Tax And Interest Deduction Worksheet Turbotax

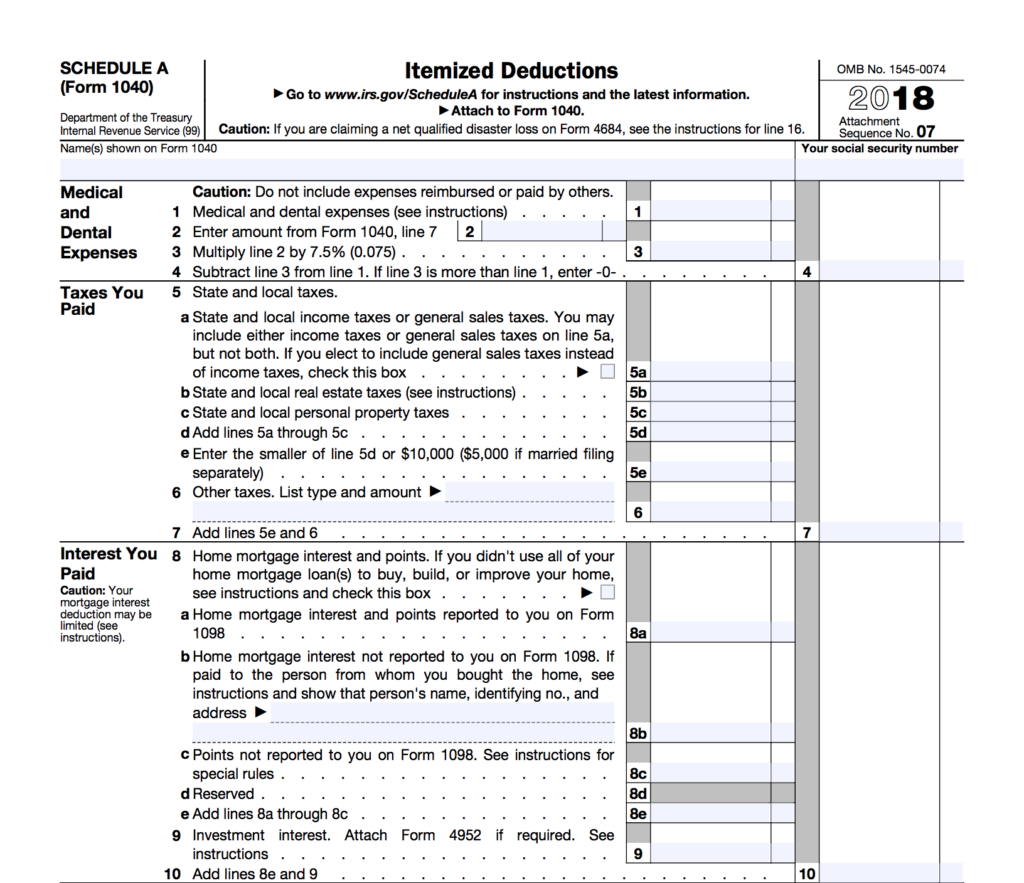

Tax And Interest Deduction Worksheet Turbotax - Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Printable Real Estate Agent Tax Deductions Worksheet

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Free tax and interest deduction worksheet, Download Free tax and

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Tax And Interest Deduction Worksheet Turbotax Worksheets Library

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Tax Deduction Worksheet 2014 Worksheet Resume Examples

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

Tax And Interest Deduction Worksheet Turbotax Printable Word Searches

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid). Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

How to Deduct Property Taxes On IRS Tax Forms Irs tax forms, Mortgage

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Tax Deduction Worksheet For Law Enforcement Worksheet Resume Examples

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Tax & Interest deduction worksheet

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Federal Tax Worksheet Free printable worksheets, Irs taxes, Worksheets

Generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).

Generally, Home Interest Is Deductible On A Form 1040 Schedule A Attachment If It's Interest Paid On Debt Secured By Your Main Or Second Home.

In tt, i have 2 home mortgage interest worksheets that include $10k and $14k on line 2.b (mortgage interest paid).