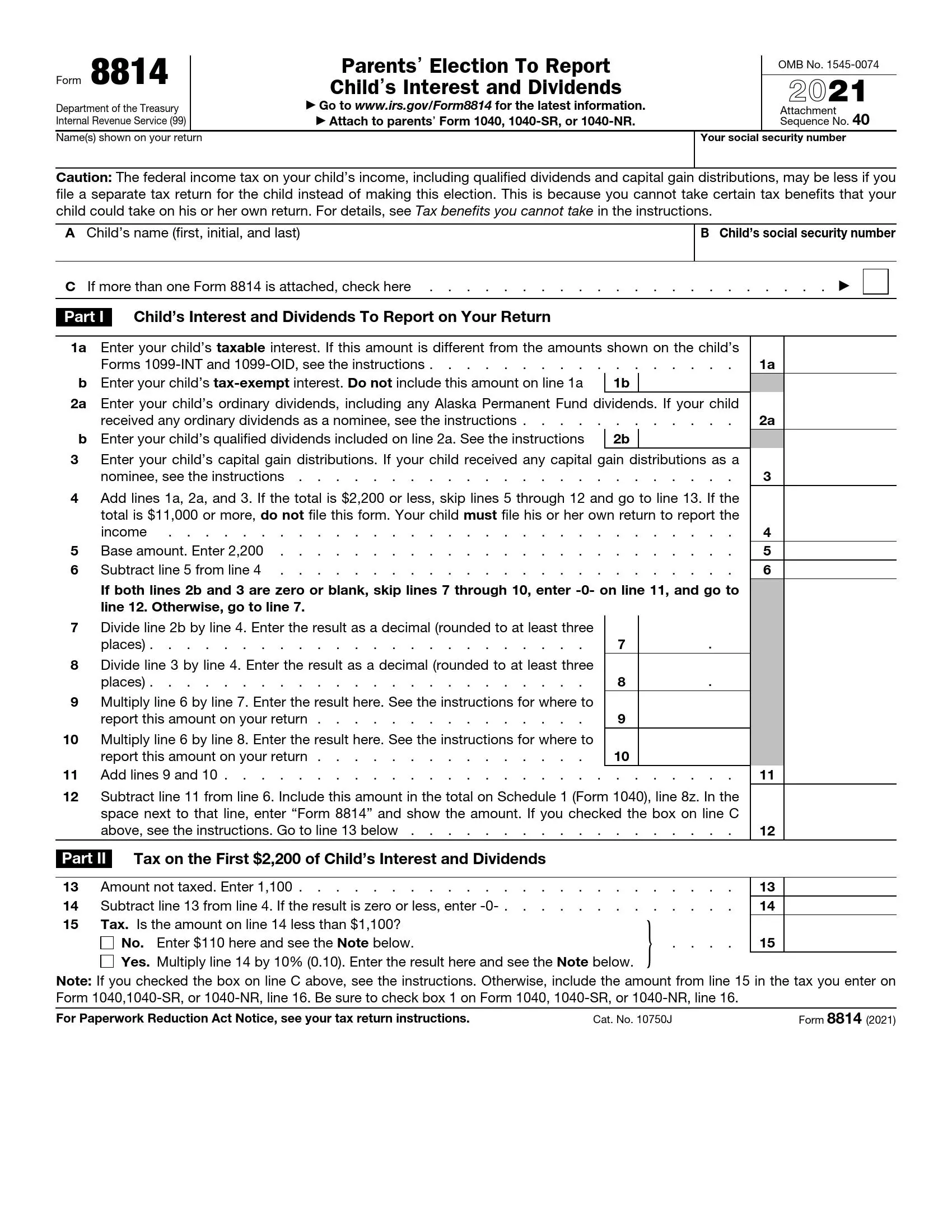

What Is Form 8814 Used For

What Is Form 8814 Used For - Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. If you choose this election, your child may not have. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. What is irs form 8814? The form will help you calculate the. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to.

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. If you choose this election, your child may not have. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. The form will help you calculate the. What is irs form 8814? Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to.

The form will help you calculate the. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. What is irs form 8814? Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. If you choose this election, your child may not have. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return.

U.S. TREAS Form treasirs88142001

Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. What is irs form 8814?.

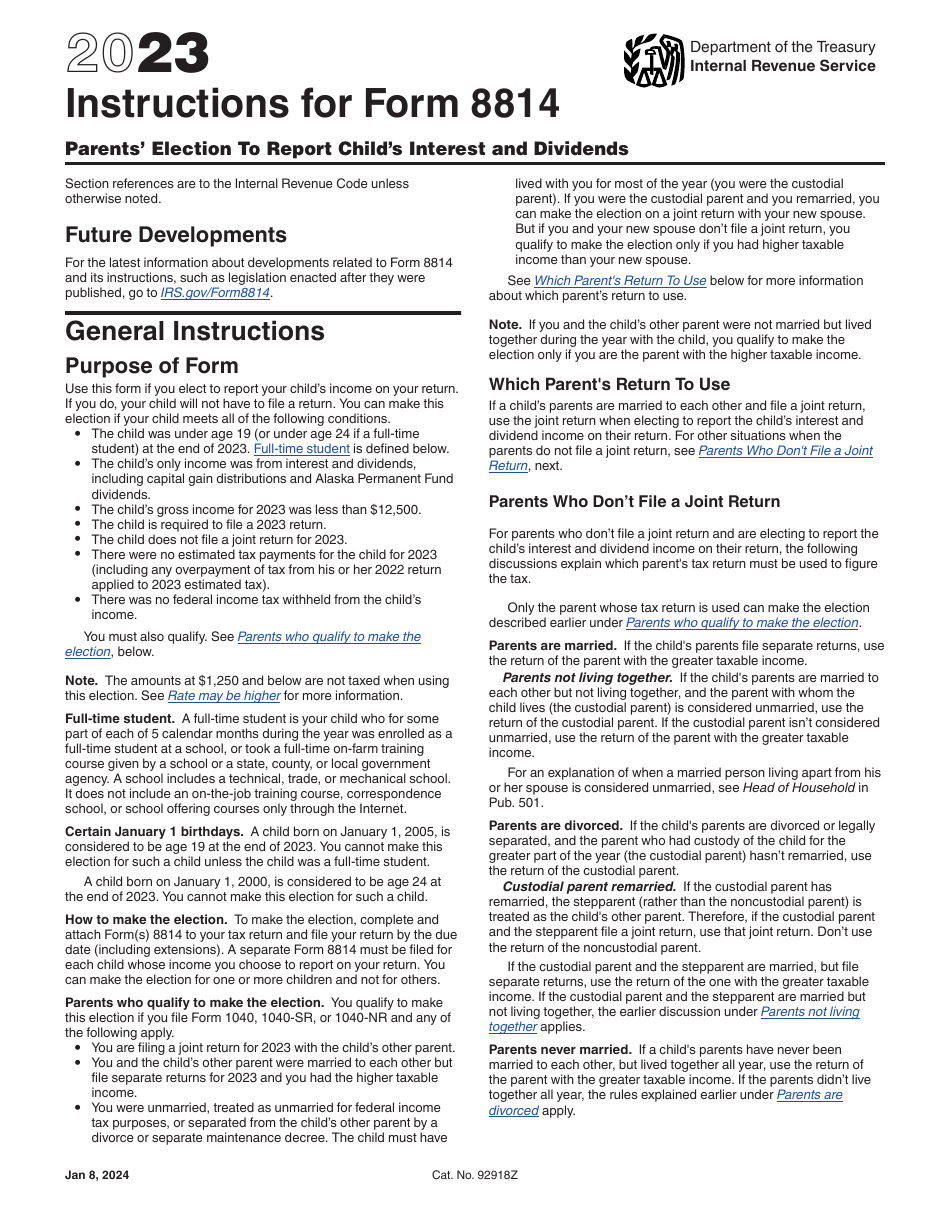

Download Instructions for IRS Form 8814 Parents' Election to Report

Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. What is irs form 8814? Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. The form will help you calculate the. If you choose this election, your child may not have.

IRS Form 8814 What Is It & Who Is Required To File? SuperMoney

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. What is irs form 8814? Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. If the child doesn't qualify for a form 8814 election, file form 8615 with a.

IRS Form 8814 Instructions Your Child's Interest & Dividends

The form will help you calculate the. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. What is irs form 8814? Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. Irs form 8814 allows parents to report their child’s unearned income—such.

Form 8814 All in One Guide 2024 US Expat Tax Service

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. The form will help you calculate the. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax.

