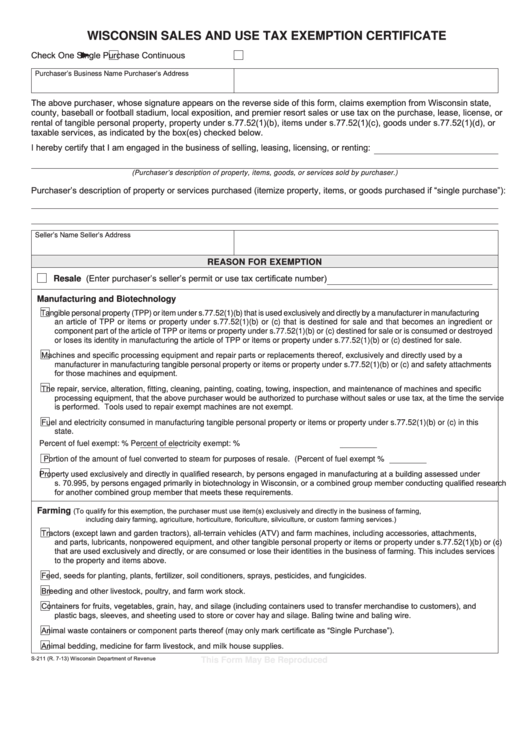

S 211 Form

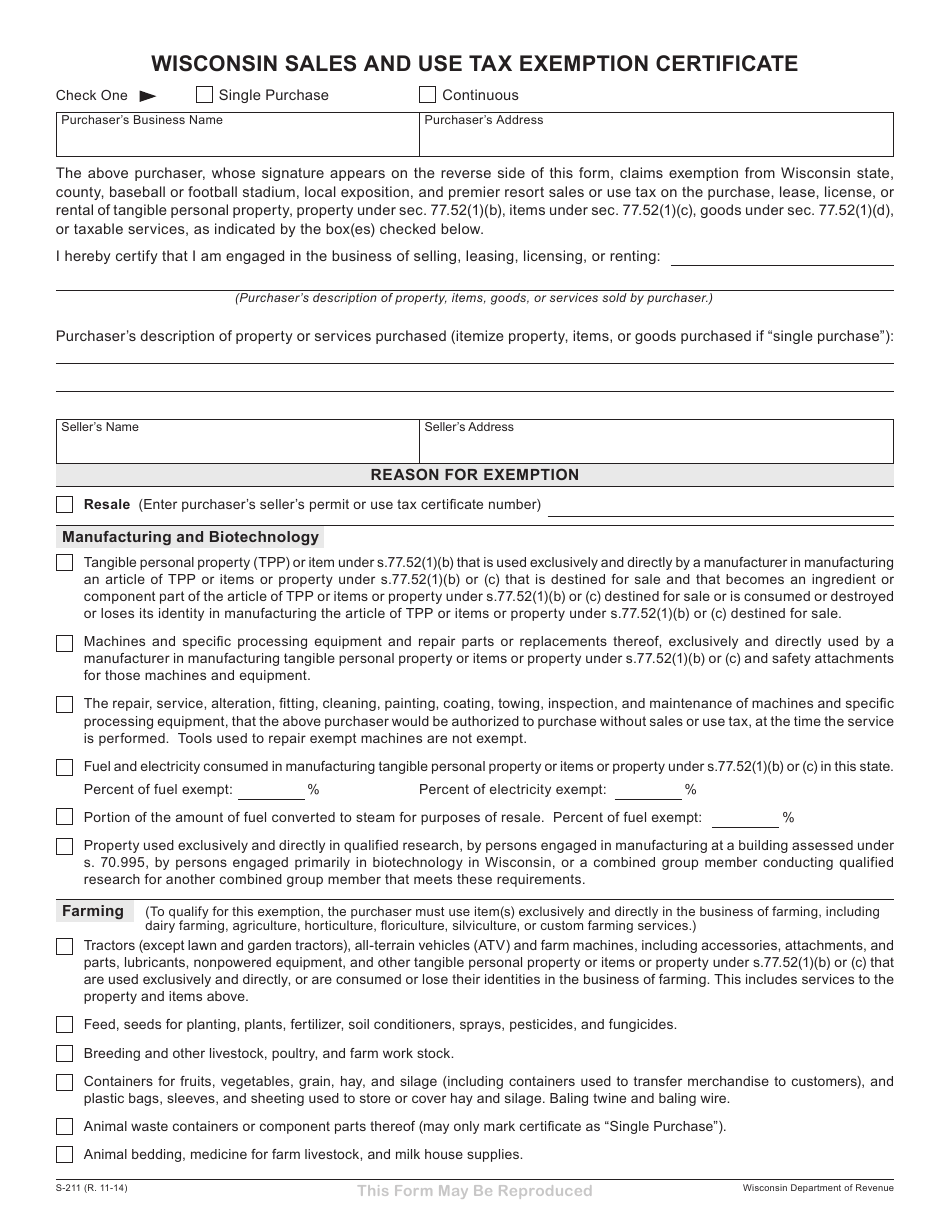

S 211 Form - This form may be reproduced. Wisconsin sales and use tax exemption certificate. Resale (enter purchaser’s seller’s permit or use tax. Download the forms from this webpage to your computer for the best user experience. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping.

