Quickbooks Online Unapplied Cash Payment Income

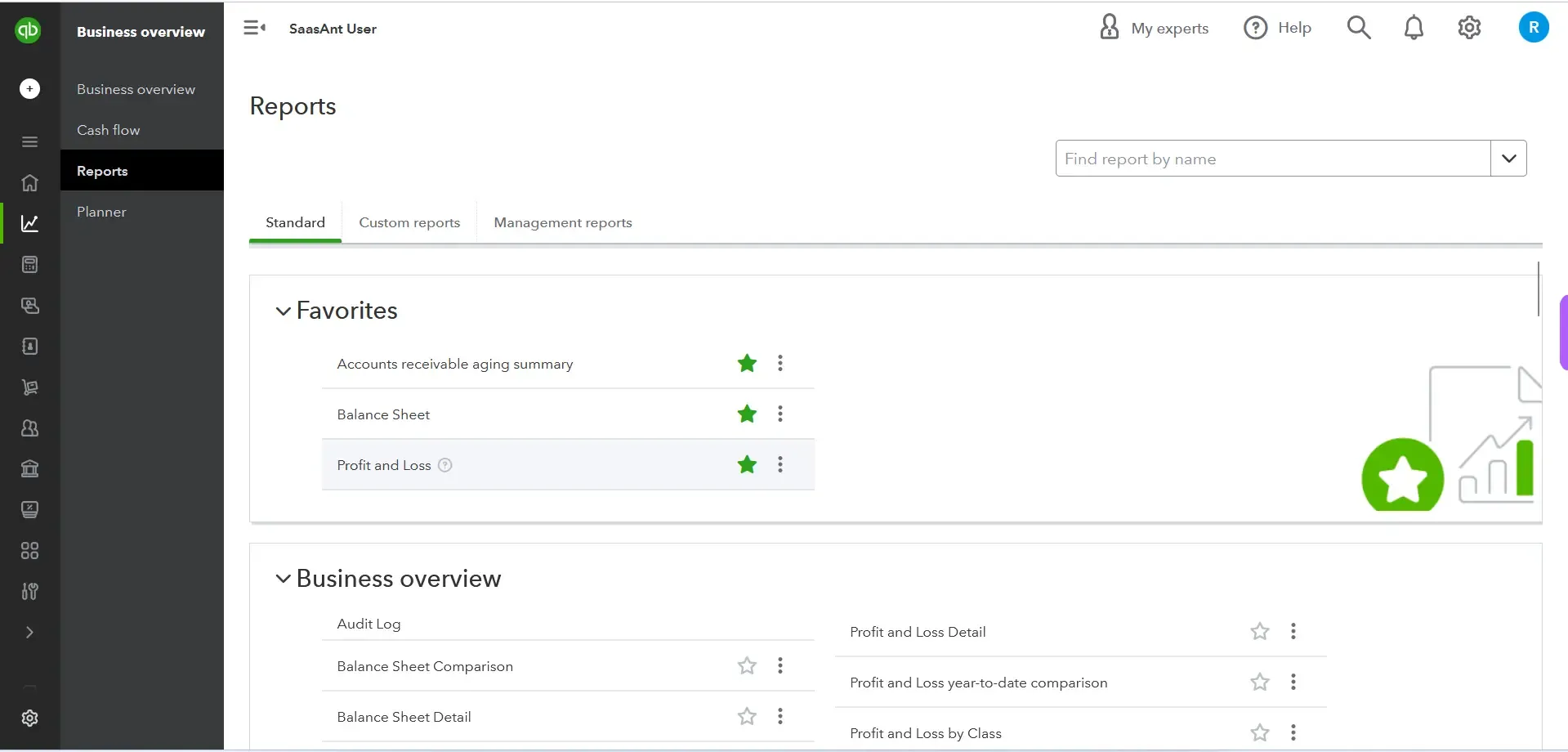

Quickbooks Online Unapplied Cash Payment Income - Set the date in the. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. Search for the open invoices report. Sign in to your quickbooks online account. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Click reports from the left menu. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment.

If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Click reports from the left menu. Set the date in the. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. Search for the open invoices report. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Sign in to your quickbooks online account.

If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. Set the date in the. Click reports from the left menu. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Search for the open invoices report. Sign in to your quickbooks online account.

Unapplied cash payment on your profit and loss

Sign in to your quickbooks online account. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Click reports from the left menu. Coming.

Unapplied Cash Payment in QuickBooks What It Means for Your

Search for the open invoices report. Click reports from the left menu. Sign in to your quickbooks online account. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the.

QuickBooks Online Cash Basis Unapplied Cash Payment

Set the date in the. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Sign in to your quickbooks online account. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. Search for the open invoices report.

Unapplied Cash Payment in QuickBooks Online Gentle Frog

We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Search for the open invoices report. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Click reports from the left menu. Set the.

Unapplied Cash Payment and Expenses in QuickBooks Online

Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. Set the date in the. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Click reports from the left menu. Sign in to your quickbooks online.

How to clean up Unapplied Cash Payment & Expenses in QuickBooks

Search for the open invoices report. Set the date in the. Click reports from the left menu. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment.

How do you fix unapplied payments in QuickBooks online? TimesMojo

Search for the open invoices report. Click reports from the left menu. Sign in to your quickbooks online account. We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. If the payment date is not within the reporting period of your profit and loss, it will be recorded.

What is Unapplied Cash Payment in QuickBooks Online?

We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Set the date in the. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. Click reports from the left menu. If the payment date is not within the.

Unapplied Cash Payment and Expenses in QuickBooks Online

We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. Click reports from the left menu. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Coming across unapplied cash payment income and expenses.

How to fix unapplied cash payments in QuickBooks Online 5 Minute

We’ll shed light on unapplied cash payment income and provide actionable insights on how to address and rectify this issue within the. If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Click reports from the left menu. Set the date in the. Search for the.

We’ll Shed Light On Unapplied Cash Payment Income And Provide Actionable Insights On How To Address And Rectify This Issue Within The.

If the payment date is not within the reporting period of your profit and loss, it will be recorded as an unapplied cash payment. Search for the open invoices report. Click reports from the left menu. Sign in to your quickbooks online account.

Set The Date In The.

Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup.