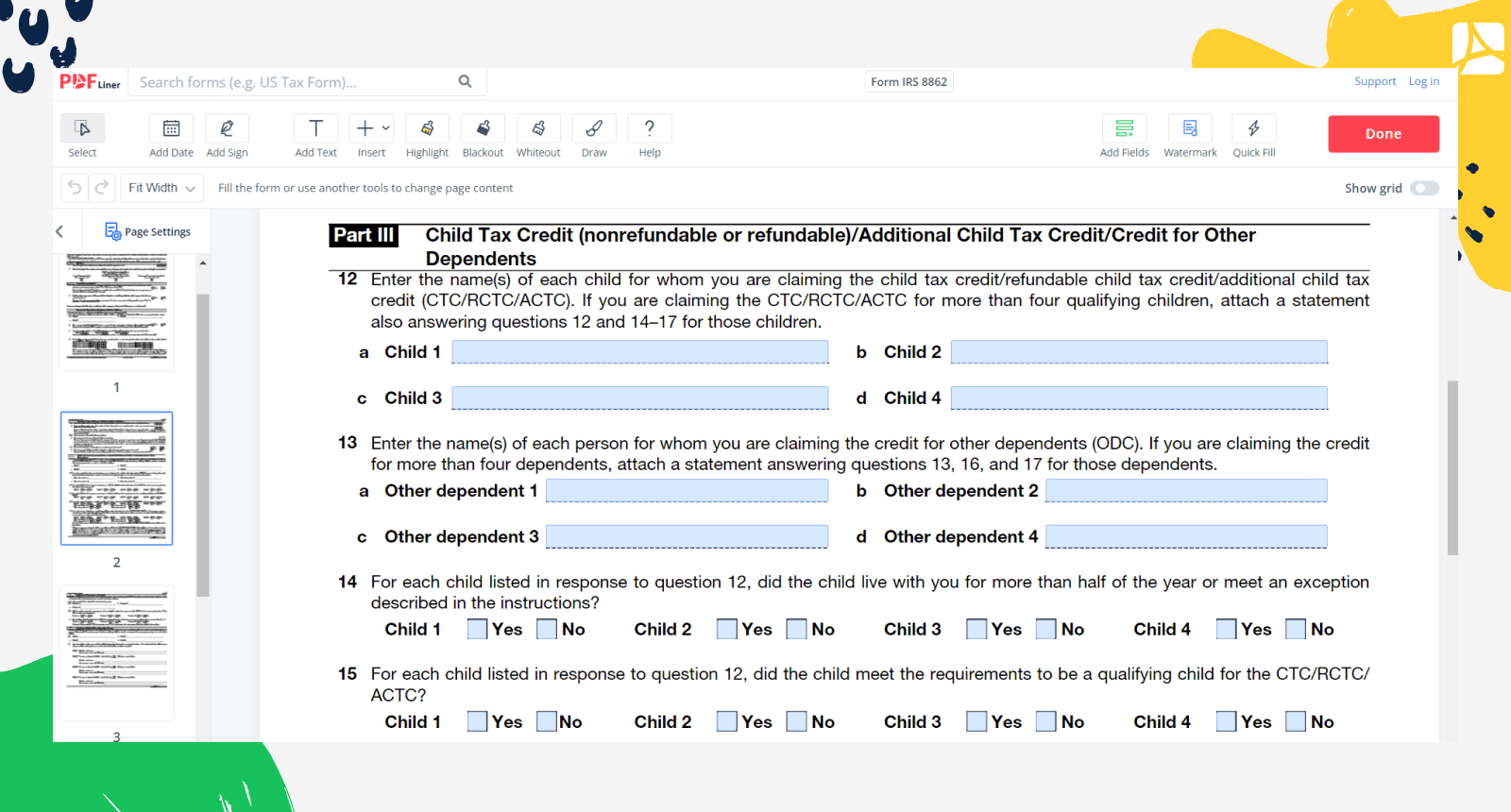

Form IRS 8862 Printable and Fillable forms online — PDFliner

You must file form 8862. Taxpayers complete form 8862 and attach it to their tax return if: You only need to file form 8862 if both of the following apply: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You may be asked to.

How And When To File Form 8862 I Have Attorney Working On Last Years Taxes

You may be asked to. Taxpayers complete form 8862 and attach it to their tax return if: You only need to file form 8862 if both of the following apply: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Your eic or another listed credit was reduced or disallowed on a tax return for a year.

Form 8862 IRS Form 8862 PDF blank, sign forms online — PDFliner

You must file form 8862. Taxpayers complete form 8862 and attach it to their tax return if: You only need to file form 8862 if both of the following apply: You may be asked to. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),.

Fillable Form 8862 Printable Forms Free Online

You must attach the applicable schedules and forms to your return for each credit you claim. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You may be asked to. You must file form 8862. Your eic or another listed credit was reduced or disallowed on a tax return for a year.

How to Complete IRS Form 8862

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Taxpayers complete form 8862 and attach it to their tax return if: Your eic or another listed credit was reduced or disallowed on a tax return for a year. You may be asked to. You only need to file form 8862 if both of the following apply:

What Is IRS Form 8862?

You only need to file form 8862 if both of the following apply: You must file form 8862. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Taxpayers complete form 8862 and attach it to their tax return if: You must attach the applicable schedules and forms to your return for each credit you claim.

You Must Attach The Applicable Schedules And Forms To Your Return For Each Credit You Claim.

Taxpayers complete form 8862 and attach it to their tax return if: You may be asked to. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. You must file form 8862.

Your Eic Or Another Listed Credit Was Reduced Or Disallowed On A Tax Return For A Year.

You only need to file form 8862 if both of the following apply:

:max_bytes(150000):strip_icc()/2022-01-1111_48_02-Form8862Rev.December2021-f23f0eab085a467eb521f33bd3758904.jpg)