Download the forms from this webpage to your computer for the best user experience. Resale (enter purchaser’s seller’s permit or use tax. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping. This form may be reproduced. Wisconsin sales and use tax exemption certificate.

Download the forms from this webpage to your computer for the best user experience. This form may be reproduced. Wisconsin sales and use tax exemption certificate. Resale (enter purchaser’s seller’s permit or use tax. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping.

2021 Form WI DoR S211 Fill Online, Printable, Fillable, Blank pdfFiller

This form may be reproduced. Resale (enter purchaser’s seller’s permit or use tax. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping. Wisconsin sales and use tax exemption certificate. Download the forms from this webpage to your computer for the best user experience.

S 211 Form Fillable Printable Forms Free Online

(to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping. Wisconsin sales and use tax exemption certificate. Resale (enter purchaser’s seller’s permit or use tax. Download the forms from this webpage to your computer for the best user experience. This form may be reproduced.

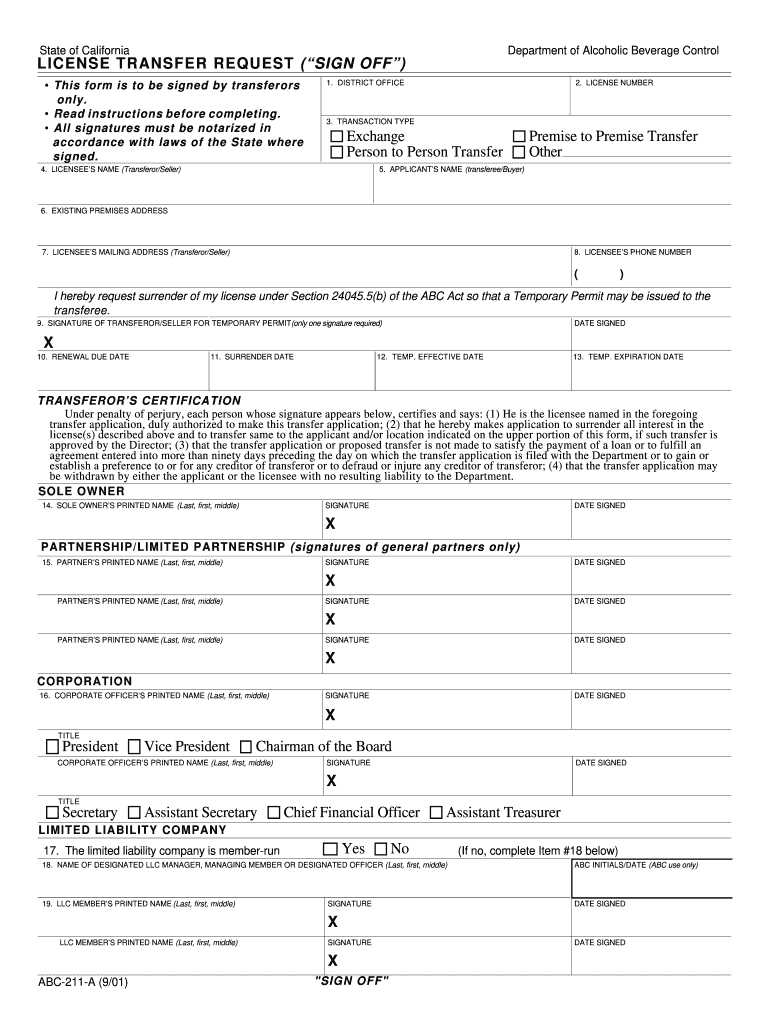

Fillable Online FL211 Fax Email Print pdfFiller

This form may be reproduced. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping. Download the forms from this webpage to your computer for the best user experience. Resale (enter purchaser’s seller’s permit or use tax. Wisconsin sales and use tax exemption certificate.

Form 211

Download the forms from this webpage to your computer for the best user experience. This form may be reproduced. Resale (enter purchaser’s seller’s permit or use tax. Wisconsin sales and use tax exemption certificate. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping.

