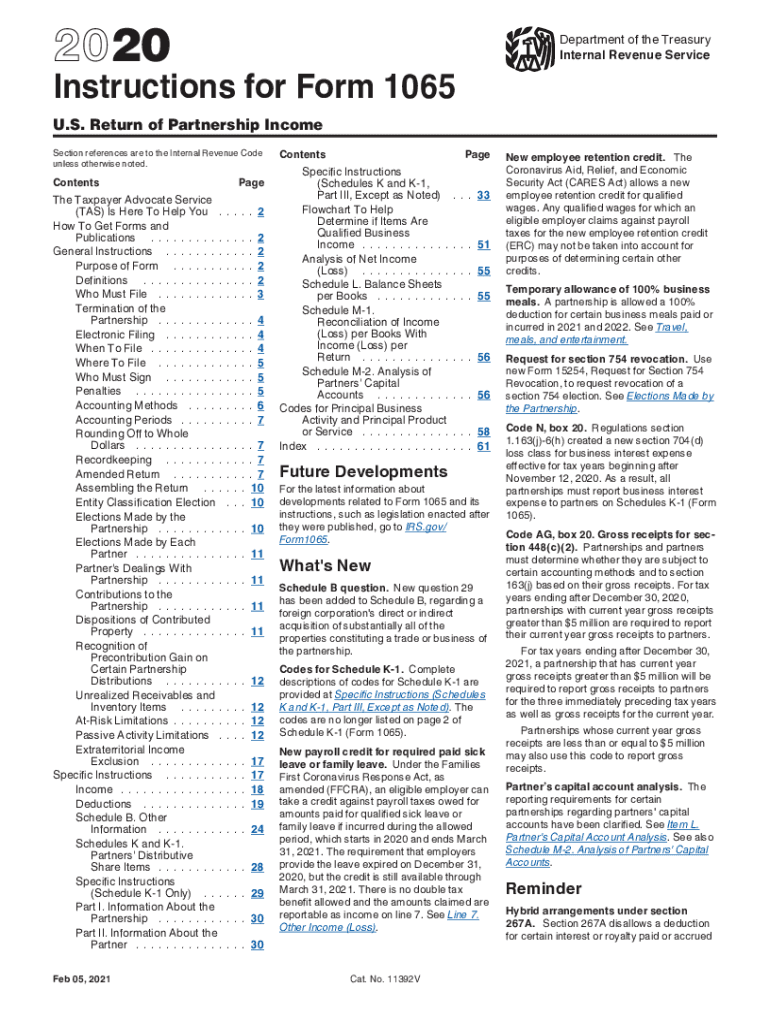

When Are Form 1065 Due

When Are Form 1065 Due - The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. You have 10 calendar days after the. The due date for form 1065 is the.

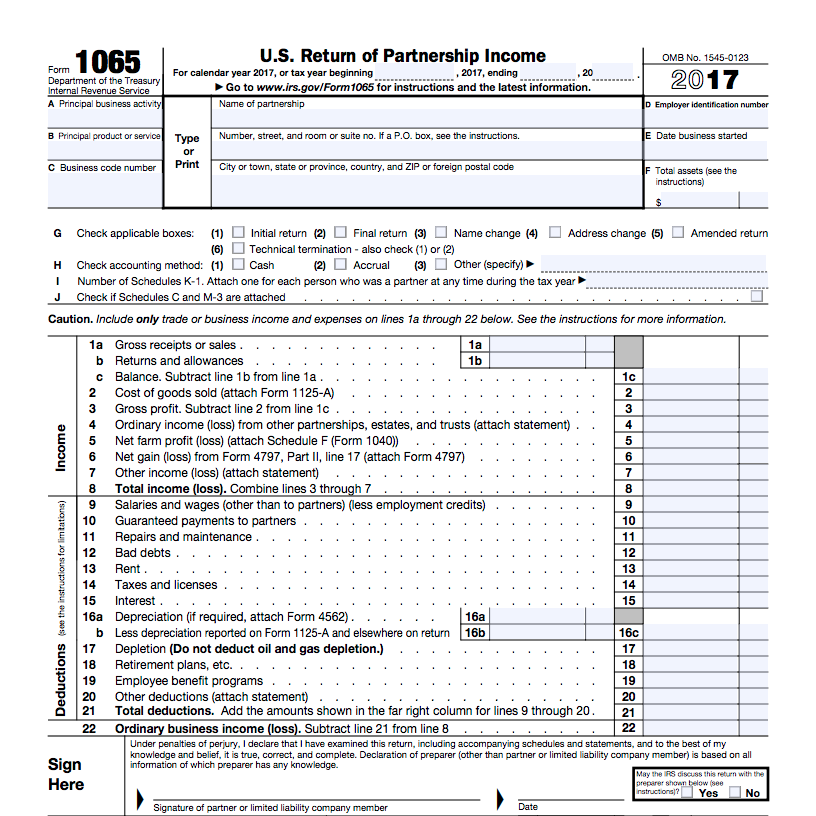

Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. You have 10 calendar days after the. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. The due date for form 1065 is the.

Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. The due date for form 1065 is the. You have 10 calendar days after the. Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc.

S Corp and Partnership Due Date Reminder U of I Tax School

Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. The due date for form 1065 is the. The deadline for filing form 1065.

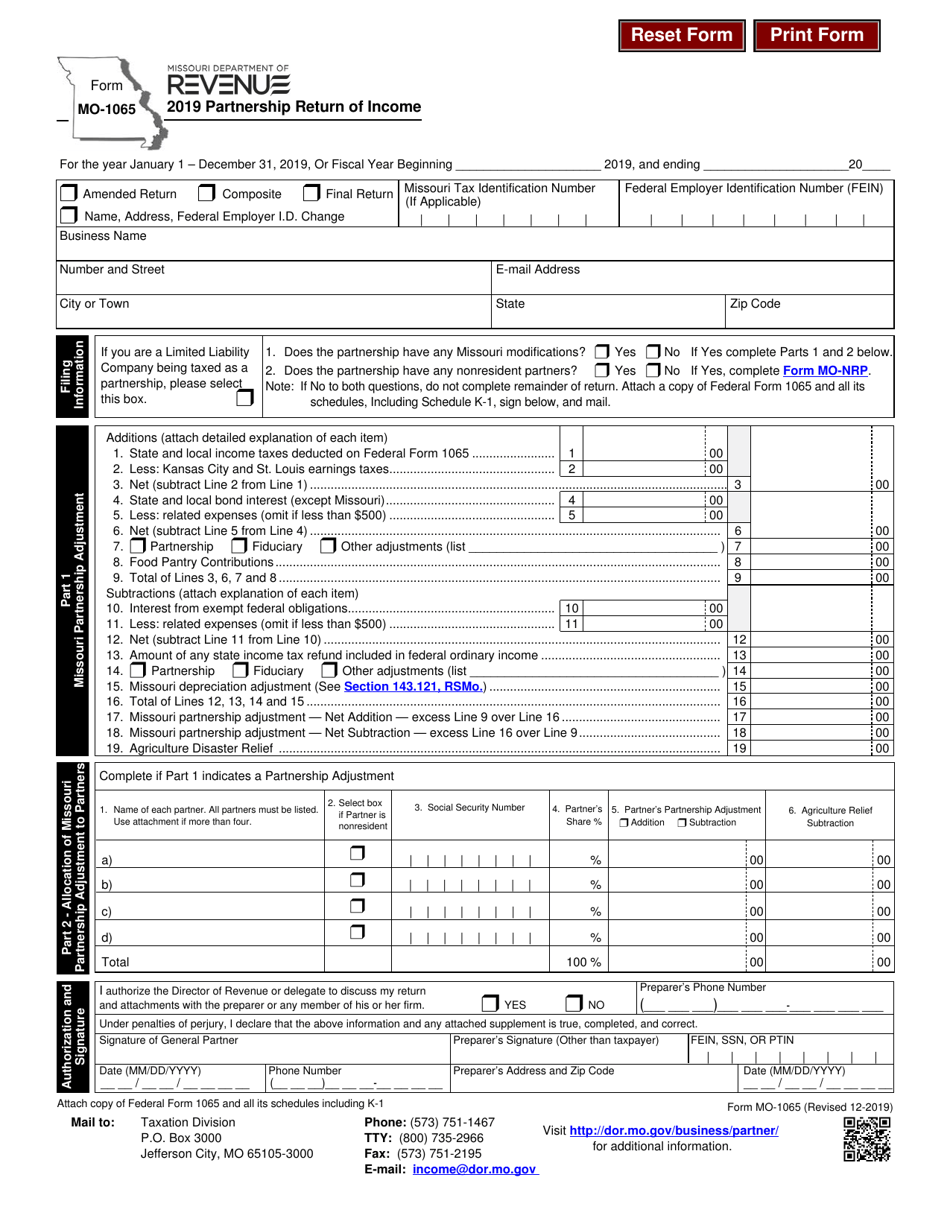

Form MO1065 2019 Fill Out, Sign Online and Download Fillable PDF

Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. You have 10 calendar days after the. The due date for form 1065 is.

Rubber Hitting The Road On New Partnership Audit Regime Your Tax

The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. The due date for form 1065 is the. You.

Docsumo

You have 10 calendar days after the. The due date for form 1065 is the. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended.

Form 1065 Due Date 2024 Matti Shelley

The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. The due date for form 1065 is the. Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. You have 10 calendar days after the. Generally, a domestic partnership must file.

