Tax Form 4952

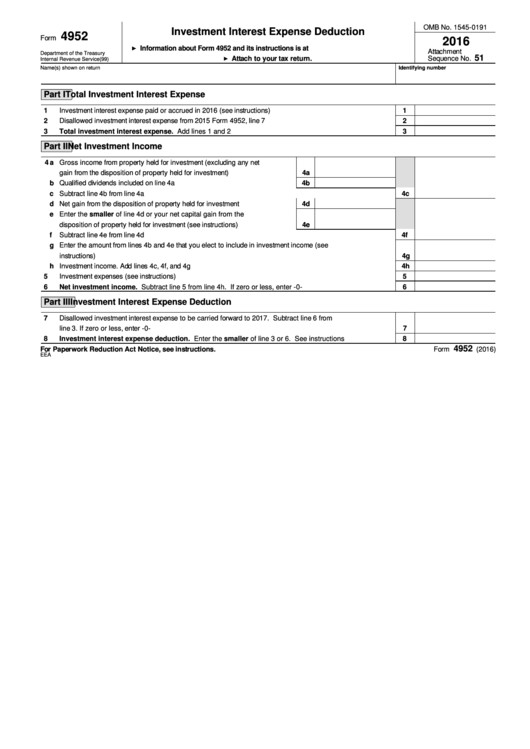

Tax Form 4952 - You don’t have to file form 4952 if all of the following apply. • your investment income from interest and ordinary dividends minus any. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be.

• your investment income from interest and ordinary dividends minus any. You don’t have to file form 4952 if all of the following apply. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be.

Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. You don’t have to file form 4952 if all of the following apply. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be. • your investment income from interest and ordinary dividends minus any.

