Where Do I Mail Form 1310 To The Irs

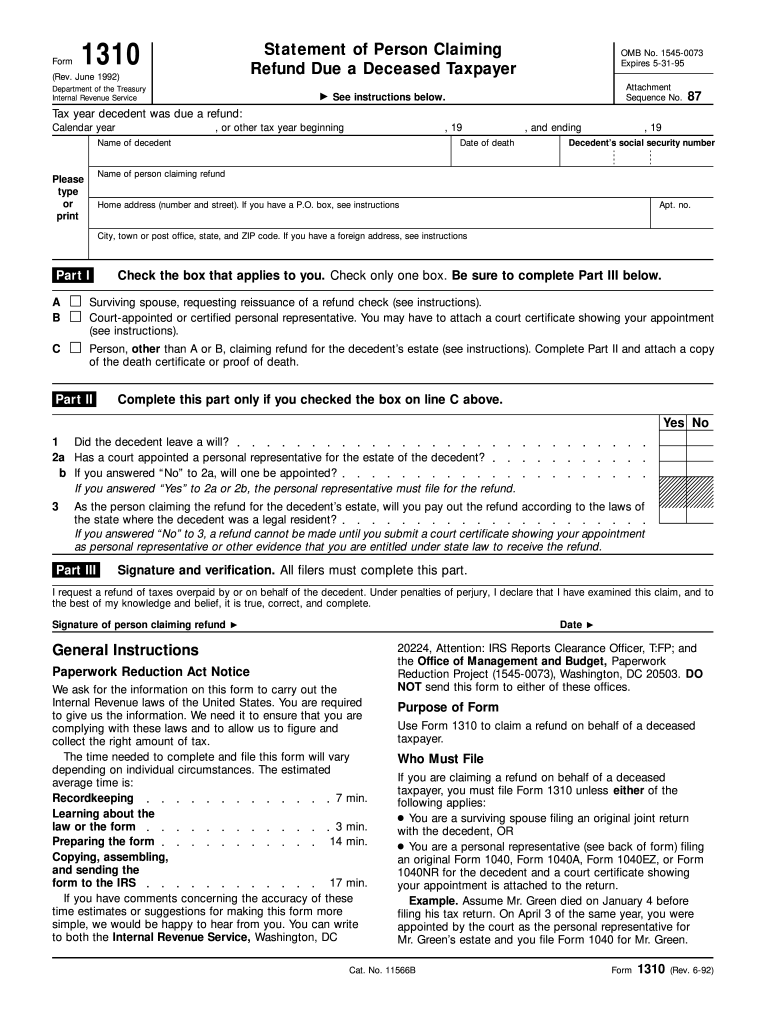

Where Do I Mail Form 1310 To The Irs - Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your.

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your.

Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.

