What Were Q4 Profits For 2018 Of Tsn

What Were Q4 Profits For 2018 Of Tsn - For the fiscal year, beef produced just. Detailed annual and quarterly income statement for tyson foods (tsn). (ap) — tyson foods inc. Depreciation and amortization were $943 million in fiscal 2018. Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. See many years of revenue, expenses and profits or losses. We repurchased approximately 5.9 million shares for $427 million.

We repurchased approximately 5.9 million shares for $427 million. Depreciation and amortization were $943 million in fiscal 2018. Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. For the fiscal year, beef produced just. See many years of revenue, expenses and profits or losses. Detailed annual and quarterly income statement for tyson foods (tsn). (ap) — tyson foods inc.

Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. Depreciation and amortization were $943 million in fiscal 2018. We repurchased approximately 5.9 million shares for $427 million. For the fiscal year, beef produced just. See many years of revenue, expenses and profits or losses. Detailed annual and quarterly income statement for tyson foods (tsn). (ap) — tyson foods inc.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

(ap) — tyson foods inc. Depreciation and amortization were $943 million in fiscal 2018. Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. We repurchased approximately 5.9 million shares for $427 million. Detailed annual and quarterly income statement for tyson foods (tsn).

NFL RedZone Available for TSN Viewers

(ap) — tyson foods inc. See many years of revenue, expenses and profits or losses. Detailed annual and quarterly income statement for tyson foods (tsn). Depreciation and amortization were $943 million in fiscal 2018. Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%.

Contáctanos TSN Soluciones Tecnologicas

(ap) — tyson foods inc. Depreciation and amortization were $943 million in fiscal 2018. For the fiscal year, beef produced just. See many years of revenue, expenses and profits or losses. We repurchased approximately 5.9 million shares for $427 million.

Tyson Foods (TSN) Q4 2022 Earnings Conference Call YouTube

(ap) — tyson foods inc. We repurchased approximately 5.9 million shares for $427 million. See many years of revenue, expenses and profits or losses. Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. Detailed annual and quarterly income statement for tyson foods (tsn).

Links úteis Agência TSN

For the fiscal year, beef produced just. See many years of revenue, expenses and profits or losses. Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. Depreciation and amortization were $943 million in fiscal 2018. Detailed annual and quarterly income statement for tyson foods (tsn).

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

We repurchased approximately 5.9 million shares for $427 million. See many years of revenue, expenses and profits or losses. (ap) — tyson foods inc. Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. Depreciation and amortization were $943 million in fiscal 2018.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

We repurchased approximately 5.9 million shares for $427 million. Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. See many years of revenue, expenses and profits or losses. Depreciation and amortization were $943 million in fiscal 2018. For the fiscal year, beef produced just.

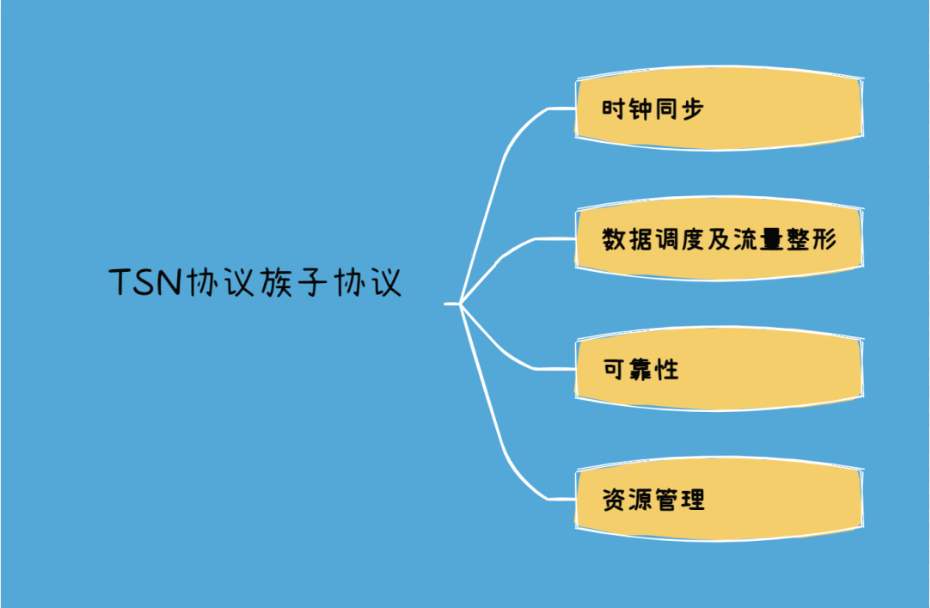

TSN的协议和标准不念博客

We repurchased approximately 5.9 million shares for $427 million. Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. See many years of revenue, expenses and profits or losses. Depreciation and amortization were $943 million in fiscal 2018. Detailed annual and quarterly income statement for tyson foods (tsn).

Corporate profits were down slightly in Q2 Kevin Drum

Compared to q4 of last year, sales volumes increased 3.4% while average price decreased less than 1%. Depreciation and amortization were $943 million in fiscal 2018. We repurchased approximately 5.9 million shares for $427 million. See many years of revenue, expenses and profits or losses. (ap) — tyson foods inc.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Detailed annual and quarterly income statement for tyson foods (tsn). (ap) — tyson foods inc. For the fiscal year, beef produced just. We repurchased approximately 5.9 million shares for $427 million. Depreciation and amortization were $943 million in fiscal 2018.

See Many Years Of Revenue, Expenses And Profits Or Losses.

For the fiscal year, beef produced just. Detailed annual and quarterly income statement for tyson foods (tsn). (ap) — tyson foods inc. We repurchased approximately 5.9 million shares for $427 million.

Compared To Q4 Of Last Year, Sales Volumes Increased 3.4% While Average Price Decreased Less Than 1%.

Depreciation and amortization were $943 million in fiscal 2018.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)