What Are Leasehold Improvements On A Balance Sheet

What Are Leasehold Improvements On A Balance Sheet - Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial. Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet.

Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial. Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet.

Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial. Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet.

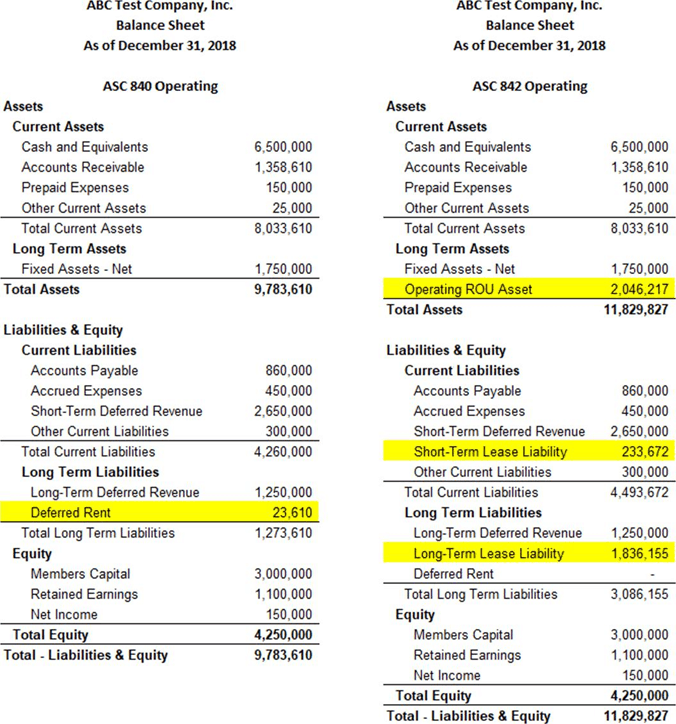

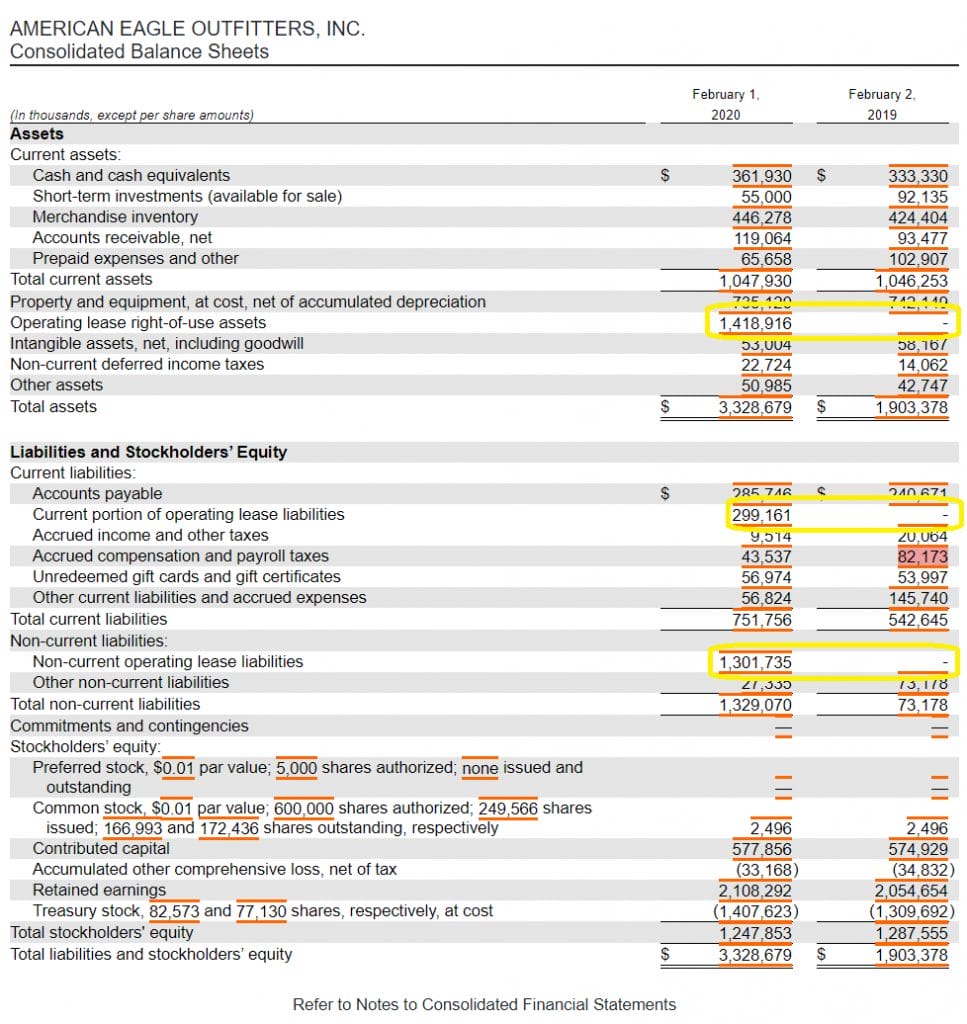

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet. Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial.

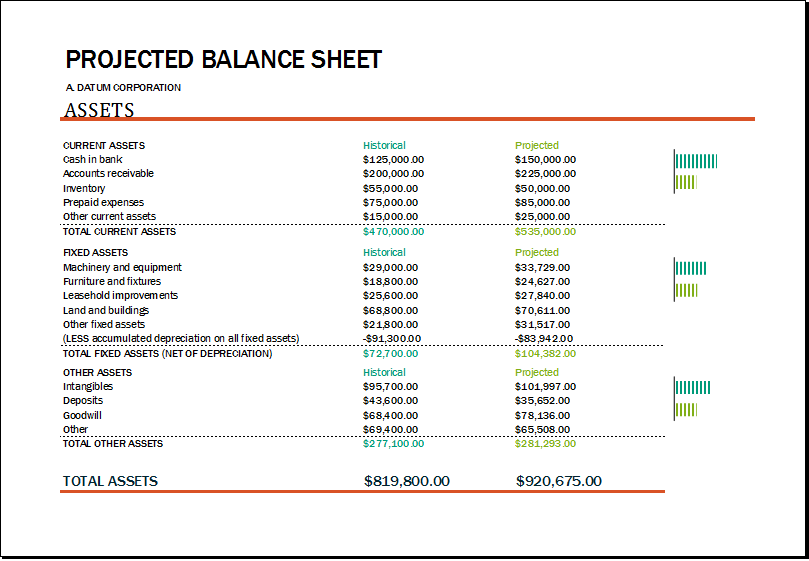

Download Free Balance Sheet Templates in Excel

Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet. Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial.