IRS Form 8814 (Kiddie Taxes) How to Complete YouTube

If you choose this election, your child may not have. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. The form will help you calculate the. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. If the child.

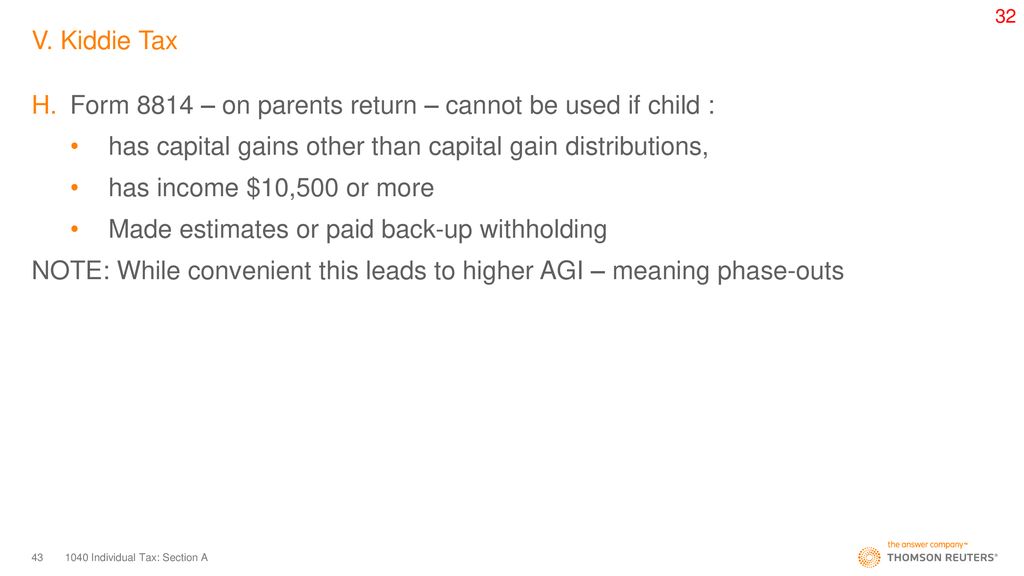

1040 Individual Tax Section A ppt download

Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. If you choose this election, your child may not have. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. The form will help you calculate the. What is.

8814 Form 2024

If you choose this election, your child may not have. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Irs form 8814, parents’ election to report child’s interest and.

IRS Form 8814 ≡ Fill Out Printable PDF Forms Online

Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. What is irs form 8814? The form will help you calculate the. If the child doesn't qualify for a form.

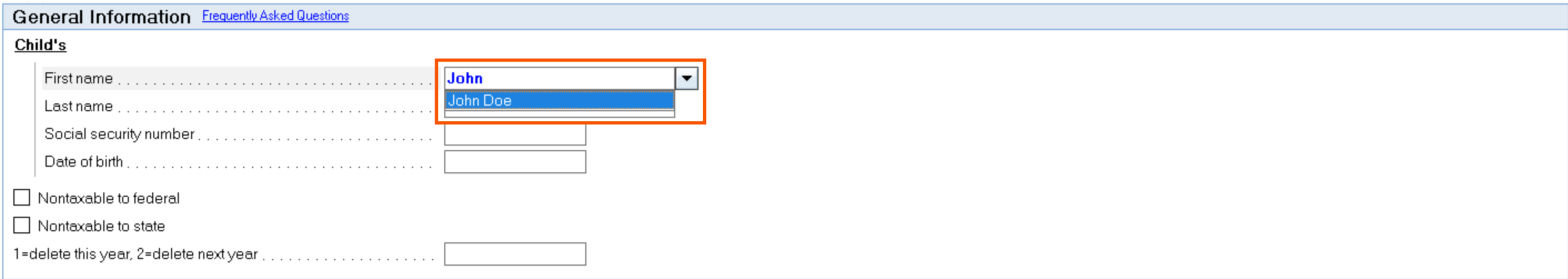

Generating Form 8814 in Lacerte

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. If you choose this election, your child may not have. Information about form 8814, parent's election to report child's interest.

Form 8814 Will Be Used If You Elect To Report Your Child's Interest/Dividend Income On Your Tax Return.

Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. What is irs form 8814? The form will help you calculate the. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating.

Irs Form 8814, Parents’ Election To Report Child’s Interest And Dividends, Is The Tax Form Parents May Use To.

If you choose this election, your child may not have. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return.