Schedule 1 Tax Form Fafsa

Schedule 1 Tax Form Fafsa - Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. Irs form 1040—line 1 (or irs form 1040. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. While completing your federal income taxes, families will need to file a schedule 1 if they are. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. What is a schedule 1?

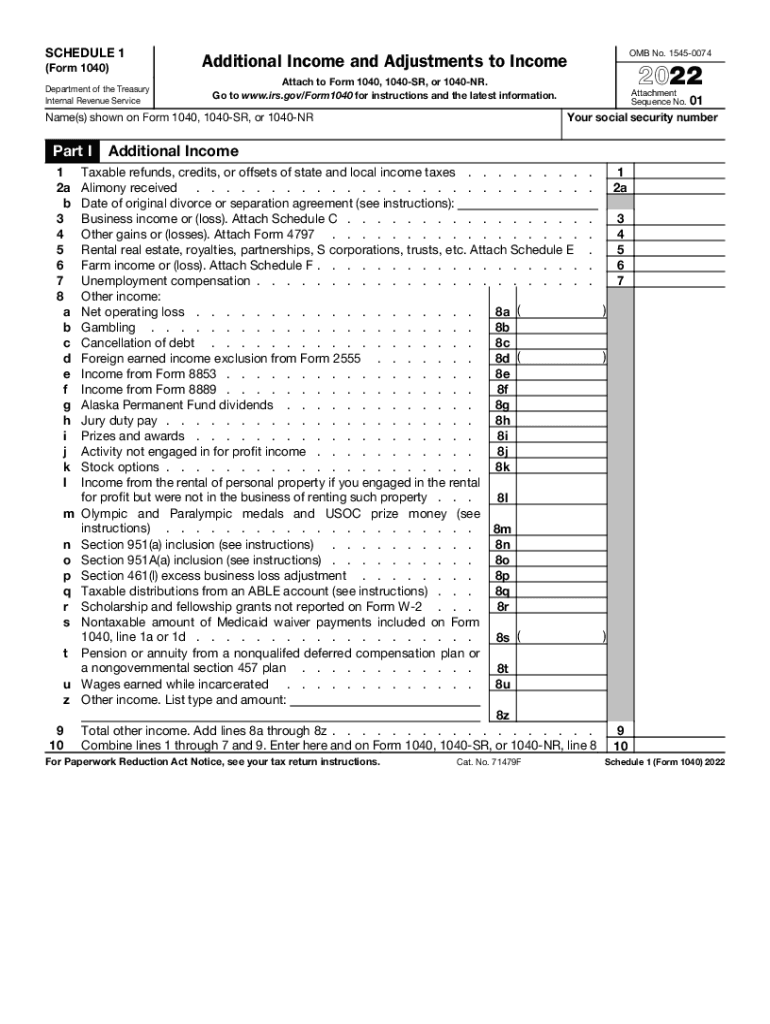

Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. What is a schedule 1? While completing your federal income taxes, families will need to file a schedule 1 if they are. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Irs form 1040—line 1 (or irs form 1040.

What is a schedule 1? Irs form 1040—line 1 (or irs form 1040. While completing your federal income taxes, families will need to file a schedule 1 if they are. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other.

What is the Schedule 1 form for FAFSA

What is a schedule 1? While completing your federal income taxes, families will need to file a schedule 1 if they are. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. If you are a freelancer or contractor (and therefore receive a.

What is the Schedule 1 form for FAFSA

While completing your federal income taxes, families will need to file a schedule 1 if they are. What is a schedule 1? If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Since the fy23 tax return covers 8 months of the 2023 calendar year and the.

What Is A Schedule 1 Tax Form? Insurance Noon

Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. While completing your federal income taxes, families will need to file a schedule 1 if they are. Irs form 1040—line 1 (or irs form 1040. What is a schedule 1? Since the fy23.