Form 1065 Preparer US partnership Tax Associate PWC WFH Cbsi

Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. The due date for form 1065 is the. You have 10 calendar days after the. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. Generally, a domestic partnership must file.

Form 1065X AR Fill Exactly for Your State

The due date for form 1065 is the. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. You have 10 calendar days after.

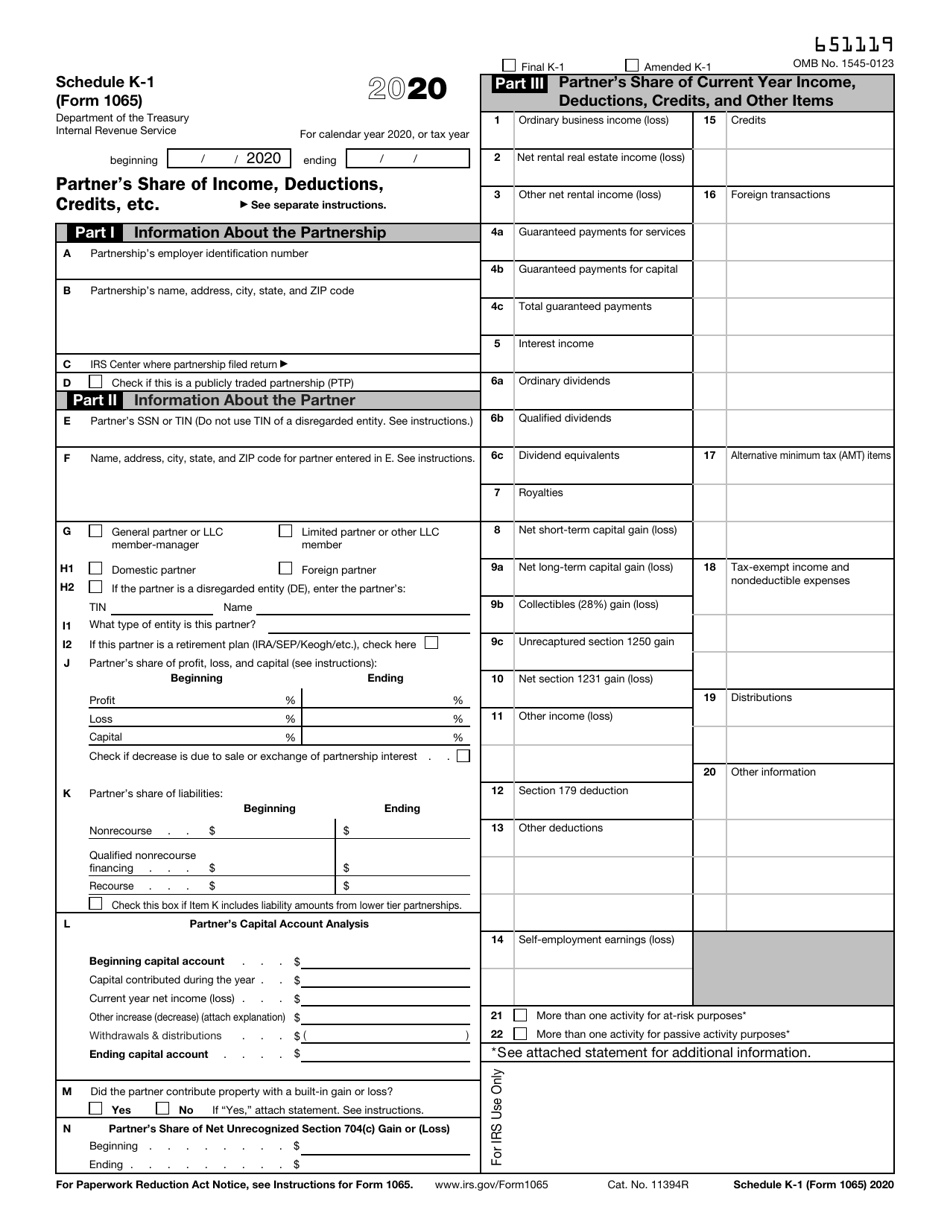

1065 K 1 Instructions 20202024 Form Fill Out and Sign Printable PDF

The due date for form 1065 is the. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. You have 10 calendar days after.

Free Fillable Form 1065 Printable Forms Free Online

You have 10 calendar days after the. The due date for form 1065 is the. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended.

form 1065 schedule d 2015 pdf

You have 10 calendar days after the. The due date for form 1065 is the. Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. Generally, a domestic partnership must file.

The Due Date For Form 1065 Is The.

Form 1065 is an information return for partnerships to report their income, gains, losses, deductions, credits, etc. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. You have 10 calendar days after the. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of.