What Is A Checkable Deposit

What Is A Checkable Deposit - Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by. Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of.

Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of. Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by.

Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by. Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of.

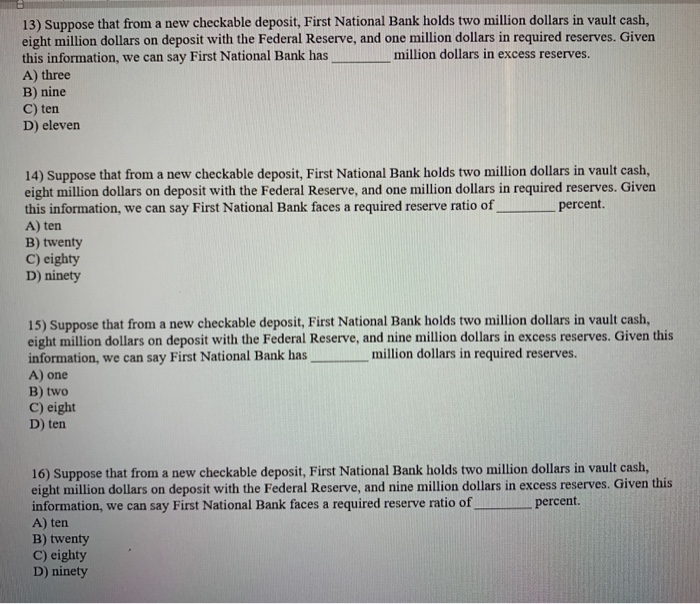

Solved 13) Suppose that from a new checkable deposit, First

Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by. Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of.

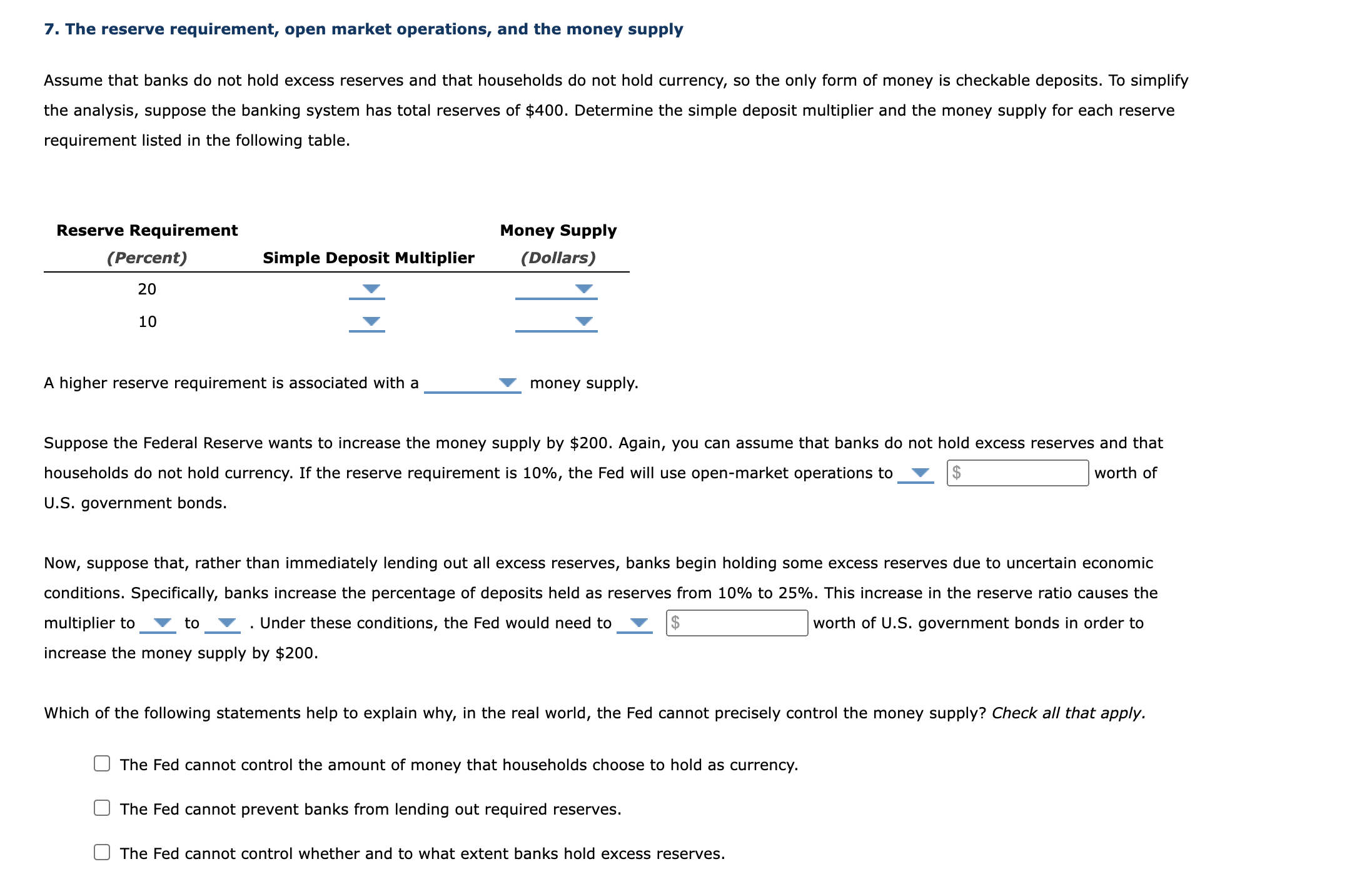

Solved 7. The reserve requirement, open market operations,

Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by. Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of.

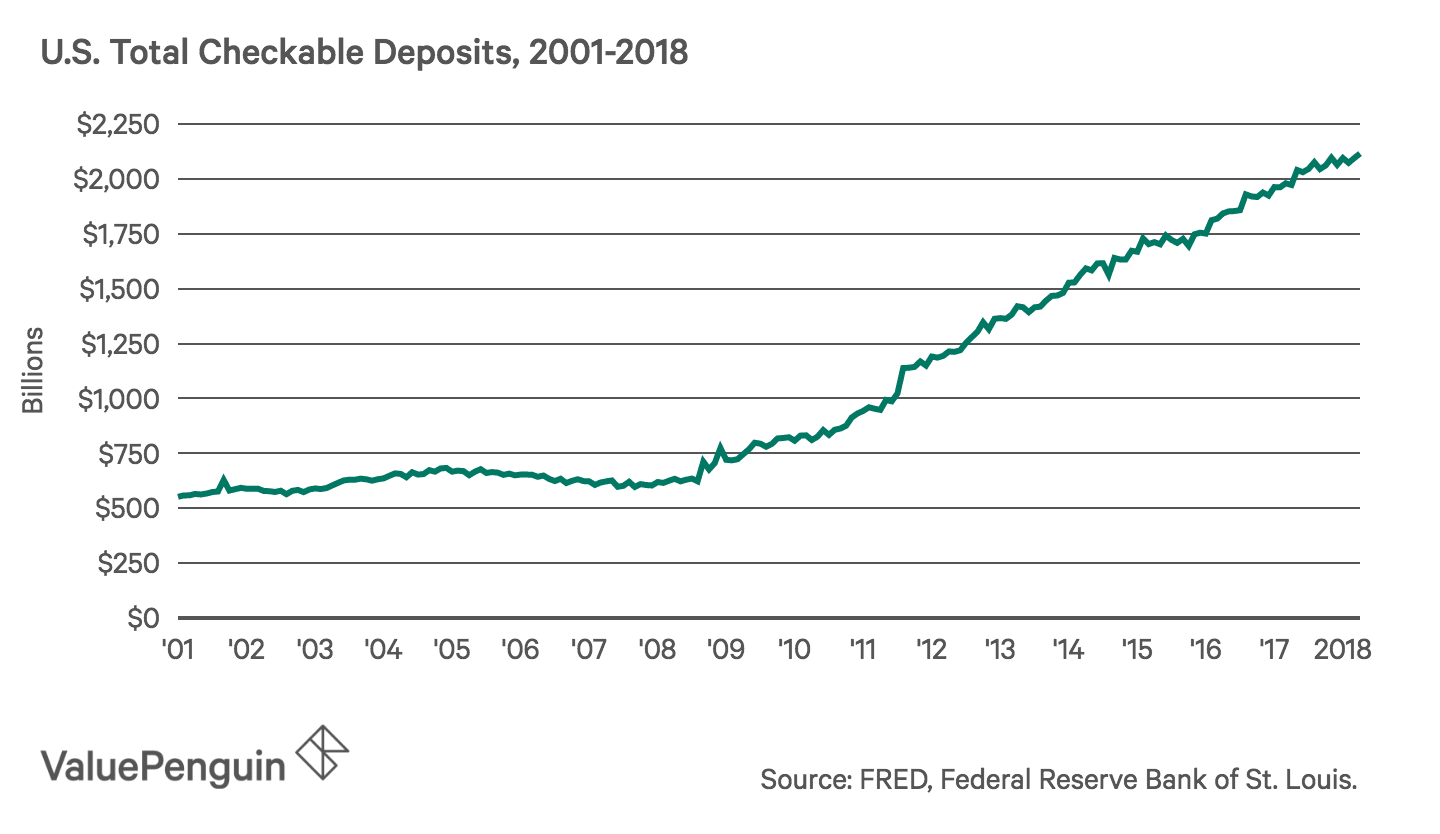

Average U.S. Checking Account Balance 2019 A Demographic Breakdown

Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by. Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of.

Chapter 14 4 Checkable Deposit Creation YouTube

Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by. Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of.

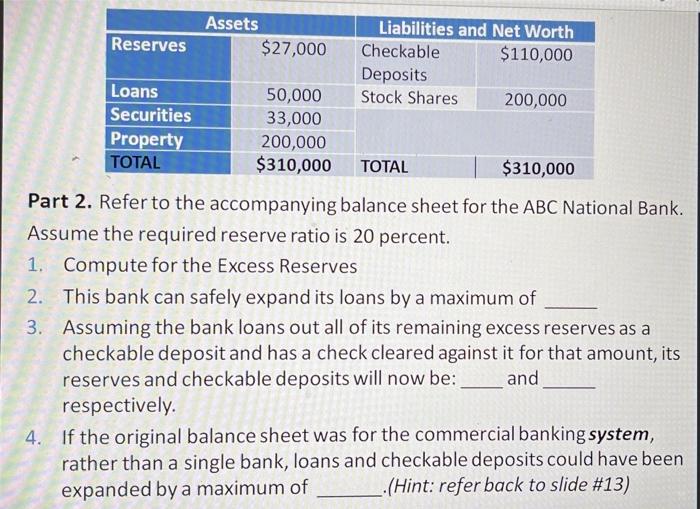

Solved Assets Liabilities and Net Worth Reserves 27,000

Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by. Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of.

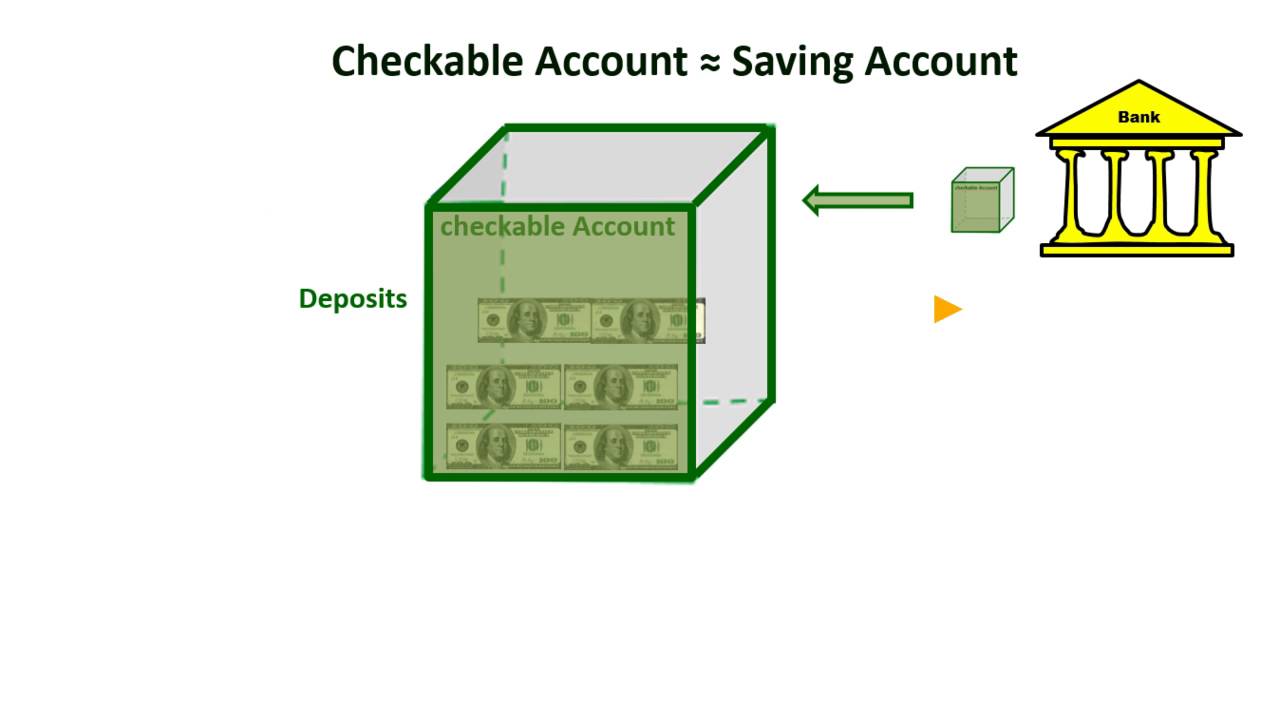

Checkable Account and Checkable Deposits Intuitively YouTube

Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of. Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by.

What are Checkable Deposits? (with pictures)

Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of. Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by.

Checkbook lets you email anyone a digital check and deposit it free

Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of. Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by.

Direct Deposit BluCurrent Credit Union Springfield, MO

Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of. Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by.

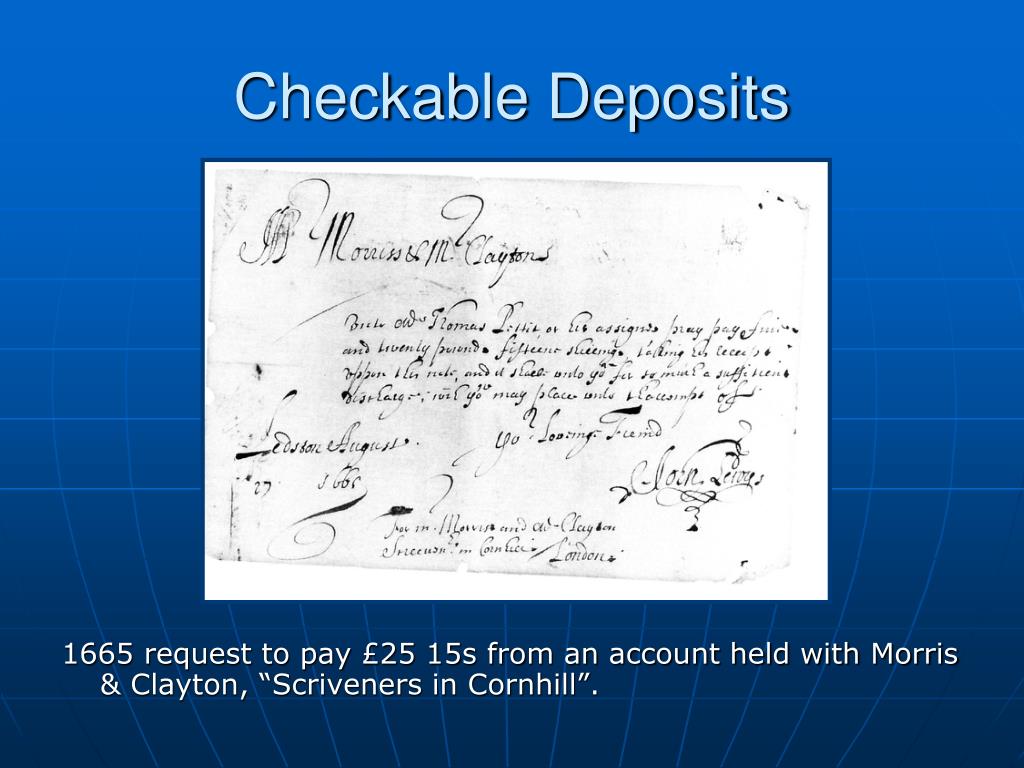

PPT What is Money? PowerPoint Presentation, free download ID4102442

Checkable deposits are a type of deposit account held at a financial institution, such as a bank, that allows the account holder to withdraw funds by. Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of.

Checkable Deposits Are A Type Of Deposit Account Held At A Financial Institution, Such As A Bank, That Allows The Account Holder To Withdraw Funds By.

Checkable deposits, also known as demand deposits, are funds held in bank accounts that can be withdrawn on demand through the use of.