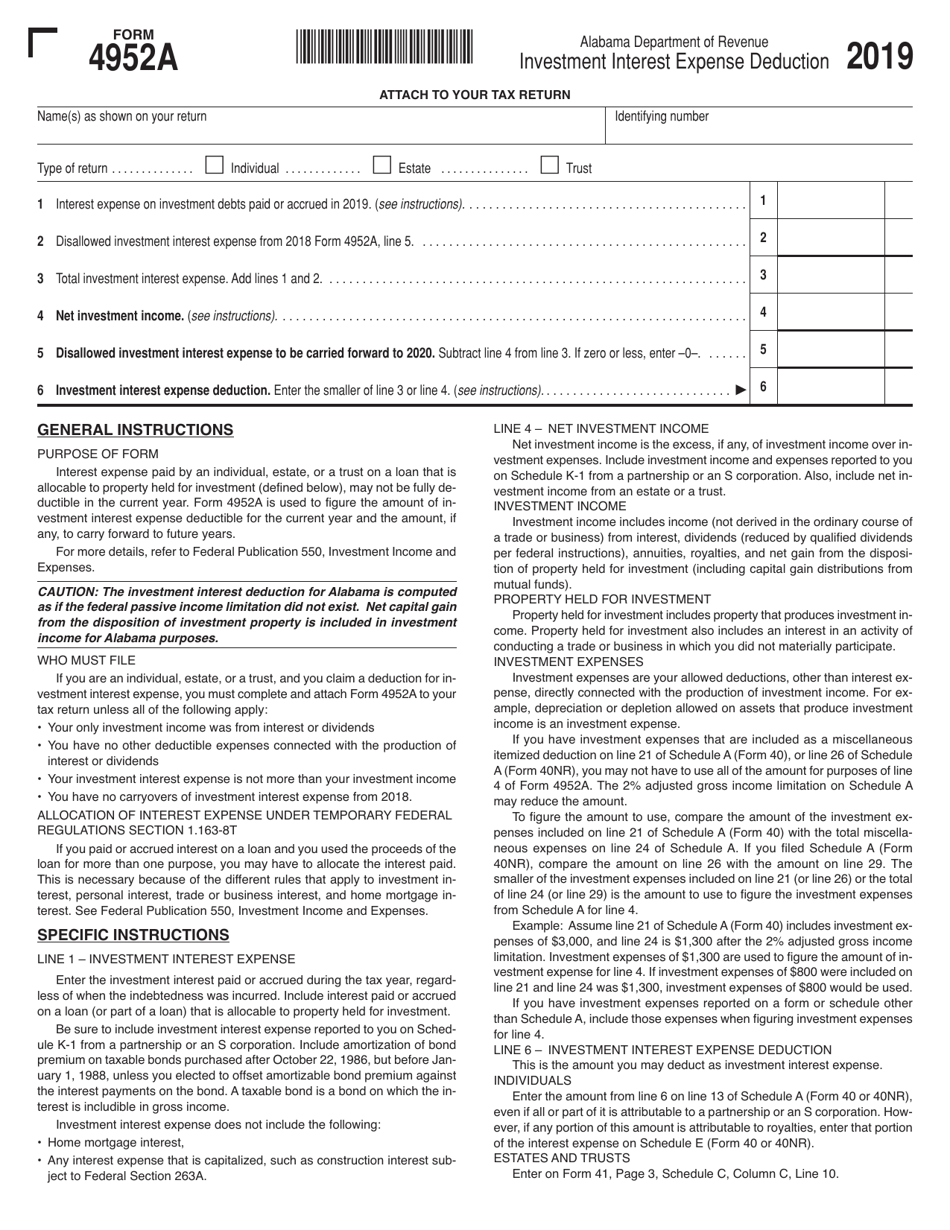

Form 4952A 2019 Fill Out, Sign Online and Download Printable PDF

• your investment income from interest and ordinary dividends minus any. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be. You don’t have to file form 4952 if all of the following apply. Learn how to use form 4952 to calculate your investment interest expense deduction.

IRS Form 6251 walkthrough (Alternative Minimum Tax For Individuals

You don’t have to file form 4952 if all of the following apply. • your investment income from interest and ordinary dividends minus any. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction.

IRS Form 4952 Instructions Investment Interest Deduction

You don’t have to file form 4952 if all of the following apply. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. • your investment income from interest and ordinary dividends.

Irs Tax Day 2024 Thia Sharia

• your investment income from interest and ordinary dividends minus any. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. You don’t have to file form 4952 if all of the.

