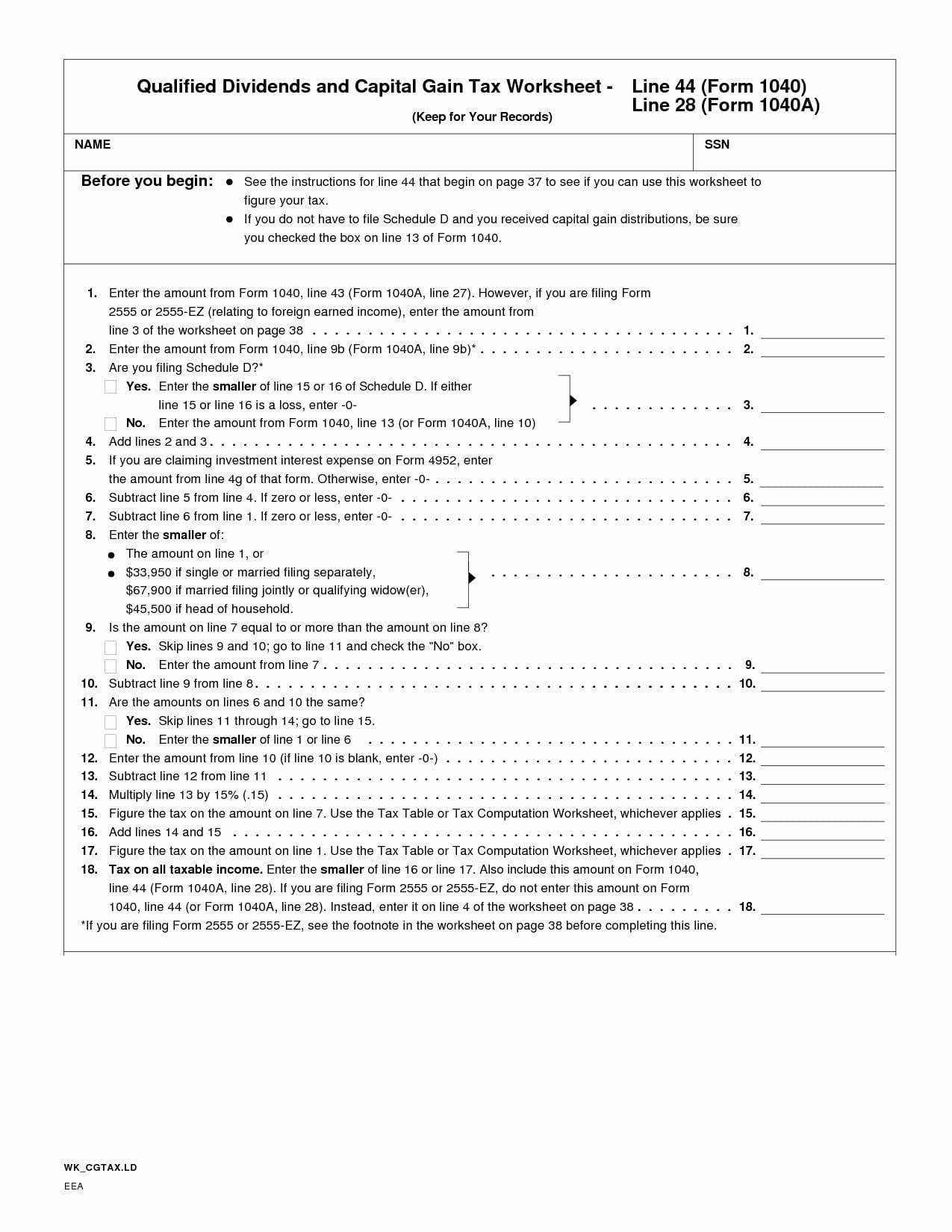

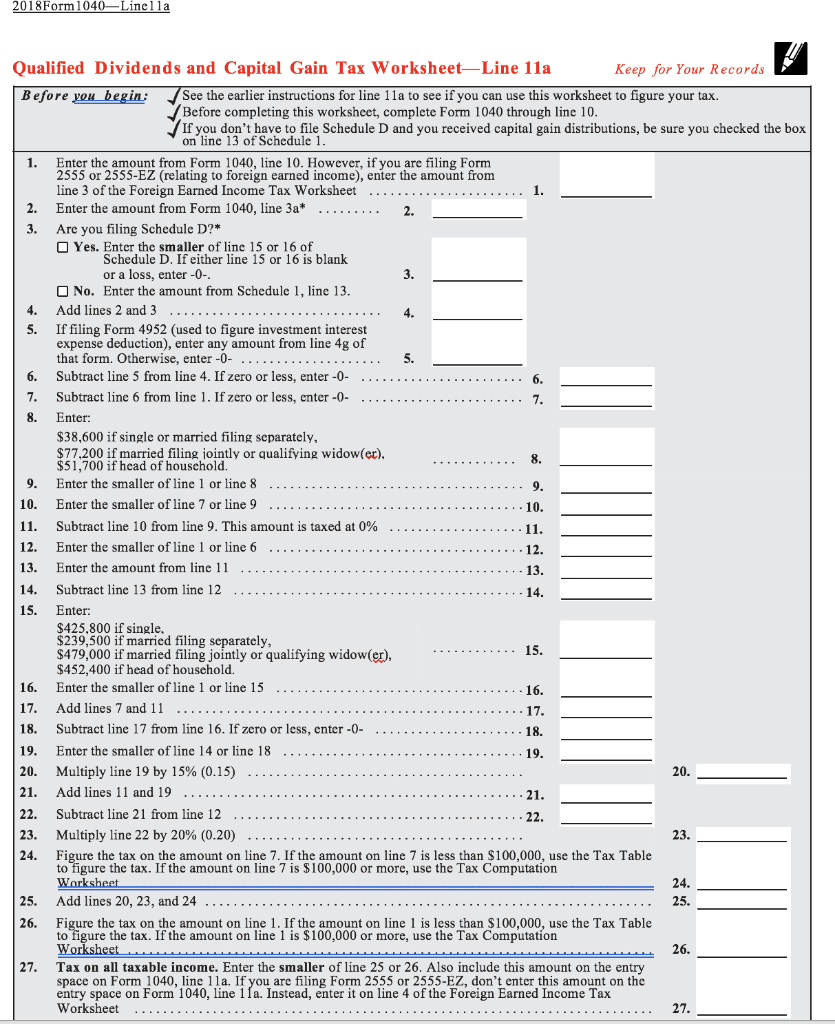

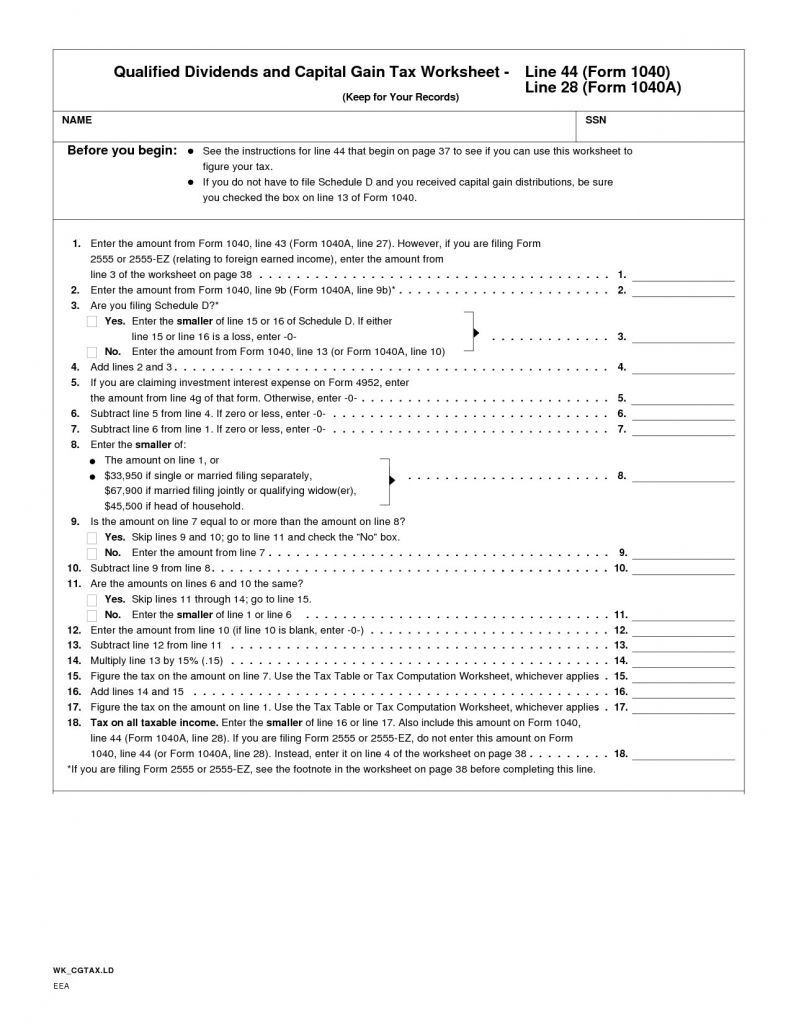

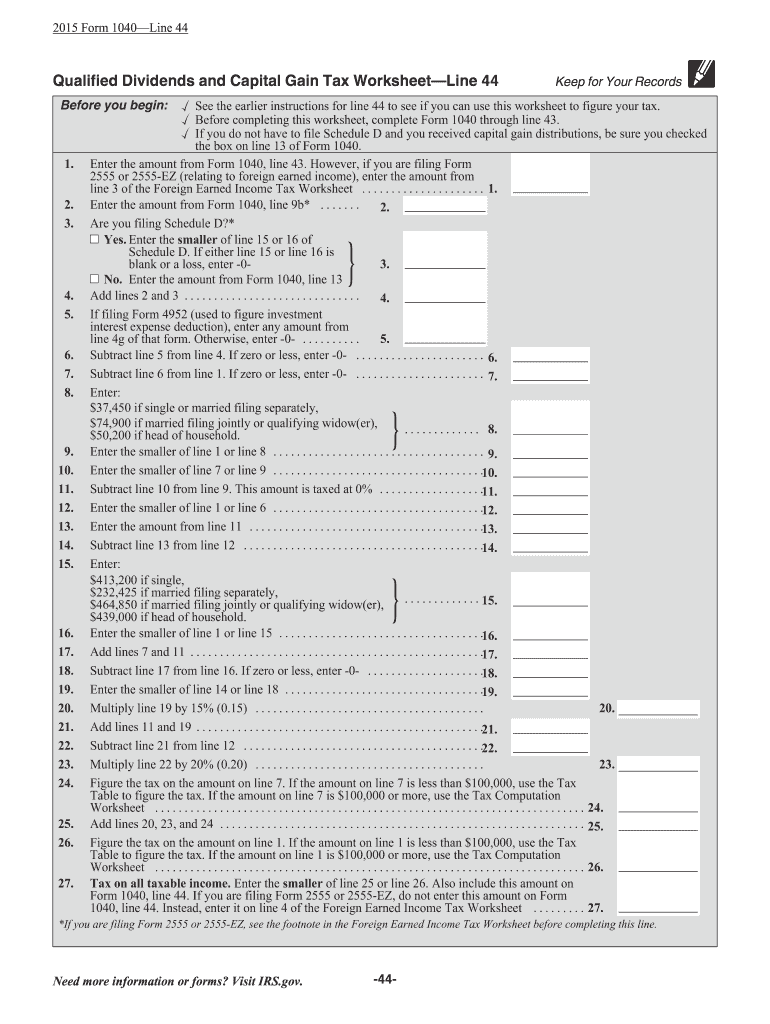

Qualified Dividends And Capital Gains Worksheet

Qualified Dividends And Capital Gains Worksheet - Find out when to use form 8949,. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Use this worksheet to figure your tax on qualified dividends and capital gains. This worksheet helps you determine the tax on your qualified dividends and capital gains. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions.

The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. This worksheet helps you determine the tax on your qualified dividends and capital gains. Find out when to use form 8949,. Use this worksheet to figure your tax on qualified dividends and capital gains.

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. This worksheet helps you determine the tax on your qualified dividends and capital gains. Find out when to use form 8949,. Use this worksheet to figure your tax on qualified dividends and capital gains. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top.

Qualified Dividends and Capital Gains Worksheet Qualified Dividends

This worksheet helps you determine the tax on your qualified dividends and capital gains. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Find out when to use form 8949,. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Use this worksheet.

Qualified Dividends And Capital Gain Tax Worksheet 2020

Find out when to use form 8949,. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. This worksheet helps you determine the tax on your qualified dividends and capital gains. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Use this worksheet.

Qualified Dividends Tax Worksheet

Find out when to use form 8949,. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. This worksheet helps you determine the tax on your qualified dividends and capital gains. Use this worksheet.

20++ Qualified Dividends And Capital Gains Worksheet 2019 Worksheets

Find out when to use form 8949,. This worksheet helps you determine the tax on your qualified dividends and capital gains. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Use this worksheet to figure your tax on qualified dividends and capital gains. The most important lesson to learn from this worksheet.

2021 Qualified Dividends And Capital Gains Worksheet

The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Find out when to use form 8949,. This worksheet helps you determine the tax on your qualified dividends and capital gains. Use this worksheet.

Qualified Dividends And Capital Gains Worksheet 2022

Use this worksheet to figure your tax on qualified dividends and capital gains. Find out when to use form 8949,. This worksheet helps you determine the tax on your qualified dividends and capital gains. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Learn how to complete schedule d (form.

Qualified Dividends And Capital Gain Tax Worksheetline 16

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. This worksheet helps you determine the tax on your qualified dividends and capital gains. Find out when to use form 8949,. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Use this worksheet.

Qualified Dividends And Capital Gains Tax Worksheet

Use this worksheet to figure your tax on qualified dividends and capital gains. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. This worksheet helps you determine the tax on your qualified dividends and capital gains. Learn how to complete schedule d (form 1040) to report capital gains and losses.

Irs Qualified Dividend Capital Gain Worksheet

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Use this worksheet to figure your tax on qualified dividends and capital gains. Find out when to use form 8949,. This worksheet helps you determine the tax on your qualified dividends and capital gains. The most important lesson to learn from this worksheet.

Capital Gains And Qualified Dividends Worksheet

This worksheet helps you determine the tax on your qualified dividends and capital gains. Use this worksheet to figure your tax on qualified dividends and capital gains. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Find out when to use form 8949,. The most important lesson to learn from this worksheet.

Use This Worksheet To Figure Your Tax On Qualified Dividends And Capital Gains.

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Find out when to use form 8949,. This worksheet helps you determine the tax on your qualified dividends and capital gains. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top.