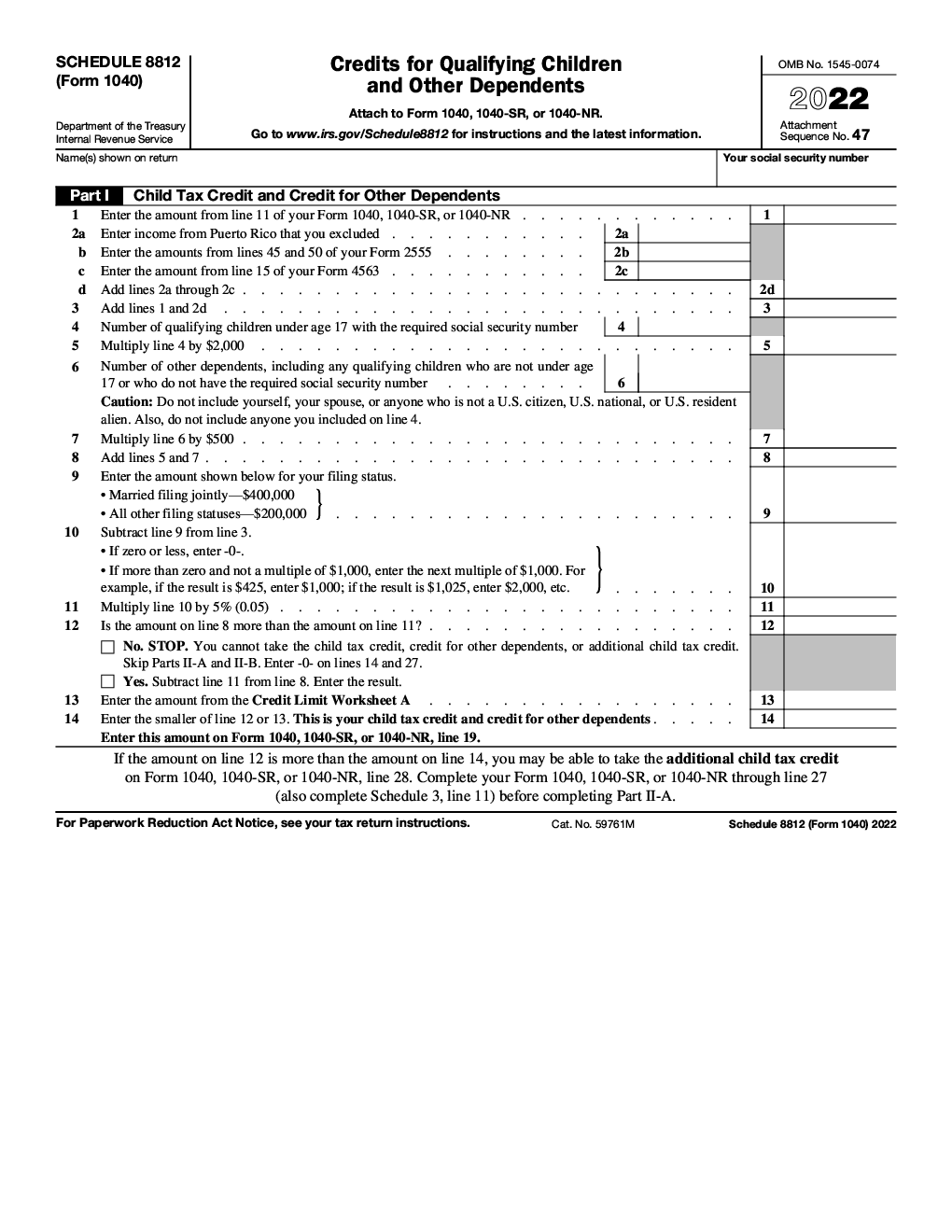

Schedule 8812 Form 2022

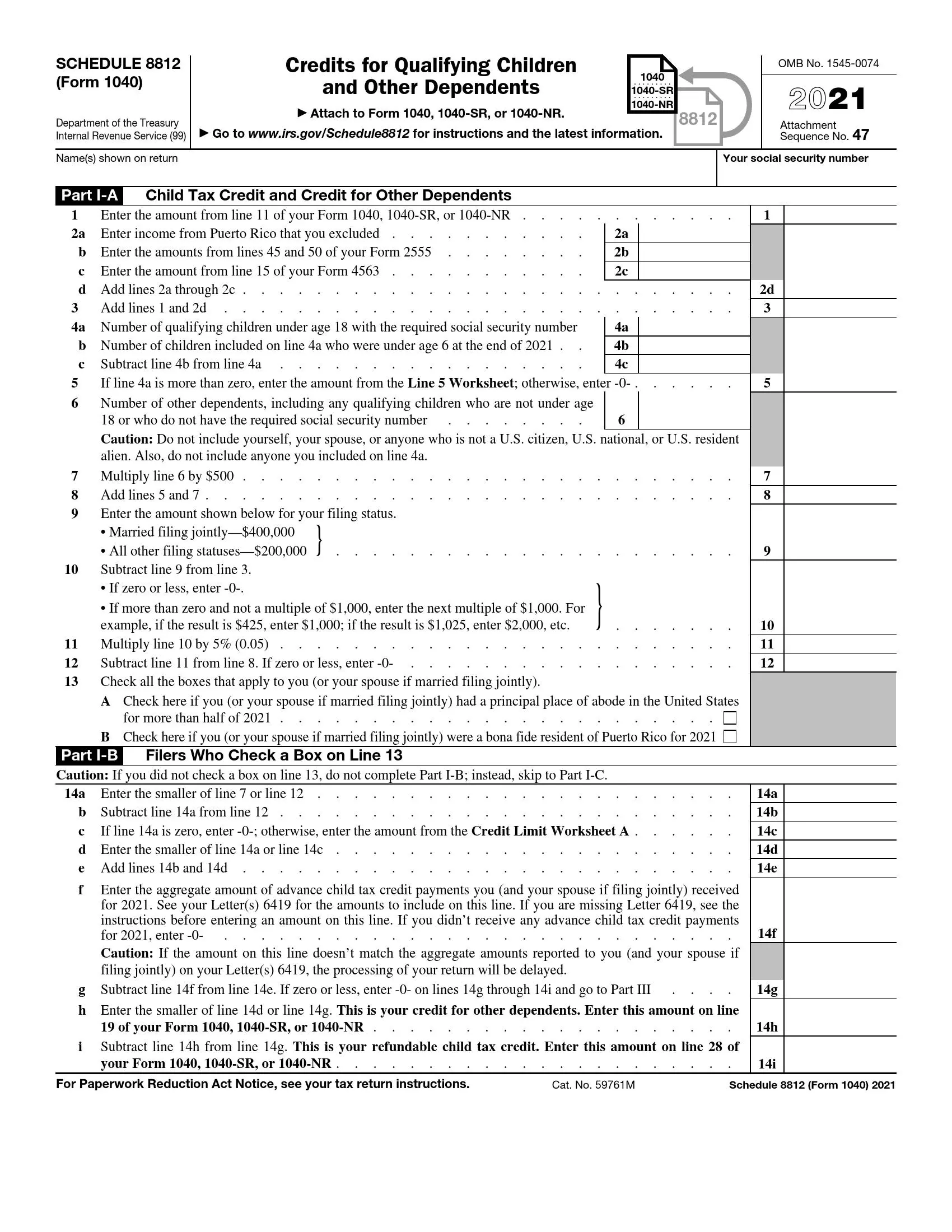

Schedule 8812 Form 2022 - We will update this page with a new version of the form for. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Find out the eligibility requirements,. Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit for 2022. It has been instructed by the irs for the year 2022 to prepare schedule 8812, in order to claim the amount of the total credit amount for. This form is for income earned in tax year 2023, with tax returns due in april 2024.

It has been instructed by the irs for the year 2022 to prepare schedule 8812, in order to claim the amount of the total credit amount for. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. This form is for income earned in tax year 2023, with tax returns due in april 2024. We will update this page with a new version of the form for. Find out the eligibility requirements,. Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit for 2022.

This form is for income earned in tax year 2023, with tax returns due in april 2024. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit for 2022. Find out the eligibility requirements,. It has been instructed by the irs for the year 2022 to prepare schedule 8812, in order to claim the amount of the total credit amount for. We will update this page with a new version of the form for.

