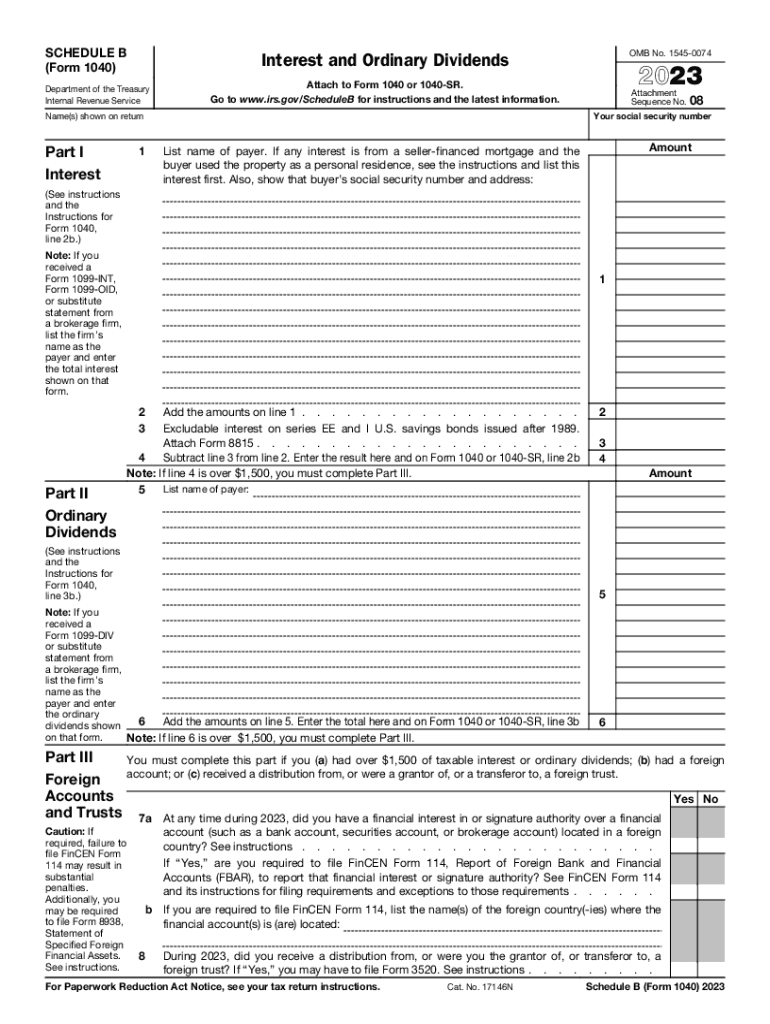

Schedule B 1040 Form

Schedule B 1040 Form - Schedule b is a form you file with your regular income tax return by april 15 (or. You received interest from a. Use schedule b (form 1040) if any of the following applies. What is schedule b (form 1040) for? You had over $1,500 of taxable interest or ordinary dividends.

Schedule b is a form you file with your regular income tax return by april 15 (or. What is schedule b (form 1040) for? You received interest from a. Use schedule b (form 1040) if any of the following applies. You had over $1,500 of taxable interest or ordinary dividends.

You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? You received interest from a. Schedule b is a form you file with your regular income tax return by april 15 (or. Use schedule b (form 1040) if any of the following applies.

