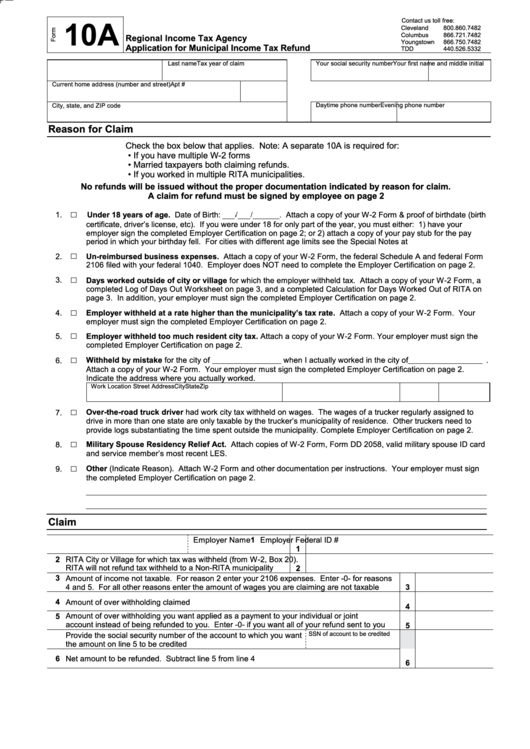

Rita Form 10A

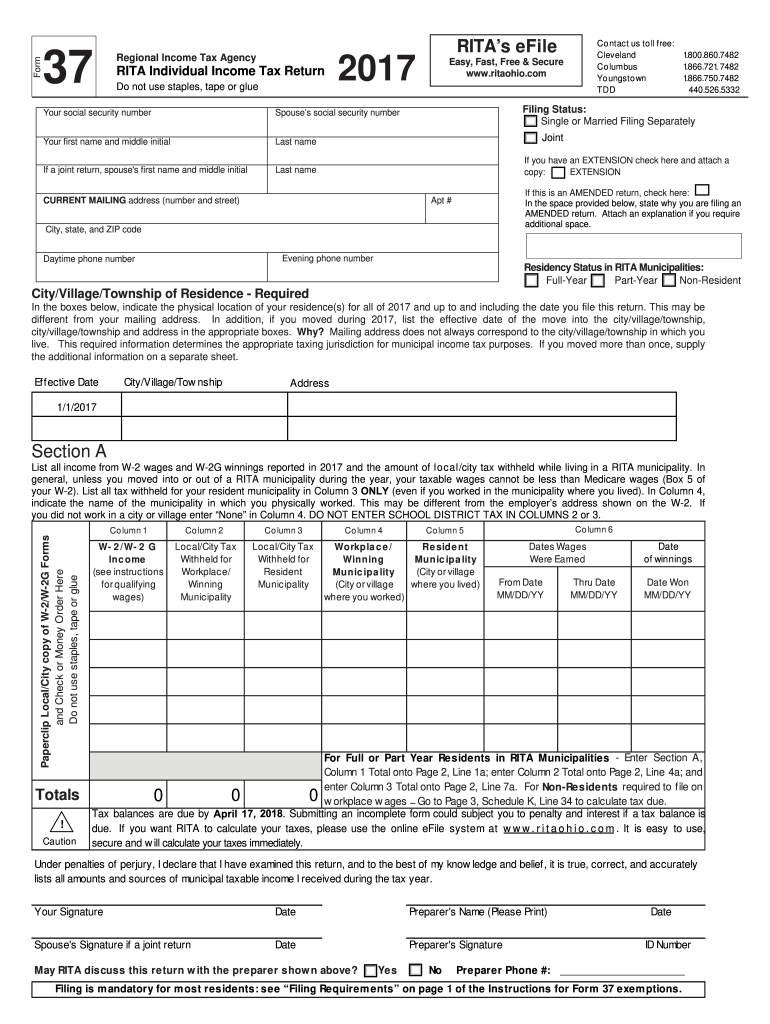

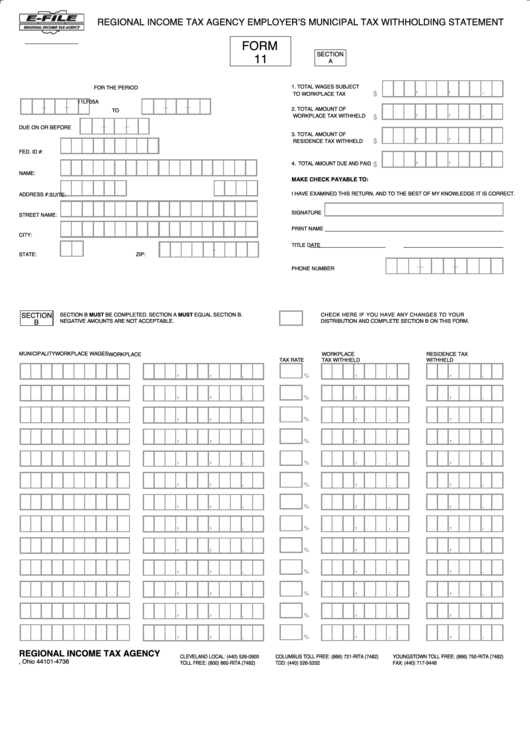

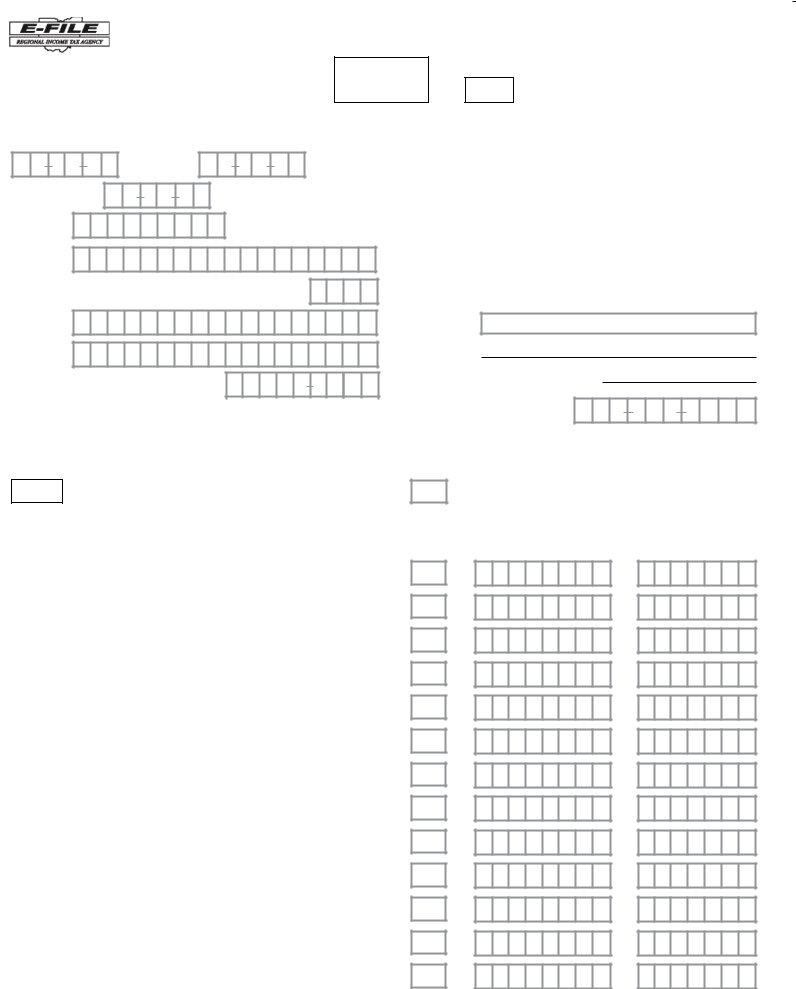

Rita Form 10A - Download individual tax forms and instructions to file your taxes with rita if filing by mail. Download and complete the pdf form to request a refund of income tax withheld by your employer for a rita municipality. Use this form to allocate existing payments/credits between separate individual accounts. Work performed in any rita municipality in which the tax was not withheld. The following forms can be found on the rita website: If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. Business forms (use these forms if you have a business in mt. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address.

Business forms (use these forms if you have a business in mt. Download individual tax forms and instructions to file your taxes with rita if filing by mail. Use this form to allocate existing payments/credits between separate individual accounts. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. Download and complete the pdf form to request a refund of income tax withheld by your employer for a rita municipality. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. Work performed in any rita municipality in which the tax was not withheld. The following forms can be found on the rita website:

Download individual tax forms and instructions to file your taxes with rita if filing by mail. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. The following forms can be found on the rita website: Business forms (use these forms if you have a business in mt. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. Use this form to allocate existing payments/credits between separate individual accounts. Work performed in any rita municipality in which the tax was not withheld. Download and complete the pdf form to request a refund of income tax withheld by your employer for a rita municipality.

Rita Form 48 Fillable Printable Forms Free Online

The following forms can be found on the rita website: Use this form to allocate existing payments/credits between separate individual accounts. Work performed in any rita municipality in which the tax was not withheld. Business forms (use these forms if you have a business in mt. If filing a form 37 and 10a, attach 10a to your completed return and.

What is a loss carry forward rita Fill out & sign online DocHub

Business forms (use these forms if you have a business in mt. Download and complete the pdf form to request a refund of income tax withheld by your employer for a rita municipality. Use this form to allocate existing payments/credits between separate individual accounts. Download individual tax forms and instructions to file your taxes with rita if filing by mail..

Rita Form 11 Fillable Printable Forms Free Online

Download and complete the pdf form to request a refund of income tax withheld by your employer for a rita municipality. Download individual tax forms and instructions to file your taxes with rita if filing by mail. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. The.

Rita form 48 instructions Fill out & sign online DocHub

If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. The following forms can be found on the rita website: Download and complete the pdf form to request a refund of income tax withheld by your employer for a rita municipality. Use this form to allocate existing payments/credits.

Rita, Fun, Hilarious

Use this form to allocate existing payments/credits between separate individual accounts. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. The following forms can be.

Fillable Online Ohio Rita Form 10a PDFfiller Fax Email Print

If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. Use this form to allocate existing payments/credits between separate individual accounts. The following forms can be found on the rita website: Work performed in any rita municipality in which the tax was not withheld. Download and complete the.

Rita Form 11 ≡ Fill Out Printable PDF Forms Online

If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. Work performed in any rita municipality in which the tax was not withheld. The following forms can be found on the rita website: Use this form to allocate existing payments/credits between separate individual accounts. Business forms (use these.

RITA

Use this form to allocate existing payments/credits between separate individual accounts. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. Work performed in any rita municipality in which the tax was not withheld. The following forms can be found on the rita website: Download individual tax forms.

Form 10a Application For Municipal Tax Refund printable pdf

If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. The following forms can be found on the rita website: Download and complete the pdf form to request a refund of income tax withheld by your employer for a rita municipality. Download individual tax forms and instructions to.

Rita Form 17 ≡ Fill Out Printable PDF Forms Online

Download individual tax forms and instructions to file your taxes with rita if filing by mail. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. The following forms can be found on the rita website: Use this form to allocate existing payments/credits between separate individual accounts. Work.

The Following Forms Can Be Found On The Rita Website:

Use this form to allocate existing payments/credits between separate individual accounts. Download and complete the pdf form to request a refund of income tax withheld by your employer for a rita municipality. Download individual tax forms and instructions to file your taxes with rita if filing by mail. Work performed in any rita municipality in which the tax was not withheld.

Business Forms (Use These Forms If You Have A Business In Mt.

If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address. If filing a form 37 and 10a, attach 10a to your completed return and mail them together to the form 10a address.