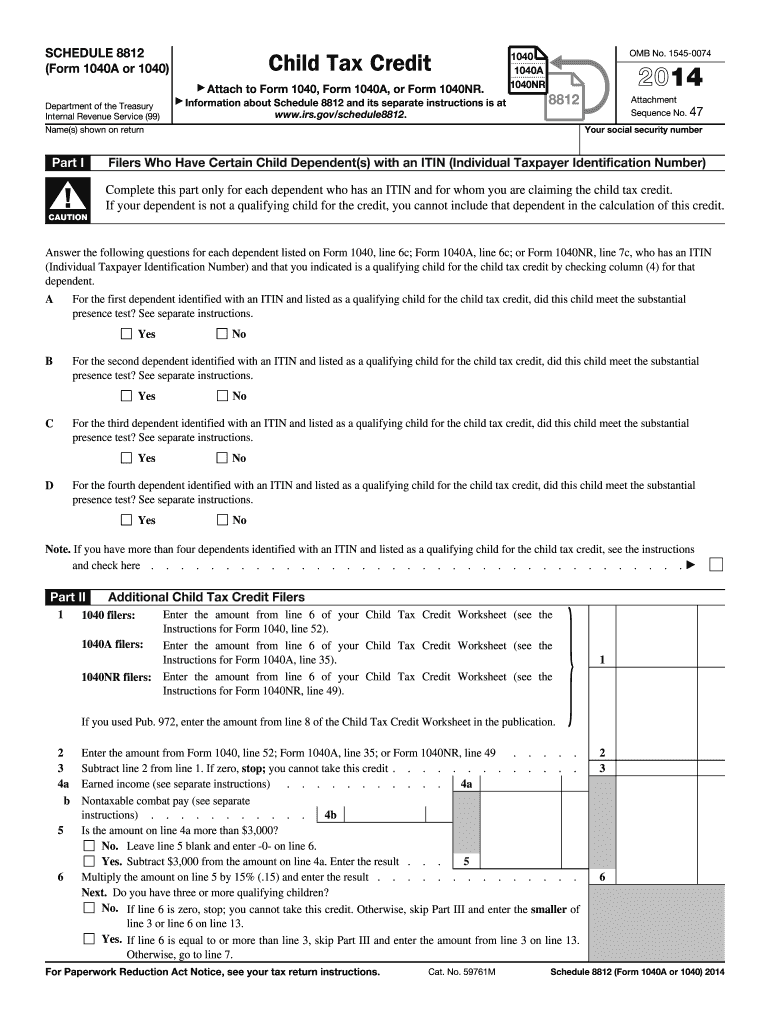

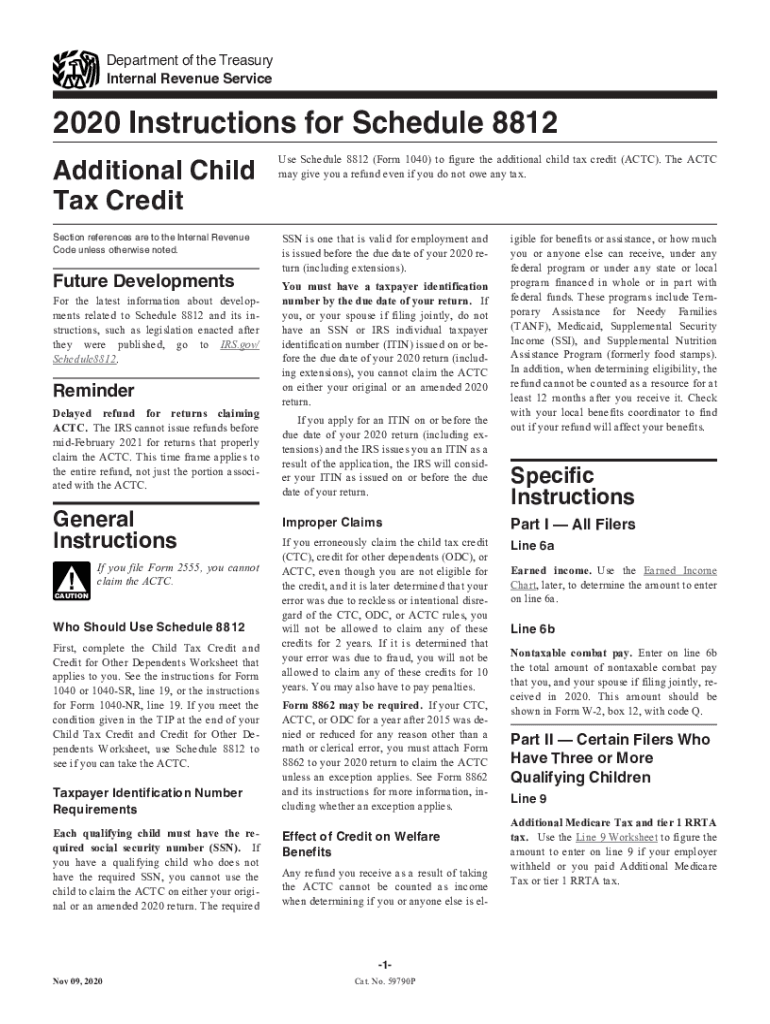

Additional Medicare Tax & RRTA Tax Worksheet Walkthrough (Schedule 8812

We will update this page with a new version of the form for. Find out the eligibility requirements,. This form is for income earned in tax year 2023, with tax returns due in april 2024. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure..

IRS Form 8812 Forms Docs 2023

Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. We will update this page with a new version of the form for. Find out the eligibility requirements,. Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit.

Form 8812 2023 Printable Forms Free Online

Find out the eligibility requirements,. We will update this page with a new version of the form for. This form is for income earned in tax year 2023, with tax returns due in april 2024. Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit for 2022. Use schedule 8812 (form 1040) to.

2022 Form IRS 1040 Schedule 8812 Instructions Fill Online, Printable

It has been instructed by the irs for the year 2022 to prepare schedule 8812, in order to claim the amount of the total credit amount for. We will update this page with a new version of the form for. Find out the eligibility requirements,. This form is for income earned in tax year 2023, with tax returns due in.

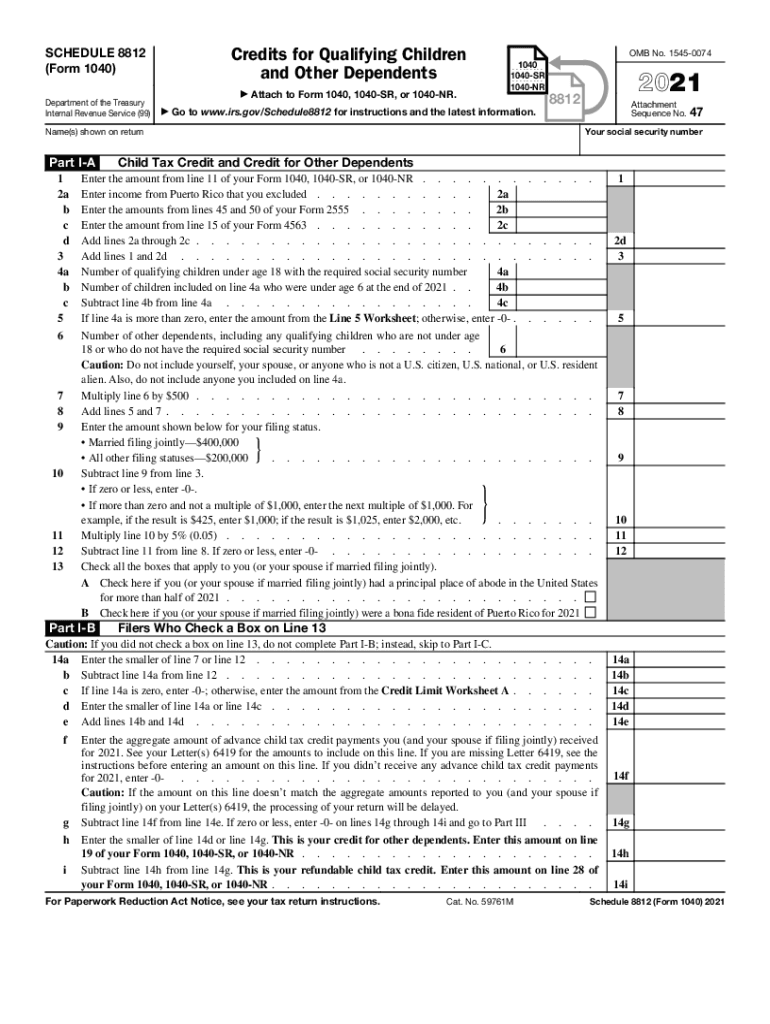

2021 Form IRS 1040 Schedule 8812 Fill Online, Printable, Fillable

This form is for income earned in tax year 2023, with tax returns due in april 2024. Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit for 2022. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to.

2022 Irs Form 8812 Credit Limit Worksheet A

We will update this page with a new version of the form for. Find out the eligibility requirements,. Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit for 2022. This form is for income earned in tax year 2023, with tax returns due in april 2024. Use schedule 8812 (form 1040) to.

2022 Irs Form 8812 Credit Limit Worksheet A

We will update this page with a new version of the form for. This form is for income earned in tax year 2023, with tax returns due in april 2024. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. It has been instructed by.

IRS Schedule 8812 Form 1040 ≡ Fill Out Printable PDF Forms Online

We will update this page with a new version of the form for. Find out the eligibility requirements,. It has been instructed by the irs for the year 2022 to prepare schedule 8812, in order to claim the amount of the total credit amount for. This form is for income earned in tax year 2023, with tax returns due in.

8812 for 20202024 Form Fill Out and Sign Printable PDF Template

Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit for 2022. This form is for income earned in tax year 2023, with tax returns due in april 2024. We will update this page with a new version of the form for. Use schedule 8812 (form 1040) to figure your child tax credits,.

Schedule 8812 Instructions for Credits for Qualifying Children and

This form is for income earned in tax year 2023, with tax returns due in april 2024. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit for.

Use Schedule 8812 (Form 1040) To Figure Your Child Tax Credits, To Report Advance Child Tax Credit Payments You Received In 2021, And To Figure.

Find out the eligibility requirements,. This form is for income earned in tax year 2023, with tax returns due in april 2024. It has been instructed by the irs for the year 2022 to prepare schedule 8812, in order to claim the amount of the total credit amount for. Learn how to figure your child tax credit, credit for other dependents, and additional child tax credit for 2022.