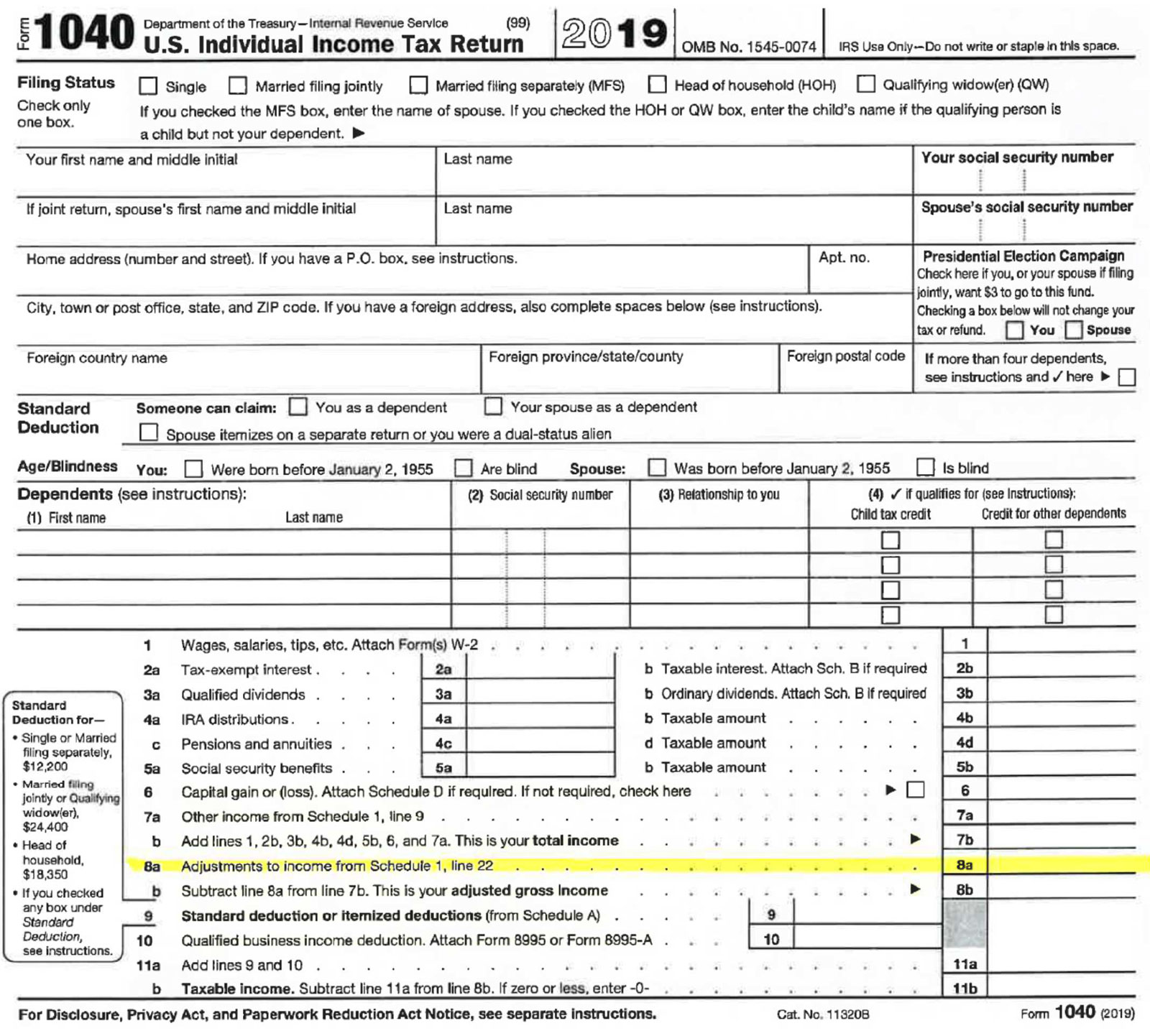

2019 Schedule Example Student Financial Aid

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Irs form 1040—line 1 (or irs form 1040. Schedule 1 the irs.

What is the Schedule 1 form for FAFSA

While completing your federal income taxes, families will need to file a schedule 1 if they are. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report.

How to Answer FAFSA Question 32 Schedule 1 (Form 1040)”

Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. While completing your federal income taxes, families will.

What is the Schedule 1 form for FAFSA

What is a schedule 1? Irs form 1040—line 1 (or irs form 1040. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. While completing your federal income taxes, families will need to file a schedule 1 if they are. Since the fy23 tax return covers 8.

What is the Schedule 1 form for FAFSA

Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. While completing your federal income taxes, families will need to file a schedule 1 if they are. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms.

What is the Schedule 1 form for FAFSA

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. What is a schedule 1? While completing your federal income taxes, families will need to file a schedule 1 if they are. If you are a freelancer or contractor (and therefore receive a 1099), then.

2024 Irs Schedule 1 Instructions And ailina ainslie

Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. While completing your federal income taxes, families will need to.

If You Are A Freelancer Or Contractor (And Therefore Receive A 1099), Then In Tax Terms You Run A “Sole Proprietorship Business” And.

Irs form 1040—line 1 (or irs form 1040. What is a schedule 1? While completing your federal income taxes, families will need to file a schedule 1 if they are. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other.