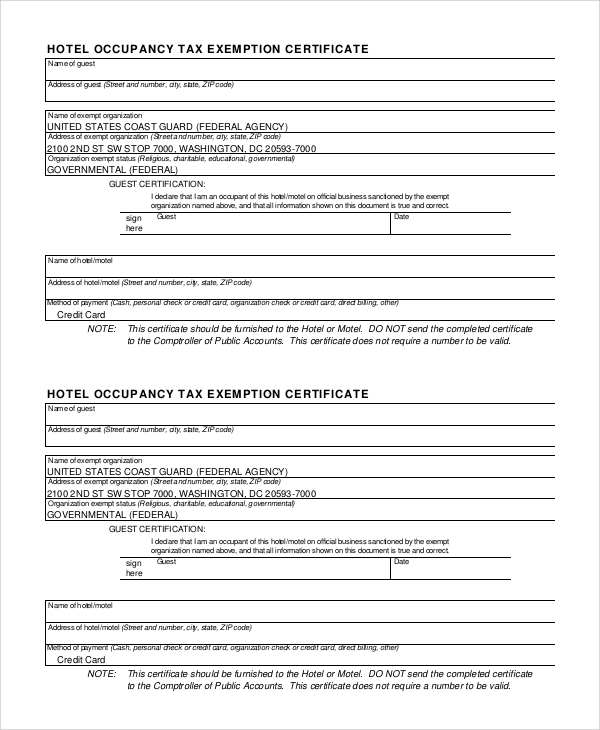

Tax Exempt Form Florida Hotel

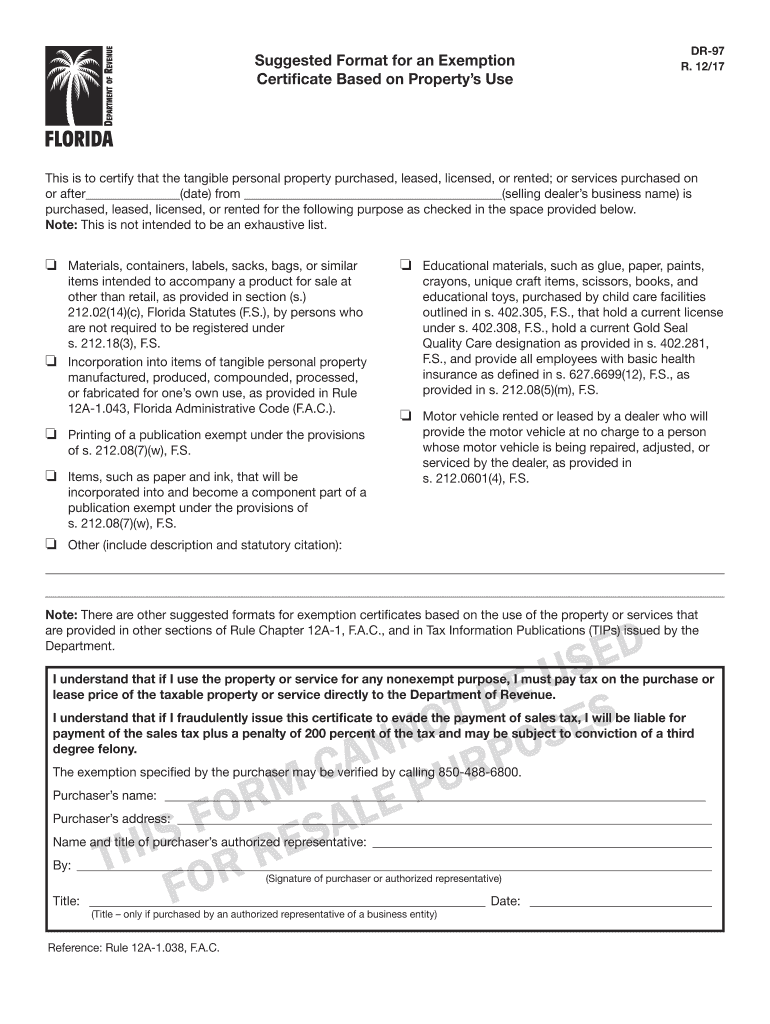

Tax Exempt Form Florida Hotel - Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed.

Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed.

To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed.

