What Is Irs Form 2439

What Is Irs Form 2439 - However, a mutual fund might keep some of its capital gains and pay a tax on them. When this happens, the mutual fund company will send you. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right.

When this happens, the mutual fund company will send you. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. However, a mutual fund might keep some of its capital gains and pay a tax on them.

However, a mutual fund might keep some of its capital gains and pay a tax on them. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. When this happens, the mutual fund company will send you.

Irs Form 53 Pdf Order Sales gbutaganskij.ru

However, a mutual fund might keep some of its capital gains and pay a tax on them. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. When this happens, the mutual fund company will send you.

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

When this happens, the mutual fund company will send you. However, a mutual fund might keep some of its capital gains and pay a tax on them. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right.

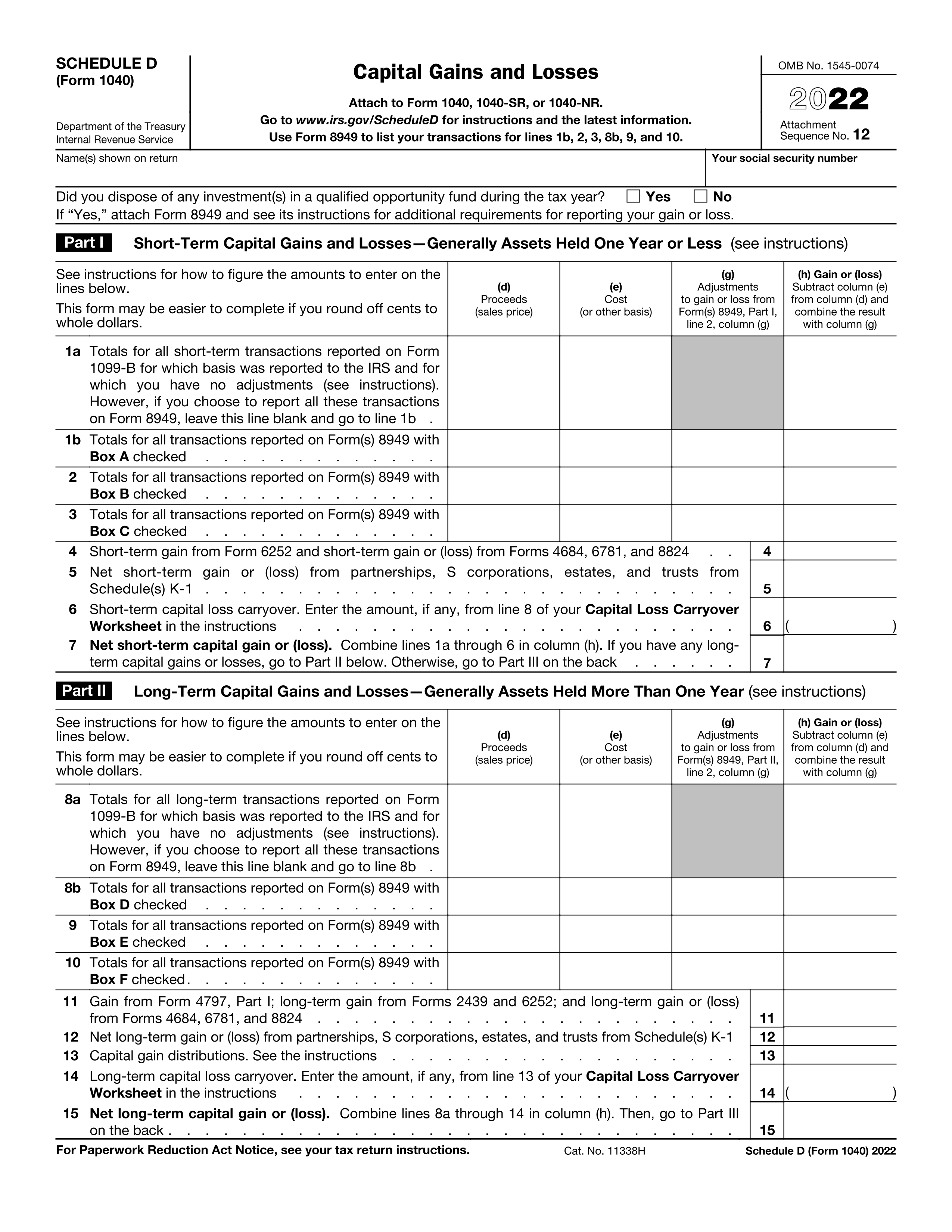

IRS Schedule D

However, a mutual fund might keep some of its capital gains and pay a tax on them. When this happens, the mutual fund company will send you. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right.

