Tax Basis Balance Sheet

Tax Basis Balance Sheet - Because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared. When an asset is sold, the tax basis is the adjusted cost basis at the time of the sale. Tax basis balance sheets provide managers with the current deferred tax liability of a company assuming all assets were sold at their current value value and all liabilities could be. The difference between an asset’s tax basis and the sale price determines whether a business. The income tax basis of accounting is a method of preparing financial statements in which revenues are reported in the tax year they are included in taxable income, and expenses are reported in. So the ending cash balance from last year will become the beginning cash.

When an asset is sold, the tax basis is the adjusted cost basis at the time of the sale. Tax basis balance sheets provide managers with the current deferred tax liability of a company assuming all assets were sold at their current value value and all liabilities could be. So the ending cash balance from last year will become the beginning cash. The income tax basis of accounting is a method of preparing financial statements in which revenues are reported in the tax year they are included in taxable income, and expenses are reported in. Because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared. The difference between an asset’s tax basis and the sale price determines whether a business.

The difference between an asset’s tax basis and the sale price determines whether a business. Tax basis balance sheets provide managers with the current deferred tax liability of a company assuming all assets were sold at their current value value and all liabilities could be. So the ending cash balance from last year will become the beginning cash. The income tax basis of accounting is a method of preparing financial statements in which revenues are reported in the tax year they are included in taxable income, and expenses are reported in. Because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared. When an asset is sold, the tax basis is the adjusted cost basis at the time of the sale.

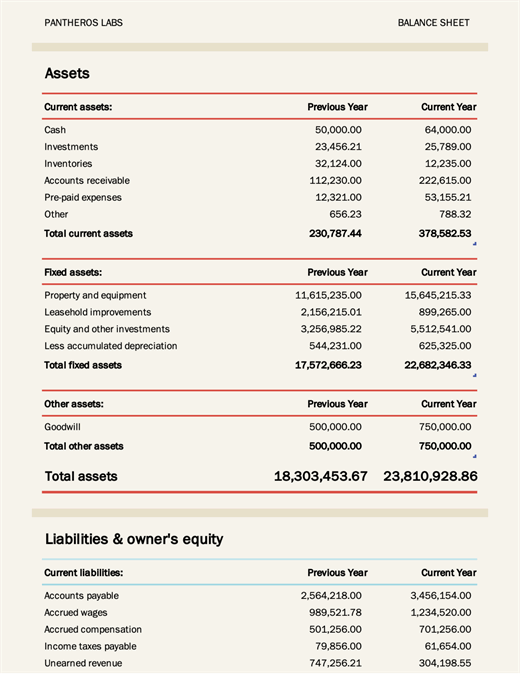

Brilliant Taxbasis Balance Sheet Cash Certificate Format

So the ending cash balance from last year will become the beginning cash. Tax basis balance sheets provide managers with the current deferred tax liability of a company assuming all assets were sold at their current value value and all liabilities could be. The difference between an asset’s tax basis and the sale price determines whether a business. When an.

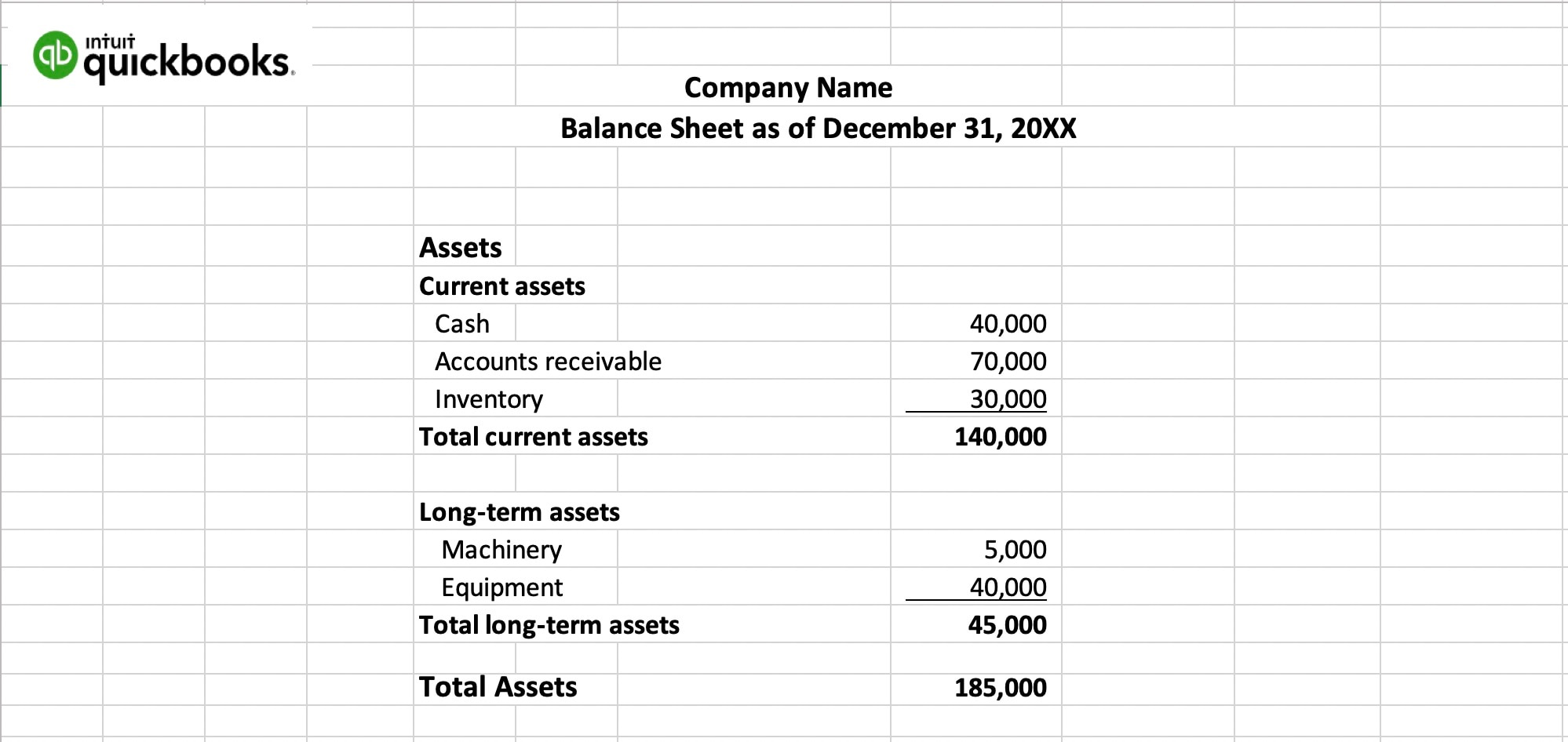

Daily Cash Balance Sheet Template / Cash Register Balancing Sheet

Because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared. So the ending cash balance from last year will become the beginning cash. When an asset is sold, the tax basis is the adjusted cost basis at the time of the sale. The difference between.

Tax Basis Balance Sheet

Because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared. The income tax basis of accounting is a method of preparing financial statements in which revenues are reported in the tax year they are included in taxable income, and expenses are reported in. When an.

