Tax Exempt Form Ohio

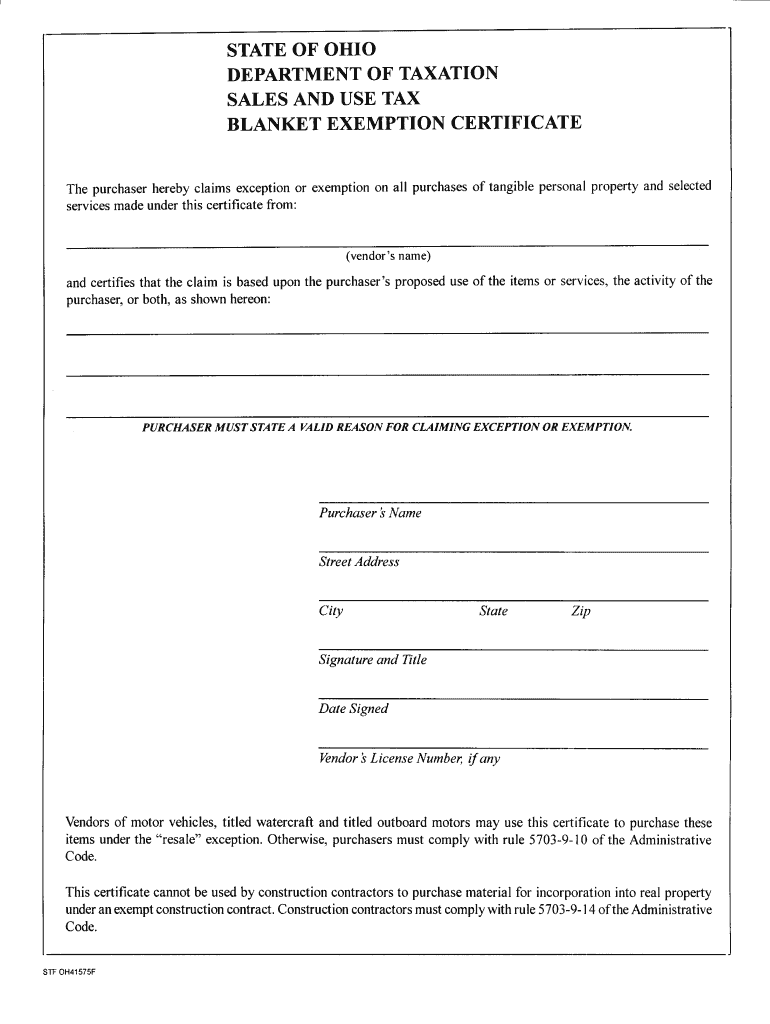

Tax Exempt Form Ohio - This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. What purchases are exempt from the ohio sales tax? While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download or print the forms. Purchasers must state a valid. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Purchasers must state a valid. This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Download or print the forms.

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. Purchasers must state a valid. Download or print the forms. What purchases are exempt from the ohio sales tax?

blanket certificate of exemption ohio Fill Online, Printable, Fillable

Download or print the forms. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are.

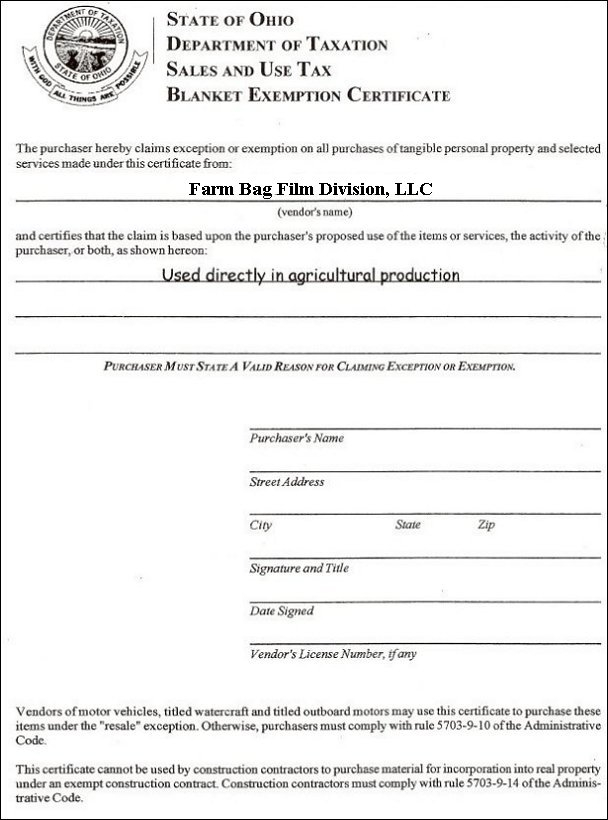

Ohio tax exempt form Fill out & sign online DocHub

Purchasers must state a valid. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download or print the forms. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. Download and fill out this form to claim exception or exemption.

Printable State Tax Forms

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Purchasers must state a valid. Download or print the forms. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. This form allows purchasers to claim exception or exemption on certain items or.

Fillable Ohio Vendor Tax Exempt Form Printable Forms Free Online

Purchasers must state a valid. This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. What purchases are exempt from the ohio sales tax? Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. Download and fill out this form to.

Ohio Sales Tax Manufacturing Exemption Form

What purchases are exempt from the ohio sales tax? Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. There is a special contractor's exemption certificate and.

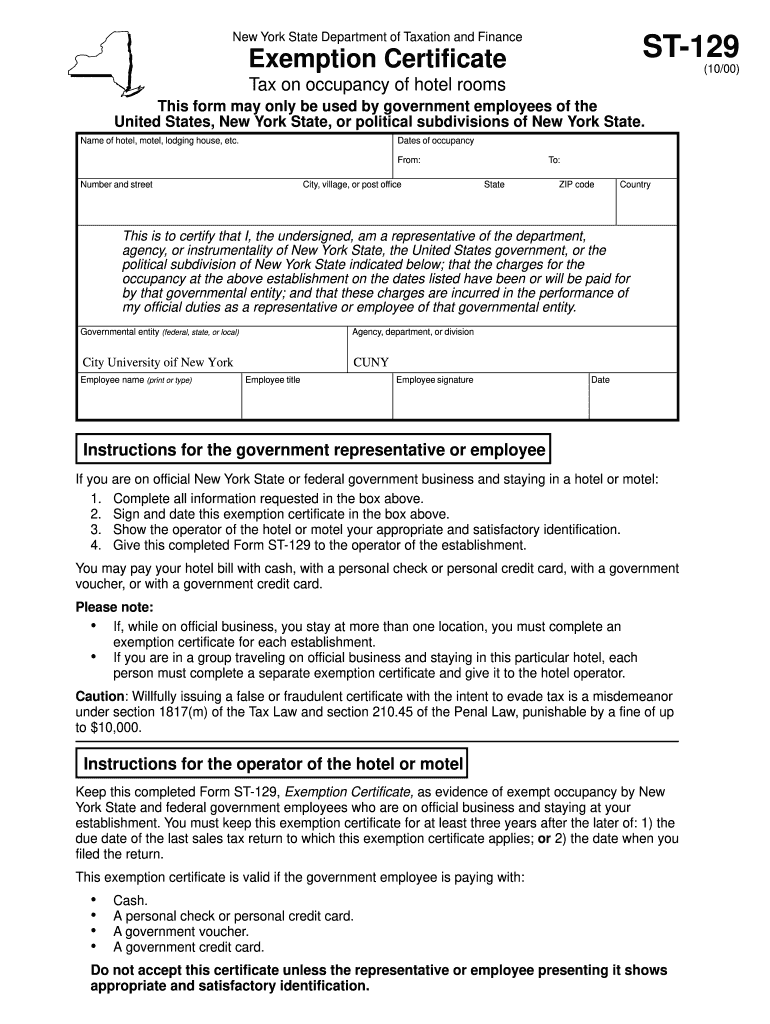

Ohio State Tax Form What Does The Exemption Mean

Download or print the forms. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who.

Blank Fillable Ohio Tax Exempt Form Printable Forms Free Online

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. What purchases are exempt from the ohio sales tax? Find out how to claim exemption or exception on sales and use tax in ohio with various.

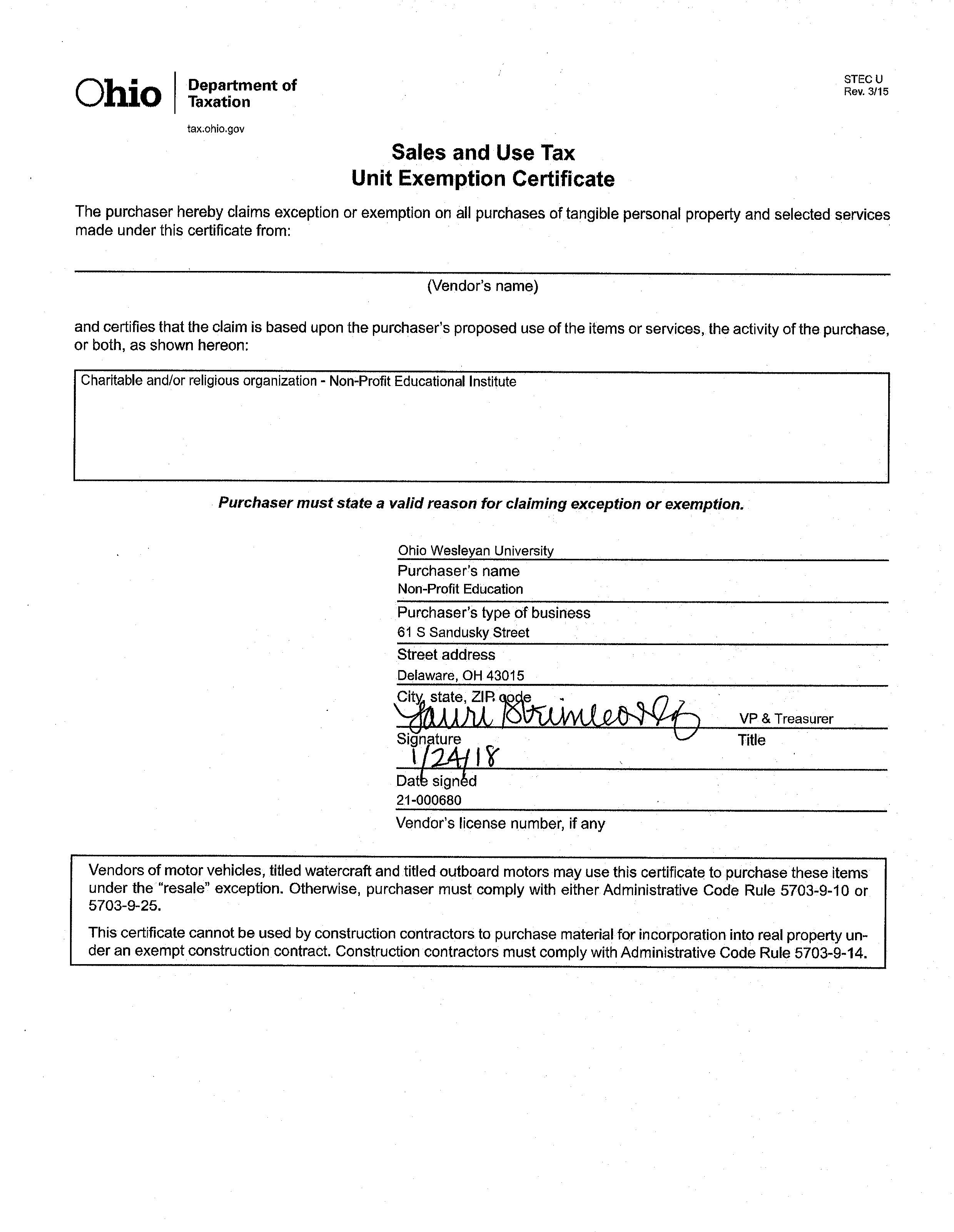

TaxExempt Forms Ohio Wesleyan University

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Purchasers must state a valid. Download or print the forms. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. A sales tax exemption certificate can be.

Ohio Tax Exempt Form Welder Service

What purchases are exempt from the ohio sales tax? While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Find out how to claim exemption or exception on sales and use tax.

State Of Ohio Unit Tax Exempt Form

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Purchasers must state a valid. Find out how to claim exemption or exception on sales and use tax.

Download And Fill Out This Form To Claim Exception Or Exemption On Purchases Of Tangible Personal Property And Selected Services In Ohio.

Download or print the forms. This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. What purchases are exempt from the ohio sales tax? A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

While The Ohio Sales Tax Of 5.75% Applies To Most Transactions, There Are Certain Items That.

Purchasers must state a valid. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations.