Quickbooks Changing Payroll Tax

Quickbooks Changing Payroll Tax - Right now, if you’re using. 1, 2025, that you should be aware of. Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled. Quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations. We're changing how we handle automated taxes for quickbooks online payroll customers. We're changing how we handle automated taxes for quickbooks online payroll customers. Learn how to change your payroll form filing and tax deposit frequency in quickbooks online payroll or quickbooks. Since the tax amount is deducted incorrectly from your employees' paychecks, you'll need to run the payroll summary report to. If you’re a quickbooks online payroll user, there are some changes coming jan. Instead of automatically withdrawing and paying payroll.

1, 2025, that you should be aware of. Instead of automatically withdrawing and paying payroll. Quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations. Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled. We're changing how we handle automated taxes for quickbooks online payroll customers. Learn how to change your payroll form filing and tax deposit frequency in quickbooks online payroll or quickbooks. If you’re a quickbooks online payroll user, there are some changes coming jan. We're changing how we handle automated taxes for quickbooks online payroll customers. Since the tax amount is deducted incorrectly from your employees' paychecks, you'll need to run the payroll summary report to. Right now, if you’re using.

We're changing how we handle automated taxes for quickbooks online payroll customers. We're changing how we handle automated taxes for quickbooks online payroll customers. Right now, if you’re using. Instead of automatically withdrawing and paying payroll. Quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations. If you’re a quickbooks online payroll user, there are some changes coming jan. Since the tax amount is deducted incorrectly from your employees' paychecks, you'll need to run the payroll summary report to. Learn how to change your payroll form filing and tax deposit frequency in quickbooks online payroll or quickbooks. 1, 2025, that you should be aware of. Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled.

Tips for Changing Payroll Frequency Quickbooks Canada Blog

Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled. Quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations. If you’re a quickbooks online payroll user, there are some changes coming jan. 1, 2025, that you should be aware of. Instead of automatically withdrawing and paying payroll.