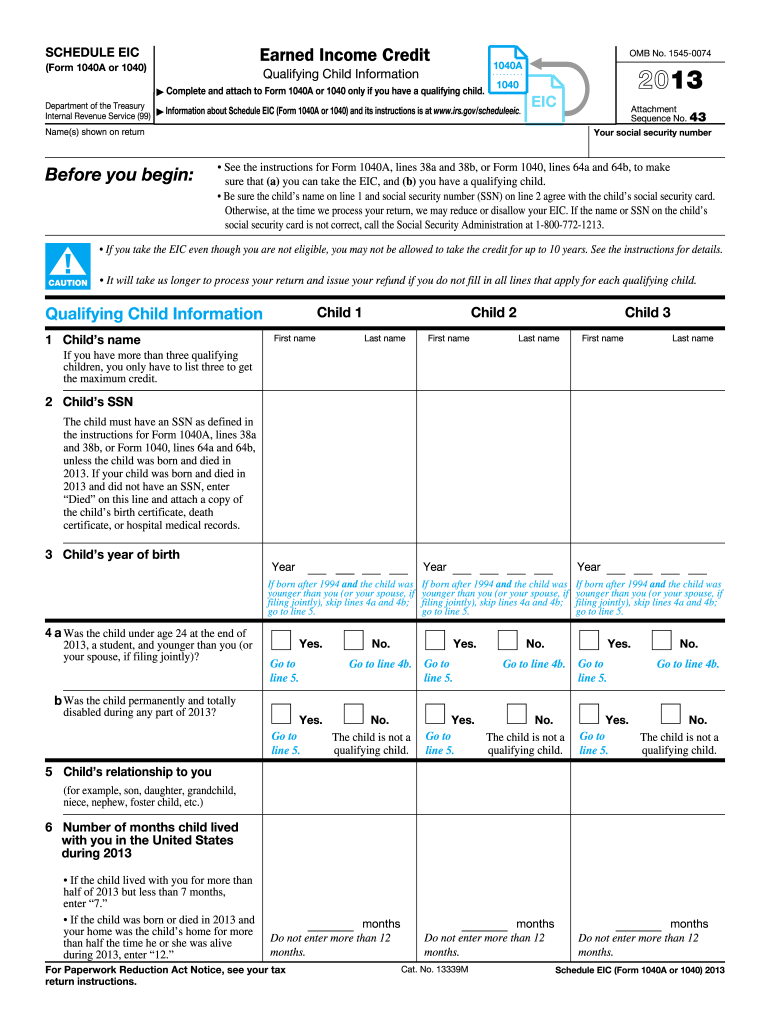

Schedule b Fill out & sign online DocHub

You had over $1,500 of taxable interest or ordinary dividends. You received interest from a. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies. Schedule b is a form you file with your regular income tax return by april 15 (or.

