What Does Form 8862 Look Like

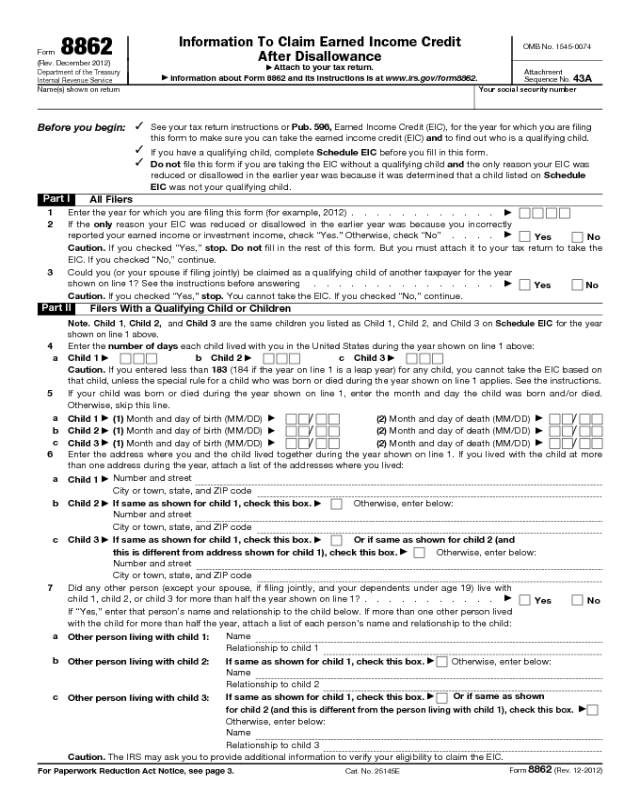

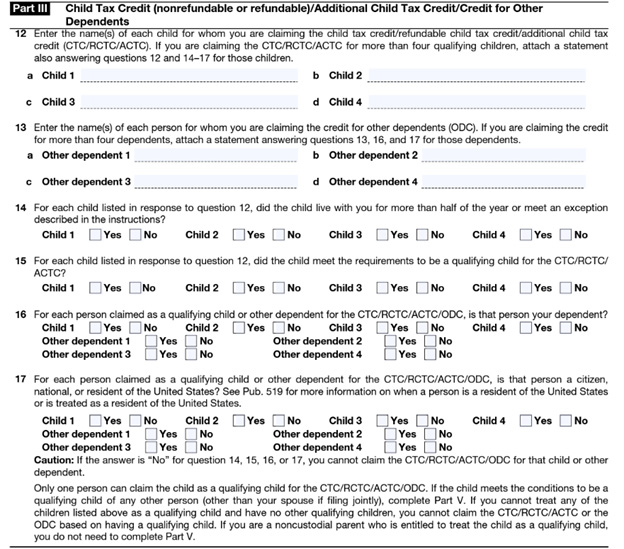

What Does Form 8862 Look Like - Irs form 8862 is used by taxpayers to claim certain refundable credits after the irs previously disallowed them. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Tax form 8862 is an irs attachment that must be filed to claim the earned income credit, the child tax credit, additional child tax credit, credit for. This article provides an overview of form 8862, detailing its purpose in allowing taxpayers to reclaim specific tax credits after previous. Taxpayers complete form 8862 and attach it to their tax return if: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit.

This article provides an overview of form 8862, detailing its purpose in allowing taxpayers to reclaim specific tax credits after previous. Tax form 8862 is an irs attachment that must be filed to claim the earned income credit, the child tax credit, additional child tax credit, credit for. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Irs form 8862 is used by taxpayers to claim certain refundable credits after the irs previously disallowed them. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Taxpayers complete form 8862 and attach it to their tax return if:

Tax form 8862 is an irs attachment that must be filed to claim the earned income credit, the child tax credit, additional child tax credit, credit for. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. This article provides an overview of form 8862, detailing its purpose in allowing taxpayers to reclaim specific tax credits after previous. Taxpayers complete form 8862 and attach it to their tax return if: Irs form 8862 is used by taxpayers to claim certain refundable credits after the irs previously disallowed them.