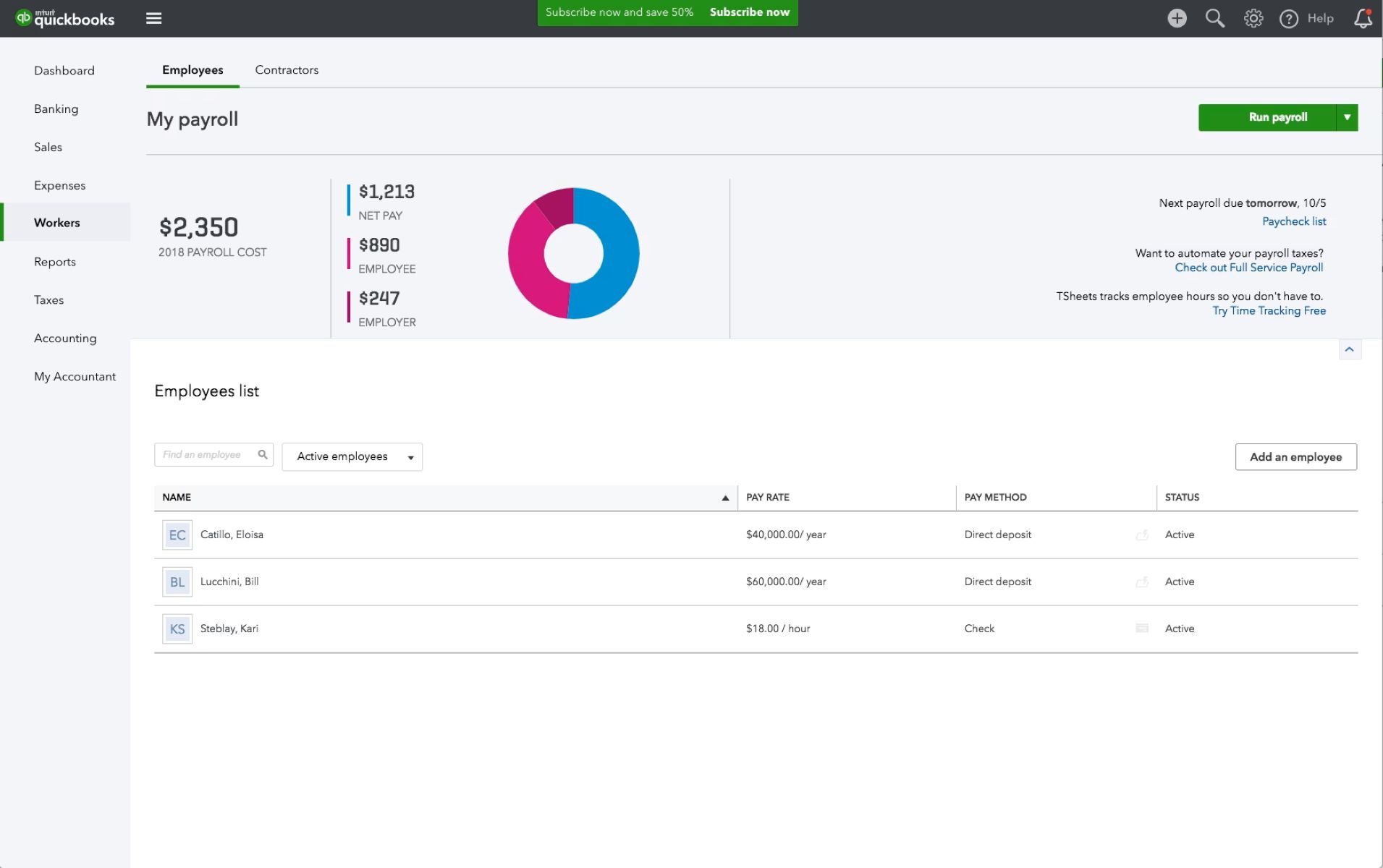

How To Do Payroll With Quickbooks

If you’re a quickbooks online payroll user, there are some changes coming jan. Quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations. Instead of automatically withdrawing and paying payroll. We're changing how we handle automated taxes for quickbooks online payroll customers. 1, 2025, that you should be aware of.

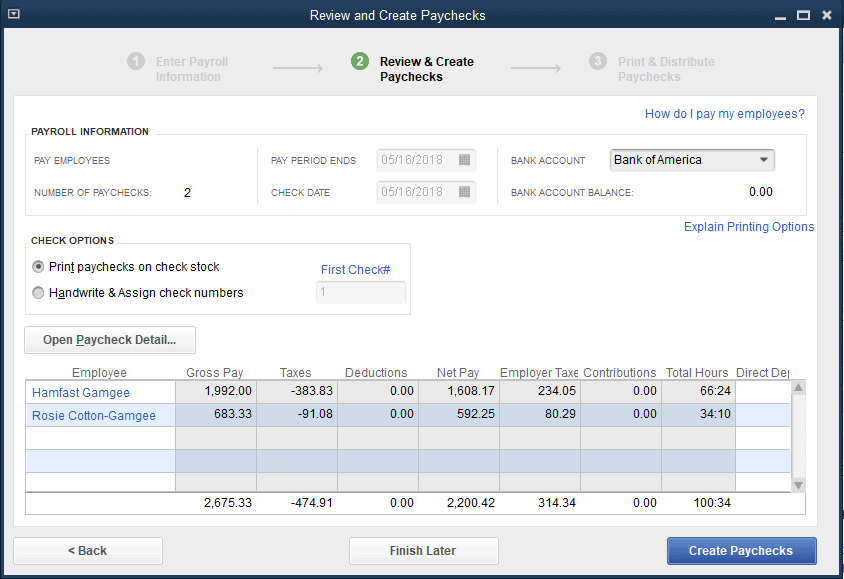

Solved QuickBooks Pro 2019 Desktop payroll

1, 2025, that you should be aware of. Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled. We're changing how we handle automated taxes for quickbooks online payroll customers. We're changing how we handle automated taxes for quickbooks online payroll customers. Quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt.

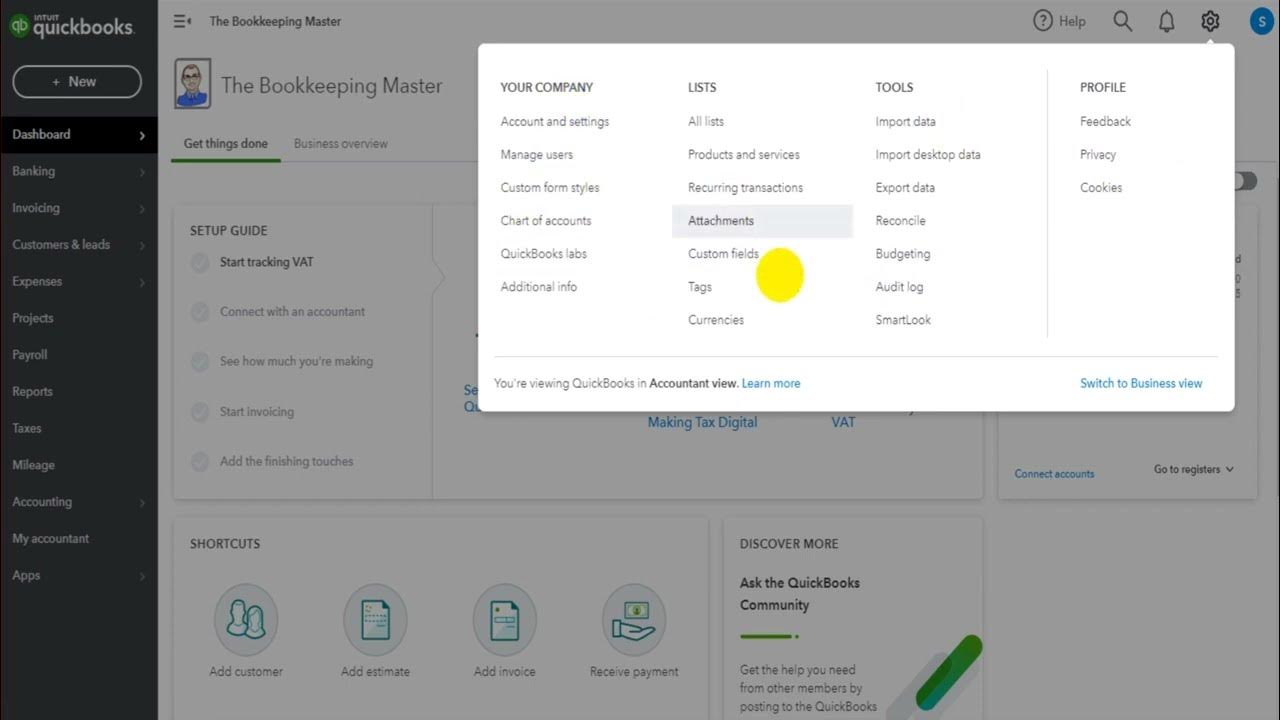

How to Change Year End on QuickBooks Online accounting quickbooks

We're changing how we handle automated taxes for quickbooks online payroll customers. 1, 2025, that you should be aware of. Quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations. Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled. Instead of automatically withdrawing and paying payroll.