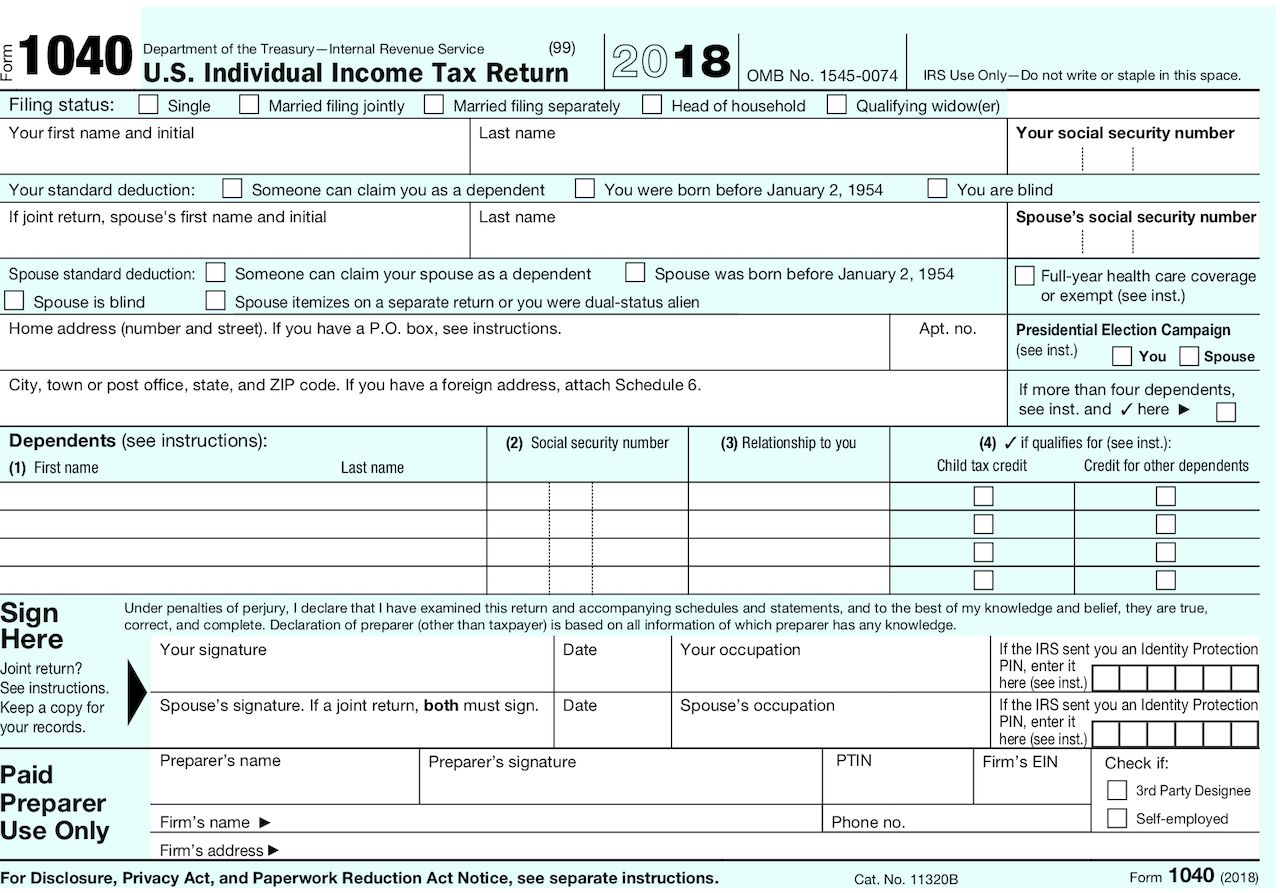

1040 form instructions tax table

Schedule b is a form you file with your regular income tax return by april 15 (or. You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies. You received interest from a.

IRS Form 1040 (Schedule B) 2018 2019 Fill out and Edit Online PDF

You received interest from a. You had over $1,500 of taxable interest or ordinary dividends. Schedule b is a form you file with your regular income tax return by april 15 (or. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies.

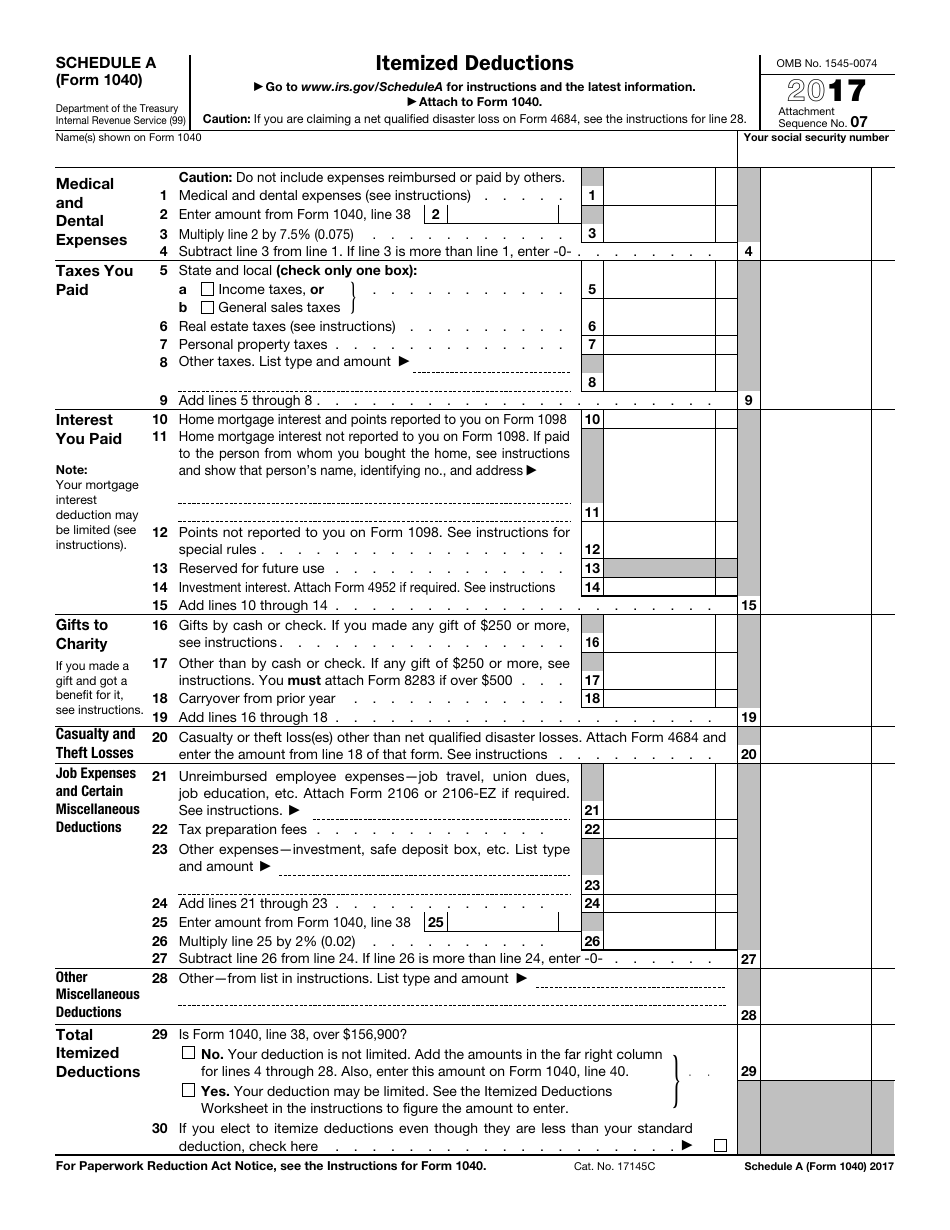

IRS Form 1040 Schedule A 2017 Fill Out, Sign Online and Download

Use schedule b (form 1040) if any of the following applies. You had over $1,500 of taxable interest or ordinary dividends. You received interest from a. Schedule b is a form you file with your regular income tax return by april 15 (or. What is schedule b (form 1040) for?

Schedule B Printable Form Printable Forms Free Online

Use schedule b (form 1040) if any of the following applies. You received interest from a. You had over $1,500 of taxable interest or ordinary dividends. Schedule b is a form you file with your regular income tax return by april 15 (or. What is schedule b (form 1040) for?

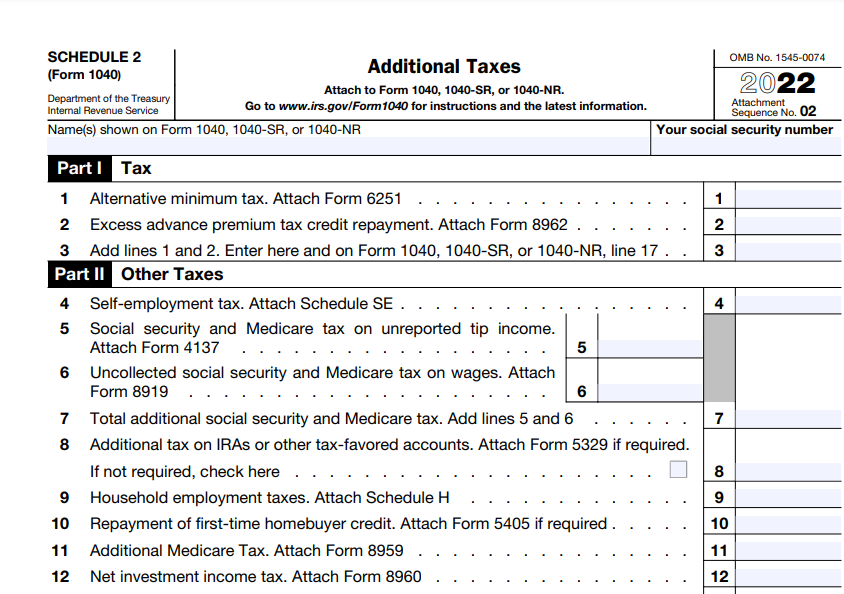

IRS Form 1040 Schedule 2. Additional Taxes Forms Docs 2023

You received interest from a. Use schedule b (form 1040) if any of the following applies. What is schedule b (form 1040) for? You had over $1,500 of taxable interest or ordinary dividends. Schedule b is a form you file with your regular income tax return by april 15 (or.

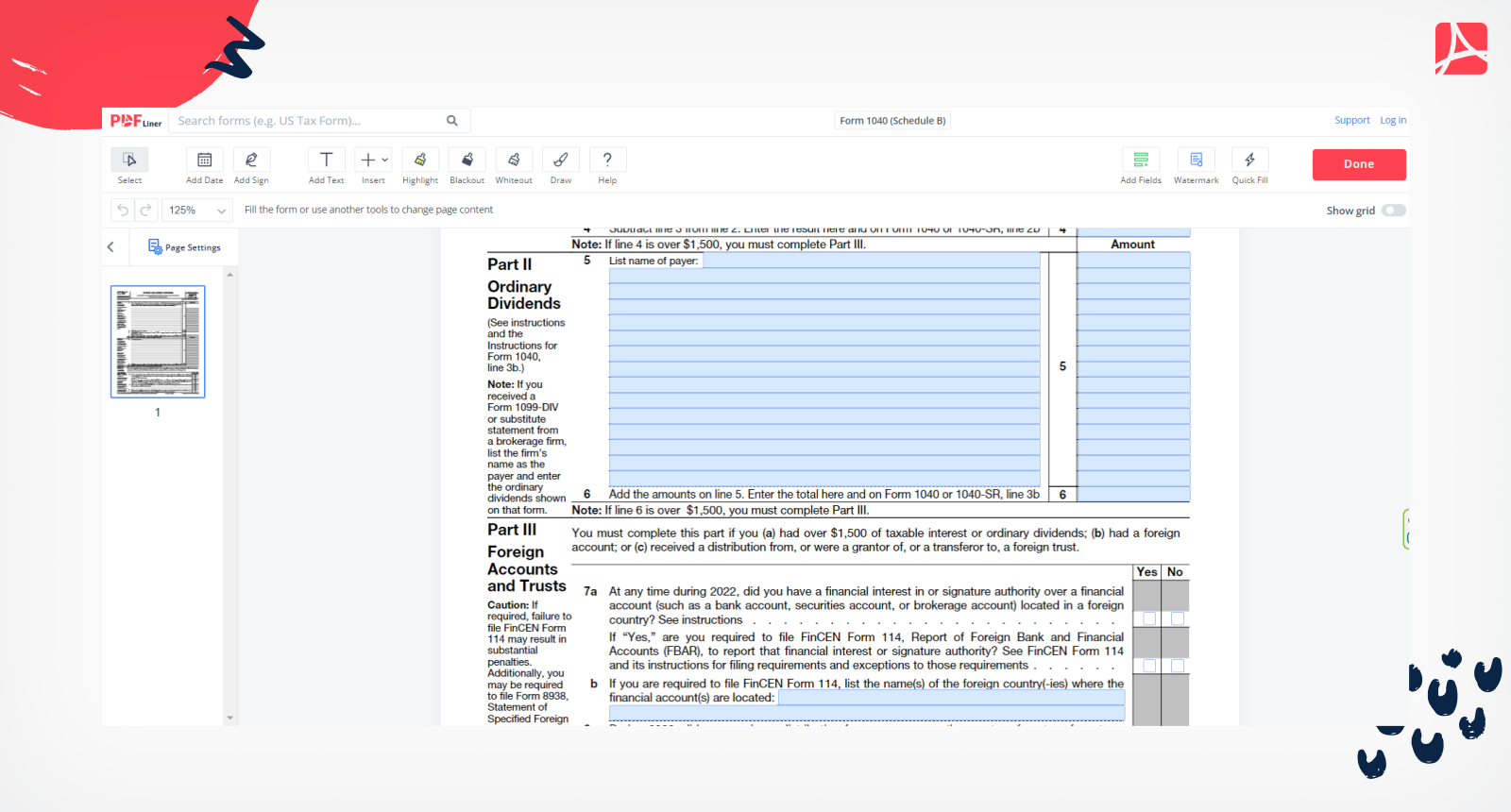

IRS Schedule B Form 1040, sign Schedule B online PDFliner

You had over $1,500 of taxable interest or ordinary dividends. Schedule b is a form you file with your regular income tax return by april 15 (or. You received interest from a. Use schedule b (form 1040) if any of the following applies. What is schedule b (form 1040) for?