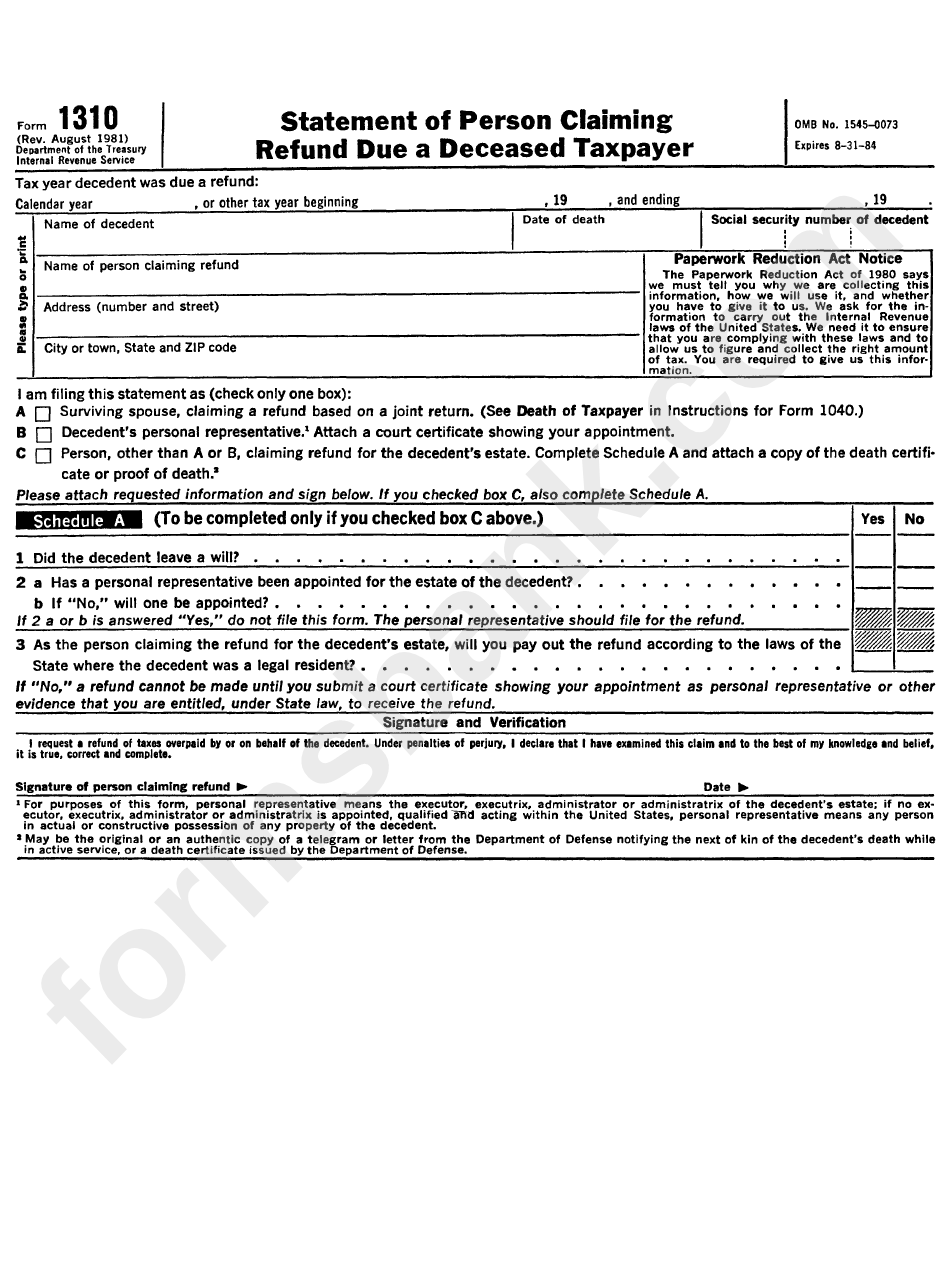

Irs Form 1310 Printable Printable Forms Free Online

Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent.