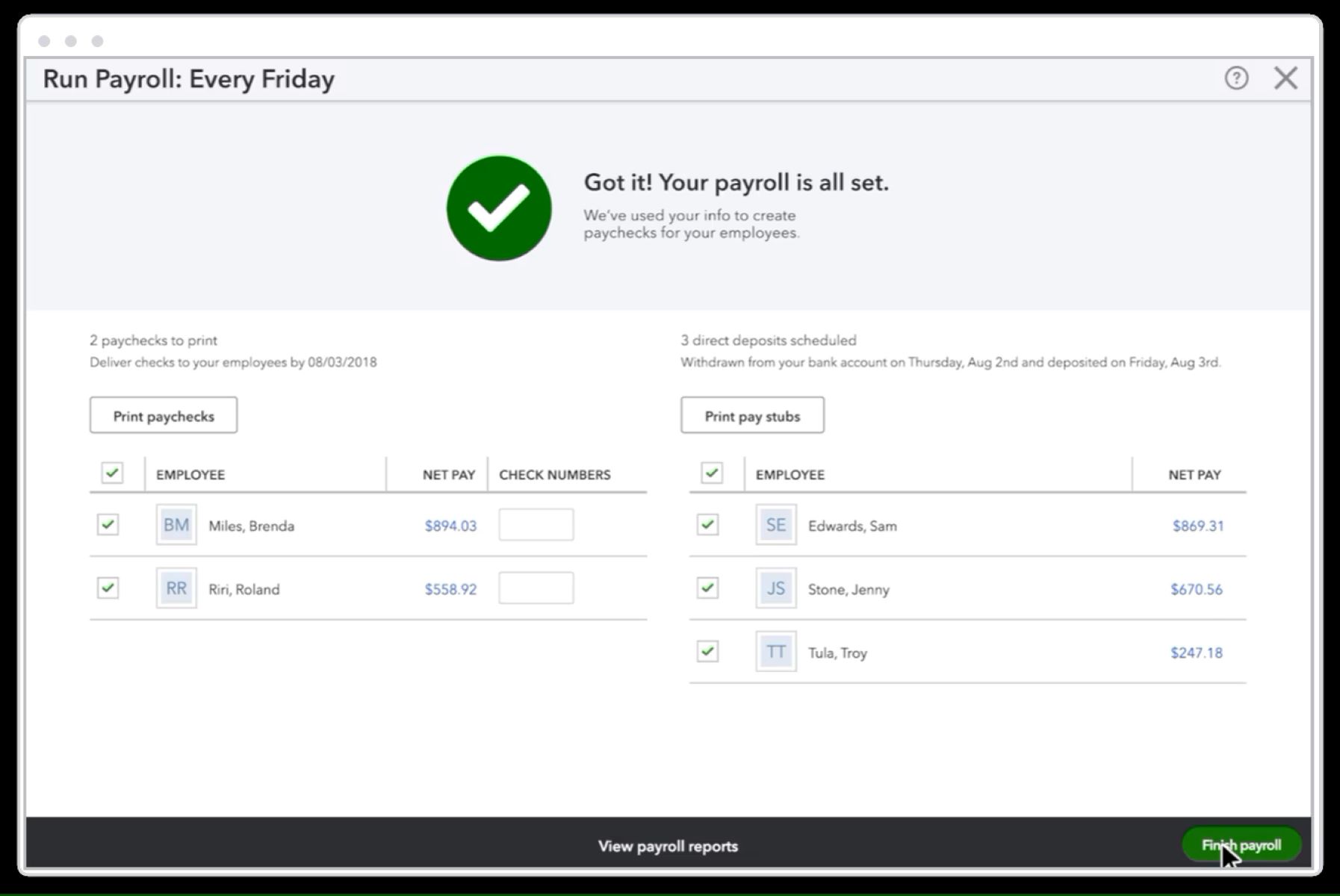

Automate Paying Payroll Taxes in QuickBooks Experts in QuickBooks

1, 2025, that you should be aware of. Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled. If you’re a quickbooks online payroll user, there are some changes coming jan. We're changing how we handle automated taxes for quickbooks online payroll customers. Instead of automatically withdrawing and paying payroll.

Automate Paying Payroll Taxes in QuickBooks Experts in QuickBooks

If you’re a quickbooks online payroll user, there are some changes coming jan. Since the tax amount is deducted incorrectly from your employees' paychecks, you'll need to run the payroll summary report to. We're changing how we handle automated taxes for quickbooks online payroll customers. We're changing how we handle automated taxes for quickbooks online payroll customers. Learn how to.

How To Setup Quickbooks Payroll

Learn how to change your payroll form filing and tax deposit frequency in quickbooks online payroll or quickbooks. Quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations. We're changing how we handle automated taxes for quickbooks online payroll customers. Instead of automatically withdrawing and paying payroll. 1, 2025, that you should.

Quickbooks Payroll Template

Right now, if you’re using. Learn how to change your payroll form filing and tax deposit frequency in quickbooks online payroll or quickbooks. If you’re a quickbooks online payroll user, there are some changes coming jan. Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled. Quickbooks desktop offers various methods to change payroll tax rates,.

Quickbooks online payroll calculator RajaCharlotte

1, 2025, that you should be aware of. Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled. Since the tax amount is deducted incorrectly from your employees' paychecks, you'll need to run the payroll summary report to. Instead of automatically withdrawing and paying payroll. Right now, if you’re using.

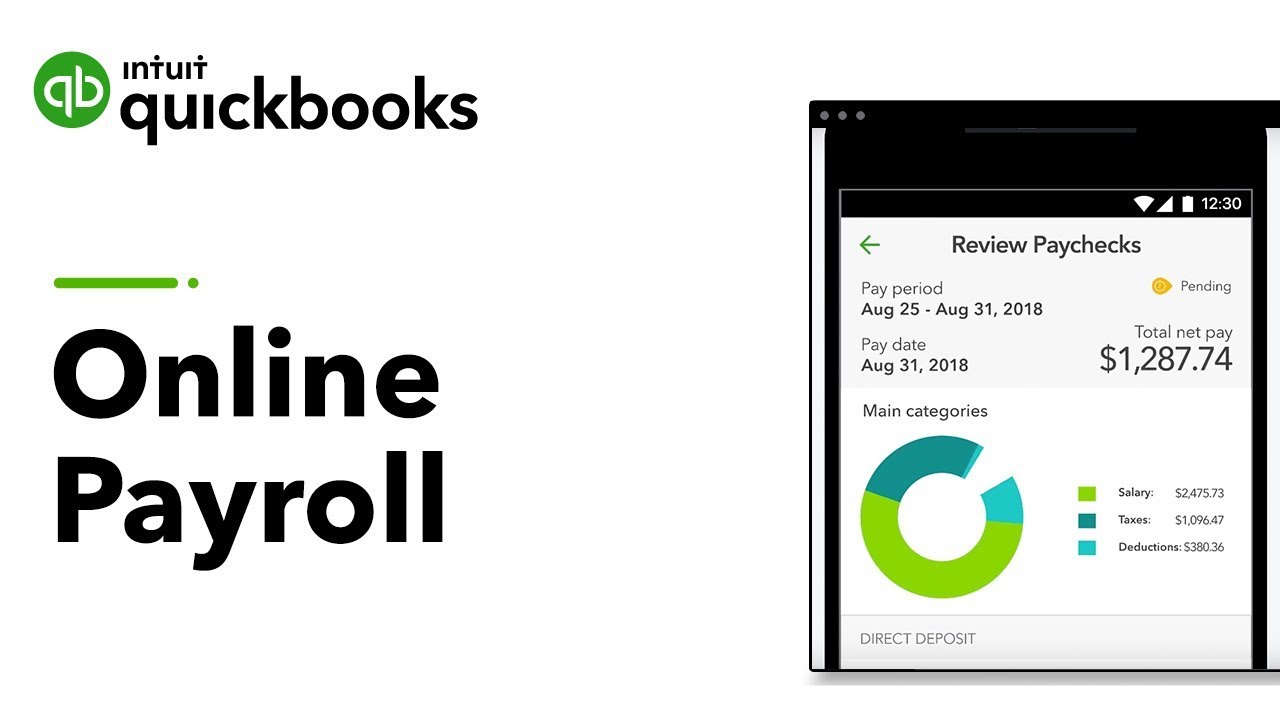

Intuit Quickbooks Online Payroll Services Best Payroll Service Review

We're changing how we handle automated taxes for quickbooks online payroll customers. 1, 2025, that you should be aware of. Instead of automatically withdrawing and paying payroll. Since the tax amount is deducted incorrectly from your employees' paychecks, you'll need to run the payroll summary report to. If you’re a quickbooks online payroll user, there are some changes coming jan.

If You’re A Quickbooks Online Payroll User, There Are Some Changes Coming Jan.

Right now, if you’re using. Instead of automatically withdrawing and paying payroll. We're changing how we handle automated taxes for quickbooks online payroll customers. 1, 2025, that you should be aware of.

Since The Tax Amount Is Deducted Incorrectly From Your Employees' Paychecks, You'll Need To Run The Payroll Summary Report To.

Quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations. Quickbooks online payroll is implementing significant changes in how automated tax withdrawals are handled. Learn how to change your payroll form filing and tax deposit frequency in quickbooks online payroll or quickbooks. We're changing how we handle automated taxes for quickbooks online payroll customers.