Section 127 Plan Template

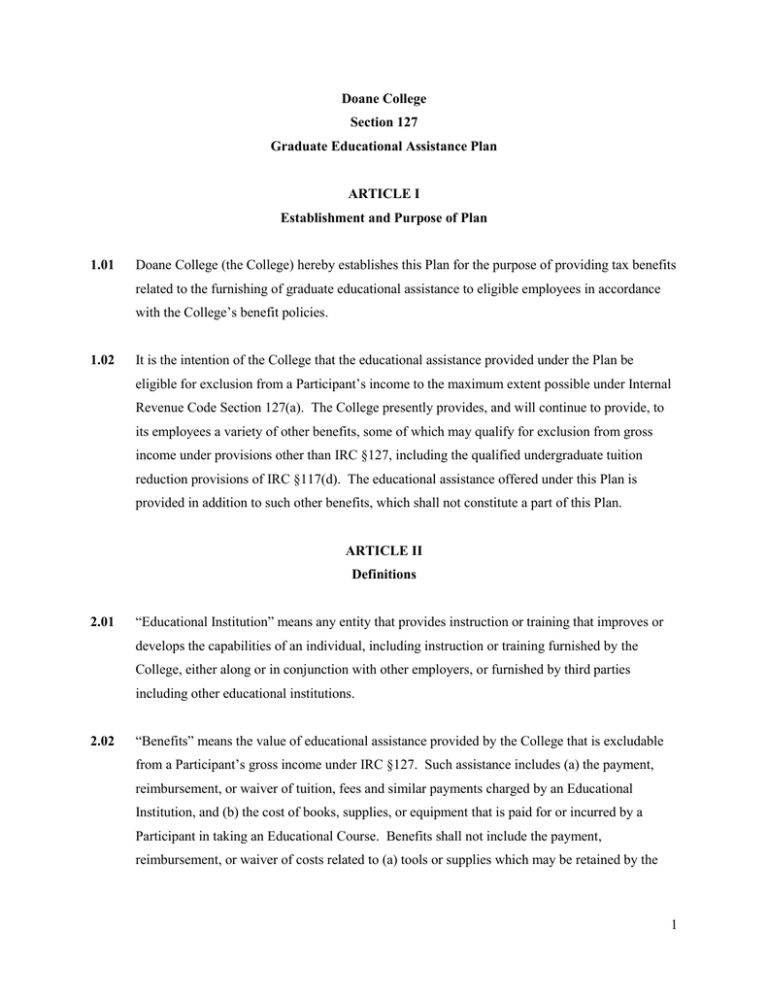

Section 127 Plan Template - Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. Start with our free section 127 plan template. Download our worksheets and sample plan documents to start customizing your section. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section.

The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. Download our worksheets and sample plan documents to start customizing your section. Start with our free section 127 plan template.

The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. Start with our free section 127 plan template. Download our worksheets and sample plan documents to start customizing your section.

Section 127 Plans Establishing a Written Plan Document

Start with our free section 127 plan template. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section. Download our worksheets and sample plan documents to start customizing.

Section 127 Plan Template

Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. Start with our free section 127 plan template. Download our worksheets and sample plan documents to start customizing your section. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program.

Section 127 Plans Aiding Student Loan Repayment Benefits Paidly

The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section. Download our worksheets and sample plan documents to start customizing your section. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. Start with our free section 127.

Section 127 Plan Template

Download our worksheets and sample plan documents to start customizing your section. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. Start with our free section 127 plan template. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program.

Section 127 Plan Template

Download our worksheets and sample plan documents to start customizing your section. Start with our free section 127 plan template. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income.

Section 127 plans The ultimate primer

Start with our free section 127 plan template. Download our worksheets and sample plan documents to start customizing your section. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income.

Section 127 Plan Template Highway Benefits

Start with our free section 127 plan template. Download our worksheets and sample plan documents to start customizing your section. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program.

Section 127 Plan Template

Start with our free section 127 plan template. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section. Download our worksheets and sample plan documents to start customizing.

Section 127 Plan Template

Download our worksheets and sample plan documents to start customizing your section. Start with our free section 127 plan template. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income.

Section 127 Plan Template

The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section. Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. Start with our free section 127 plan template. Download our worksheets and sample plan documents to start customizing.

Start With Our Free Section 127 Plan Template.

Section 127 of the internal revenue code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts. Download our worksheets and sample plan documents to start customizing your section. The [employer name] educational assistance program (plan) is intended to be a qualified educational assistance program under section.