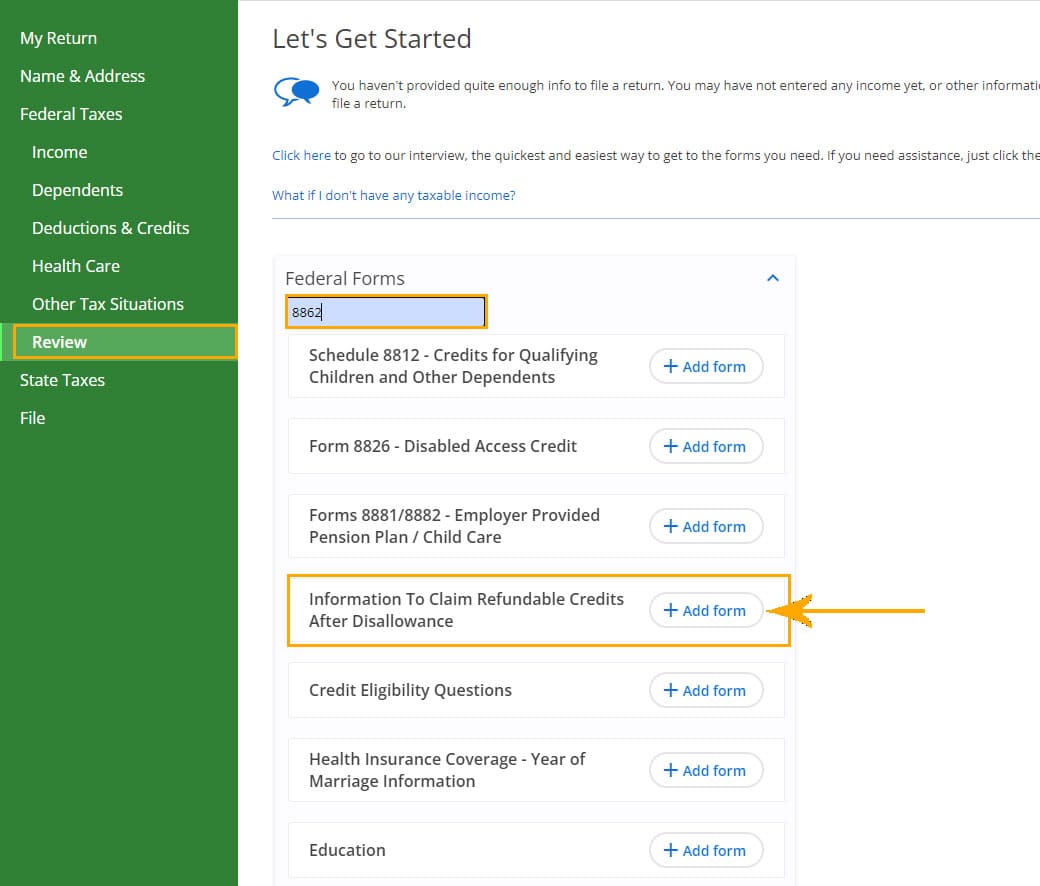

Can anyone help , Its Asking for form 8862 r/TurboTax

This article provides an overview of form 8862, detailing its purpose in allowing taxpayers to reclaim specific tax credits after previous. Taxpayers complete form 8862 and attach it to their tax return if: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Tax form 8862 is an irs attachment that must be filed to claim the earned.

Form 8862 Added To Your IRS Tax Return Instructions eFile

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. This article provides an overview of form 8862, detailing its purpose in allowing taxpayers to reclaim specific tax credits after previous. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following.

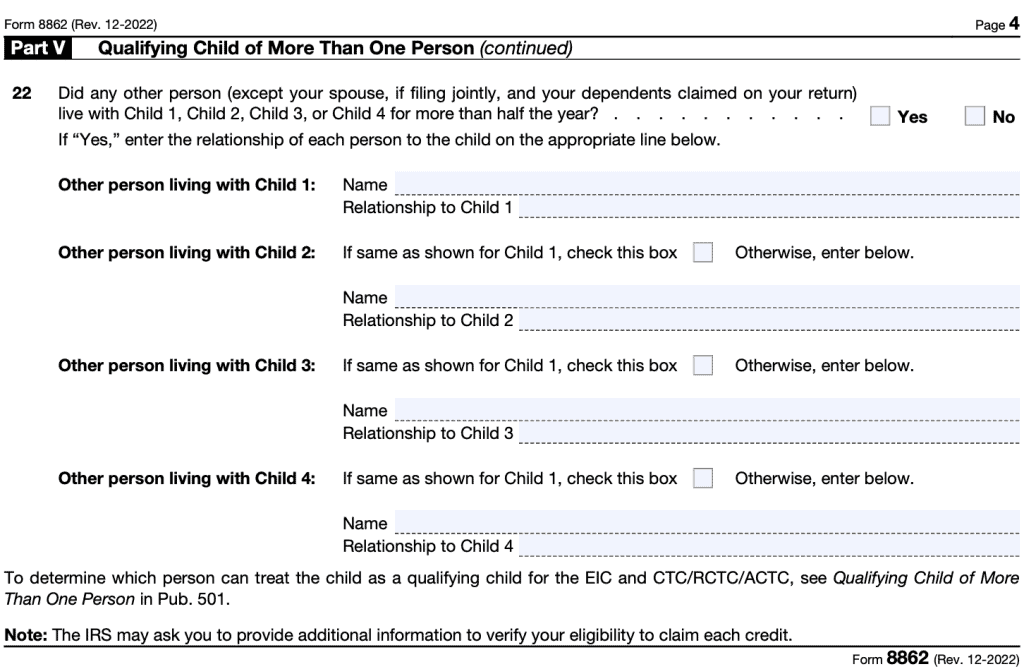

IRS Form 8862 Claiming Certain Tax Credits After Disallowance

Irs form 8862 is used by taxpayers to claim certain refundable credits after the irs previously disallowed them. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Tax form 8862 is an irs attachment that must be filed to claim the earned income credit, the child tax credit, additional child tax credit, credit for. Taxpayers complete form.

Form 8862 Edit, Fill, Sign Online Handypdf

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Tax form 8862 is an irs attachment that must be filed to claim the earned income credit, the child tax.

How to Complete IRS Form 8862

Tax form 8862 is an irs attachment that must be filed to claim the earned income credit, the child tax credit, additional child tax credit, credit for. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Irs form 8862 is used.

IRS Form 8862 Diagram Quizlet

This article provides an overview of form 8862, detailing its purpose in allowing taxpayers to reclaim specific tax credits after previous. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following.

What Is IRS Form 8862?

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Tax form 8862 is an irs attachment that must be filed to claim the earned income credit, the child tax credit, additional child tax credit, credit for. Irs form 8862 is used by taxpayers to claim certain refundable credits after the irs previously disallowed them. Taxpayers complete form.

IRS Form 8862 Instructions

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Irs form 8862 is used by taxpayers to claim certain refundable credits after the irs previously disallowed them. This article.

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Taxpayers complete form 8862 and attach it to their tax return if: Tax form 8862 is an irs attachment that must be filed to claim the earned income credit, the child tax credit, additional child tax credit, credit for. This article provides an overview of form 8862, detailing its purpose in allowing taxpayers to reclaim specific tax credits after previous..

Irs Form 8862 Printable Printable Forms Free Online

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Irs form 8862 is used by taxpayers to claim certain refundable credits after the irs previously disallowed them. This article provides an overview of form 8862, detailing its purpose in allowing taxpayers to reclaim specific tax credits after previous. Taxpayers complete form 8862 and attach it to their.

Tax Form 8862 Is An Irs Attachment That Must Be Filed To Claim The Earned Income Credit, The Child Tax Credit, Additional Child Tax Credit, Credit For.

Taxpayers complete form 8862 and attach it to their tax return if: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Irs form 8862 is used by taxpayers to claim certain refundable credits after the irs previously disallowed them. This article provides an overview of form 8862, detailing its purpose in allowing taxpayers to reclaim specific tax credits after previous.

:max_bytes(150000):strip_icc()/2022-01-1111_48_02-Form8862Rev.December2021-f23f0eab085a467eb521f33bd3758904.jpg)