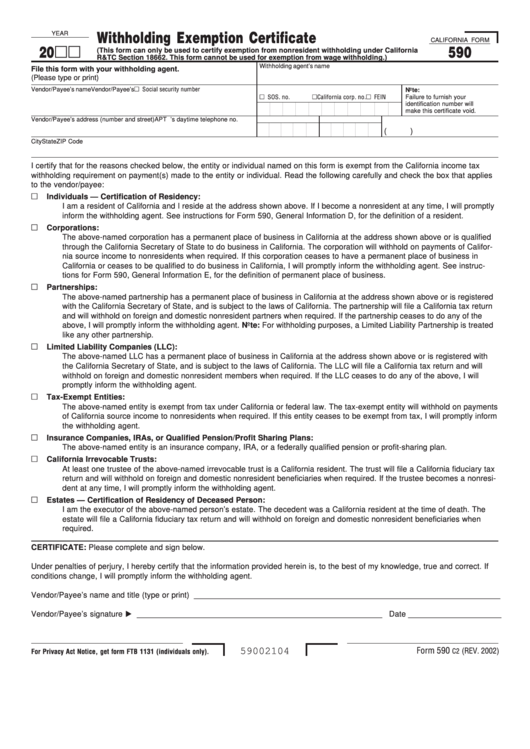

California Hotel Tax Exempt Form For Federal Employees

To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed. Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1.

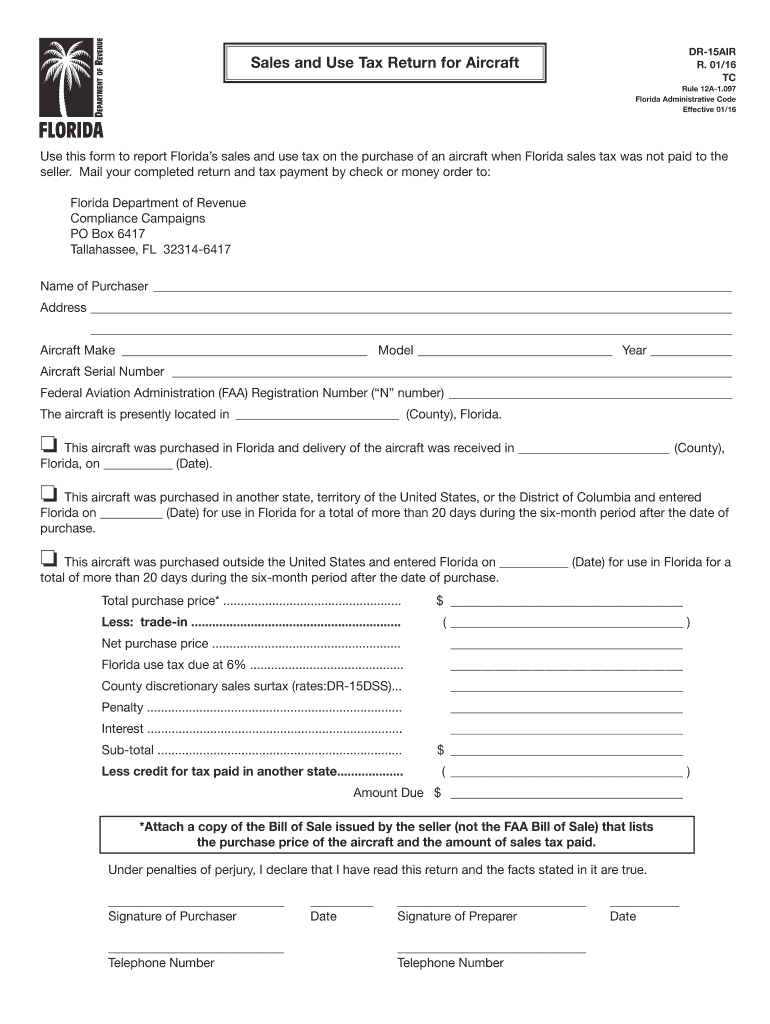

Florida Military Exemption Tax Complete with ease airSlate SignNow

The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1.

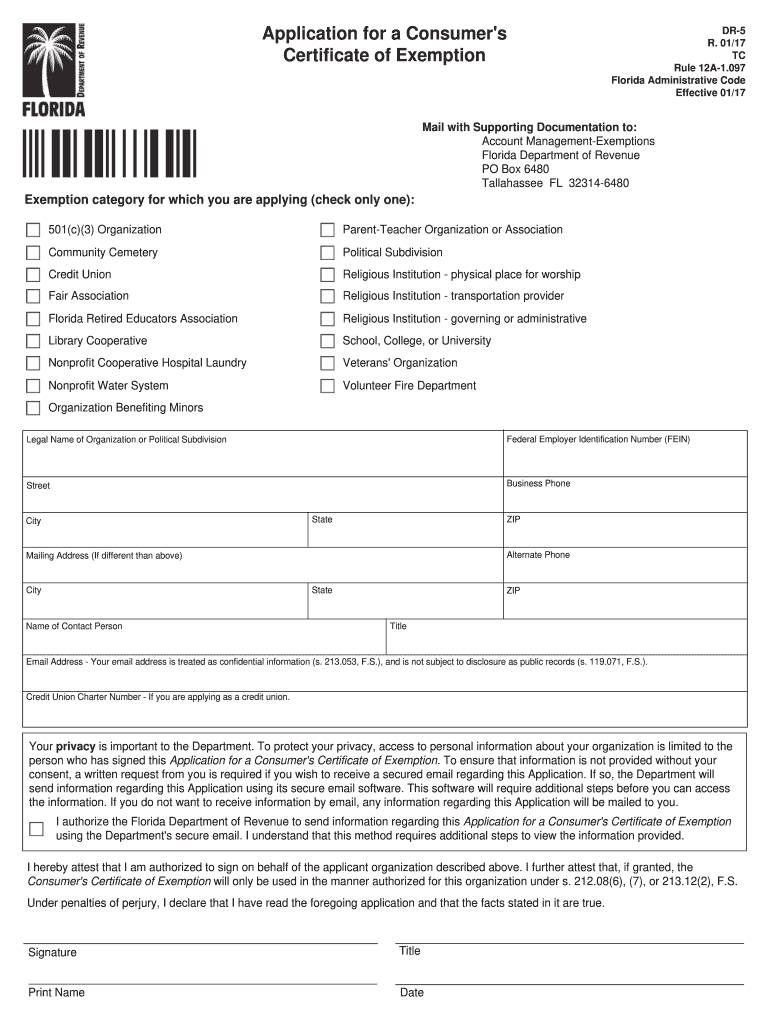

Florida Sales Tax Exemption Form Dr13

The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed. Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form.

FREE 10+ Sample Tax Exemption Forms in PDF

Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed.

Tax exempt form florida Fill out & sign online DocHub

Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed.

Tax Exempt Form For Ellis County

Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form.

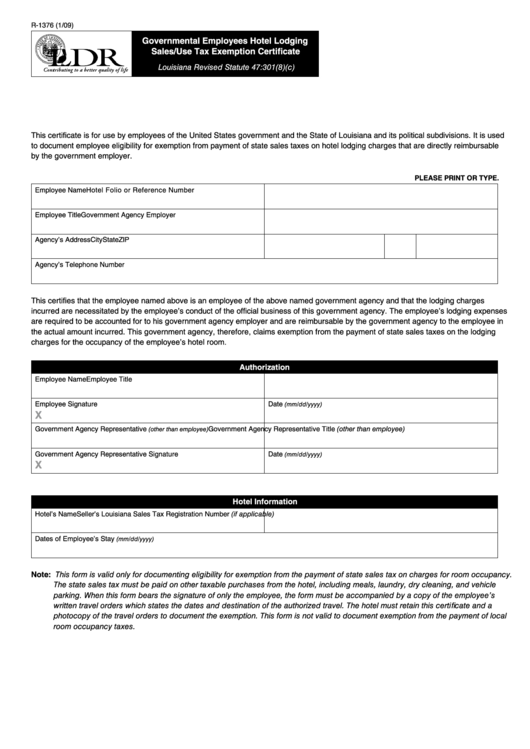

Fillable Form R1376 Governmental Employees Hotel Lodging Sales/use

The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1.

Hotel Tax In Florida 2024 Trixi Herminia

Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form.

Hotel tax exempt after 30 days Fill out & sign online DocHub

To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed. Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1.

Gsa Hotel Tax Exempt Form Florida

To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form. The purchase or lease of tangible personal property and/or services or the rental of living accommodations made on the dates listed. Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1.

The Purchase Or Lease Of Tangible Personal Property And/Or Services Or The Rental Of Living Accommodations Made On The Dates Listed.

Florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 1. To be eligible for the exemption, florida law requires that political subdivisions obtain a sales tax consumer’s certificate of exemption (form.