S Corp Balance Sheet Requirement

S Corp Balance Sheet Requirement - You must maintain a balance sheet for your s corporation. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”). In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. Does an s corp have to file a balance sheet? Do you need to maintain a balance sheet for an s corporation tax return? When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than.

In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. Does an s corp have to file a balance sheet? You must maintain a balance sheet for your s corporation. When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. Do you need to maintain a balance sheet for an s corporation tax return? If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”).

You must maintain a balance sheet for your s corporation. Does an s corp have to file a balance sheet? If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”). In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. Do you need to maintain a balance sheet for an s corporation tax return? Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain.

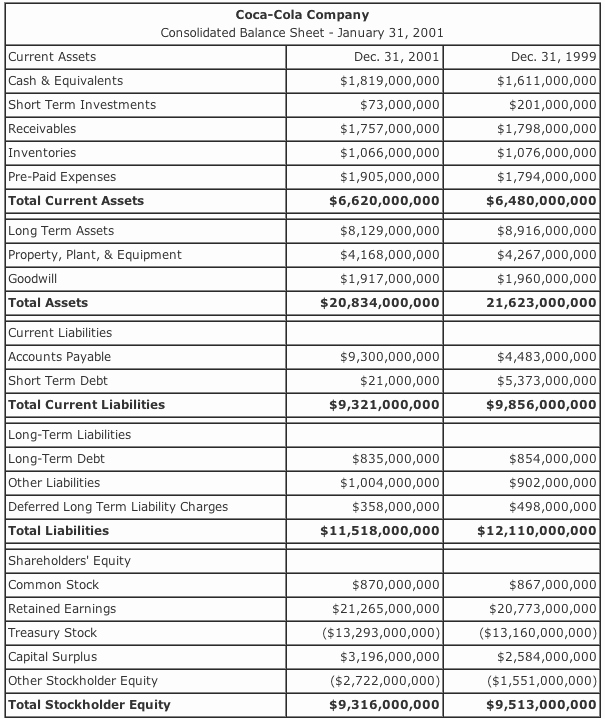

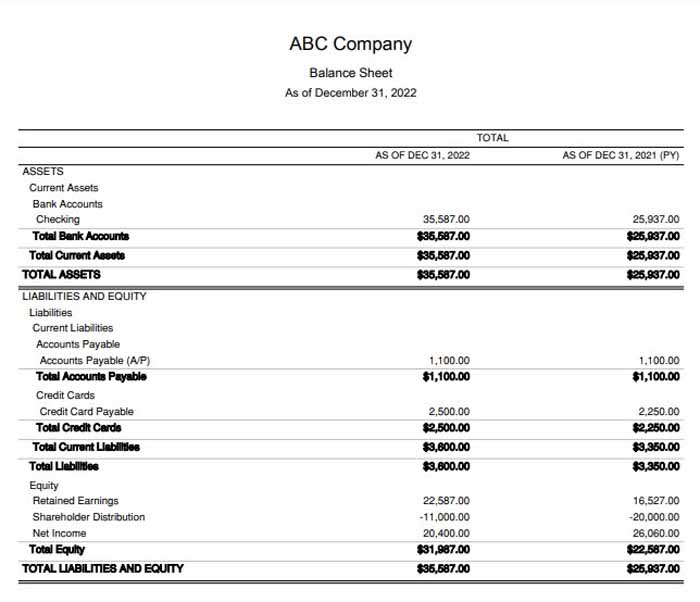

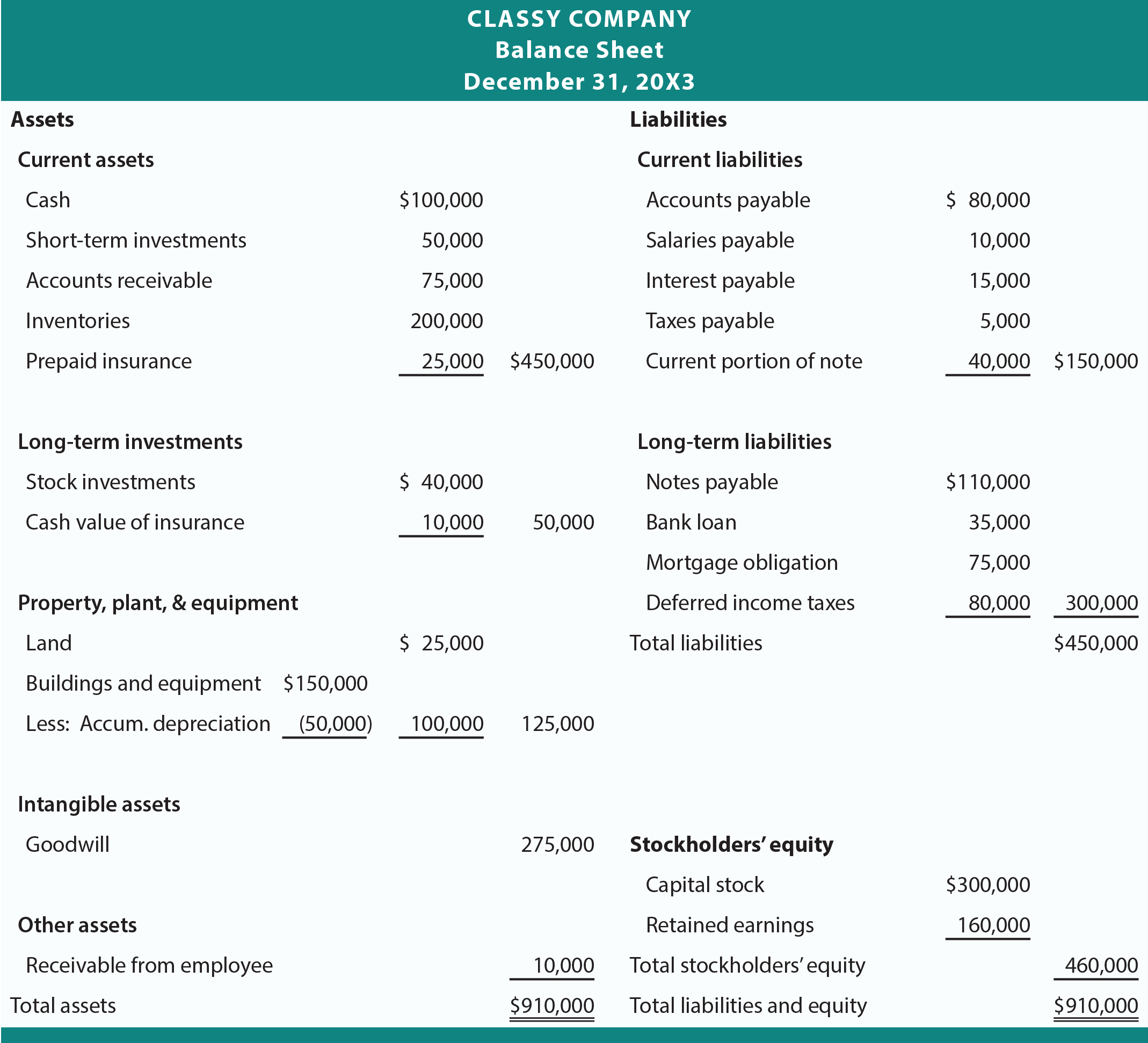

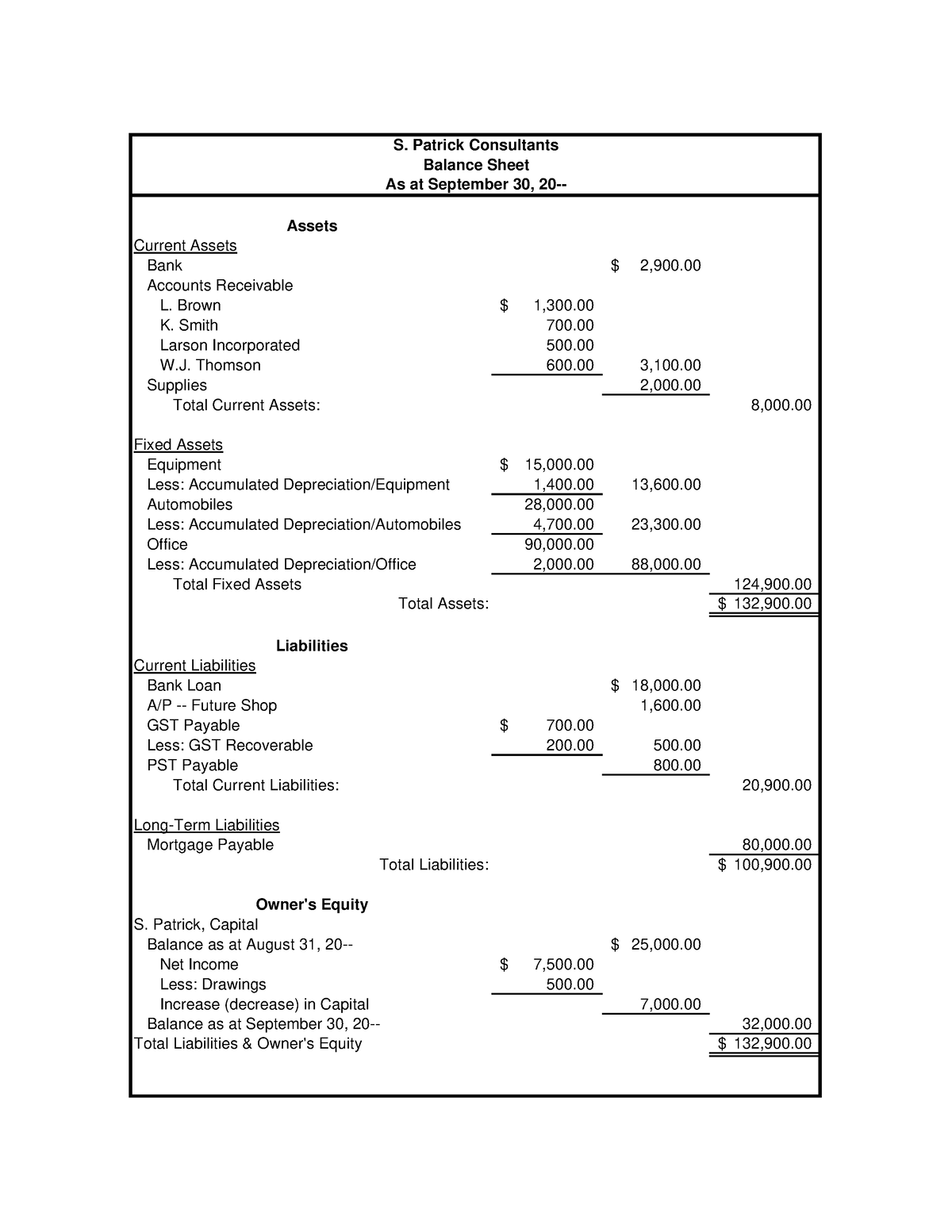

50 S Corp Balance Sheet Template Template

Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. In.

How To Complete Form 1120S & Schedule K1 (+Free Checklist) 雷竞技app,雷电

In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. Throughout the tax year, you must maintain a detailed balance sheet for your s.

50 S Corp Balance Sheet Template Template

Do you need to maintain a balance sheet for an s corporation tax return? If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”). Throughout the tax year, you must maintain a detailed balance sheet for.

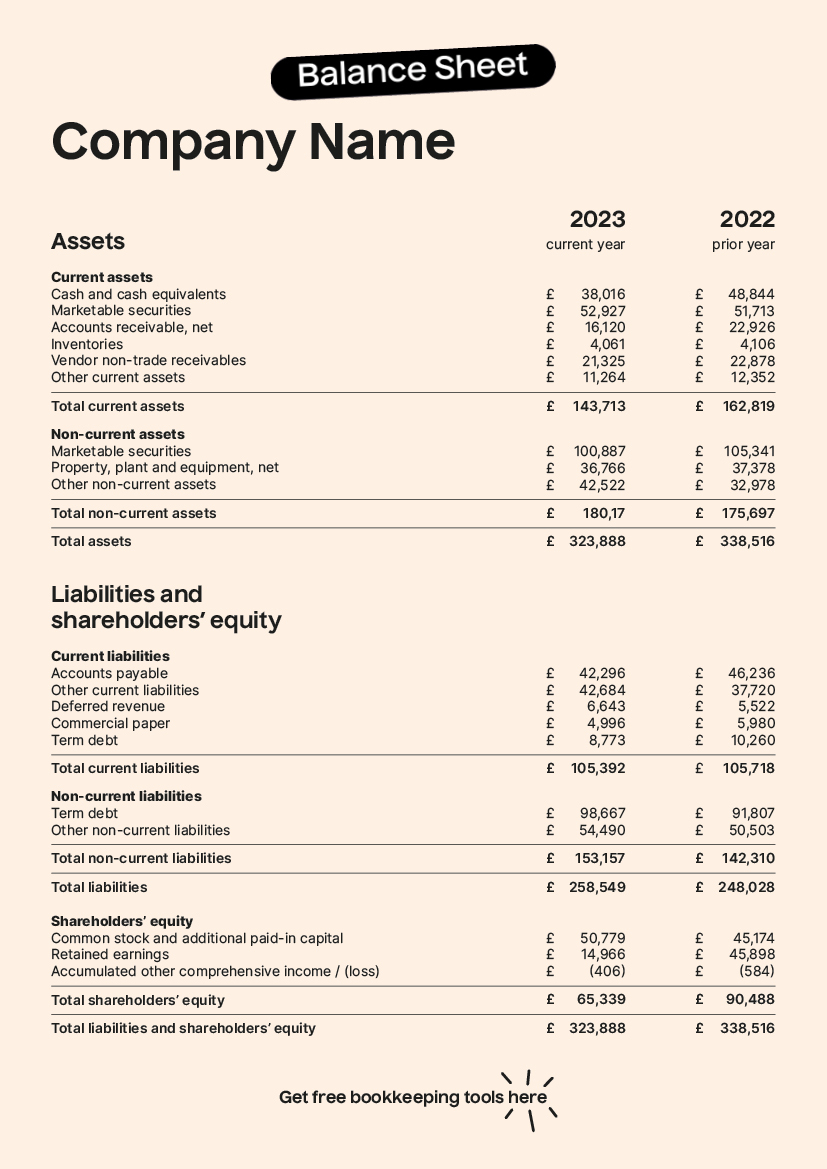

How to read a balance sheet TaxScouts

In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. Do you.

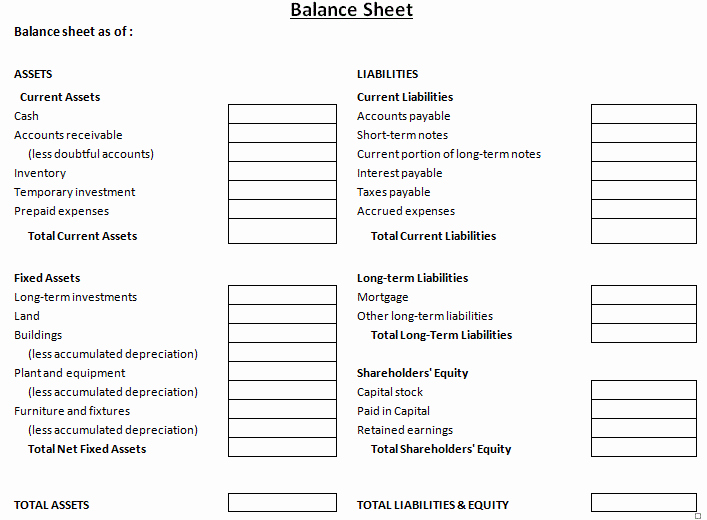

Classified Balance Sheet PDF Template Free Download Assets Current

You must maintain a balance sheet for your s corporation. Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. Throughout the tax year, you must maintain a detailed balance sheet for your.

S Corp Balance Sheet Template

You must maintain a balance sheet for your s corporation. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. In some instances you have to.

Financial Statements Balance Sheet SCORE

When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. You must maintain a balance sheet for your s corporation. Do you need to maintain a balance sheet for an.

50 S Corp Balance Sheet Template

Do you need to maintain a balance sheet for an s corporation tax return? Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form..

