Texas Sales Tax Rate

Texas Sales Tax Rate - City sales and use tax. Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. Terminate or reinstate a business; Sales and use tax applications. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Collecting and paying the correct local tax rate is your. Local taxing jurisdictions (cities, counties, special purpose. Apply for a sales tax permit online! Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

Terminate or reinstate a business; Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Local taxing jurisdictions (cities, counties, special purpose. Apply for a sales tax permit online! Sales and use tax applications. Collecting and paying the correct local tax rate is your. City sales and use tax.

Apply for a sales tax permit online! Collecting and paying the correct local tax rate is your. Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. Sales and use tax applications. Terminate or reinstate a business; Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. City sales and use tax. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Local taxing jurisdictions (cities, counties, special purpose.

Ultimate Texas Sales Tax Guide Zamp

Apply for a sales tax permit online! Terminate or reinstate a business; Sales and use tax applications. Local taxing jurisdictions (cities, counties, special purpose. City sales and use tax.

Texas Sales Tax Holiday 2024 Alexa Marlane

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Terminate or reinstate a business; Apply for a sales tax permit online! Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in.

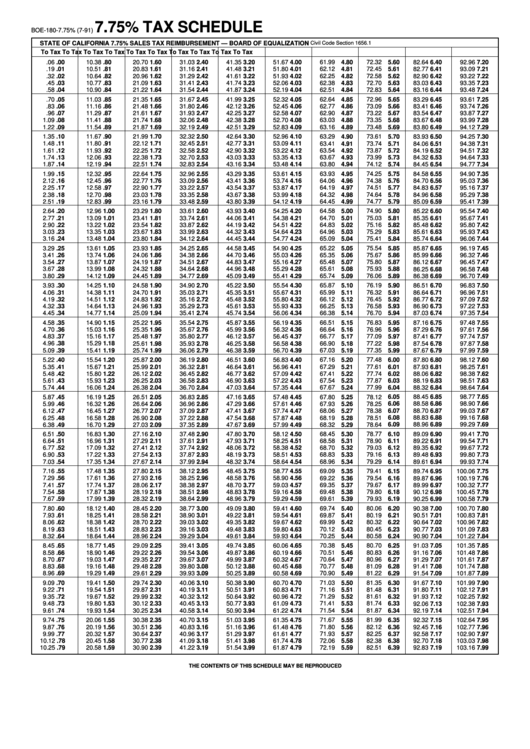

Texas Sales Tax Chart

Sales and use tax applications. City sales and use tax. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Collecting and paying the.

Texas Weekly Texas Weekly Vol 32 Issue 14 The Texas Tribune

Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Sales and use tax.

Sale Tax In Texas 2024 Berta Celinka

Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Apply for a sales tax permit online! Terminate or reinstate a business; Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal.

Printable Sales Tax Chart

Local taxing jurisdictions (cities, counties, special purpose. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Sales and use tax applications. Terminate or reinstate a business; City sales and use tax.

Texas Sales Tax Rate Tax Sales Tax Sales Chart And if you’re

Sales and use tax applications. Local taxing jurisdictions (cities, counties, special purpose. Terminate or reinstate a business; Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. City sales and use tax.

Sales Tax Rate Texas 2024 Karee Marjory

Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid in the preceding state fiscal year (september 1 to. Sales and use tax applications. Collecting and paying the correct local tax rate is your. Apply for a sales tax permit online! Texas imposes a 6.25 percent state sales.

What Is Texas Sales Tax Rate 2024 Vivi Joletta

Terminate or reinstate a business; Collecting and paying the correct local tax rate is your. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately.

Texas Sales Tax Rate 2024 Jeanne Maudie

Apply for a sales tax permit online! Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported. Collecting and paying the correct local tax rate is your. Depending on the tax, texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported and paid.

Depending On The Tax, Texas Taxpayers May Be Required To Electronically Report (File) And/Or Pay Based On The Amount Reported And Paid In The Preceding State Fiscal Year (September 1 To.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Collecting and paying the correct local tax rate is your. Local taxing jurisdictions (cities, counties, special purpose. Sales and use tax applications.

Apply For A Sales Tax Permit Online!

City sales and use tax. Terminate or reinstate a business; Sales tax filers, please validate the business location address shown on your permit to ensure local tax is being accurately reported.

.png)