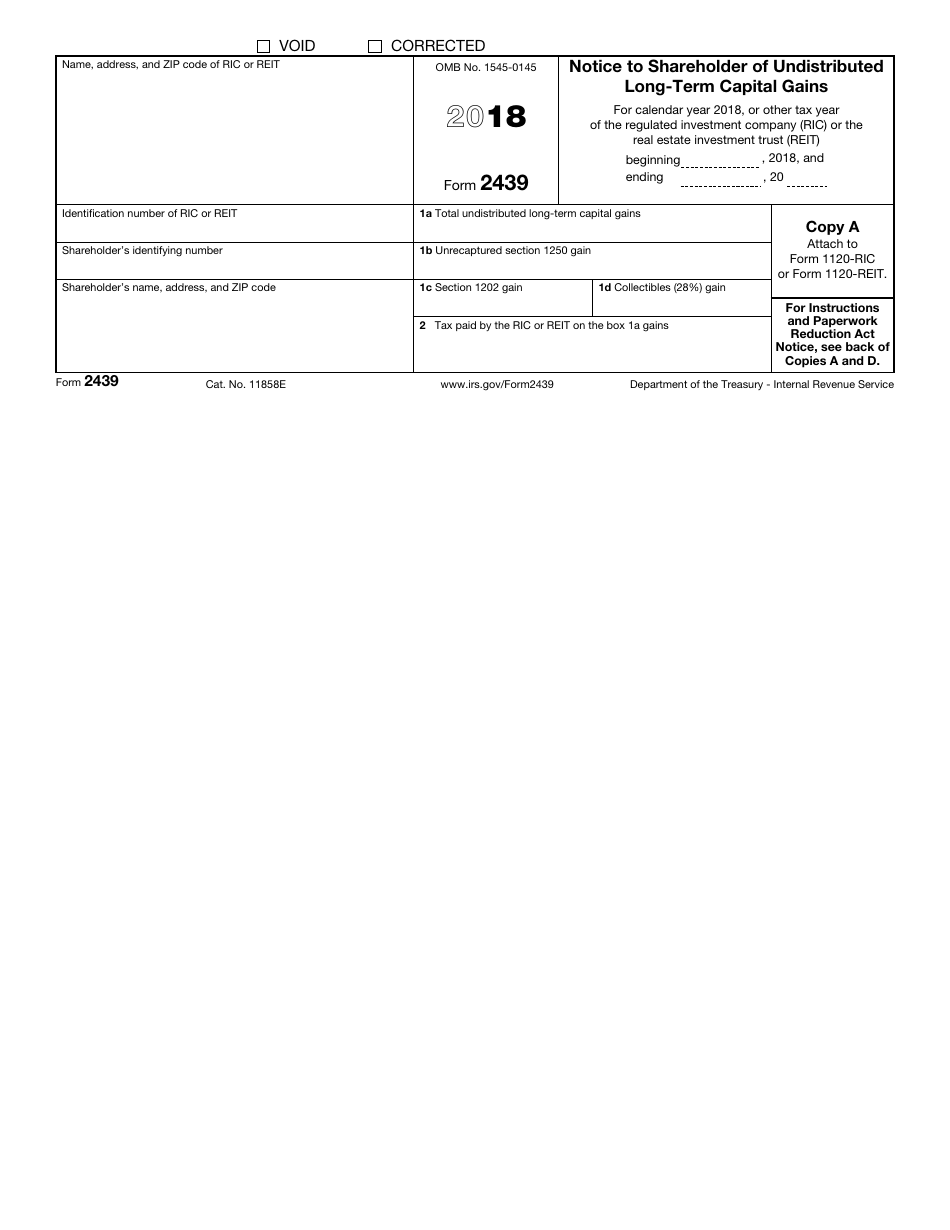

IRS Form 2439 2018 Fill Out, Sign Online and Download Fillable PDF

When this happens, the mutual fund company will send you. However, a mutual fund might keep some of its capital gains and pay a tax on them. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right.

IRS Form 2439 Walkthrough (Notice to Shareholder of Undistributed Long

To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. However, a mutual fund might keep some of its capital gains and pay a tax on them. When this happens, the mutual fund company will send you.

2023 Form IRS 8949 Fill Online, Printable, Fillable, Blank pdfFiller

However, a mutual fund might keep some of its capital gains and pay a tax on them. When this happens, the mutual fund company will send you. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right.