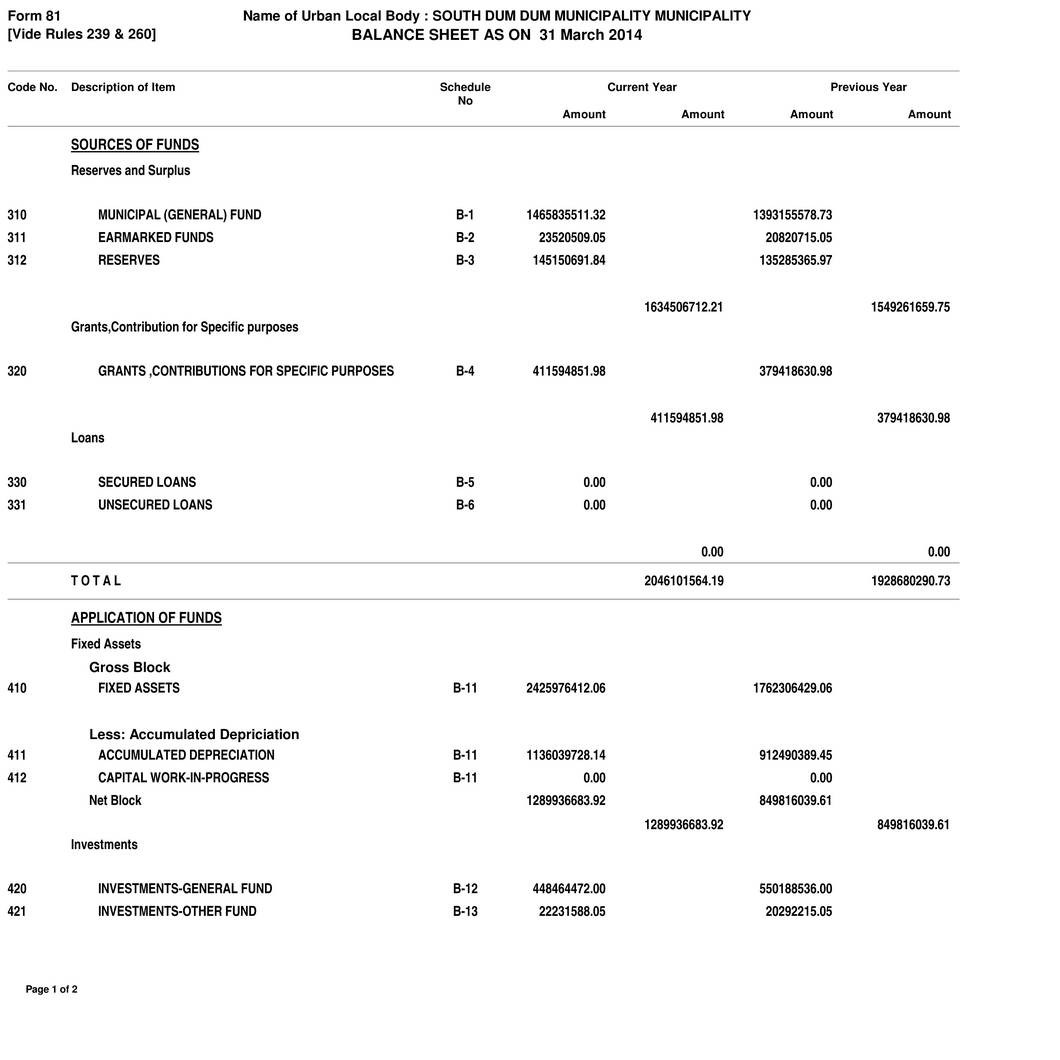

Balance Sheet Definition, Purpose, Format, Example, and More

Yes , per page 21 of the irs instructions linked to below, corporations with total receipts (page 1, line 1a plus lines 4 through 10) and total assets at the end of the tax year less than. Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. Does an s corp have to file a.

S Corp Balance Sheet Template

Do you need to maintain a balance sheet for an s corporation tax return? Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. In some instances you have to transcribe all of the information from a balance sheet onto the s corporation tax form. If your s corp has more than $250,000 in net.

In Some Instances You Have To Transcribe All Of The Information From A Balance Sheet Onto The S Corporation Tax Form.

Do you need to maintain a balance sheet for an s corporation tax return? Does an s corp have to file a balance sheet? Throughout the tax year, you must maintain a detailed balance sheet for your s corporation. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records.

Yes , Per Page 21 Of The Irs Instructions Linked To Below, Corporations With Total Receipts (Page 1, Line 1A Plus Lines 4 Through 10) And Total Assets At The End Of The Tax Year Less Than.

When it comes time to file taxes, you’ll be able to refer to this sheet in order to remain. You must maintain a balance sheet for your s corporation. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then you must include a balance sheet when you file your s corp return (“schedule l”).