Under The Corporate Form Of Business Organization Quizlet

Under The Corporate Form Of Business Organization Quizlet - In the united states, corporations generate a significantly greater. We examine the three different legal forms of business organization—sole proprietorship, partnership, and corporation—to see why this is. Which of the following forms of business organizations is most likely to give jonathan total control over his business decisions? Under the corporate form of business organization a. Under the corporate form of business organization a) a stockholder is personally liable for the debts of the corporation. Study with quizlet and memorize flashcards containing terms like corporation, two common classifications of corporations, publicly held. The corporation is the easiest form of business organization to establish. Study with quizlet and memorize flashcards containing terms like which of the following is not a characteristic of a corporation? A stockholder is personally liable for the debts of the corporation b.

The corporation is the easiest form of business organization to establish. Study with quizlet and memorize flashcards containing terms like which of the following is not a characteristic of a corporation? Which of the following forms of business organizations is most likely to give jonathan total control over his business decisions? Under the corporate form of business organization a. Study with quizlet and memorize flashcards containing terms like corporation, two common classifications of corporations, publicly held. We examine the three different legal forms of business organization—sole proprietorship, partnership, and corporation—to see why this is. In the united states, corporations generate a significantly greater. Under the corporate form of business organization a) a stockholder is personally liable for the debts of the corporation. A stockholder is personally liable for the debts of the corporation b.

Study with quizlet and memorize flashcards containing terms like which of the following is not a characteristic of a corporation? Study with quizlet and memorize flashcards containing terms like corporation, two common classifications of corporations, publicly held. Under the corporate form of business organization a) a stockholder is personally liable for the debts of the corporation. A stockholder is personally liable for the debts of the corporation b. The corporation is the easiest form of business organization to establish. In the united states, corporations generate a significantly greater. Under the corporate form of business organization a. We examine the three different legal forms of business organization—sole proprietorship, partnership, and corporation—to see why this is. Which of the following forms of business organizations is most likely to give jonathan total control over his business decisions?

Legal Forms of Business Organization【Dr. Deric】 YouTube

In the united states, corporations generate a significantly greater. The corporation is the easiest form of business organization to establish. Which of the following forms of business organizations is most likely to give jonathan total control over his business decisions? Under the corporate form of business organization a) a stockholder is personally liable for the debts of the corporation. Under.

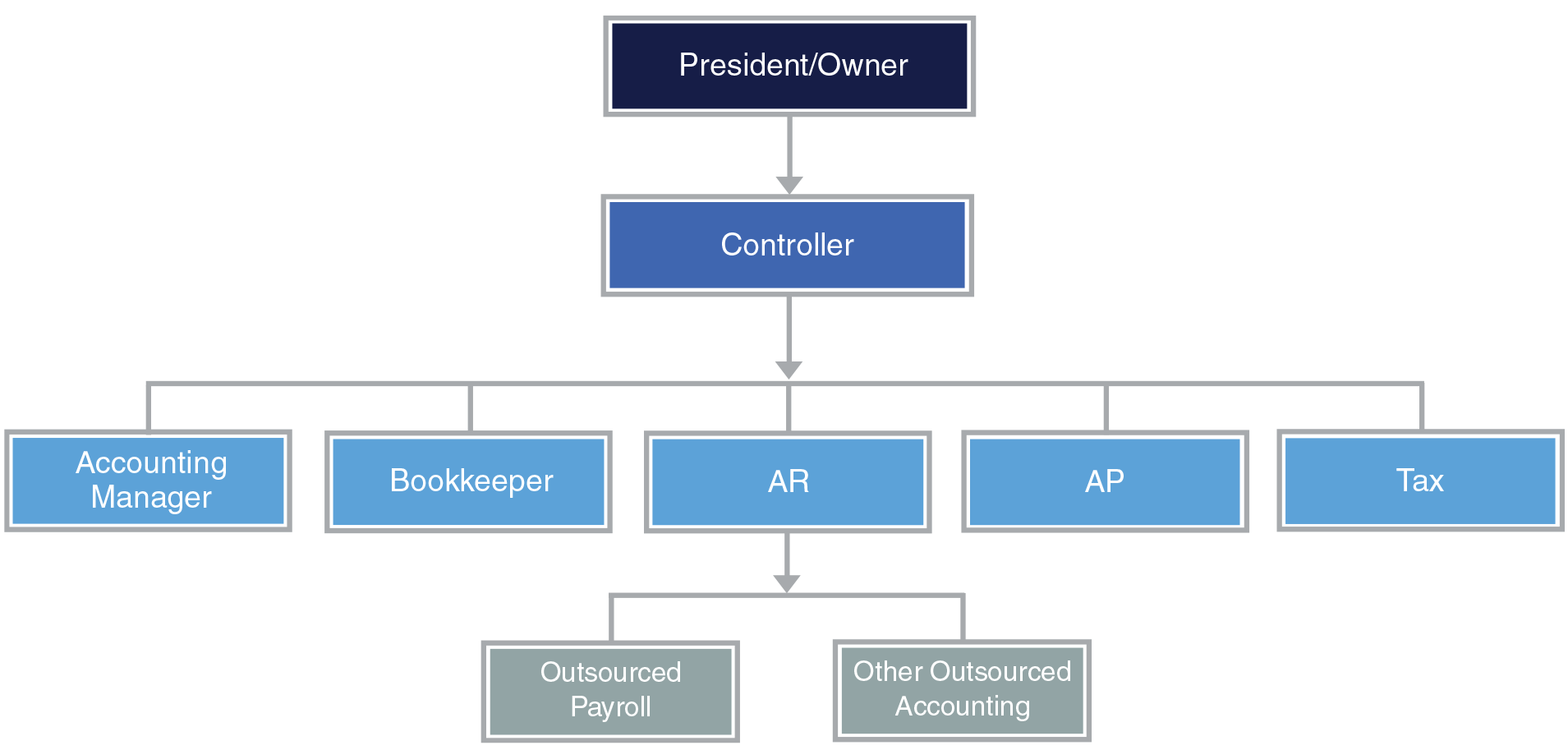

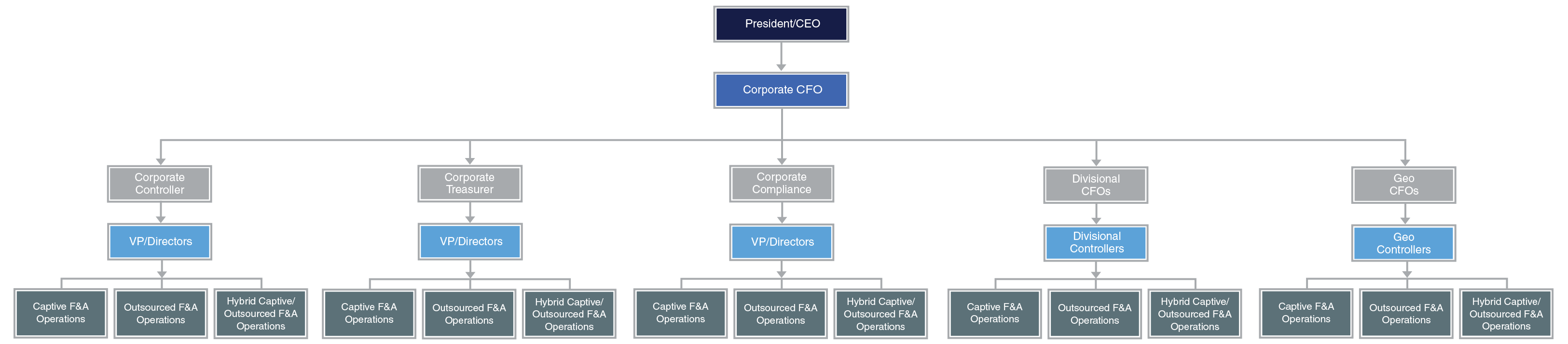

Accounting Firm Organizational Chart

A stockholder is personally liable for the debts of the corporation b. Under the corporate form of business organization a. Study with quizlet and memorize flashcards containing terms like which of the following is not a characteristic of a corporation? Study with quizlet and memorize flashcards containing terms like corporation, two common classifications of corporations, publicly held. In the united.

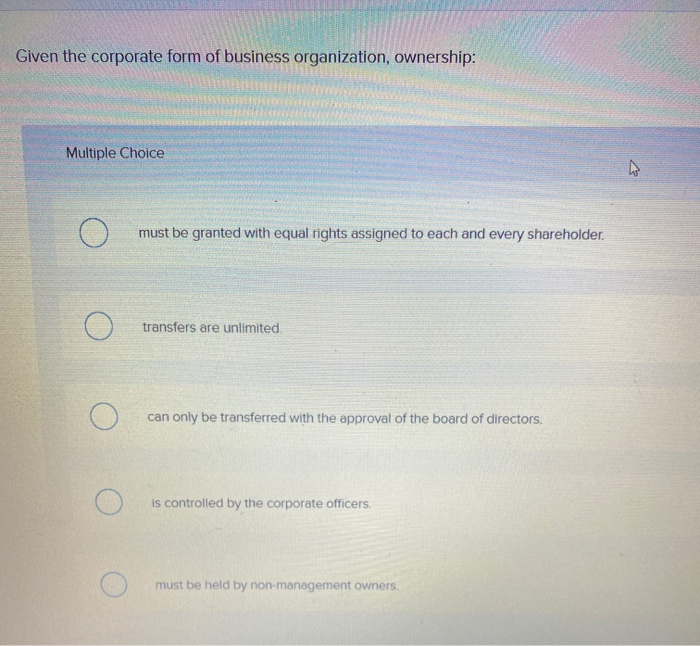

Solved Given the corporate form of business organization,

A stockholder is personally liable for the debts of the corporation b. The corporation is the easiest form of business organization to establish. In the united states, corporations generate a significantly greater. Under the corporate form of business organization a) a stockholder is personally liable for the debts of the corporation. We examine the three different legal forms of business.

