Virginia Tax Exempt Form St 13A

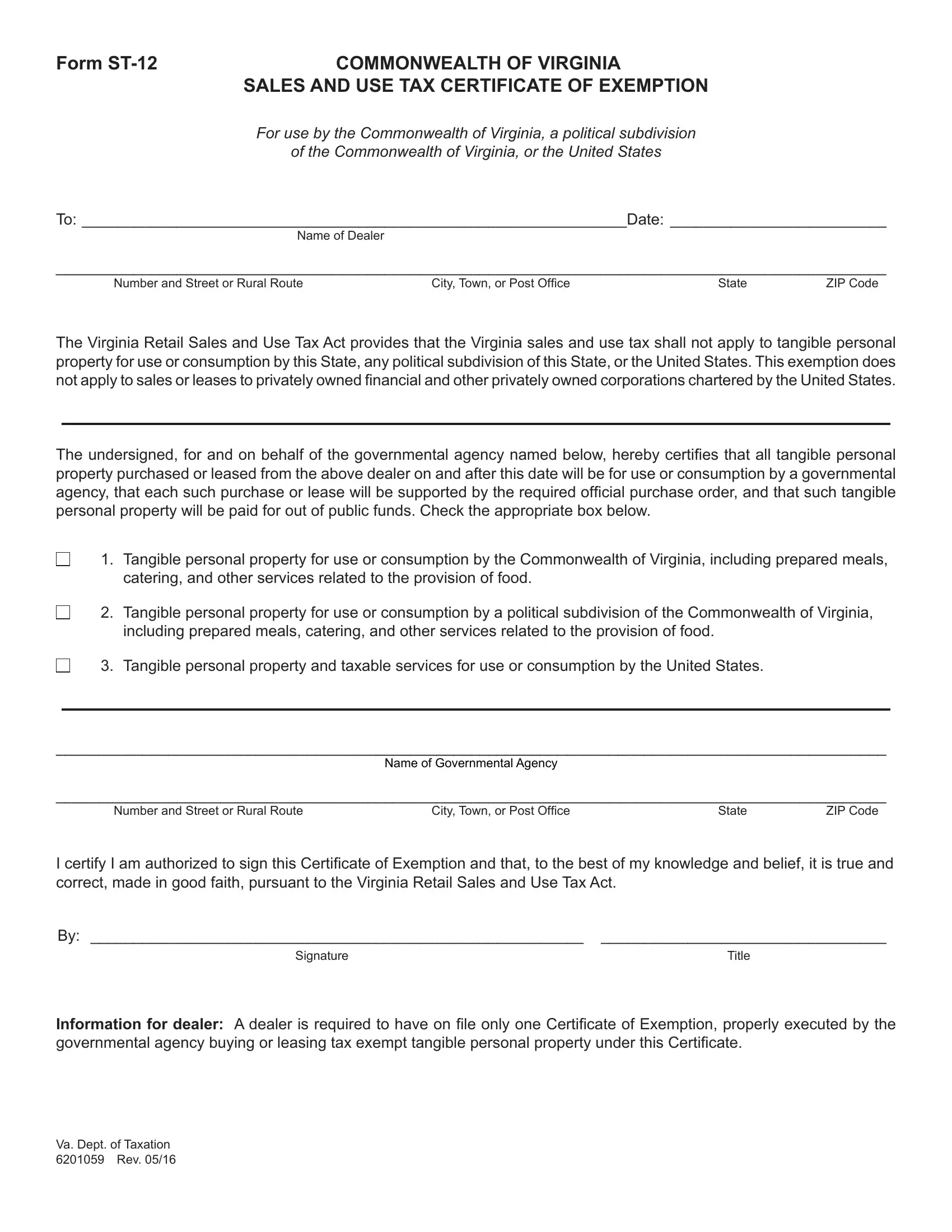

Virginia Tax Exempt Form St 13A - Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Tangible personal property, including prepared.

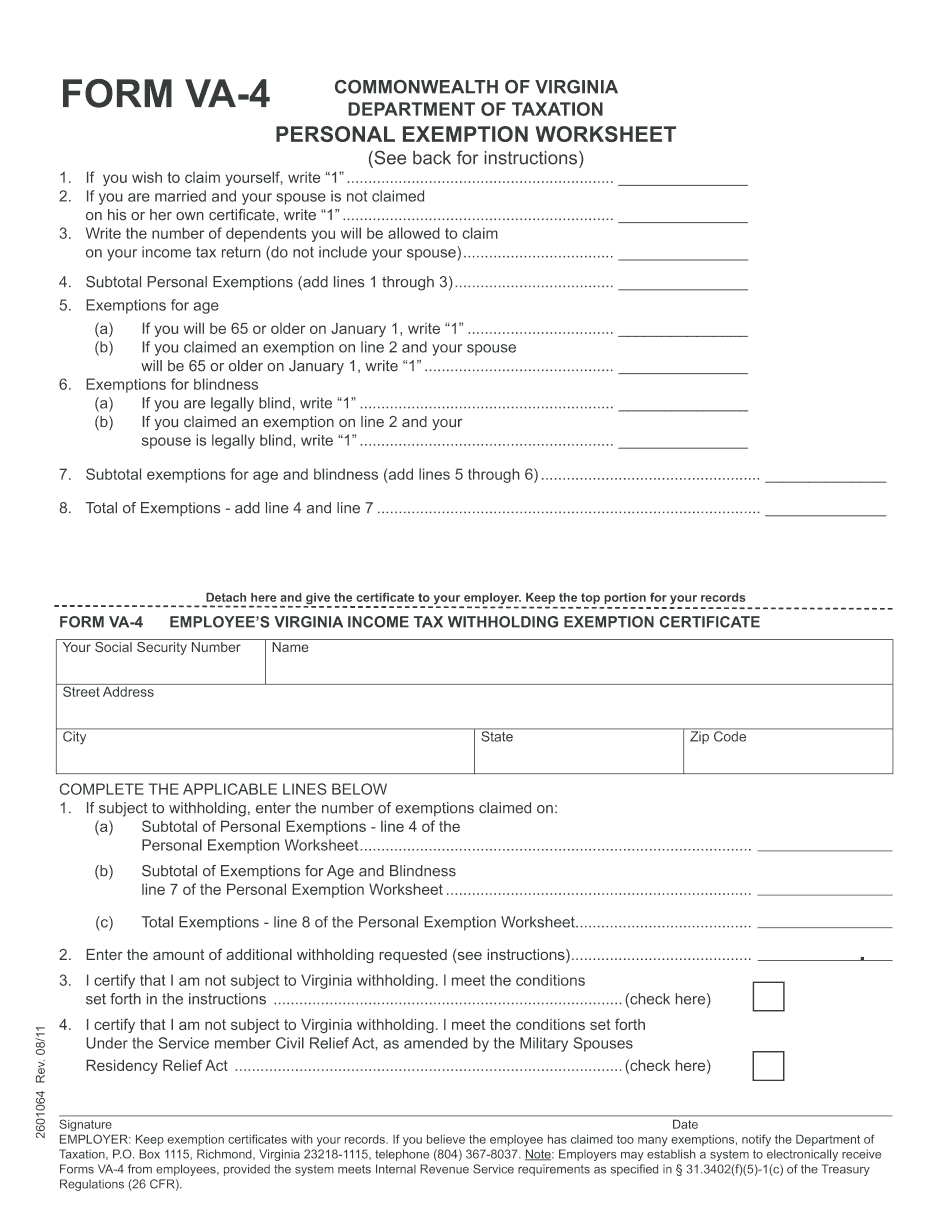

Va Tax Exempt Form 2024

The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: Tangible personal property, including prepared. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

South Carolina Vehicle Tax Exemption Form

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to:

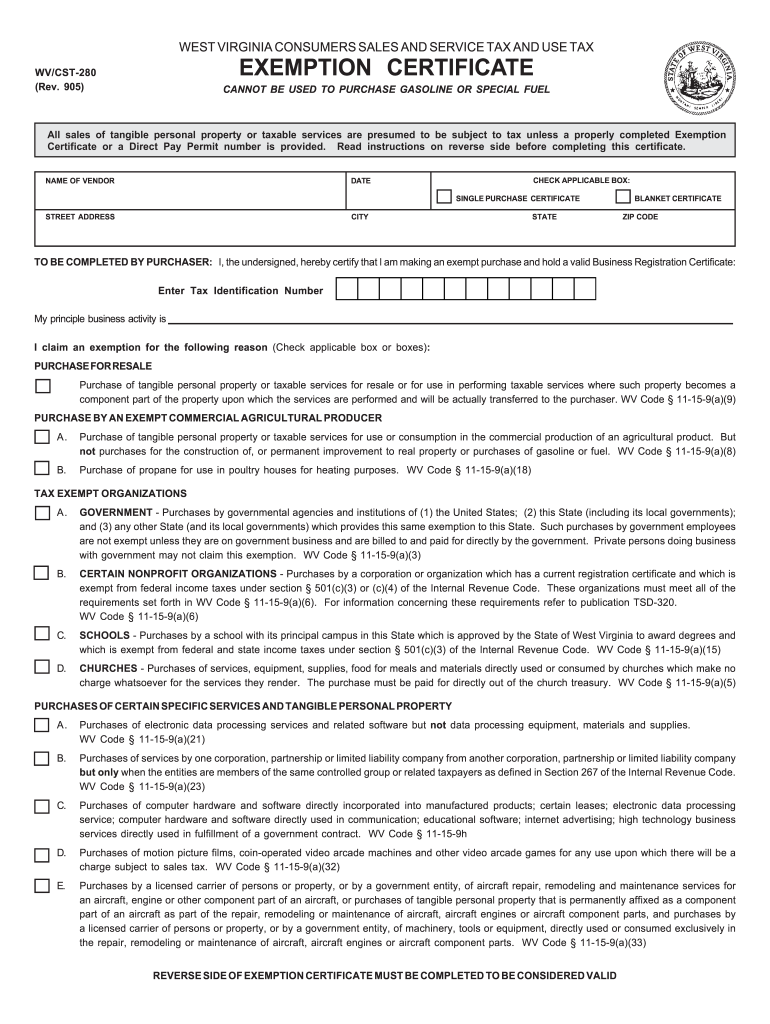

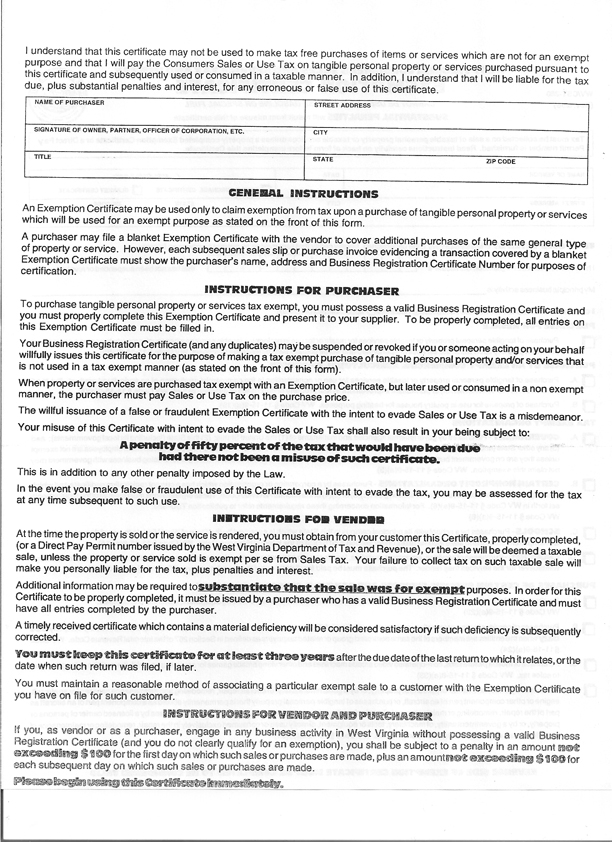

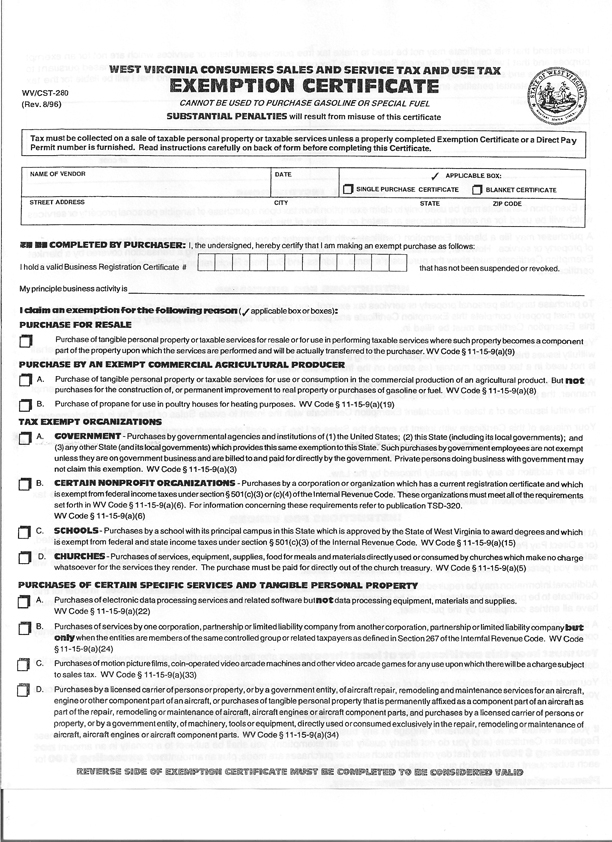

Wv Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller

Tangible personal property, including prepared. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to:

West Virginia Tax Exempt

The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Tangible personal property, including prepared.

Va Tax Exempt Form 2024

Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: Tangible personal property, including prepared.

Virginia State Tax Exemption Form

Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

South Carolina Hotel Tax Exempt Form

Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Virginia Sales Tax Exemption PDF Form FormsPal

Tangible personal property, including prepared. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

West Virginia Tax Exemption Certificate Form

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: Tangible personal property, including prepared.

A Sales Tax Exemption Certificate Can Be Used By Businesses (Or In Some Cases, Individuals) Who Are Making Purchases That Are Exempt From The.

The virginia retail sales and use tax act provides that the sales and use tax shall not apply to: Tangible personal property, including prepared.