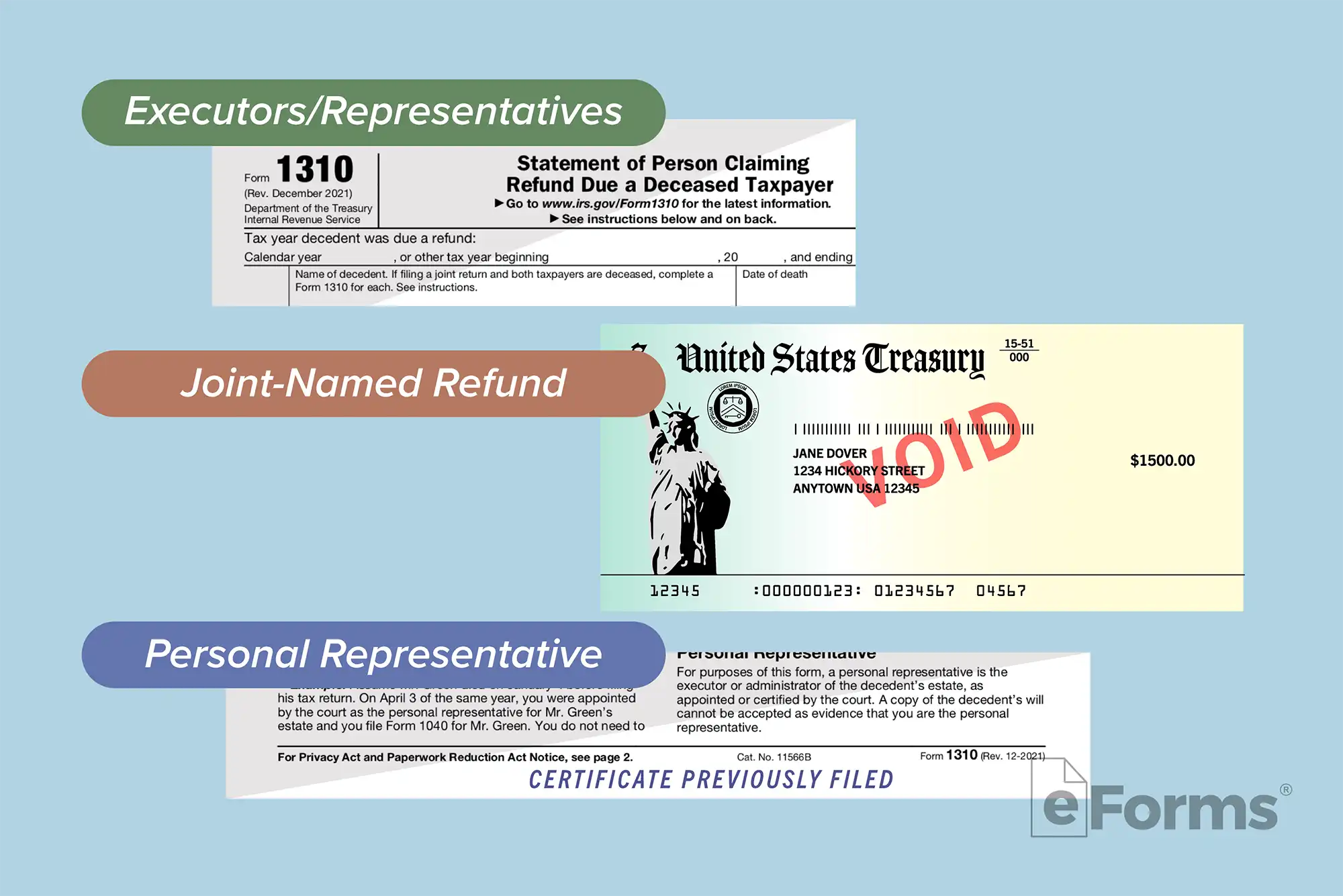

How to File IRS Form 1310 Refund Due a Deceased Taxpayer

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on.

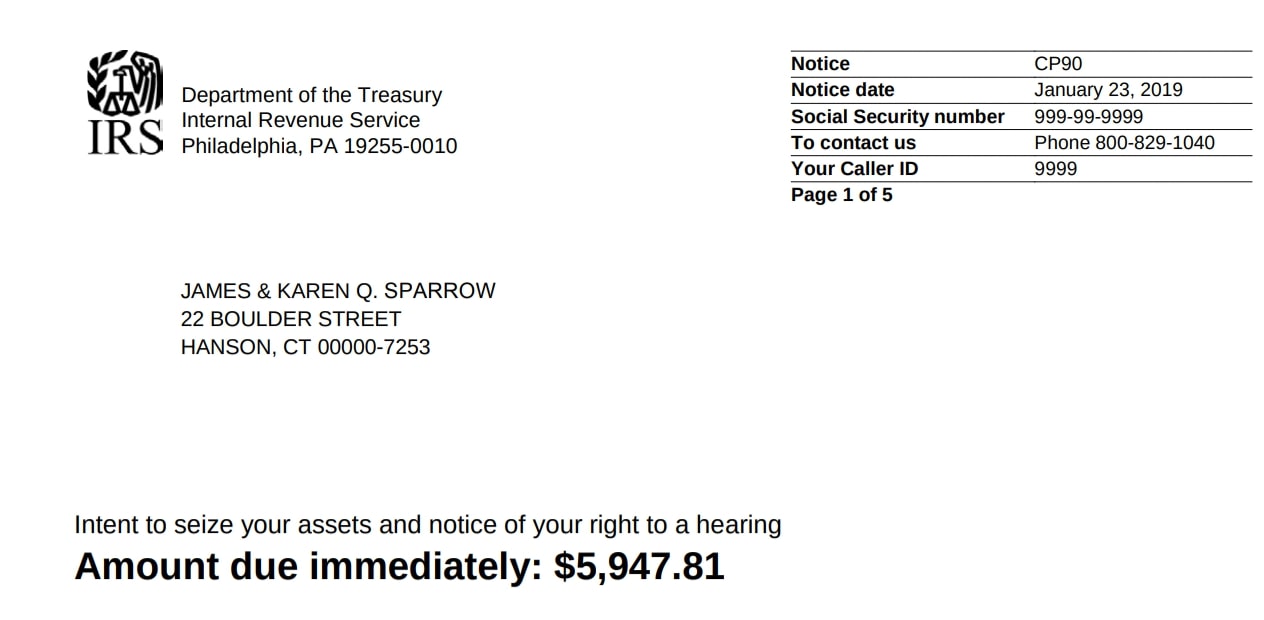

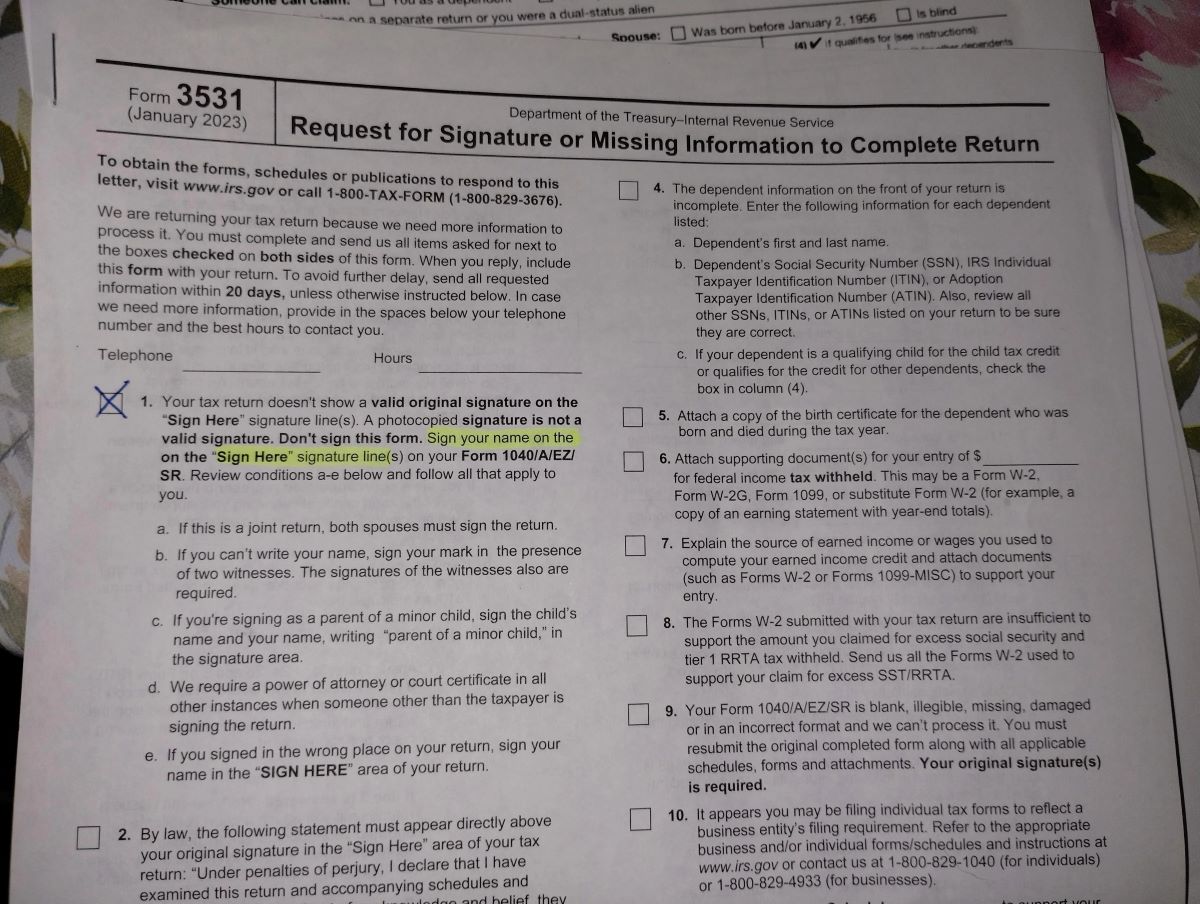

IRS Certified Mail Understanding Your Letter And Responding

If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your. Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent.

IRS Form 1310 Claiming a Refund for a Deceased Person YouTube

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your. Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the.

Irs Form 1310 Printable

Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on.

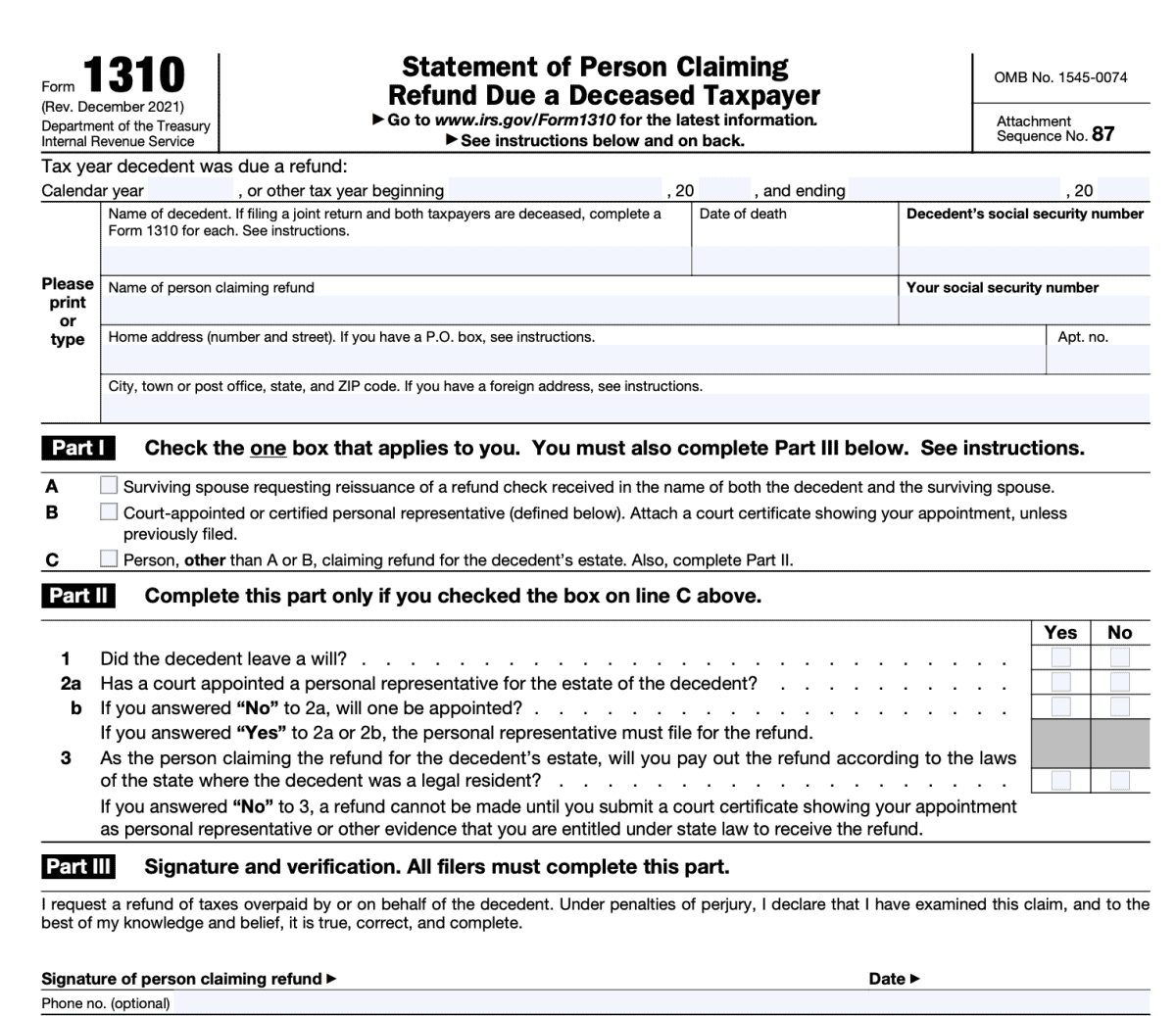

20212024 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your. Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the.

Where To Mail IRS Form 3531 LiveWell

Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent.

1310 Tax Exempt Form

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on.

Free IRS Form 1310 PDF eForms

If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your. Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the beneficiary. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent.

Claiming a Deceased Taxpayer’s Refund IRS Form 1310 YouTube

If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Attaching form 1310 notifies the irs that the taxpayer has died and directs the irs to send the refund to the.

Attaching Form 1310 Notifies The Irs That The Taxpayer Has Died And Directs The Irs To Send The Refund To The Beneficiary.

If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the address shown on your. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.