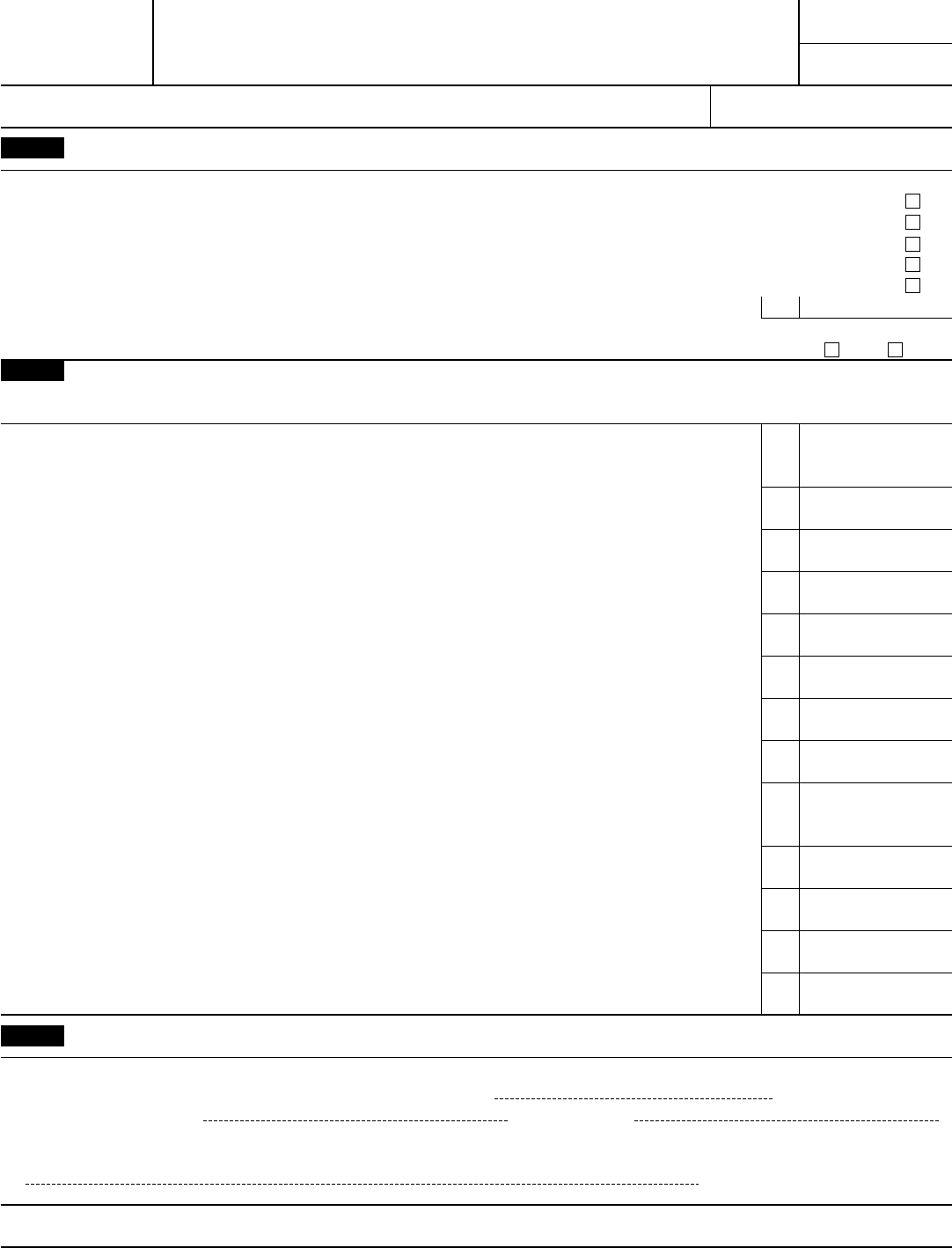

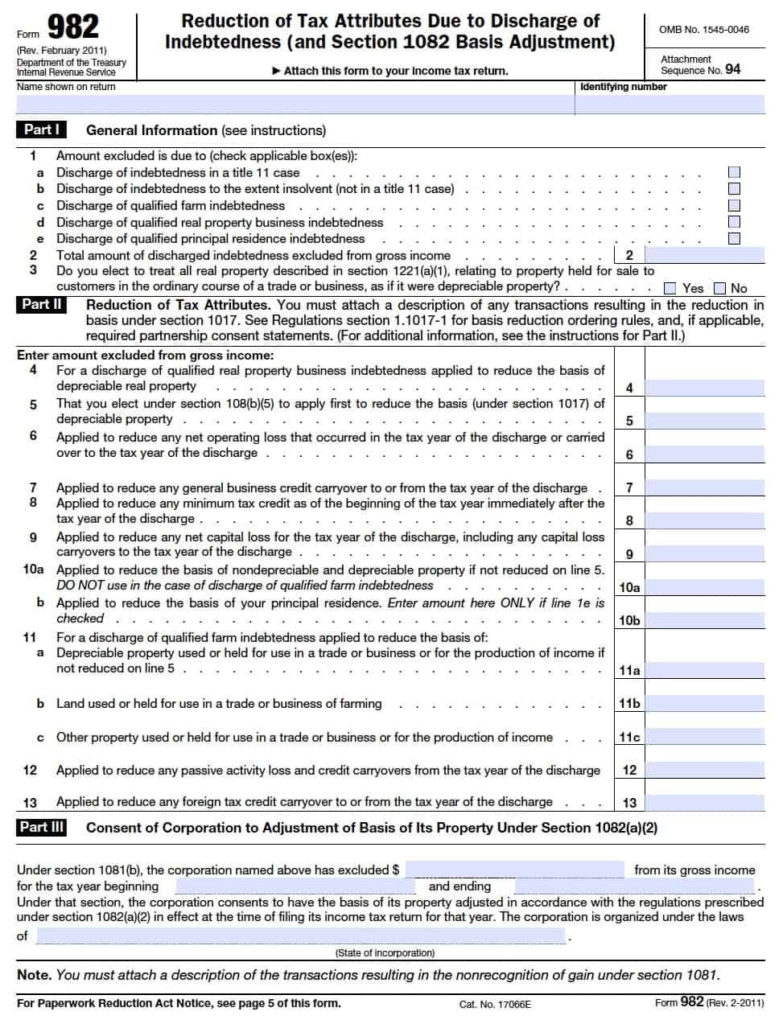

Tax Form 982

Tax Form 982 - You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as. Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108.

Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as. Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108.

Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as.

Form 982 Edit, Fill, Sign Online Handypdf

Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or.