Chapter 2 Forms of Business Organization_word文档在线阅读与下载_无忧文档

Study with quizlet and memorize flashcards containing terms like which of the following is not a characteristic of a corporation? The corporation is the easiest form of business organization to establish. Under the corporate form of business organization a. Under the corporate form of business organization a) a stockholder is personally liable for the debts of the corporation. Which of.

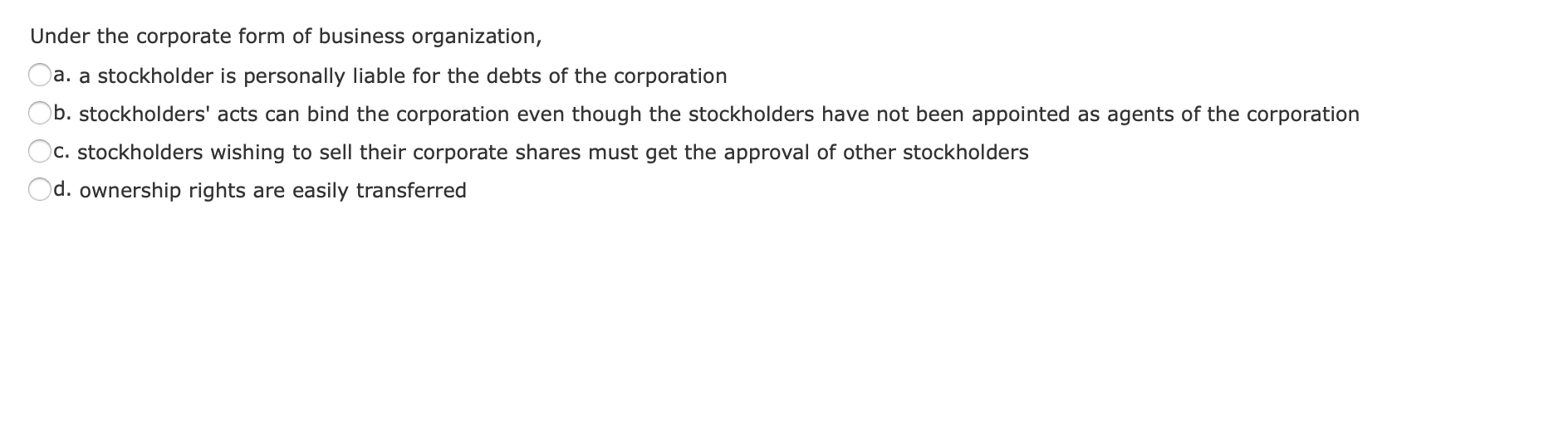

Solved Under the corporate form of business organization,

Under the corporate form of business organization a. Study with quizlet and memorize flashcards containing terms like which of the following is not a characteristic of a corporation? The corporation is the easiest form of business organization to establish. Under the corporate form of business organization a) a stockholder is personally liable for the debts of the corporation. In the.

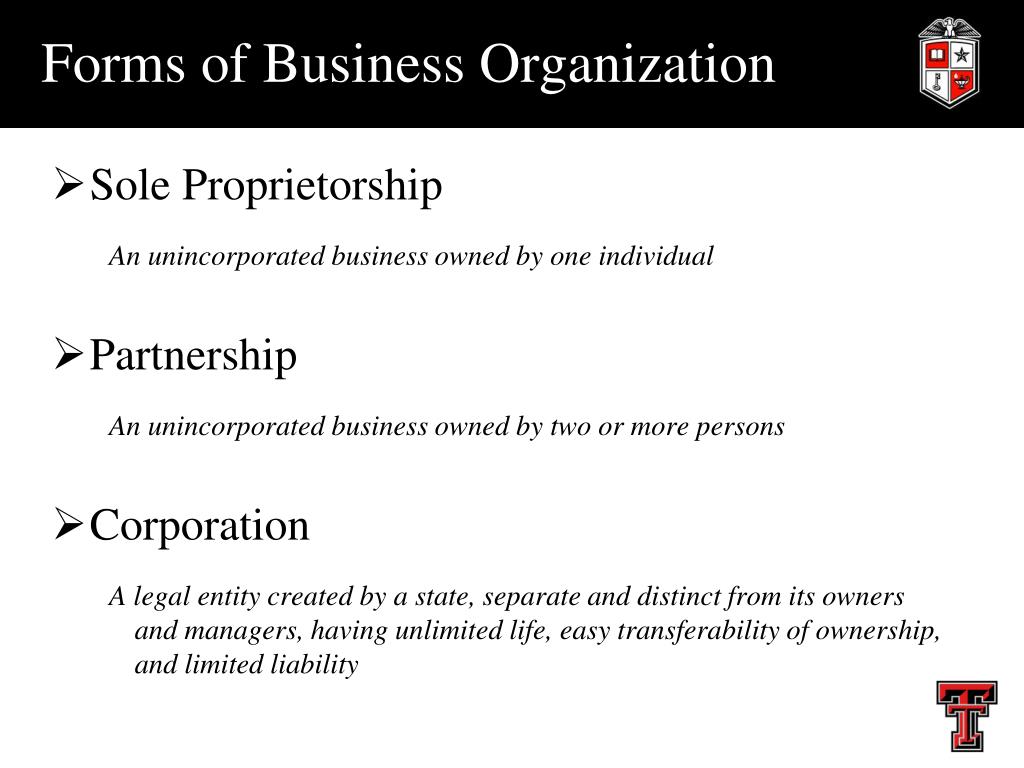

An Unincorporated Business Owned by Two or More Persons

Study with quizlet and memorize flashcards containing terms like corporation, two common classifications of corporations, publicly held. Which of the following forms of business organizations is most likely to give jonathan total control over his business decisions? In the united states, corporations generate a significantly greater. The corporation is the easiest form of business organization to establish. We examine the.

BUSINESS & ORGANIZATIONAL MANAGEMENT PROGAMS

Study with quizlet and memorize flashcards containing terms like which of the following is not a characteristic of a corporation? Which of the following forms of business organizations is most likely to give jonathan total control over his business decisions? In the united states, corporations generate a significantly greater. The corporation is the easiest form of business organization to establish..

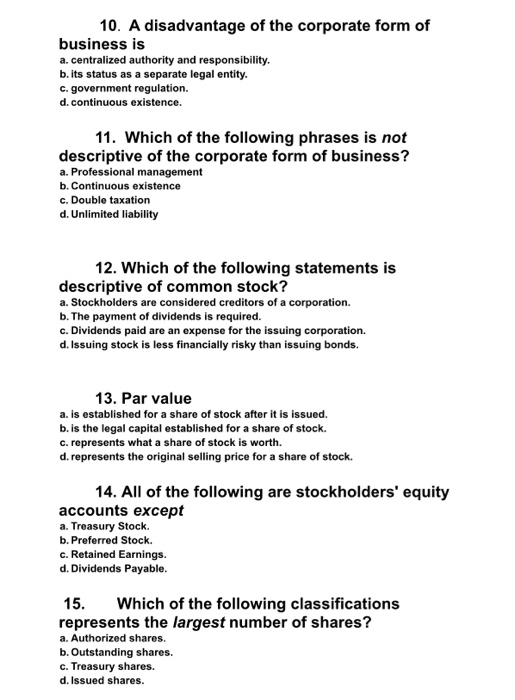

Solved 10. A disadvantage of the corporate form of business

Study with quizlet and memorize flashcards containing terms like which of the following is not a characteristic of a corporation? We examine the three different legal forms of business organization—sole proprietorship, partnership, and corporation—to see why this is. Under the corporate form of business organization a. Under the corporate form of business organization a) a stockholder is personally liable for.

3 Types of Accounting Organization Structures

Which of the following forms of business organizations is most likely to give jonathan total control over his business decisions? Under the corporate form of business organization a) a stockholder is personally liable for the debts of the corporation. A stockholder is personally liable for the debts of the corporation b. Study with quizlet and memorize flashcards containing terms like.

business organization quizlet

In the united states, corporations generate a significantly greater. The corporation is the easiest form of business organization to establish. Under the corporate form of business organization a. Study with quizlet and memorize flashcards containing terms like corporation, two common classifications of corporations, publicly held. A stockholder is personally liable for the debts of the corporation b.

In The United States, Corporations Generate A Significantly Greater.

Study with quizlet and memorize flashcards containing terms like which of the following is not a characteristic of a corporation? Under the corporate form of business organization a. The corporation is the easiest form of business organization to establish. We examine the three different legal forms of business organization—sole proprietorship, partnership, and corporation—to see why this is.

Study With Quizlet And Memorize Flashcards Containing Terms Like Corporation, Two Common Classifications Of Corporations, Publicly Held.

Which of the following forms of business organizations is most likely to give jonathan total control over his business decisions? Under the corporate form of business organization a) a stockholder is personally liable for the debts of the corporation. A stockholder is personally liable for the debts of the corporation b.