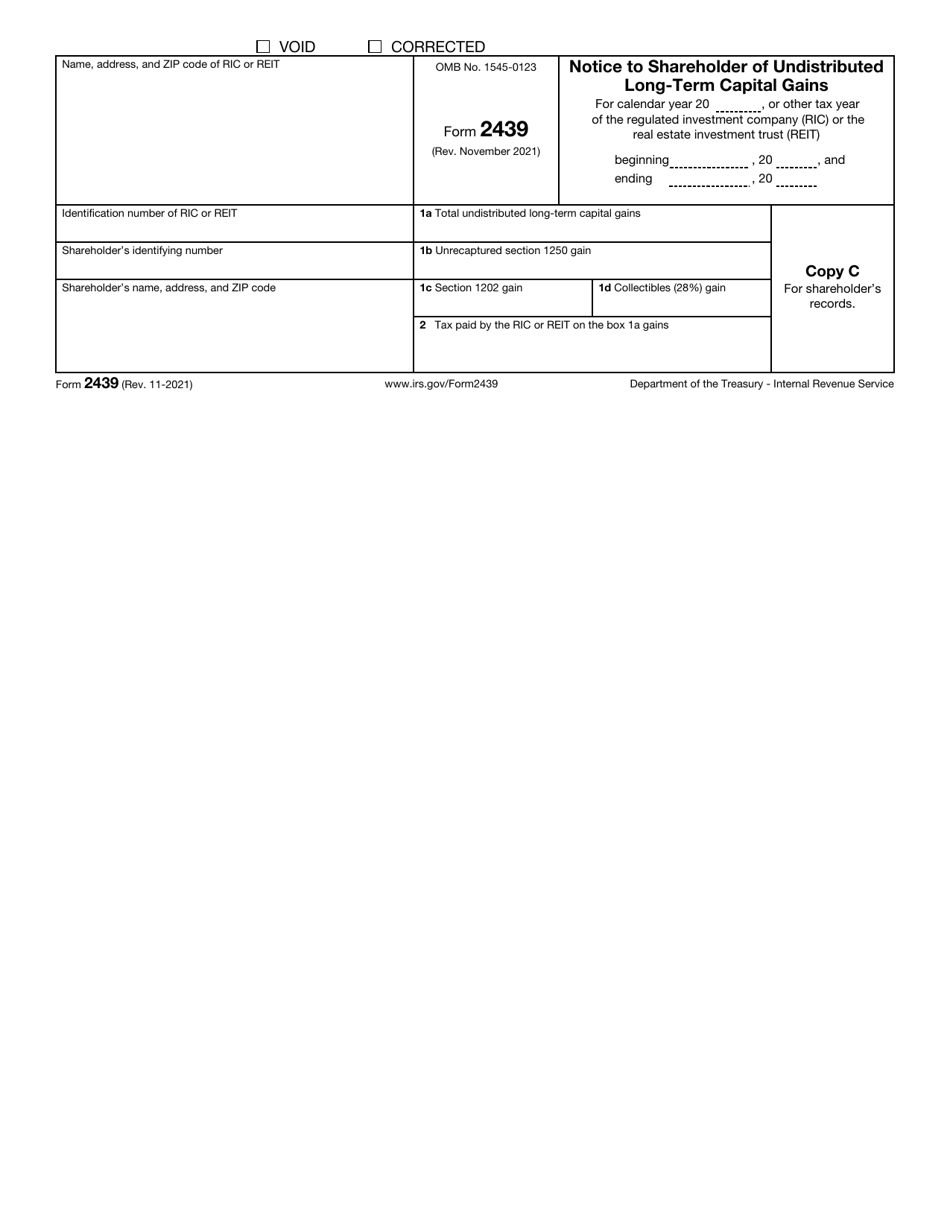

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

When this happens, the mutual fund company will send you. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. However, a mutual fund might keep some of its capital gains and pay a tax on them.

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

However, a mutual fund might keep some of its capital gains and pay a tax on them. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. When this happens, the mutual fund company will send you.

U.S. TREAS Form treasirs24391992

However, a mutual fund might keep some of its capital gains and pay a tax on them. When this happens, the mutual fund company will send you. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right.

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

However, a mutual fund might keep some of its capital gains and pay a tax on them. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. When this happens, the mutual fund company will send you.

To Enter Form 2439 Go To Investment Income And Select Undistributed Capital Gains Or You Can Search For Form 2439 In The Top Right.

When this happens, the mutual fund company will send you. However, a mutual fund might keep some of its capital gains and pay a tax on them.