Tax Form 8849

Tax Form 8849 - Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. An ultimate purchaser of gasoline, gasohol,. Usually the irs pays back the amount by cheque to the mailing. Use this form to claim a refund of excise taxes on certain fuel related sales. If by any chance you paid or deposited in additional to.

Usually the irs pays back the amount by cheque to the mailing. An ultimate purchaser of gasoline, gasohol,. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. If by any chance you paid or deposited in additional to. Use this form to claim a refund of excise taxes on certain fuel related sales.

Use this form to claim a refund of excise taxes on certain fuel related sales. If by any chance you paid or deposited in additional to. Usually the irs pays back the amount by cheque to the mailing. An ultimate purchaser of gasoline, gasohol,. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid.

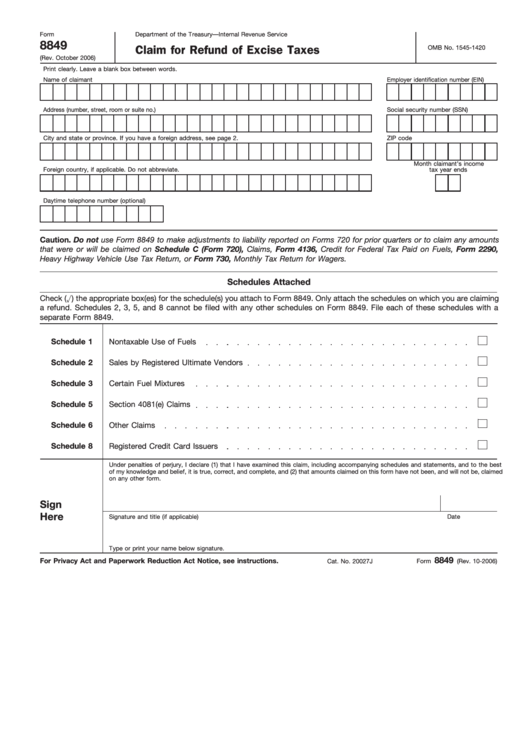

Fillable Form 8849 Claim For Refund Of Excise Taxes printable pdf

Use this form to claim a refund of excise taxes on certain fuel related sales. An ultimate purchaser of gasoline, gasohol,. If by any chance you paid or deposited in additional to. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. Usually the irs pays back the amount by cheque to the mailing.

Services Form 8849 Form 2290 HVUT Online 7.95 per filing

Use this form to claim a refund of excise taxes on certain fuel related sales. If by any chance you paid or deposited in additional to. Usually the irs pays back the amount by cheque to the mailing. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. An ultimate purchaser of gasoline, gasohol,.

Fillable Form 8849 Claim For Refund Of Excise Taxes printable pdf

If by any chance you paid or deposited in additional to. An ultimate purchaser of gasoline, gasohol,. Usually the irs pays back the amount by cheque to the mailing. Use this form to claim a refund of excise taxes on certain fuel related sales. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid.

Everything you need to know about Form 8849 Blog ExpressTruckTax

Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. Usually the irs pays back the amount by cheque to the mailing. An ultimate purchaser of gasoline, gasohol,. Use this form to claim a refund of excise taxes on certain fuel related sales. If by any chance you paid or deposited in additional to.

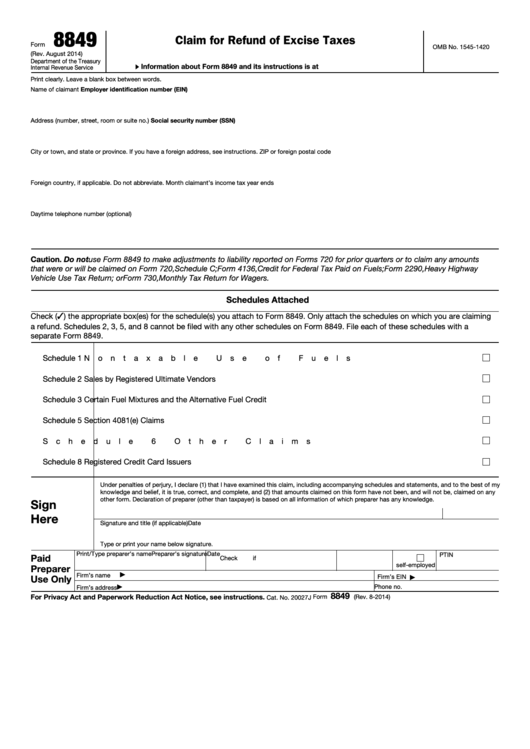

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

An ultimate purchaser of gasoline, gasohol,. Use this form to claim a refund of excise taxes on certain fuel related sales. Usually the irs pays back the amount by cheque to the mailing. If by any chance you paid or deposited in additional to. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid.

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

If by any chance you paid or deposited in additional to. Usually the irs pays back the amount by cheque to the mailing. Use this form to claim a refund of excise taxes on certain fuel related sales. An ultimate purchaser of gasoline, gasohol,. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid.

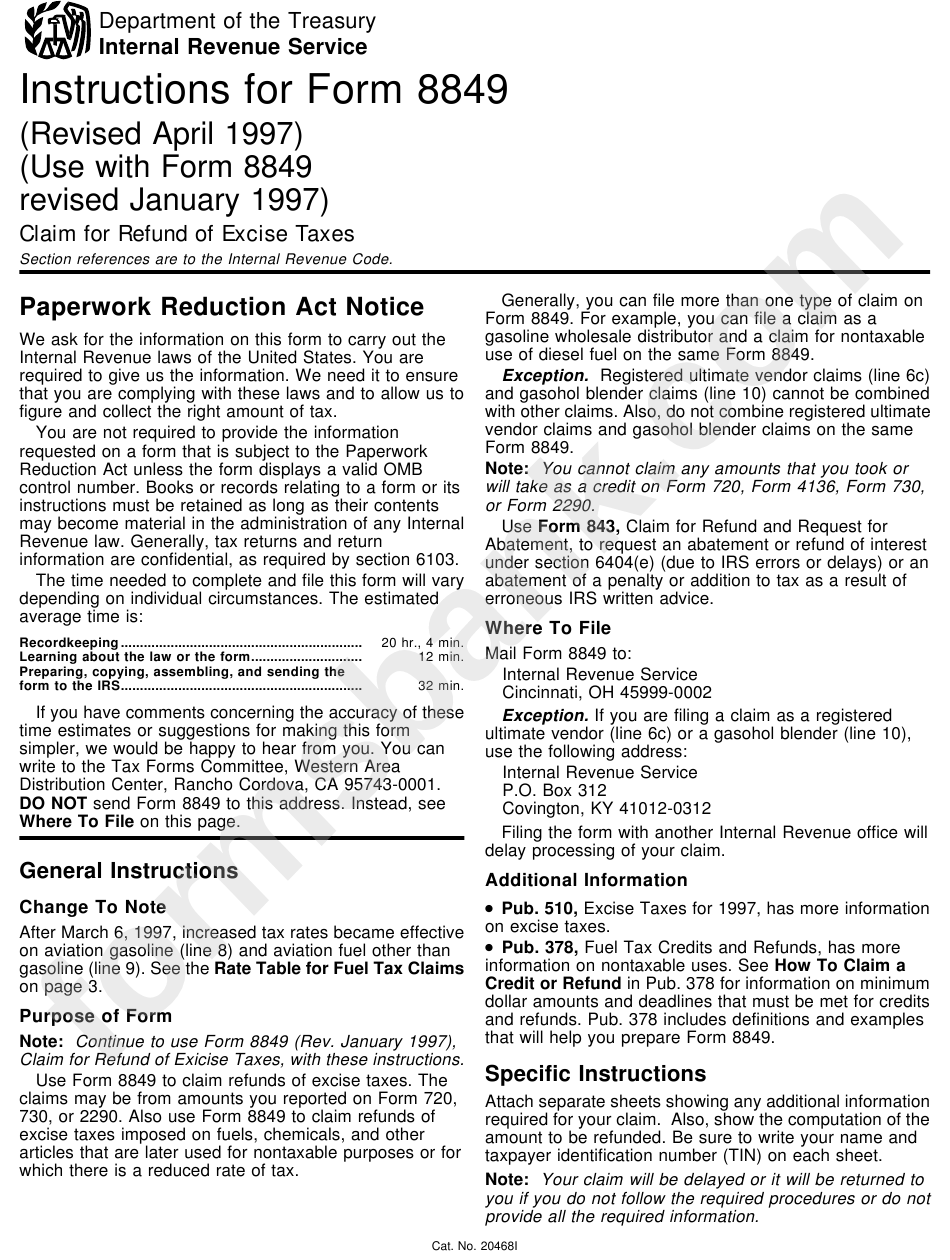

Instructions For Form 8849 Claim For Refund Of Excise Taxes 1997

Use this form to claim a refund of excise taxes on certain fuel related sales. An ultimate purchaser of gasoline, gasohol,. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. If by any chance you paid or deposited in additional to. Usually the irs pays back the amount by cheque to the mailing.

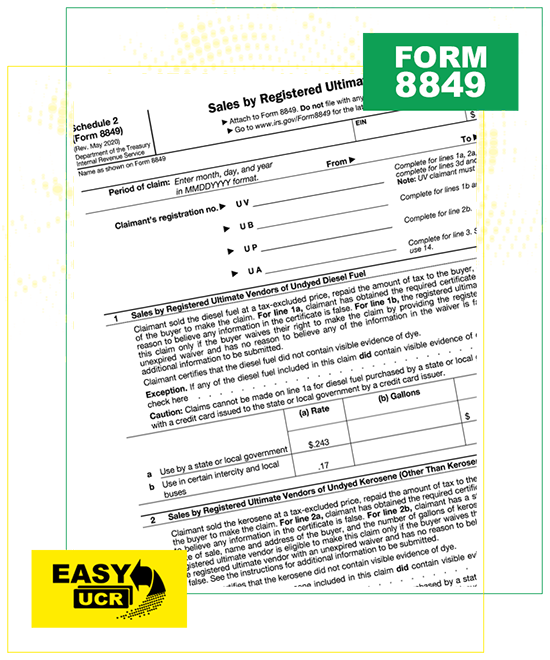

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

Use this form to claim a refund of excise taxes on certain fuel related sales. An ultimate purchaser of gasoline, gasohol,. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. Usually the irs pays back the amount by cheque to the mailing. If by any chance you paid or deposited in additional to.

Form 8849 Edit, Fill, Sign Online Handypdf

Use this form to claim a refund of excise taxes on certain fuel related sales. Usually the irs pays back the amount by cheque to the mailing. If by any chance you paid or deposited in additional to. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. An ultimate purchaser of gasoline, gasohol,.

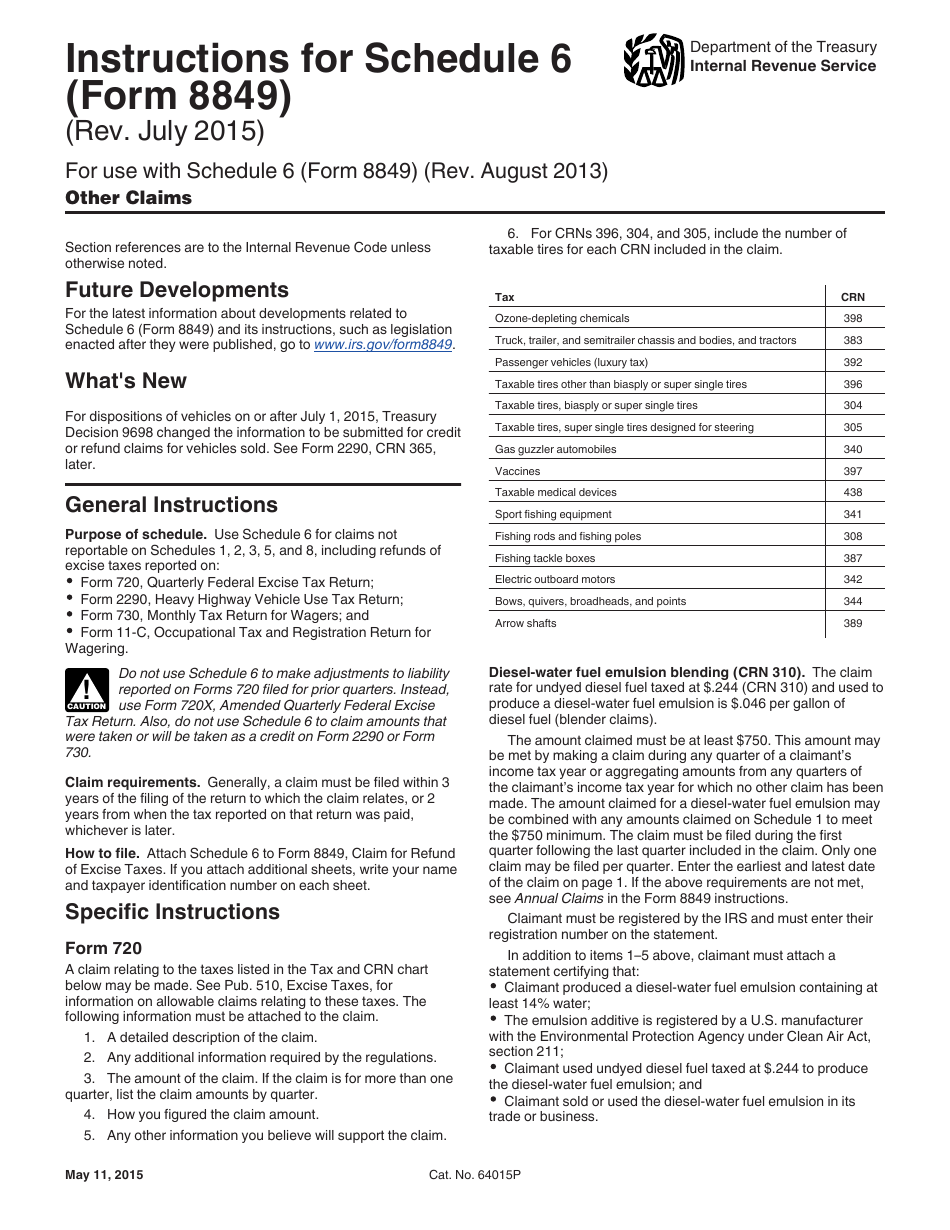

Download Instructions for IRS Form 8849 Schedule 6 Other Claims PDF

Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. Use this form to claim a refund of excise taxes on certain fuel related sales. An ultimate purchaser of gasoline, gasohol,. If by any chance you paid or deposited in additional to. Usually the irs pays back the amount by cheque to the mailing.

Use This Form To Claim A Refund Of Excise Taxes On Certain Fuel Related Sales.

Usually the irs pays back the amount by cheque to the mailing. Irs 8849 form is used to refund the 2290 claims for the additional dollars paid. An ultimate purchaser of gasoline, gasohol,. If by any chance you paid or deposited in additional to.