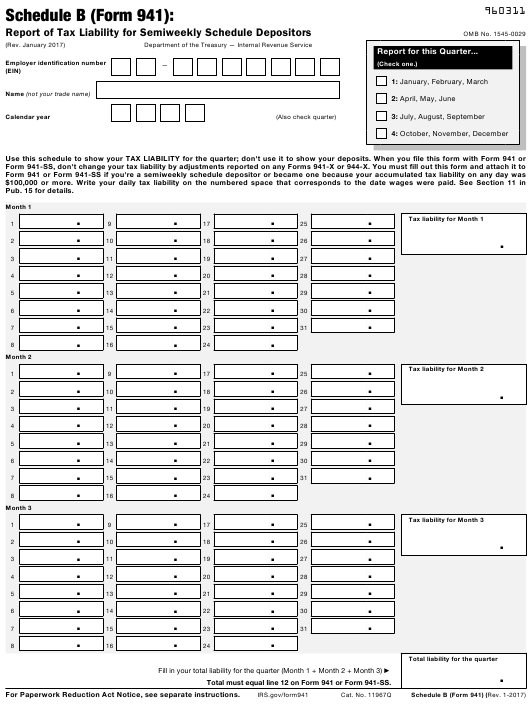

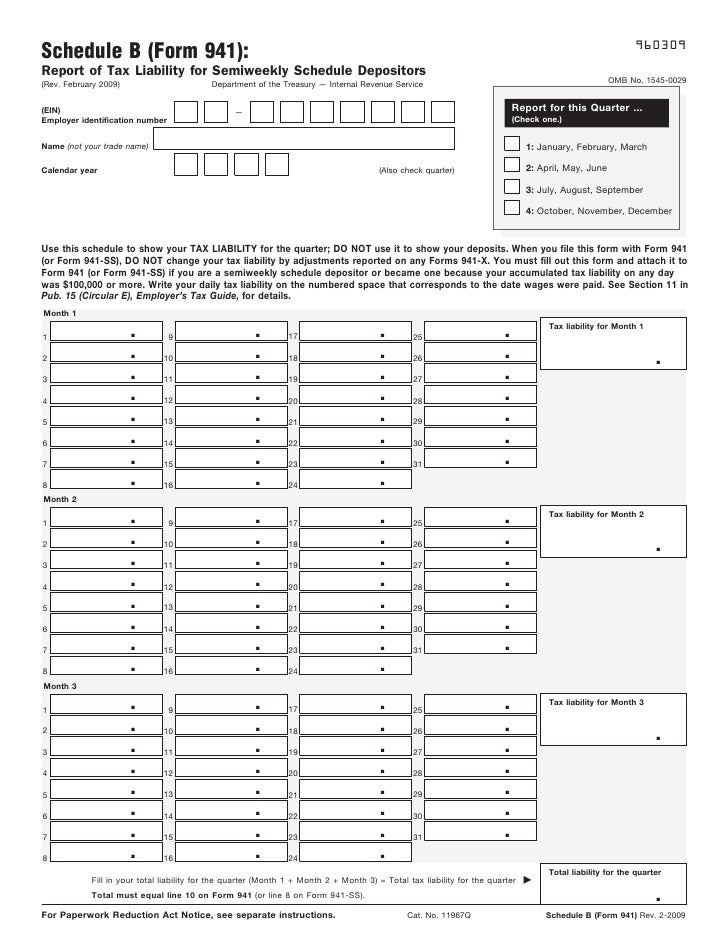

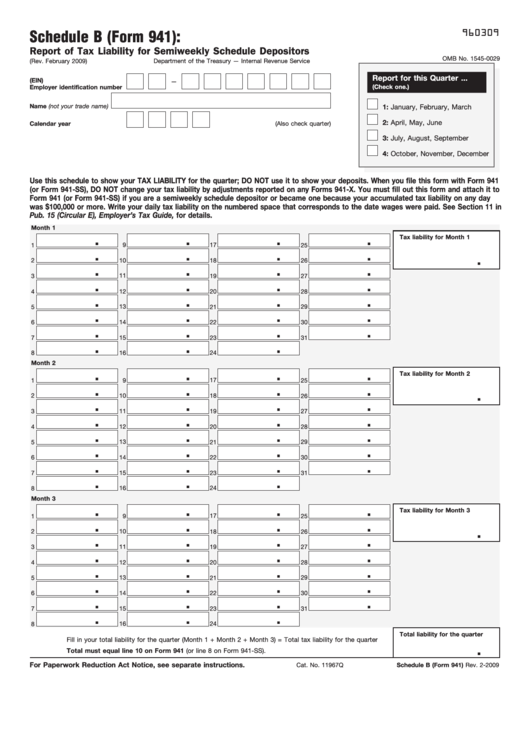

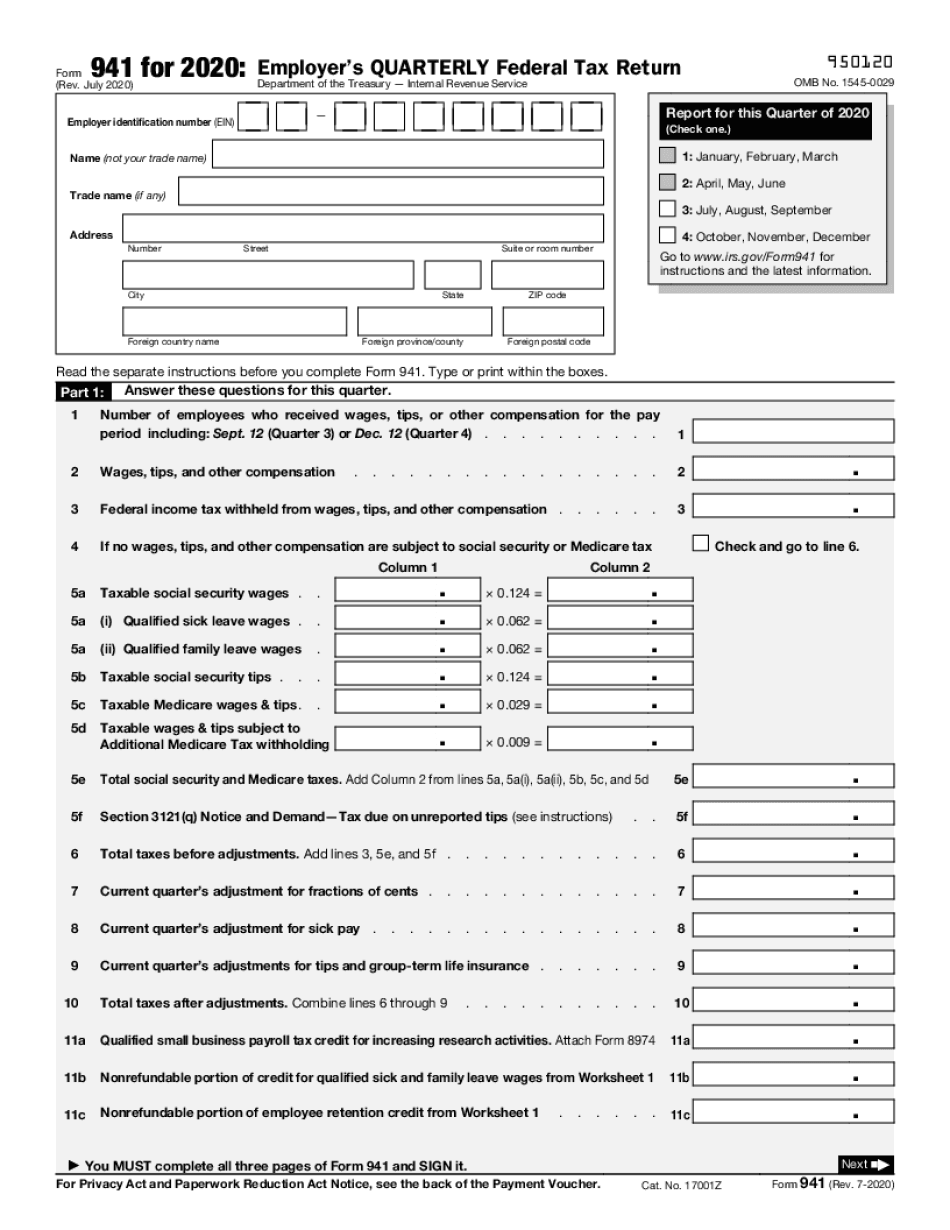

Schedule B Form 941

Schedule B Form 941 - Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. You are a semiweekly depositor if you: Schedule b is filed with form 941. Reported more than $50,000 of employment taxes in the lookback period. File schedule b (form 941) if you are a semiweekly schedule depositor.

Reported more than $50,000 of employment taxes in the lookback period. File schedule b (form 941) if you are a semiweekly schedule depositor. You are a semiweekly depositor if you: Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Schedule b is filed with form 941.

Schedule b is filed with form 941. You are a semiweekly depositor if you: File schedule b (form 941) if you are a semiweekly schedule depositor. Reported more than $50,000 of employment taxes in the lookback period. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Therefore, the due date of schedule b is the same as the due date for the applicable form 941.

How to File Schedule B for Form 941

Reported more than $50,000 of employment taxes in the lookback period. Schedule b is filed with form 941. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. You are a semiweekly depositor if you: Therefore, the due date of schedule b is the same as the due date for the.

Printable Schedule B Form 941 Fillable Form 2023

You are a semiweekly depositor if you: Schedule b is filed with form 941. File schedule b (form 941) if you are a semiweekly schedule depositor. Reported more than $50,000 of employment taxes in the lookback period. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

2023 Schedule B Form 941 Printable Forms Free Online

You are a semiweekly depositor if you: File schedule b (form 941) if you are a semiweekly schedule depositor. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Reported more than.

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Schedule b is filed with form 941. You are a semiweekly depositor if you: Reported more than $50,000 of employment taxes in the lookback period. File schedule b (form 941) if you are a semiweekly schedule depositor.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. File schedule b (form 941) if you are a semiweekly schedule depositor. You are a semiweekly depositor if you: Reported more than $50,000 of employment taxes in the lookback period. Therefore, the due date of schedule b is the same as.

8 Form Schedule B 8 What’s So Trendy About 8 Form Schedule B 8 That

You are a semiweekly depositor if you: Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Reported more than $50,000 of employment taxes in the lookback period. Schedule b is filed.

941b 20172024 Form Fill Out and Sign Printable PDF Template

Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Reported more than $50,000 of employment taxes in the lookback period. You are a semiweekly depositor if you: Schedule b is filed with form 941. File schedule b (form 941) if you are a semiweekly schedule depositor.

IRS Form 941 Schedule B 2024

Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Reported more than $50,000 of employment taxes in the lookback period. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. You are a semiweekly depositor if you: File schedule b (form.

Free Fillable Form Schedule B Printable Forms Free Online

File schedule b (form 941) if you are a semiweekly schedule depositor. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Reported more than $50,000 of employment taxes in the lookback period. Therefore, the due date of schedule b is the same as the due date for the applicable form.

Printable Form 941 Schedule B Printable Forms Free Online

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. You are a semiweekly depositor if you: Reported more than $50,000 of employment taxes in the lookback period. File schedule b (form 941) if you are a semiweekly schedule depositor. Schedule b is filed with form 941.

Complete Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, And Attach It To Form 941.

File schedule b (form 941) if you are a semiweekly schedule depositor. Reported more than $50,000 of employment taxes in the lookback period. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Schedule b is filed with form 941.