1040 forms airSlate SignNow

You received interest from a. Schedule b is a form you file with your regular income tax return by april 15 (or. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies. You had over $1,500 of taxable interest or ordinary dividends.

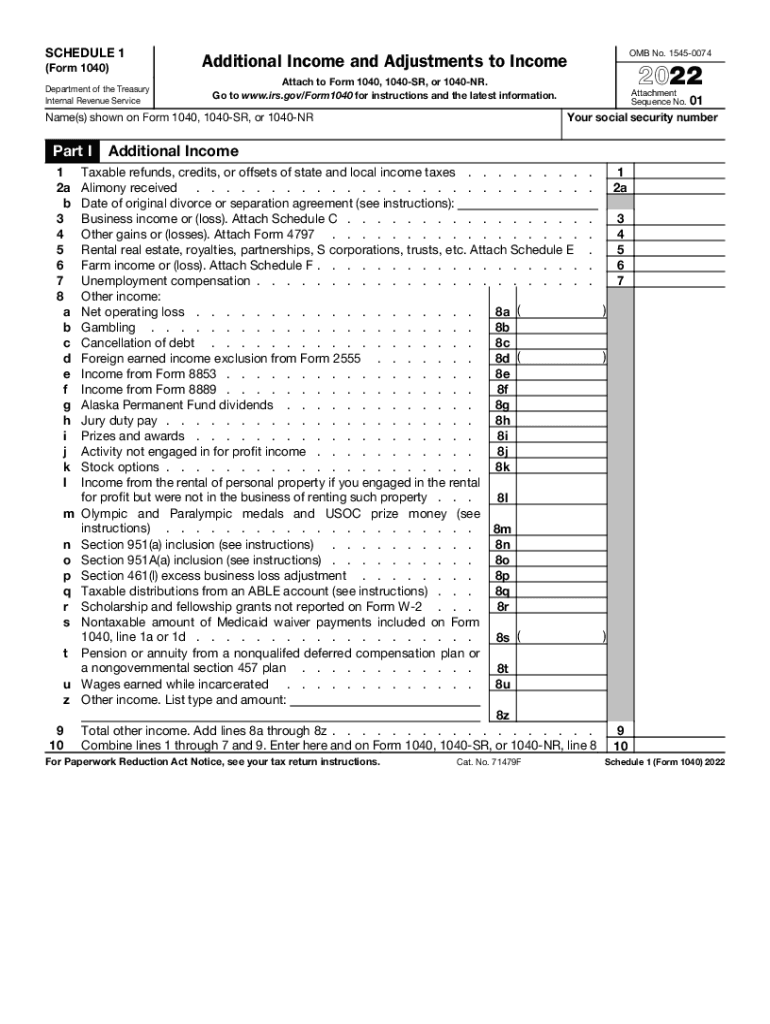

Schedule 1 20222024 Form Fill Out and Sign Printable PDF Template

You received interest from a. Schedule b is a form you file with your regular income tax return by april 15 (or. You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies.

2023 Form 1040sr Printable Forms Free Online

Schedule b is a form you file with your regular income tax return by april 15 (or. You received interest from a. You had over $1,500 of taxable interest or ordinary dividends. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies.

You Had Over $1,500 Of Taxable Interest Or Ordinary Dividends.

You received interest from a. What is schedule b (form 1040) for? Use schedule b (form 1040) if any of the following applies. Schedule b is a form you file with your regular income tax return by april 15 (or.

:max_bytes(150000):strip_icc()/ScheduleB-InterestandOrdinaryDividends-c6ff80bf2c1f4de981e0b0625a4e3dc7.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png)