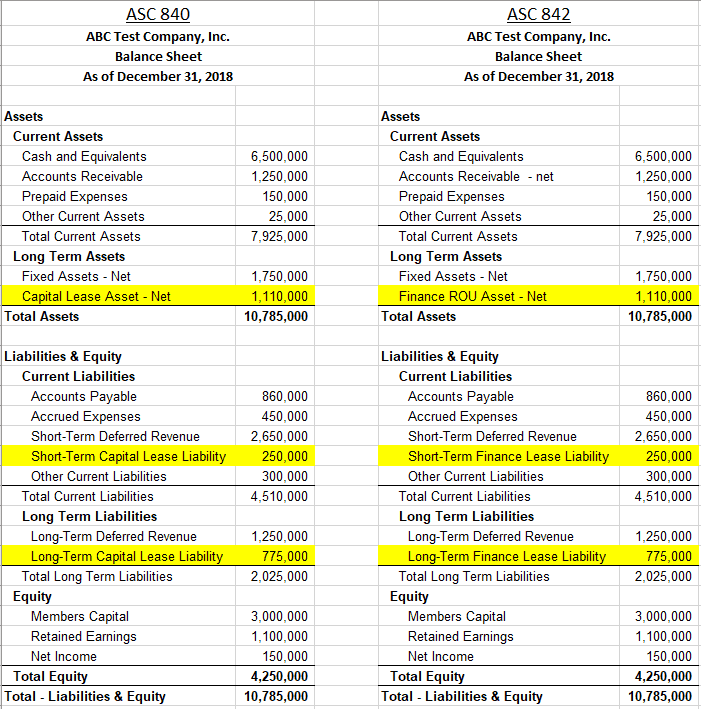

Lease Liabilities The True Impact on the Balance Sheet

Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet. Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial.

Amazing Ifrs 16 Balance Sheet Example Ratio Analysis Formulas In

Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet. Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial.

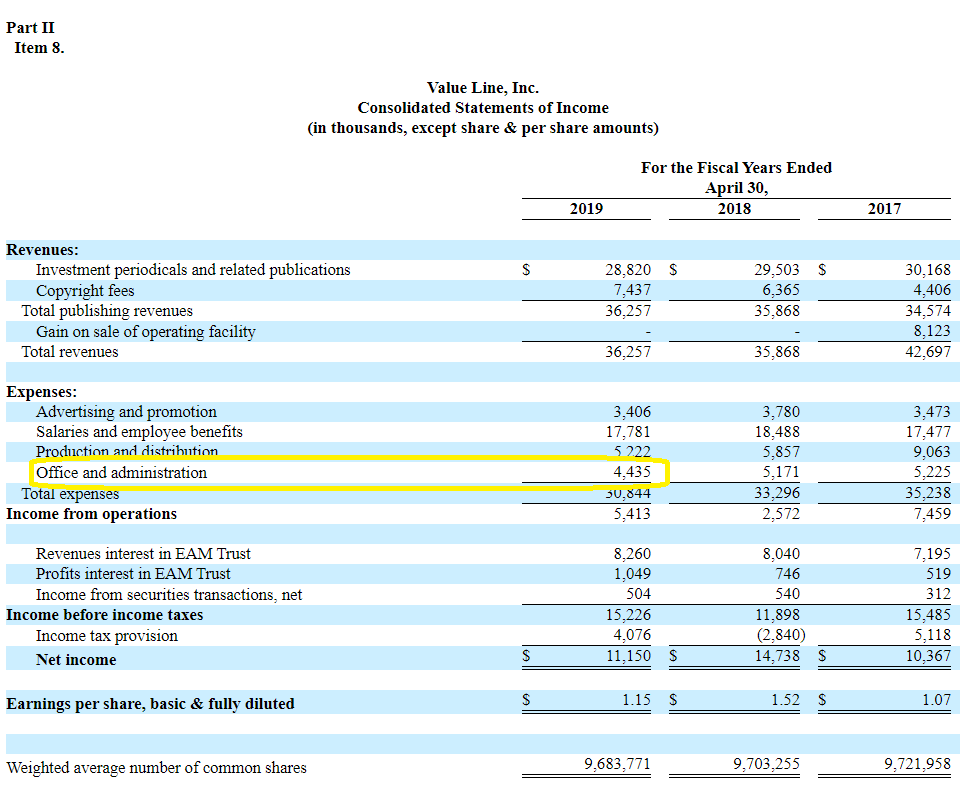

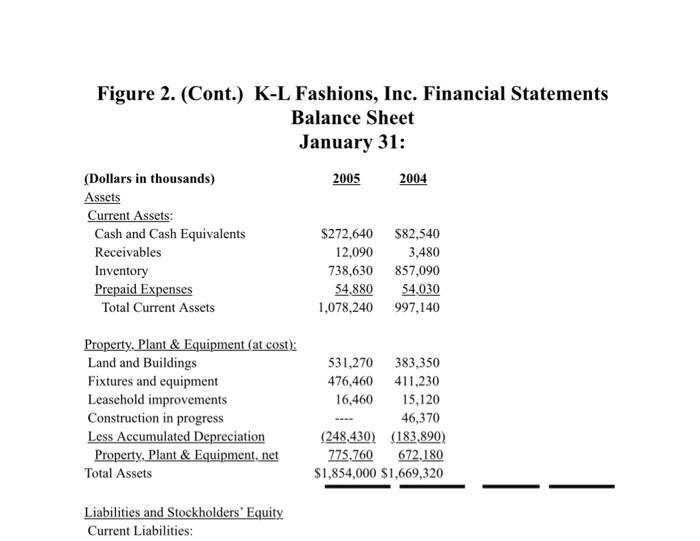

Figure 2. (Cont.) KL Fashions, Inc. Financial

Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet. Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial.

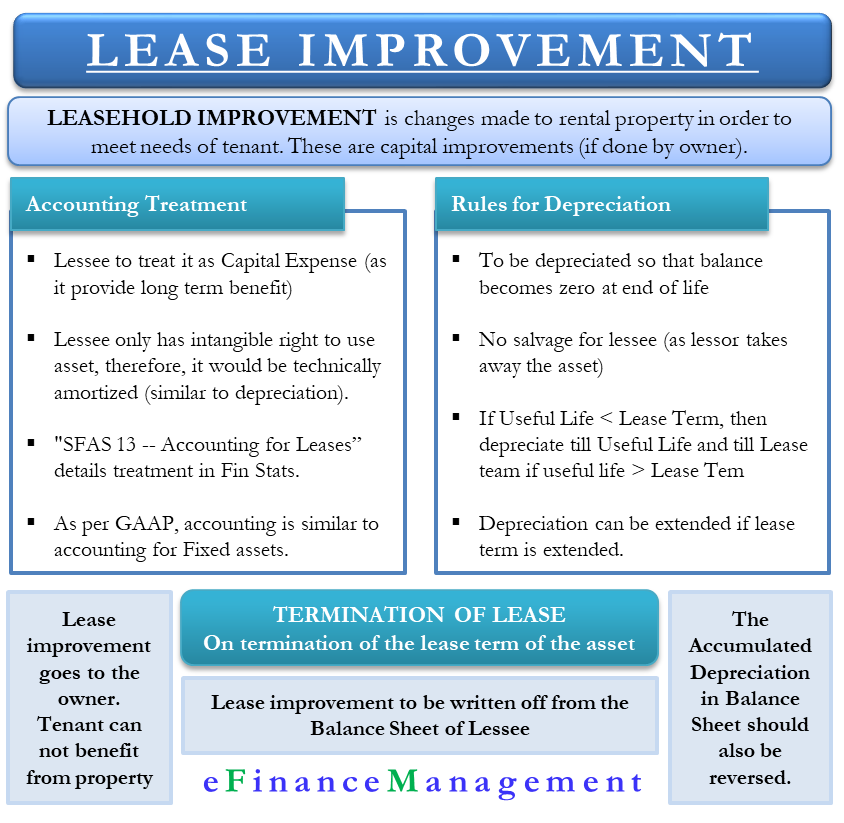

Leasehold Improvement Definition, Categories, & Taxation

Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial. Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet.

Mejora de Locales arrendados / PCGA, Contabilidad, Depreciación

Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet. Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial.

Balance Sheet( in thousands)(1) Includes capital lease obligations of

Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial. Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial. Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet.

Bonus Depreciation 2024 Leasehold Improvements Lorna Sigrid

Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial. Leasehold improvements have a significant influence on a company’s financial statements, affecting both the balance sheet.

Leasehold Improvements Have A Significant Influence On A Company’s Financial Statements, Affecting Both The Balance Sheet.

Proper treatment of leasehold improvements impacts not only the balance sheet but also tax liabilities and overall financial.