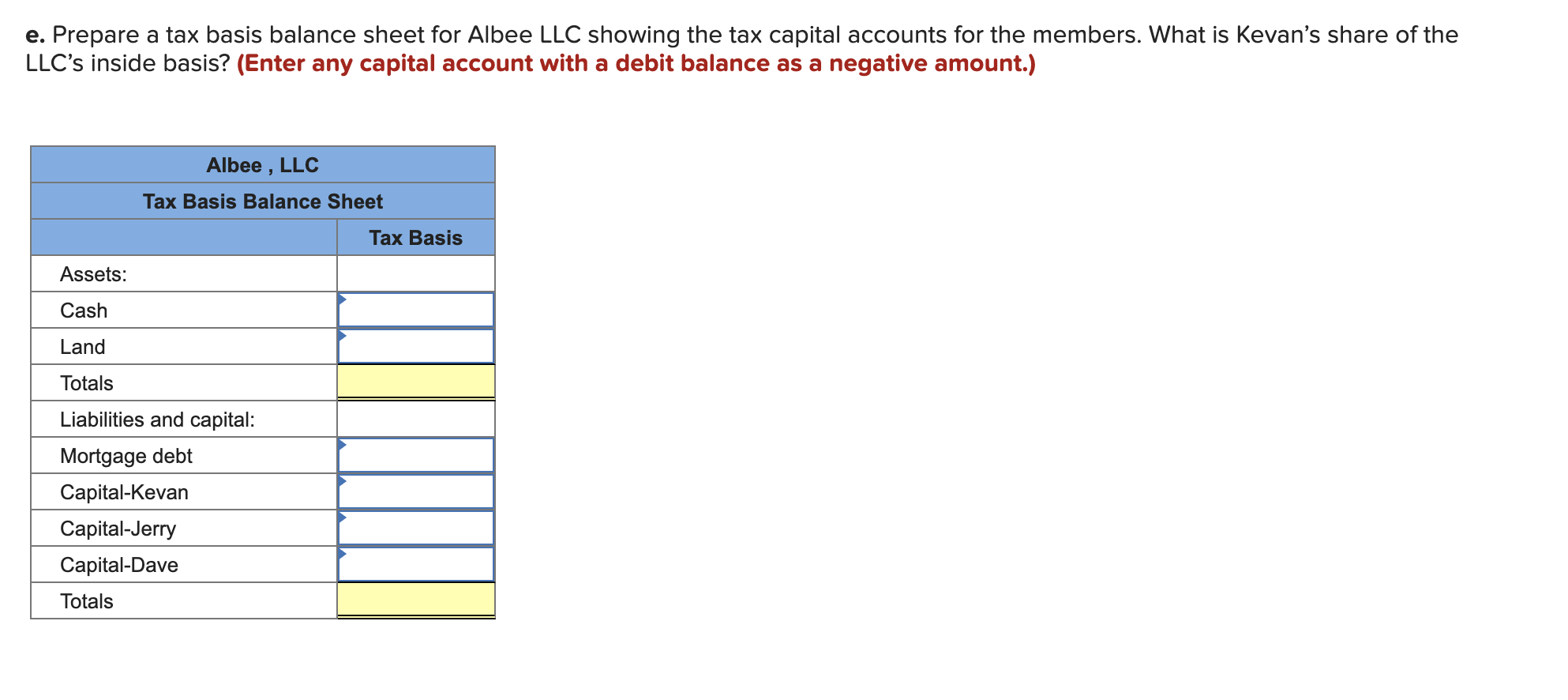

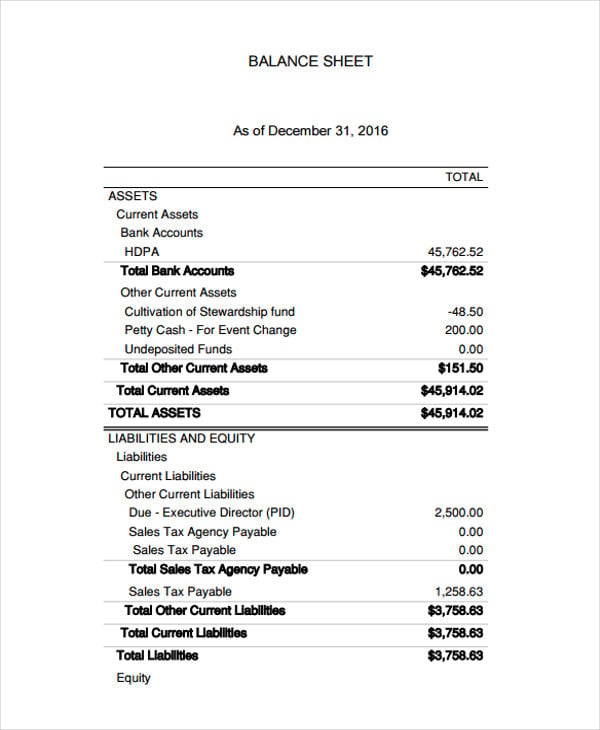

Solved e. Prepare a tax basis balance sheet for Albee LLC

The difference between an asset’s tax basis and the sale price determines whether a business. The income tax basis of accounting is a method of preparing financial statements in which revenues are reported in the tax year they are included in taxable income, and expenses are reported in. Tax basis balance sheets provide managers with the current deferred tax liability.

Detailed Balance Sheet Format

When an asset is sold, the tax basis is the adjusted cost basis at the time of the sale. The income tax basis of accounting is a method of preparing financial statements in which revenues are reported in the tax year they are included in taxable income, and expenses are reported in. The difference between an asset’s tax basis and.

Best Tax Basis Balance Sheet Template Sample Of Audited Profit And Loss

Because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared. So the ending cash balance from last year will become the beginning cash. The income tax basis of accounting is a method of preparing financial statements in which revenues are reported in the tax year.

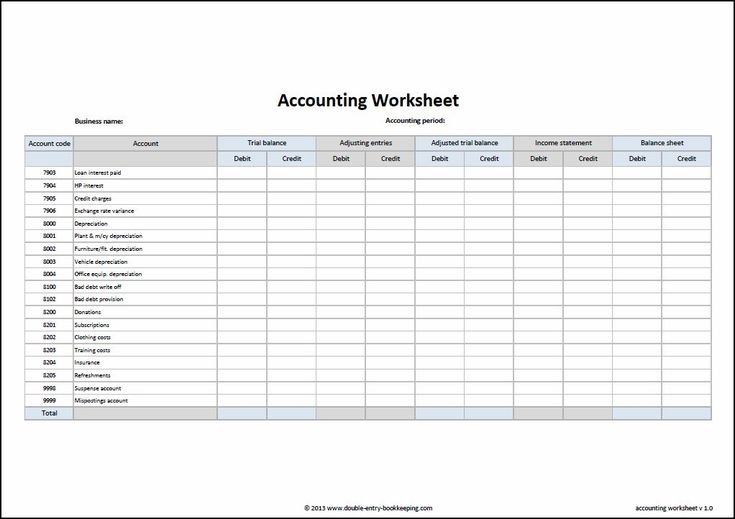

Attached are Statement, Tax notes ,Balance sheet and... Course

When an asset is sold, the tax basis is the adjusted cost basis at the time of the sale. Because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared. So the ending cash balance from last year will become the beginning cash. Tax basis balance.

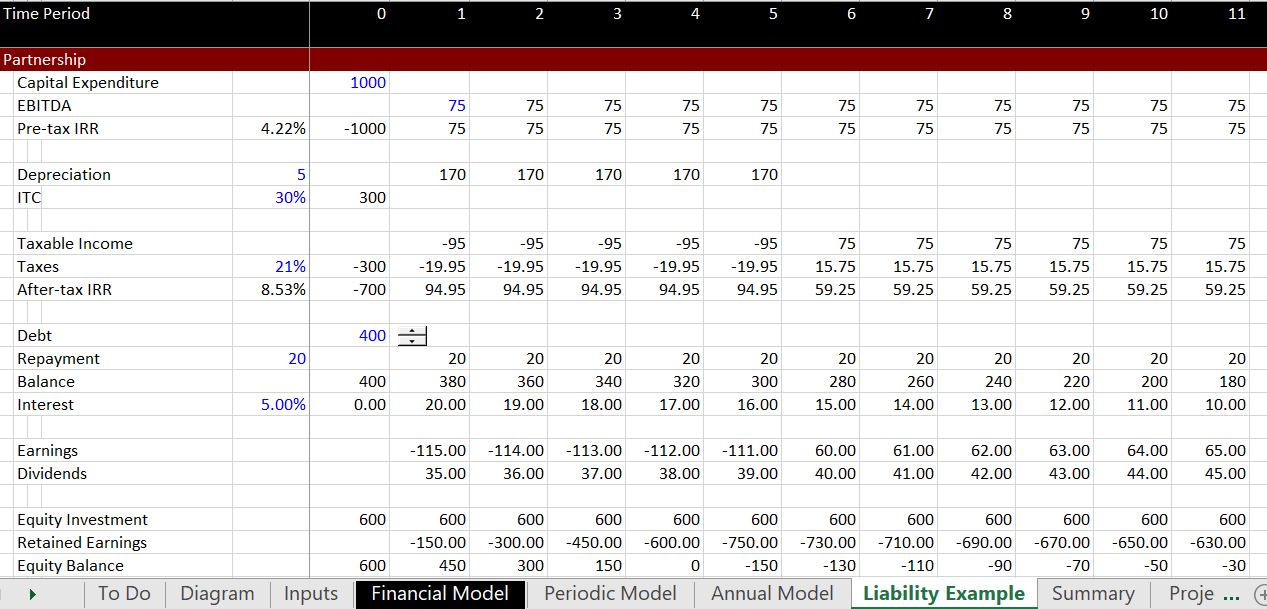

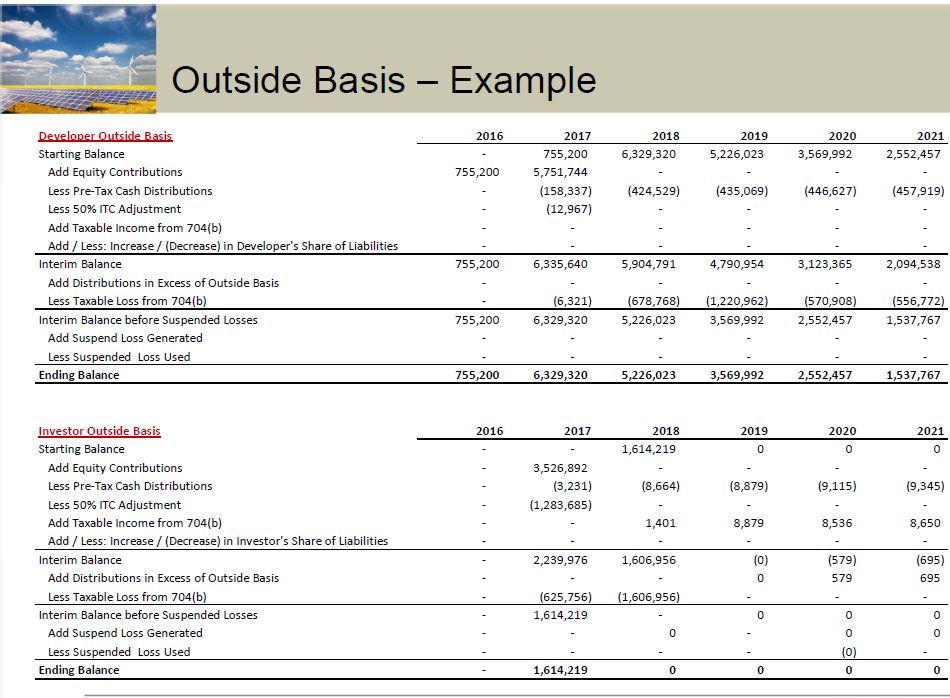

Partnership Basis Template For Tax Purposes

When an asset is sold, the tax basis is the adjusted cost basis at the time of the sale. Because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared. Tax basis balance sheets provide managers with the current deferred tax liability of a company assuming.

Tax Basis Balance Sheet Example

So the ending cash balance from last year will become the beginning cash. Tax basis balance sheets provide managers with the current deferred tax liability of a company assuming all assets were sold at their current value value and all liabilities could be. When an asset is sold, the tax basis is the adjusted cost basis at the time of.

Tax Basis Balance Sheet Example

Because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared. Tax basis balance sheets provide managers with the current deferred tax liability of a company assuming all assets were sold at their current value value and all liabilities could be. The difference between an asset’s.

Because Of The Complexities Of Accounting Principles Generally Accepted In The United States Of America (Gaap), Many Smaller Entities Have Determined That Financial Statements Prepared.

When an asset is sold, the tax basis is the adjusted cost basis at the time of the sale. The difference between an asset’s tax basis and the sale price determines whether a business. So the ending cash balance from last year will become the beginning cash. The income tax basis of accounting is a method of preparing financial statements in which revenues are reported in the tax year they are included in taxable income, and expenses are reported in.