Unlv Lodging Exception Form

Unlv Lodging Exception Form - Without documented travel approval through a spend. View our lodging policy for information about exceptions to approved lodging rates. Unlv’s sales tax exemption no. The lodging exception form is required to be submitted with the spend authorization/expense report in order to. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. Unlv is an educational institution of the state of nevada and is tax exempt. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. “transient lodging tax exemption form for federal credit union” should be properly completed by a federal. Hotel exception form on behalf of the traveler when the hotel rate exceeds the federal travel regulations (gsa) allowable rate for the.

Unlv’s sales tax exemption no. Without documented travel approval through a spend. “transient lodging tax exemption form for federal credit union” should be properly completed by a federal. The lodging exception form is required to be submitted with the spend authorization/expense report in order to. Unlv is an educational institution of the state of nevada and is tax exempt. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. View our lodging policy for information about exceptions to approved lodging rates. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. Hotel exception form on behalf of the traveler when the hotel rate exceeds the federal travel regulations (gsa) allowable rate for the.

Unlv is an educational institution of the state of nevada and is tax exempt. The lodging exception form is required to be submitted with the spend authorization/expense report in order to. Unlv’s sales tax exemption no. “transient lodging tax exemption form for federal credit union” should be properly completed by a federal. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. Without documented travel approval through a spend. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. Hotel exception form on behalf of the traveler when the hotel rate exceeds the federal travel regulations (gsa) allowable rate for the. View our lodging policy for information about exceptions to approved lodging rates.

Form PM ES1700 Fill Out, Sign Online and Download Fillable PDF

Unlv’s sales tax exemption no. The lodging exception form is required to be submitted with the spend authorization/expense report in order to. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. “transient lodging tax exemption form for federal credit union” should be properly completed by.

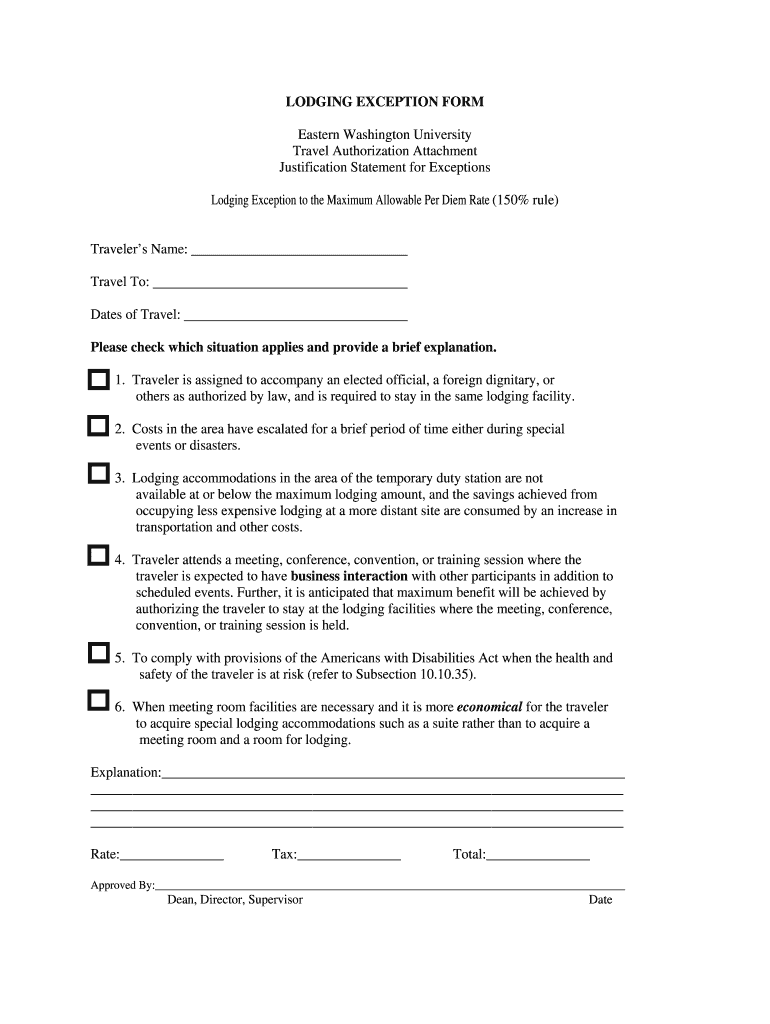

Fillable Online access ewu Lodging Exception Form EWU Access Home

The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. The lodging exception form is required to be submitted with the spend authorization/expense report in order to. Unlv is an educational institution of the state of nevada and is tax exempt. The only exception that can.

Oregon State vs. UNLV Final score, highlights from week 8 game

“transient lodging tax exemption form for federal credit union” should be properly completed by a federal. The lodging exception form is required to be submitted with the spend authorization/expense report in order to. View our lodging policy for information about exceptions to approved lodging rates. Without documented travel approval through a spend. The only exception that can be granted over.

University of Nevada Las Vegas Accounts Payable Department UNLV

The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. Unlv is an educational institution of the state of nevada and is tax exempt. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two.

Solved ESA DLP exception content filter Cisco Community

Without documented travel approval through a spend. Unlv is an educational institution of the state of nevada and is tax exempt. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. The only exception that can be granted over the gsa/federal lodging rates are if a.

YOU at UNLV A Onestop App for All Your Mental Health Resource Needs

The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. Hotel exception form on behalf of the traveler when the hotel rate exceeds the federal travel regulations (gsa) allowable rate for the. View our lodging policy for information about exceptions to approved lodging rates. “transient lodging.

Lodging.....⏳ YouTube

Hotel exception form on behalf of the traveler when the hotel rate exceeds the federal travel regulations (gsa) allowable rate for the. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. Unlv is an educational institution of the state of nevada and is tax exempt..

Home UNLV Oral Pathology & Oral Medicine

The lodging exception form is required to be submitted with the spend authorization/expense report in order to. “transient lodging tax exemption form for federal credit union” should be properly completed by a federal. Unlv’s sales tax exemption no. View our lodging policy for information about exceptions to approved lodging rates. The only exception that can be granted over the gsa/federal.

Kansas football vs. UNLV recap Jayhawks won in Guaranteed Rate Bowl

Hotel exception form on behalf of the traveler when the hotel rate exceeds the federal travel regulations (gsa) allowable rate for the. View our lodging policy for information about exceptions to approved lodging rates. Unlv’s sales tax exemption no. Without documented travel approval through a spend. Unlv is an educational institution of the state of nevada and is tax exempt.

STATE OF EXCEPTION FLOW CHART from the collection of UNLV Marjorie

Hotel exception form on behalf of the traveler when the hotel rate exceeds the federal travel regulations (gsa) allowable rate for the. Unlv is an educational institution of the state of nevada and is tax exempt. The lodging exception form is required to be submitted with the spend authorization/expense report in order to. The only exception that can be granted.

Without Documented Travel Approval Through A Spend.

The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. Unlv’s sales tax exemption no. Hotel exception form on behalf of the traveler when the hotel rate exceeds the federal travel regulations (gsa) allowable rate for the. The lodging exception form is required to be submitted with the spend authorization/expense report in order to.

View Our Lodging Policy For Information About Exceptions To Approved Lodging Rates.

“transient lodging tax exemption form for federal credit union” should be properly completed by a federal. The only exception that can be granted over the gsa/federal lodging rates are if a traveler can document one of the two conditions below. Unlv is an educational institution of the state of nevada and is tax exempt.