Irs.gov Insolvency Worksheet Form Printable

Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as. Form 982 is used to calculate the amount of discharged debt that can.

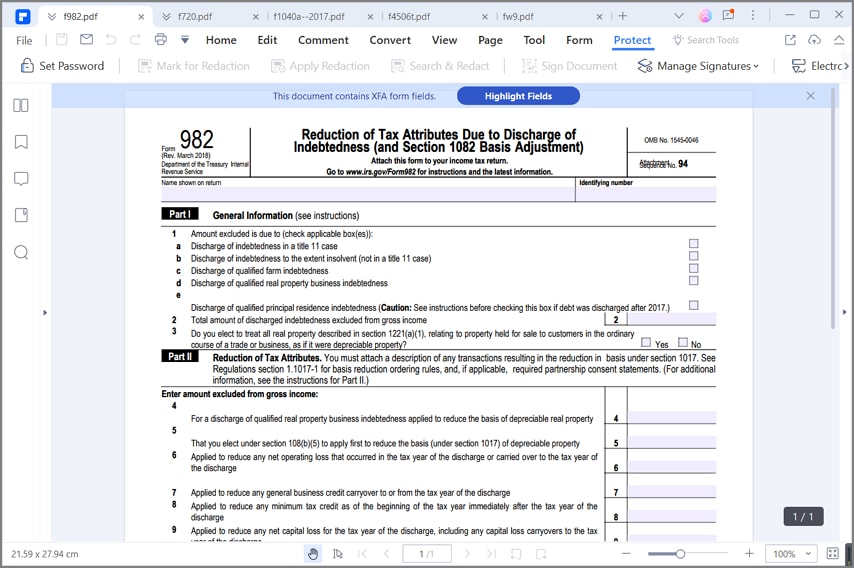

IRS Form 982 Reduction of Attributes Due to Discharge of Indebtedness

Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or.

Pdf Fillable Irs Form 982 Printable Forms Free Online

Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or.

Insolvency Worksheet Form 982

Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or.

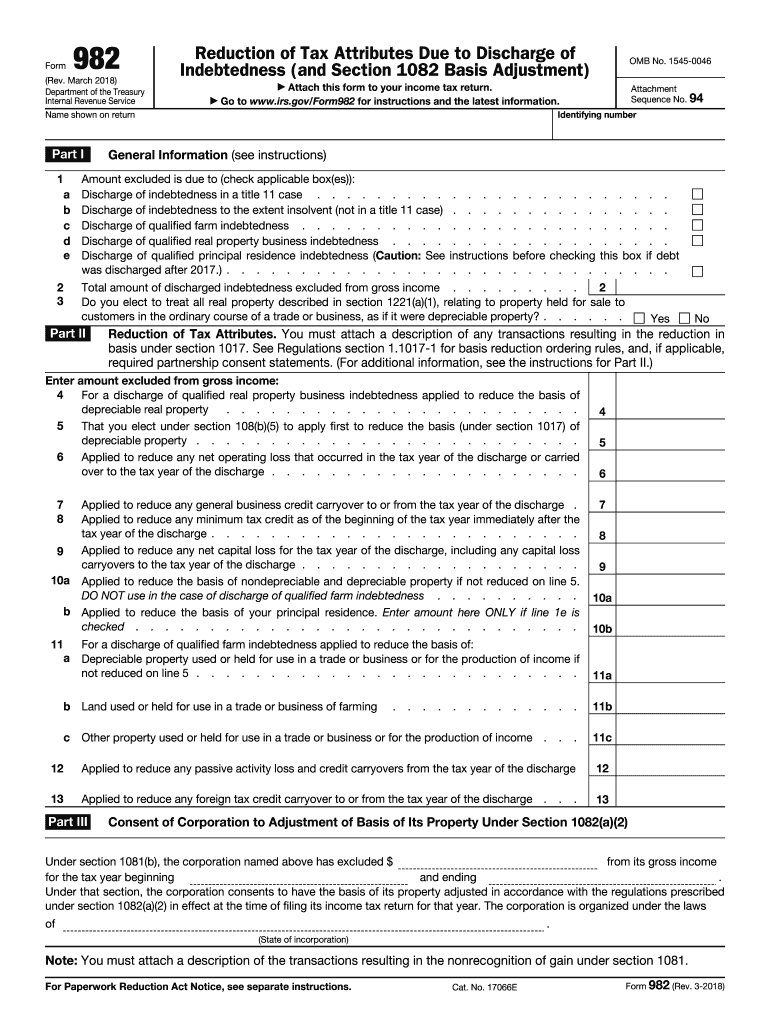

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as. Form 982 is used to calculate the amount of discharged debt that can.

Download Instructions for IRS Form 982 Reduction of Tax Attributes Due

Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as. Form 982 (reduction of tax attributes due to discharge of.

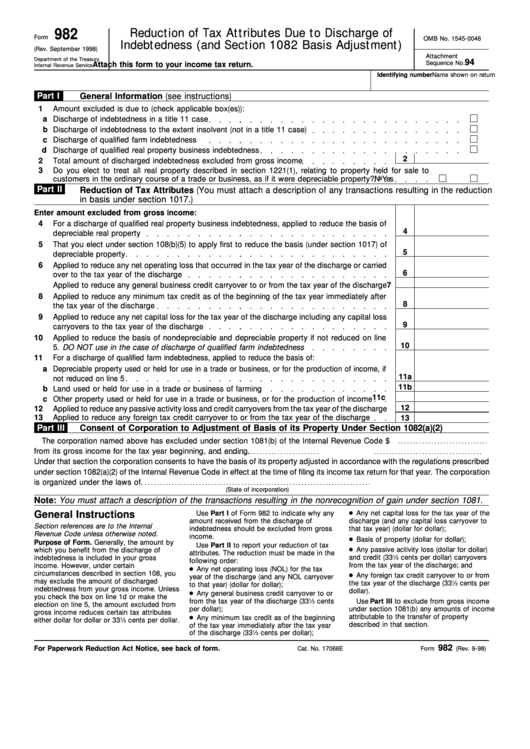

Irs Form 982 Insolvency Worksheet

Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as. Form 982 is used to calculate the amount of discharged debt that can.

Tax Form 982 Insolvency Worksheet — Db Free Download Nude Photo Gallery

Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or.

Tax Form 982 Insolvency Worksheet —

You must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as. Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. Form 982 is used to calculate the amount of discharged debt that can.

You Must File Form 982 To Report The Exclusion And The Reduction Of Certain Tax Attributes Either Dollar For Dollar Or 33 1 / 3 Cents Per Dollar (As.

Form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to. Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108.