Texas Rendition Form

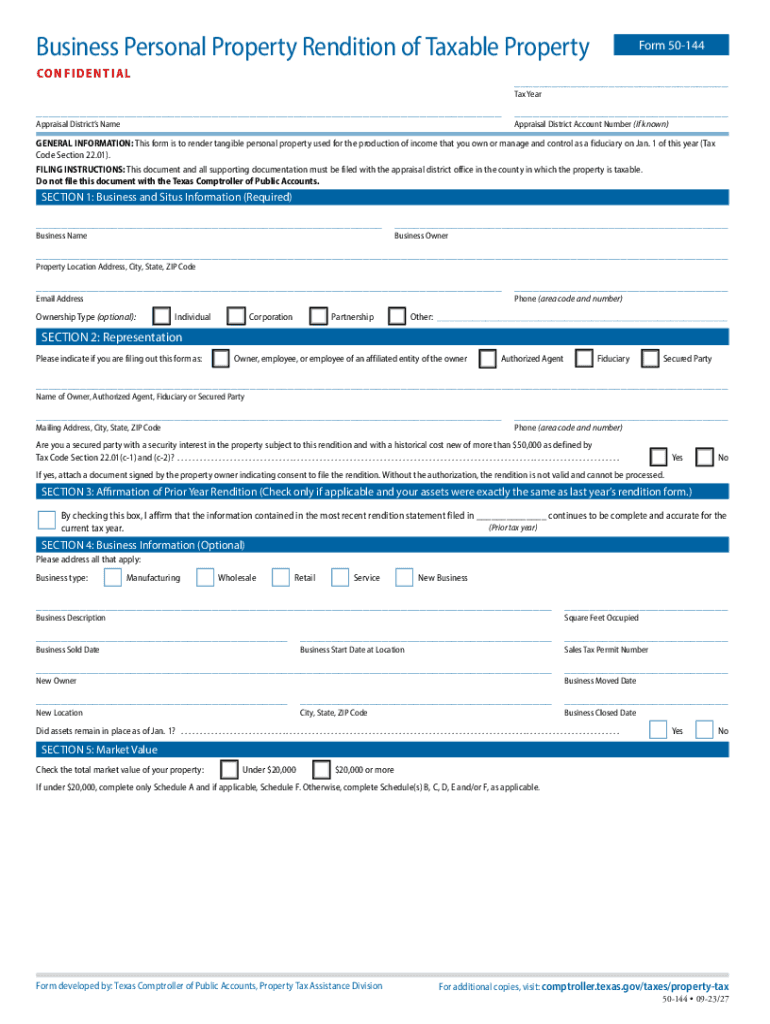

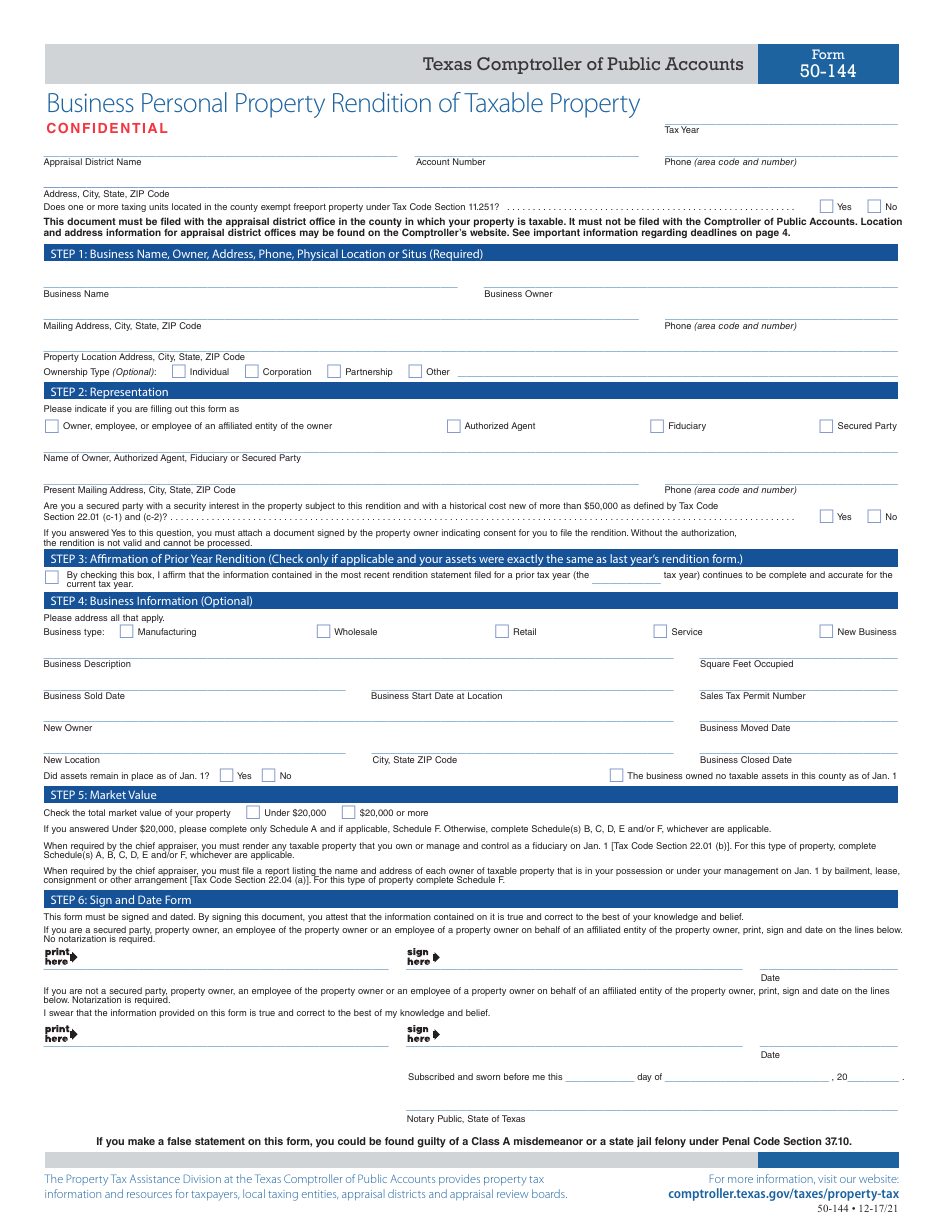

Texas Rendition Form - If you own business vehicles or aircraft that. Download and complete texas property tax forms. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. This is your chance to report your assets as of january 1, 2024. Beginning january 1st, you are able to file your annual rendition form. A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition statement. For gregg county appraisal district, most businesses will need to file the general rendition.

If you own business vehicles or aircraft that. Download and complete texas property tax forms. For gregg county appraisal district, most businesses will need to file the general rendition. This is your chance to report your assets as of january 1, 2024. Beginning january 1st, you are able to file your annual rendition form. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition statement.

Download and complete texas property tax forms. For gregg county appraisal district, most businesses will need to file the general rendition. A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition statement. If you own business vehicles or aircraft that. Beginning january 1st, you are able to file your annual rendition form. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. This is your chance to report your assets as of january 1, 2024.