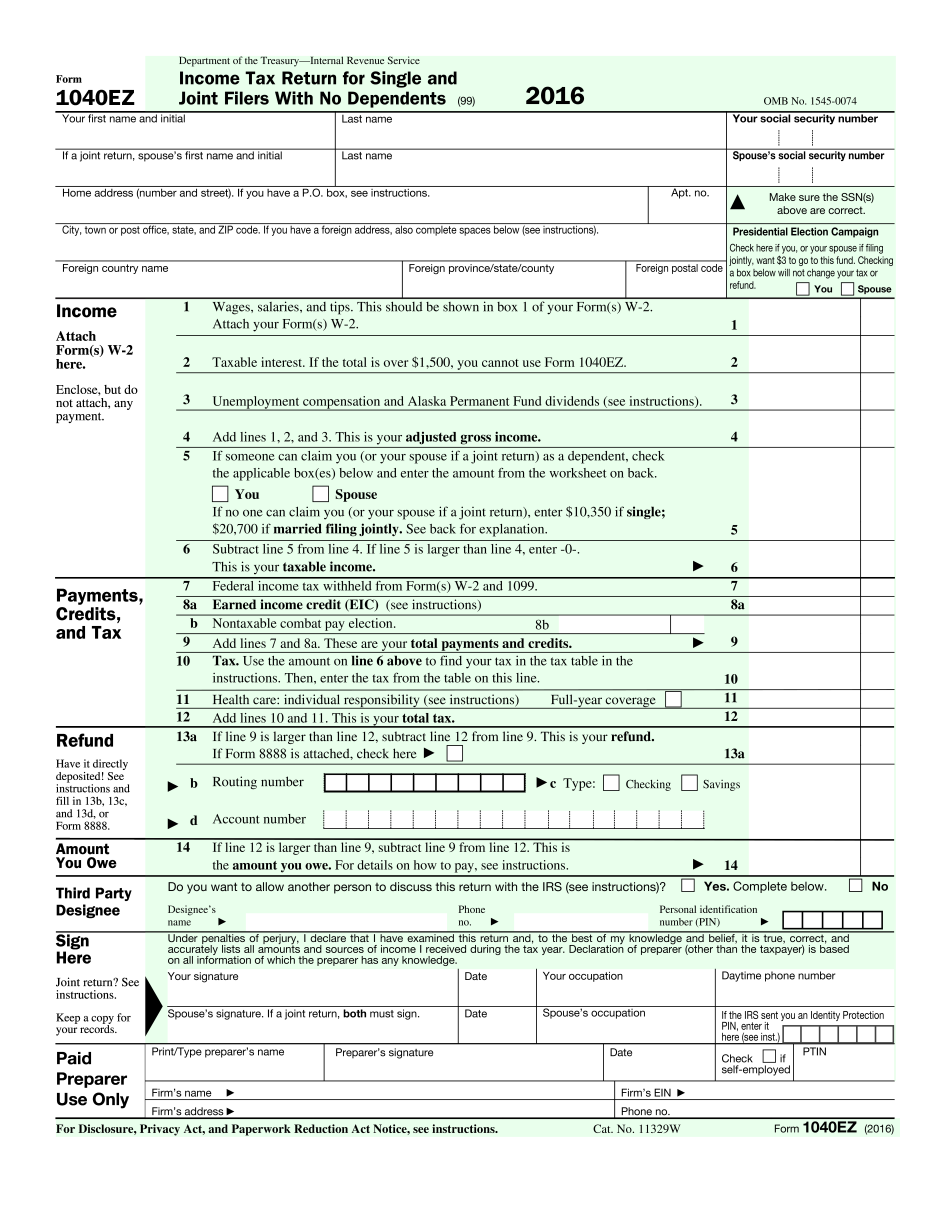

Irs Printable Form 1040

You don’t have to file form 4952 if all of the following apply. • your investment income from interest and ordinary dividends minus any. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction.

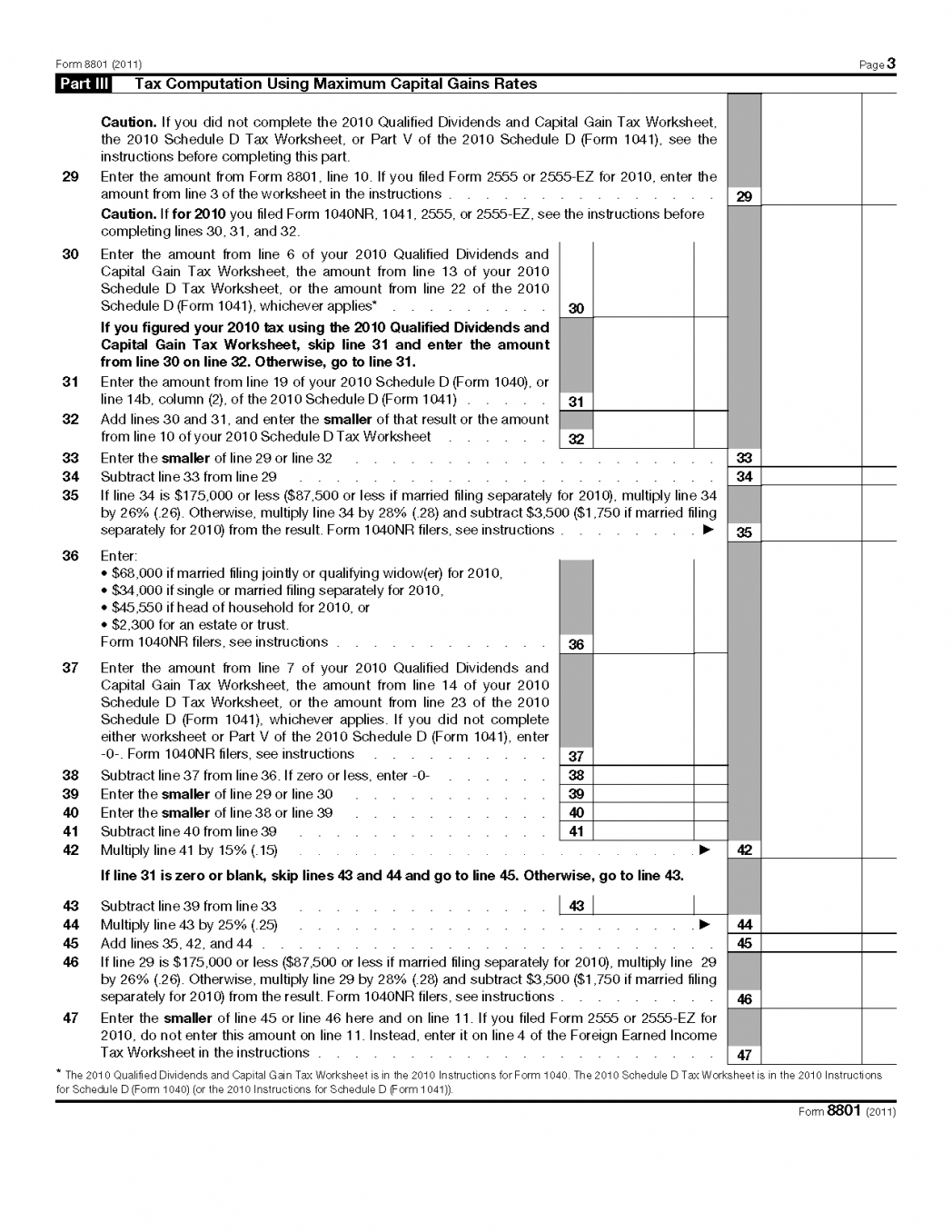

2020 Qualified Dividends And Capital Gains Worksheet

Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. • your investment income from interest and ordinary dividends minus any. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be. You don’t have to file form 4952 if all of the.

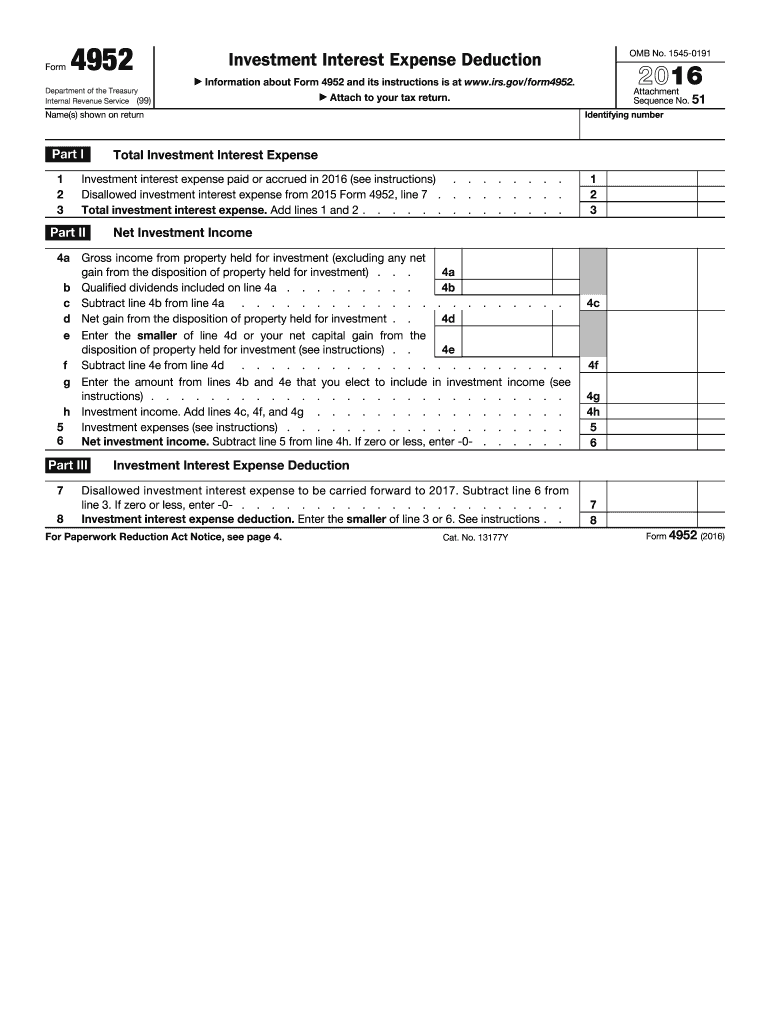

Form 4952 Fillable Printable Forms Free Online

Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be. • your investment income from interest and ordinary dividends minus any. You don’t have to file form 4952 if all of the following apply. Learn how to use form 4952 to calculate your investment interest expense deduction.

Tax Form 3CEB offline utility is now available for filing on portal

• your investment income from interest and ordinary dividends minus any. You don’t have to file form 4952 if all of the following apply. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

• your investment income from interest and ordinary dividends minus any. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. You don’t have to file form 4952 if all of the.

Form 4952 Investment Interest Expense Deduction 2016 printable pdf

• your investment income from interest and ordinary dividends minus any. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. You don’t have to file form 4952 if all of the.

• Your Investment Income From Interest And Ordinary Dividends Minus Any.

You don’t have to file form 4952 if all of the following apply. Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover.