What Tax Form Does A Single Member Llc File

What Tax Form Does A Single Member Llc File - A domestic smllc, by default, is a disregarded. If the llc is a corporation,. Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc.

Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc. If the llc is a corporation,. A domestic smllc, by default, is a disregarded.

If the llc is a corporation,. A domestic smllc, by default, is a disregarded. Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc.

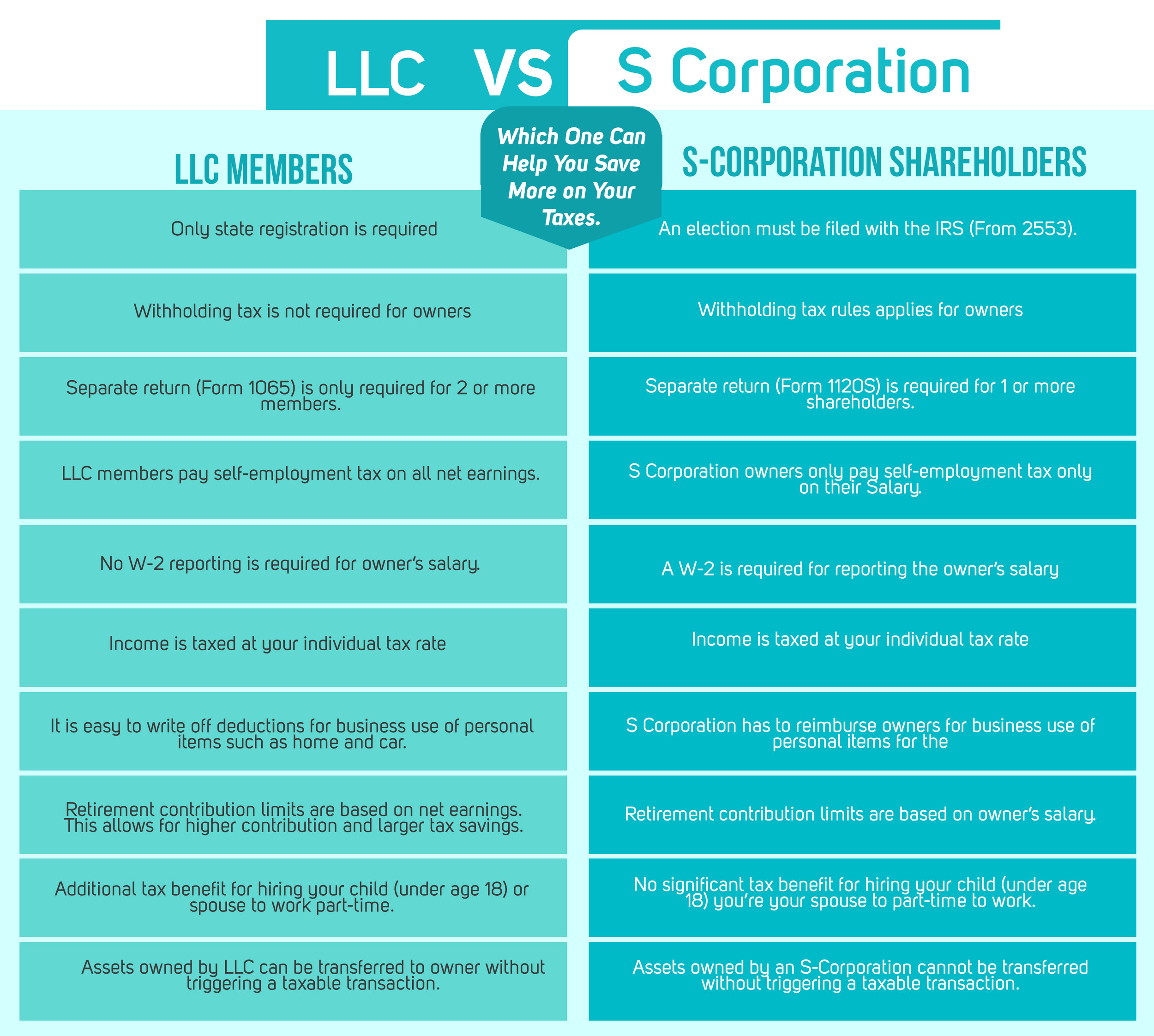

LLC single member tax rate everything you need to know. Techupstar

If the llc is a corporation,. Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc. A domestic smllc, by default, is a disregarded.

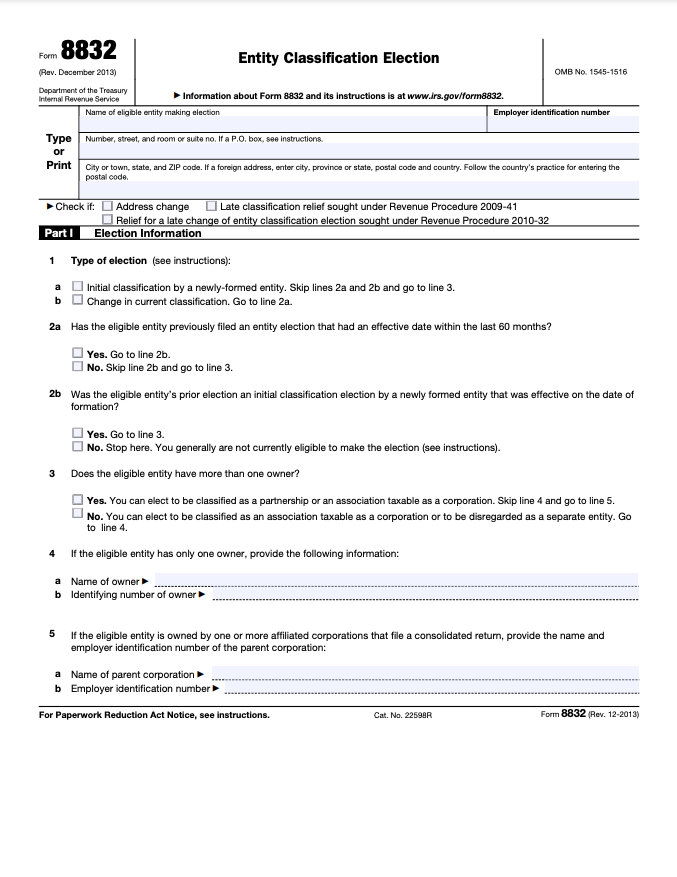

Form 8832 and Changing Your LLC Tax Status Bench Accounting

A domestic smllc, by default, is a disregarded. If the llc is a corporation,. Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc.

Llc Tax Filing Deadline 2024 Nanni Jacquelin

Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc. A domestic smllc, by default, is a disregarded. If the llc is a corporation,.

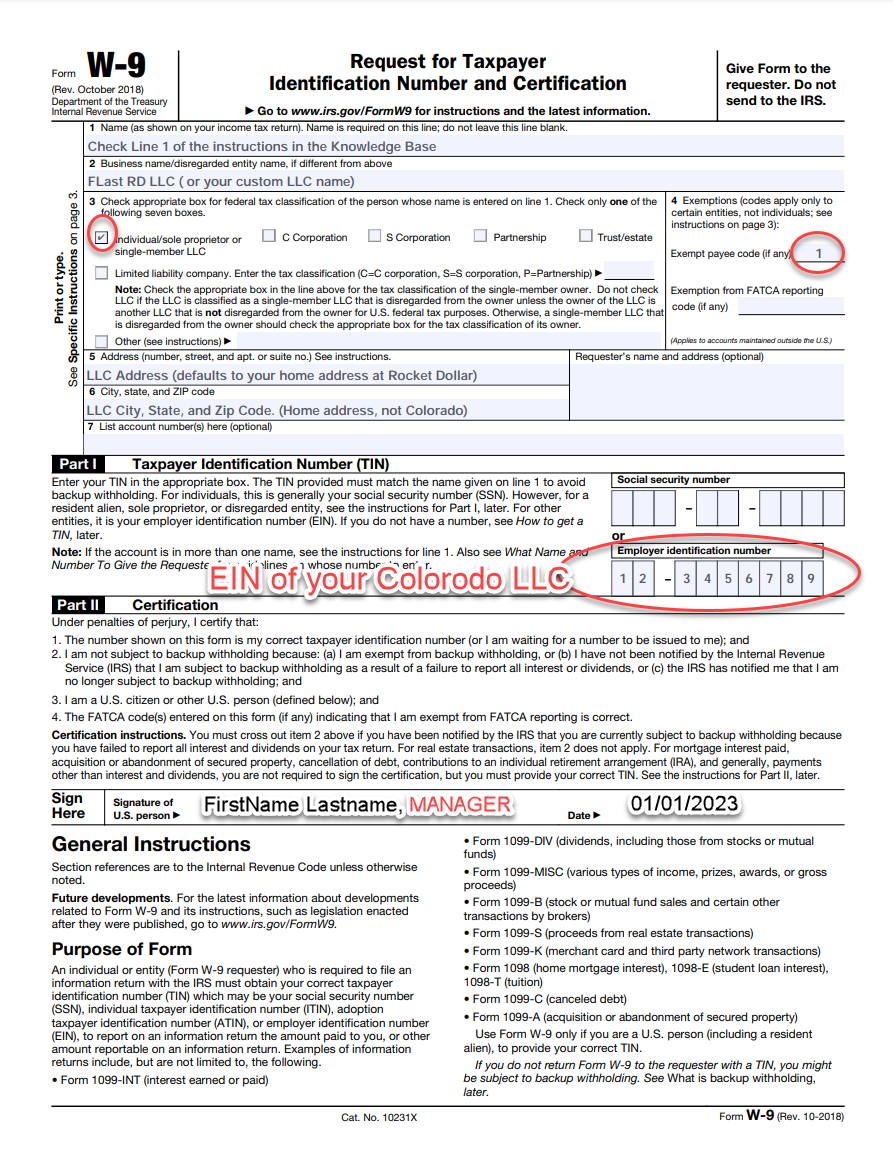

W9 Form 2024 Massachusetts Wally Jordanna

If the llc is a corporation,. A domestic smllc, by default, is a disregarded. Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc.

eskesenconway425278 FlightGear JP Wiki

Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc. A domestic smllc, by default, is a disregarded. If the llc is a corporation,.

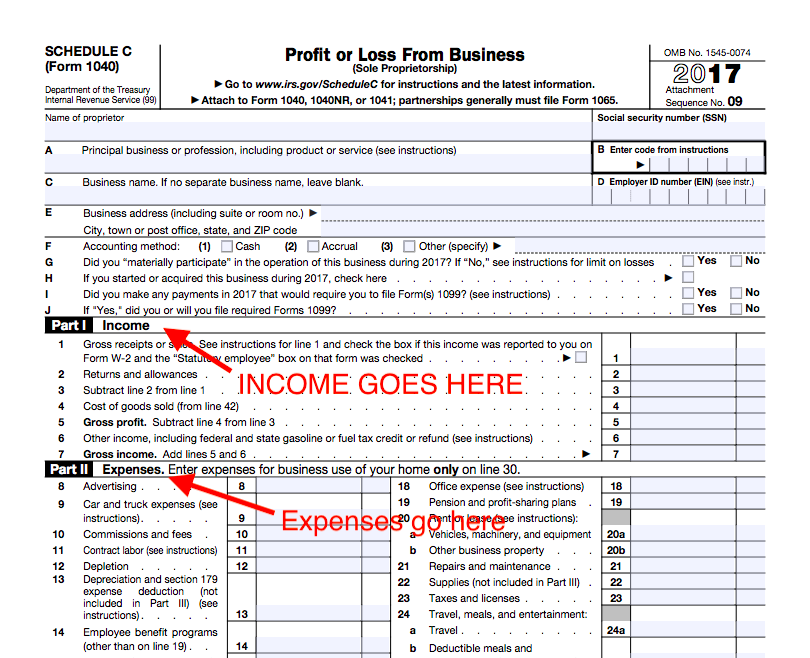

How to File Taxes as a Singlemember LLC or Sole Proprietor

Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc. If the llc is a corporation,. A domestic smllc, by default, is a disregarded.

Tax Extension Application for Individuals and Business Taxpayers

If the llc is a corporation,. A domestic smllc, by default, is a disregarded. Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc.

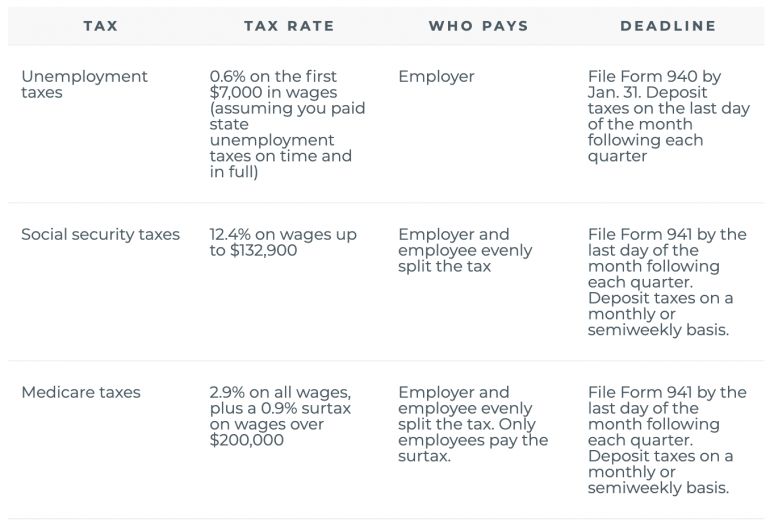

How to file federal taxes for small business golfgera

If the llc is a corporation,. Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc. A domestic smllc, by default, is a disregarded.

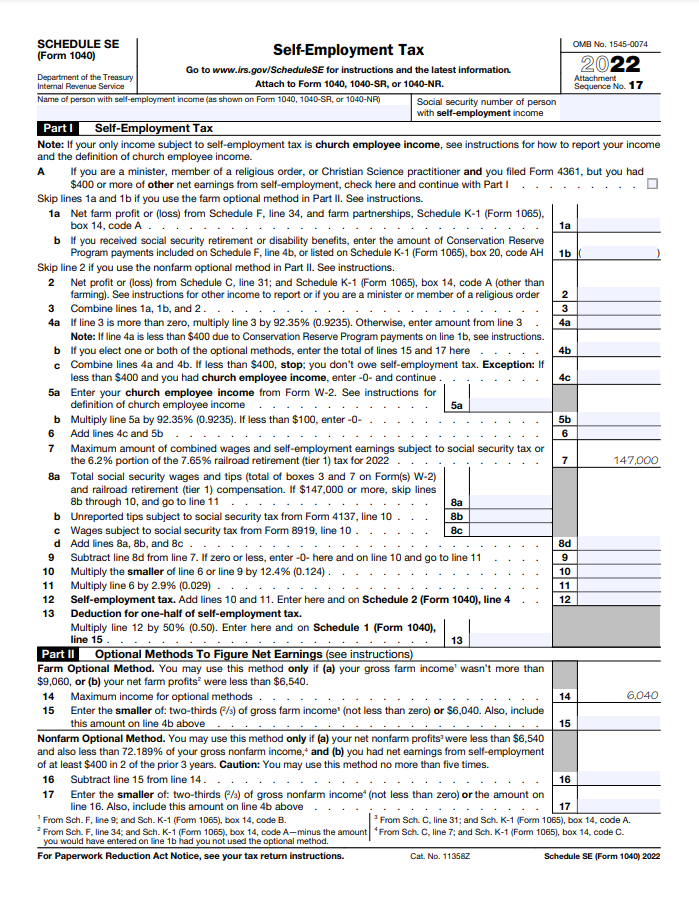

Sole Proprietorship Taxes An Overview and Walkthrough Bench Accounting

A domestic smllc, by default, is a disregarded. If the llc is a corporation,. Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc.

A Domestic Smllc, By Default, Is A Disregarded.

Learn how an llc is classified for federal tax purposes based on the number of members and the election made by the llc. If the llc is a corporation,.