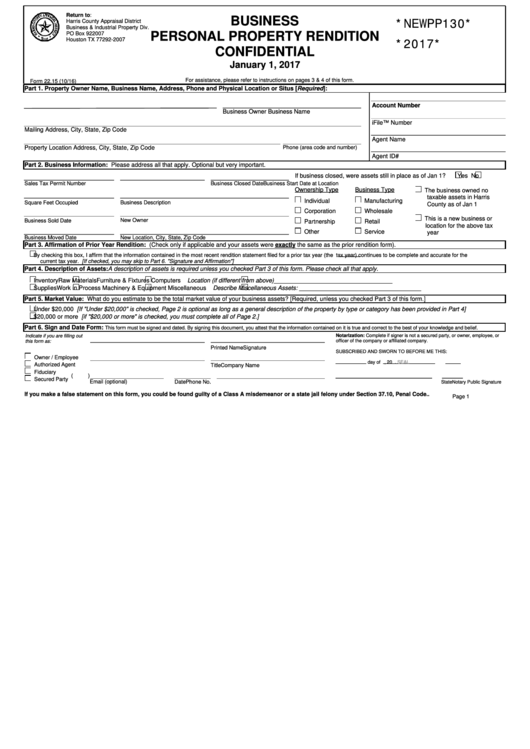

Top Hcad Forms And Templates free to download in PDF format

If you own business vehicles or aircraft that. Beginning january 1st, you are able to file your annual rendition form. A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition statement. For gregg county appraisal district, most businesses will need to file the general rendition. This form.

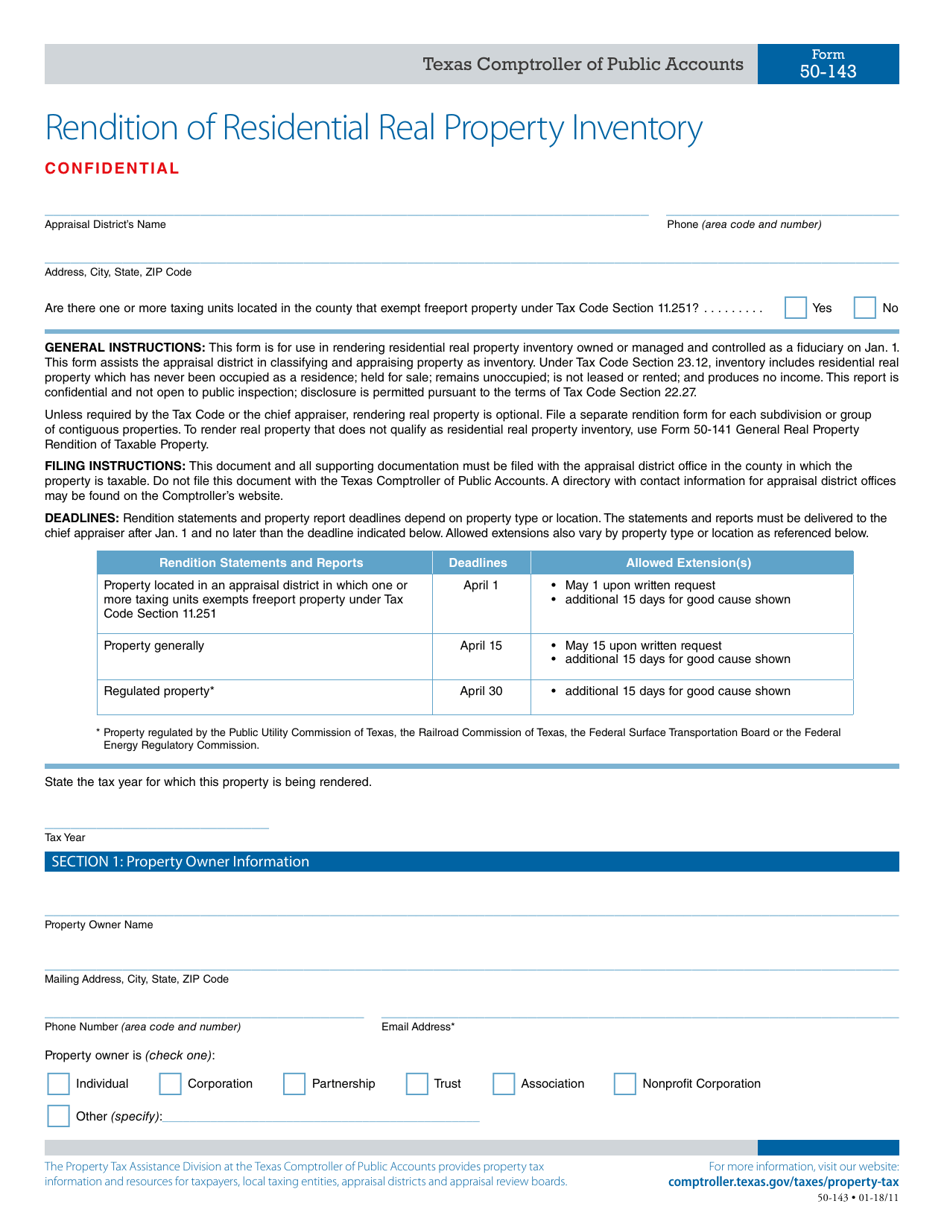

Form 50143 Fill Out, Sign Online and Download Fillable PDF, Texas

Download and complete texas property tax forms. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. This is your chance to report your assets as of january 1, 2024. If you own business vehicles or aircraft that. For gregg county appraisal district, most businesses.

Fill Free fillable Harris County Appraisal District PDF forms

Beginning january 1st, you are able to file your annual rendition form. For gregg county appraisal district, most businesses will need to file the general rendition. If you own business vehicles or aircraft that. This is your chance to report your assets as of january 1, 2024. This form is for use in rendering, pursuant to tax code §22.01, tangible.

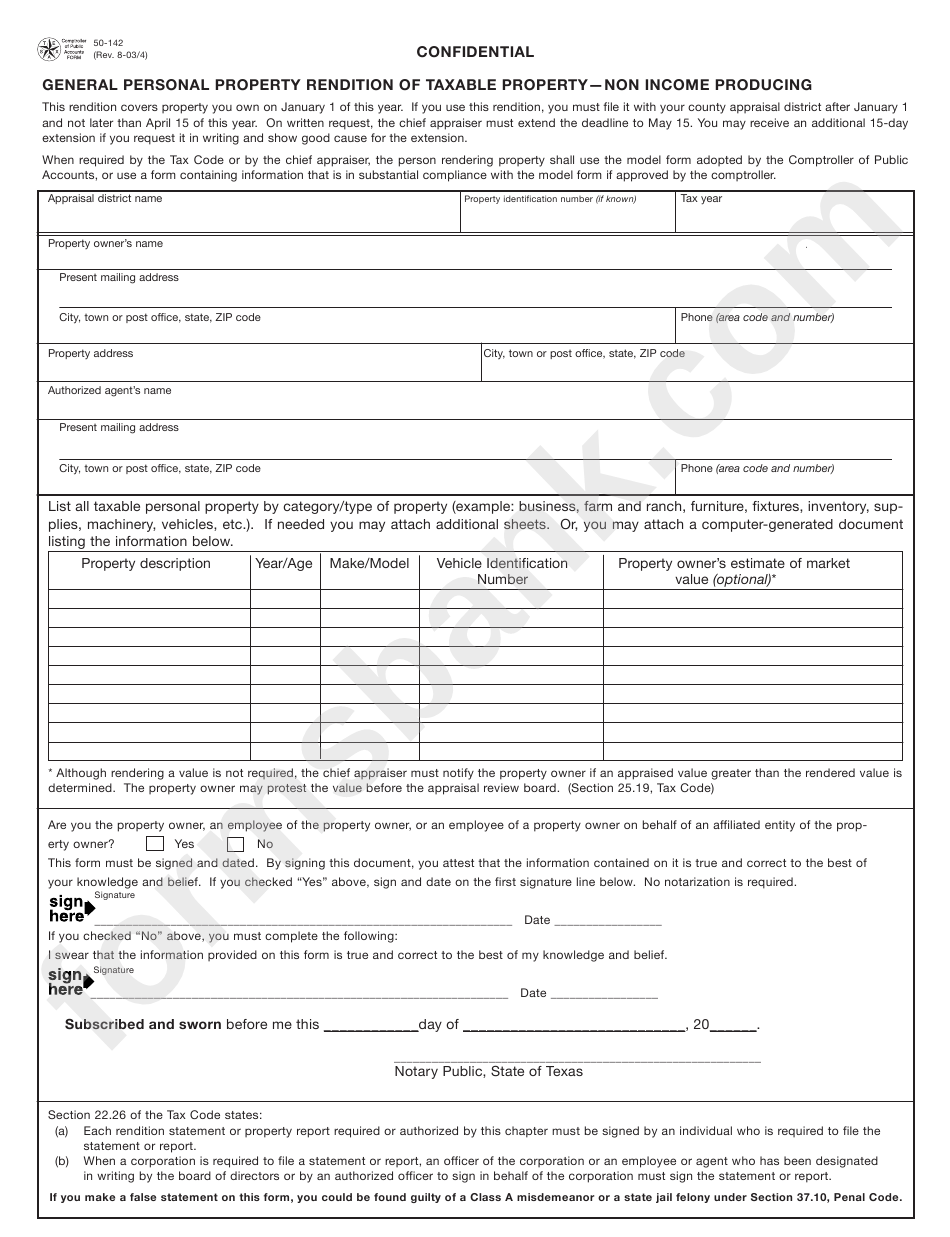

Form 50142 General Personal Property Rendition Of Taxable Property

For gregg county appraisal district, most businesses will need to file the general rendition. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. If you own business vehicles or aircraft that. Download and complete texas property tax forms. This is your chance to report.

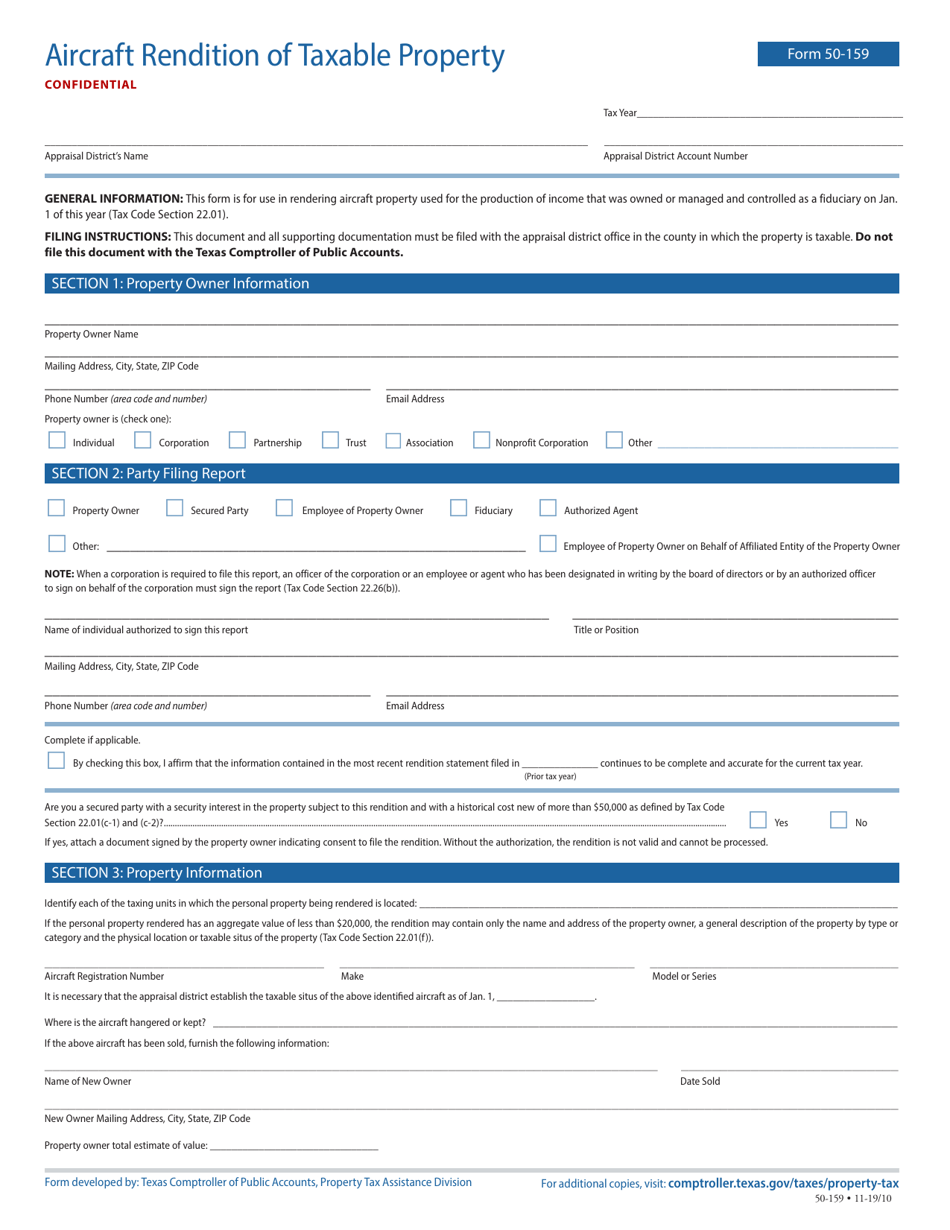

Form 50159 Download Fillable PDF or Fill Online Aircraft Rendition of

This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition statement. For gregg county appraisal district, most businesses will need to file.

Texas Form 05 141 Fill Online, Printable, Fillable, Blank pdfFiller

If you own business vehicles or aircraft that. This is your chance to report your assets as of january 1, 2024. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. A person or business who owns tangible personal property with an aggregate value of.

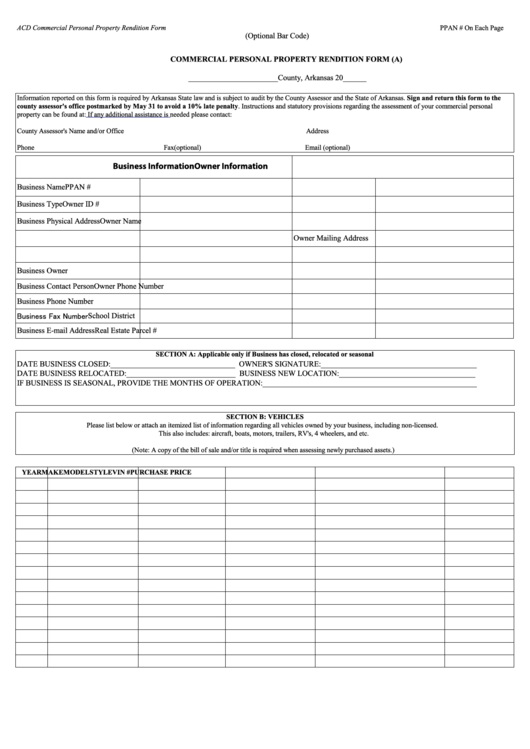

Commercial Personal Property Rendition Form printable pdf download

Beginning january 1st, you are able to file your annual rendition form. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition.

Fill Free fillable Harris County Appraisal District PDF forms

Beginning january 1st, you are able to file your annual rendition form. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition.

Texas Rendition 20232024 Form Fill Out and Sign Printable PDF

A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition statement. If you own business vehicles or aircraft that. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. This is your.

Form 50144 Fill Out, Sign Online and Download Fillable PDF, Texas

If you own business vehicles or aircraft that. For gregg county appraisal district, most businesses will need to file the general rendition. This is your chance to report your assets as of january 1, 2024. Download and complete texas property tax forms. A person or business who owns tangible personal property with an aggregate value of $20,000 or more is.

A Person Or Business Who Owns Tangible Personal Property With An Aggregate Value Of $20,000 Or More Is Required To File A Rendition Statement.

Beginning january 1st, you are able to file your annual rendition form. This form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or. If you own business vehicles or aircraft that. For gregg county appraisal district, most businesses will need to file the general rendition.

Download And Complete Texas Property Tax Forms.

This is your chance to report your assets as of january 1, 2024.