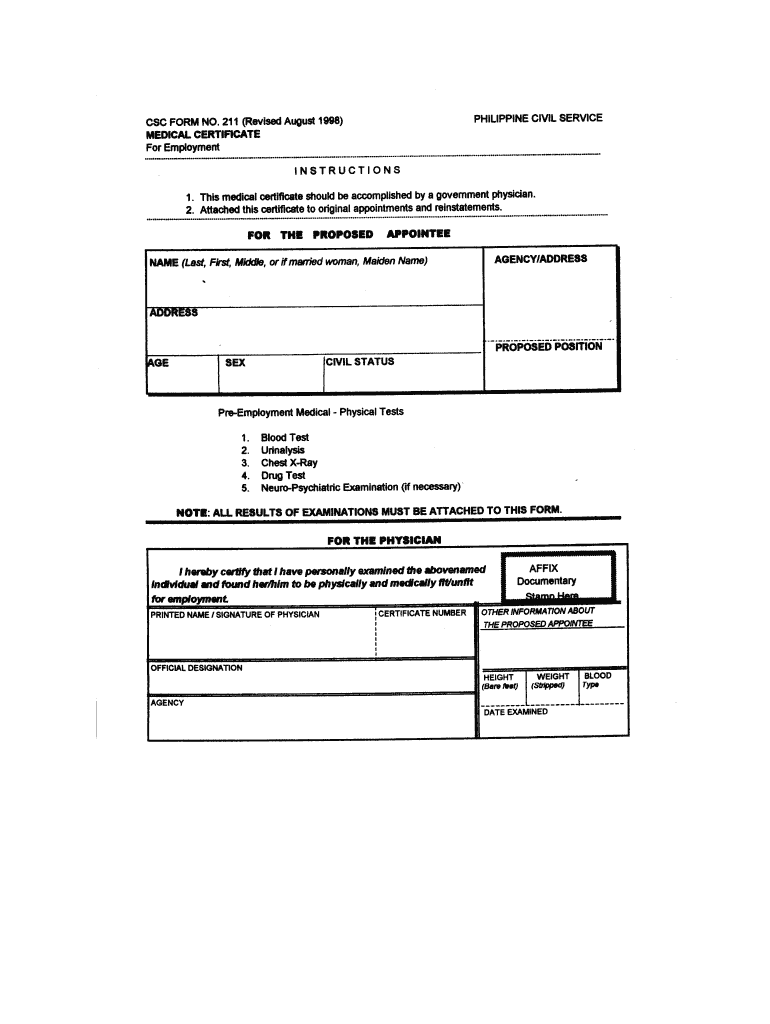

Medical Certificate Form 211 Revised 2017 airSlate SignNow

(to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping. Wisconsin sales and use tax exemption certificate. This form may be reproduced. Resale (enter purchaser’s seller’s permit or use tax. Download the forms from this webpage to your computer for the best user experience.

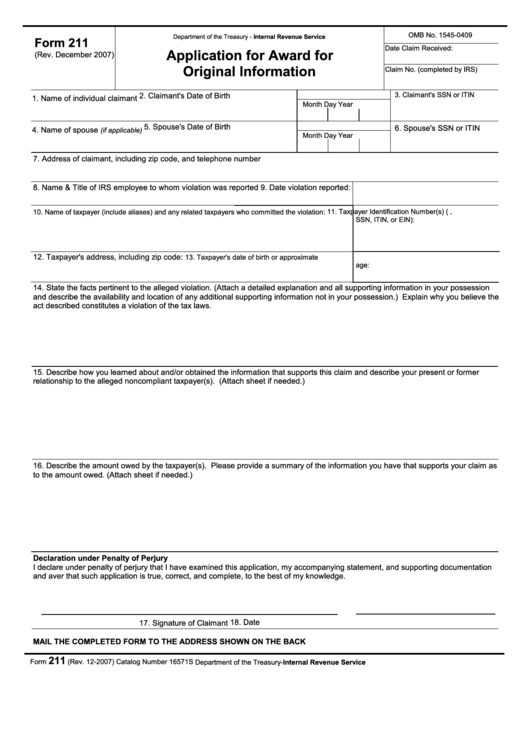

IRS Form 211 Ausfüllhilfe und Erläuterung Wiensworld

(to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping. Download the forms from this webpage to your computer for the best user experience. Resale (enter purchaser’s seller’s permit or use tax. Wisconsin sales and use tax exemption certificate. This form may be reproduced.

Fillable Form 211 Application For Award For Original Information

Resale (enter purchaser’s seller’s permit or use tax. This form may be reproduced. Download the forms from this webpage to your computer for the best user experience. Wisconsin sales and use tax exemption certificate. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping.

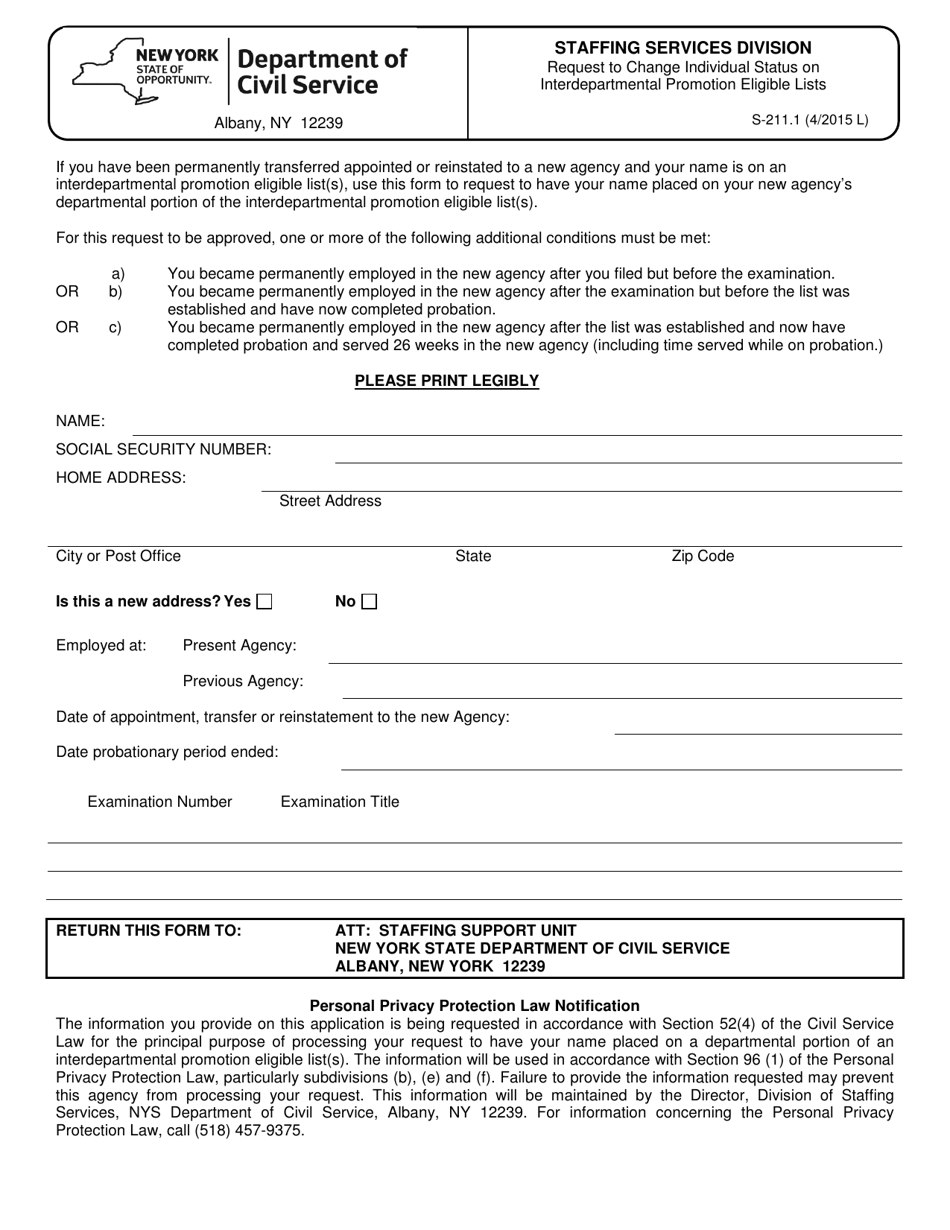

Form S211.1 Fill Out, Sign Online and Download Fillable PDF, New

(to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping. Resale (enter purchaser’s seller’s permit or use tax. Download the forms from this webpage to your computer for the best user experience. Wisconsin sales and use tax exemption certificate. This form may be reproduced.

Abc 211a Complete with ease airSlate SignNow

Resale (enter purchaser’s seller’s permit or use tax. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping. Download the forms from this webpage to your computer for the best user experience. This form may be reproduced. Wisconsin sales and use tax exemption certificate.

Form S211 Fill Out, Sign Online and Download Printable PDF

Download the forms from this webpage to your computer for the best user experience. This form may be reproduced. Wisconsin sales and use tax exemption certificate. Resale (enter purchaser’s seller’s permit or use tax. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping.

Wisconsin Sales And Use Tax Exemption Certificate.

This form may be reproduced. Download the forms from this webpage to your computer for the best user experience. Resale (enter purchaser’s seller’s permit or use tax. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping.