Property Tax Appeal Form

Property Tax Appeal Form - You may follow these appeal procedures if you have a concern about: Property owners have the right to protest actions concerning their property tax appraisals. Any action taken by the. To begin an appeal application, click on the filing type below. Learn about your right to protest property taxes in texas. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. This article explains what to do if you disagree with your property tax appraisal, how to prepare for a protest hearing,.

Learn about your right to protest property taxes in texas. Any action taken by the. This article explains what to do if you disagree with your property tax appraisal, how to prepare for a protest hearing,. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. You may follow these appeal procedures if you have a concern about: Property owners have the right to protest actions concerning their property tax appraisals. To begin an appeal application, click on the filing type below.

A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. Learn about your right to protest property taxes in texas. To begin an appeal application, click on the filing type below. You may follow these appeal procedures if you have a concern about: This article explains what to do if you disagree with your property tax appraisal, how to prepare for a protest hearing,. Any action taken by the. Property owners have the right to protest actions concerning their property tax appraisals.

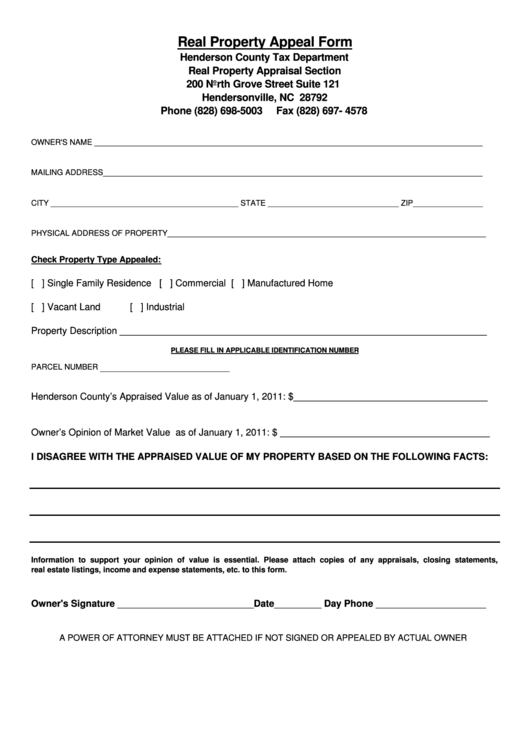

Real Property Appeal Form Henderson County Tax Department printable

Learn about your right to protest property taxes in texas. To begin an appeal application, click on the filing type below. You may follow these appeal procedures if you have a concern about: Property owners have the right to protest actions concerning their property tax appraisals. A property owner or an owner’s designated agent can use this form to file.

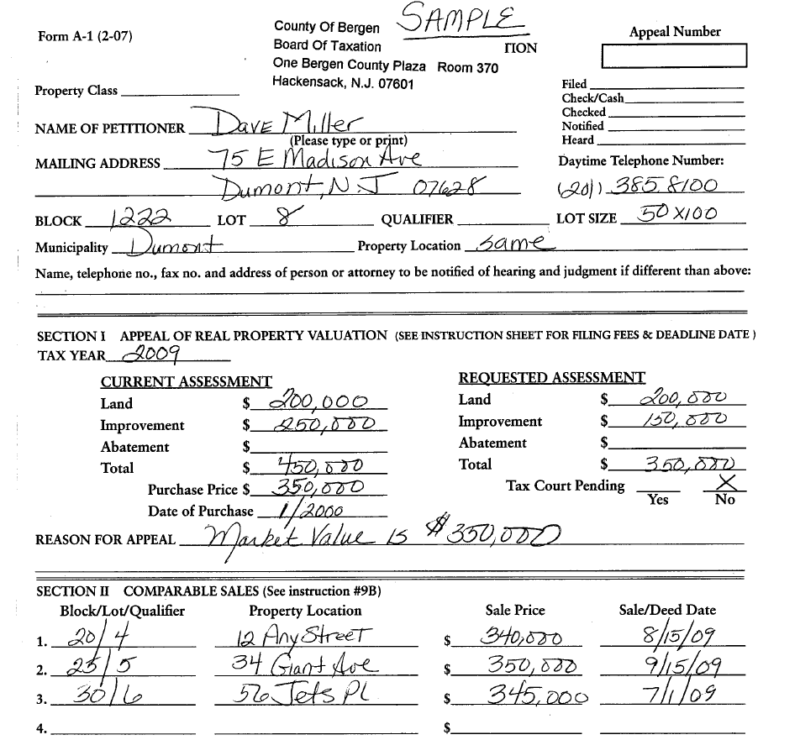

Understanding & Executing a Successful Property Tax Appeal in Bergen

To begin an appeal application, click on the filing type below. This article explains what to do if you disagree with your property tax appraisal, how to prepare for a protest hearing,. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41..

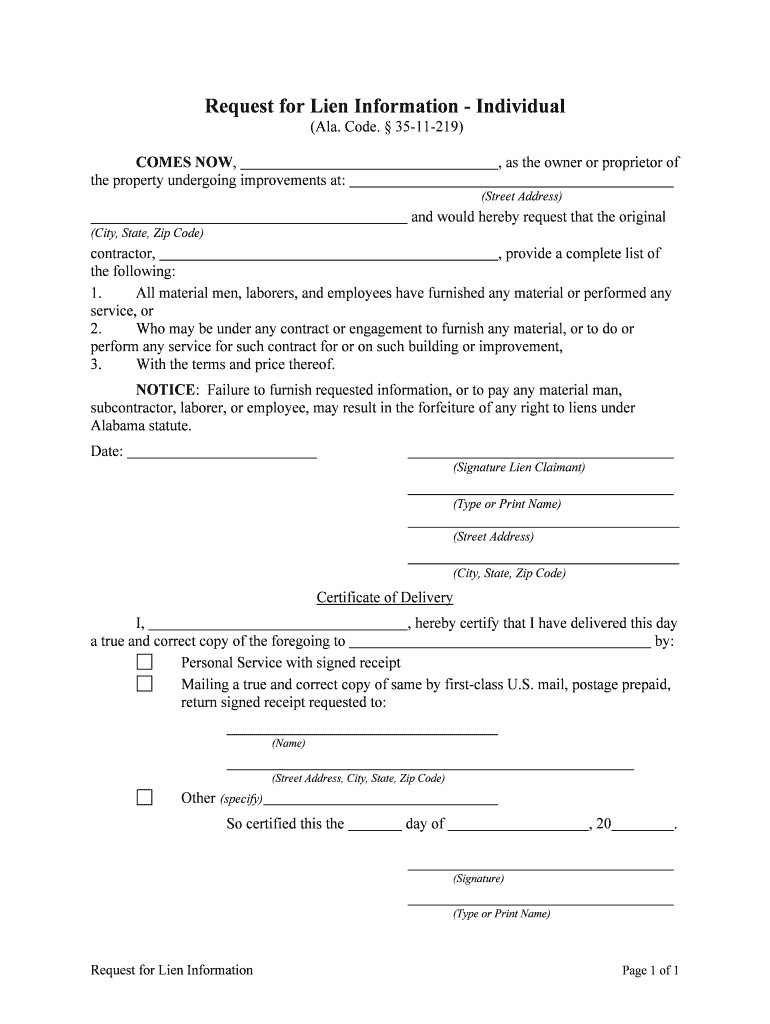

Writing a Property Tax Appeal Letter with Sample Form Fill Out and

Learn about your right to protest property taxes in texas. Any action taken by the. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. Property owners have the right to protest actions concerning their property tax appraisals. To begin an appeal.

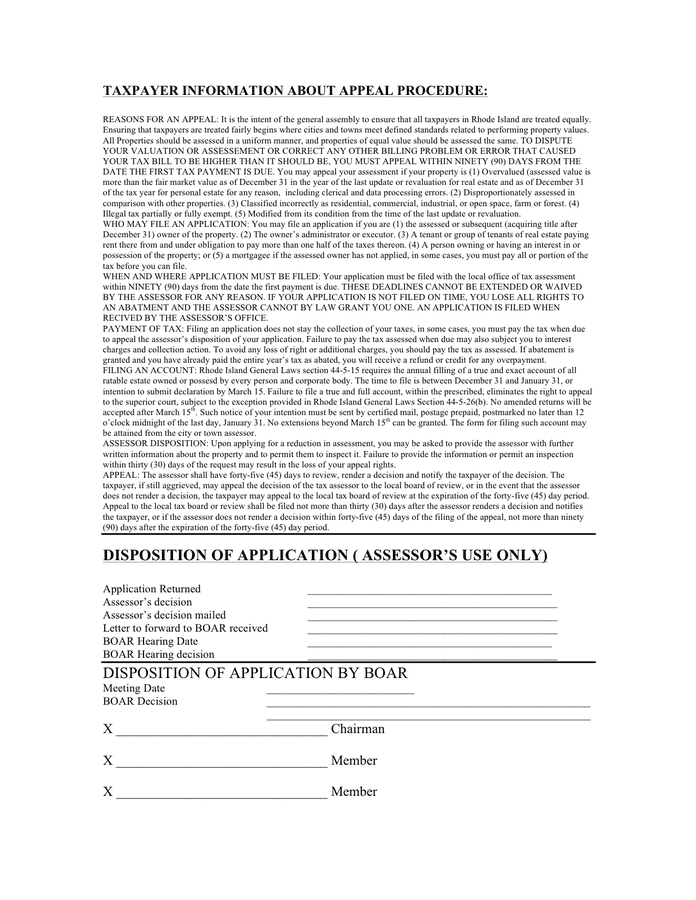

Application for appeal of property tax form (Rhode Island) in Word and

To begin an appeal application, click on the filing type below. Learn about your right to protest property taxes in texas. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. You may follow these appeal procedures if you have a concern.

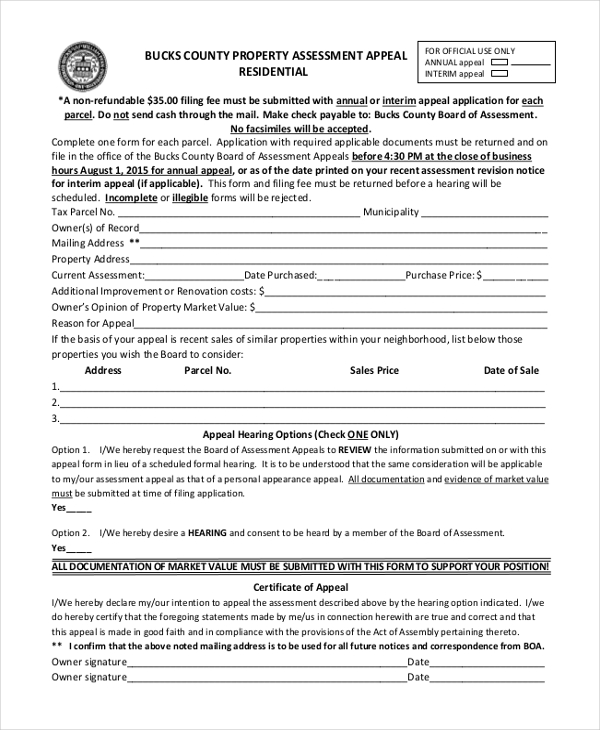

FREE 9+ Sample Property Assessment Forms in PDF MS Word

This article explains what to do if you disagree with your property tax appraisal, how to prepare for a protest hearing,. Learn about your right to protest property taxes in texas. To begin an appeal application, click on the filing type below. Any action taken by the. You may follow these appeal procedures if you have a concern about:

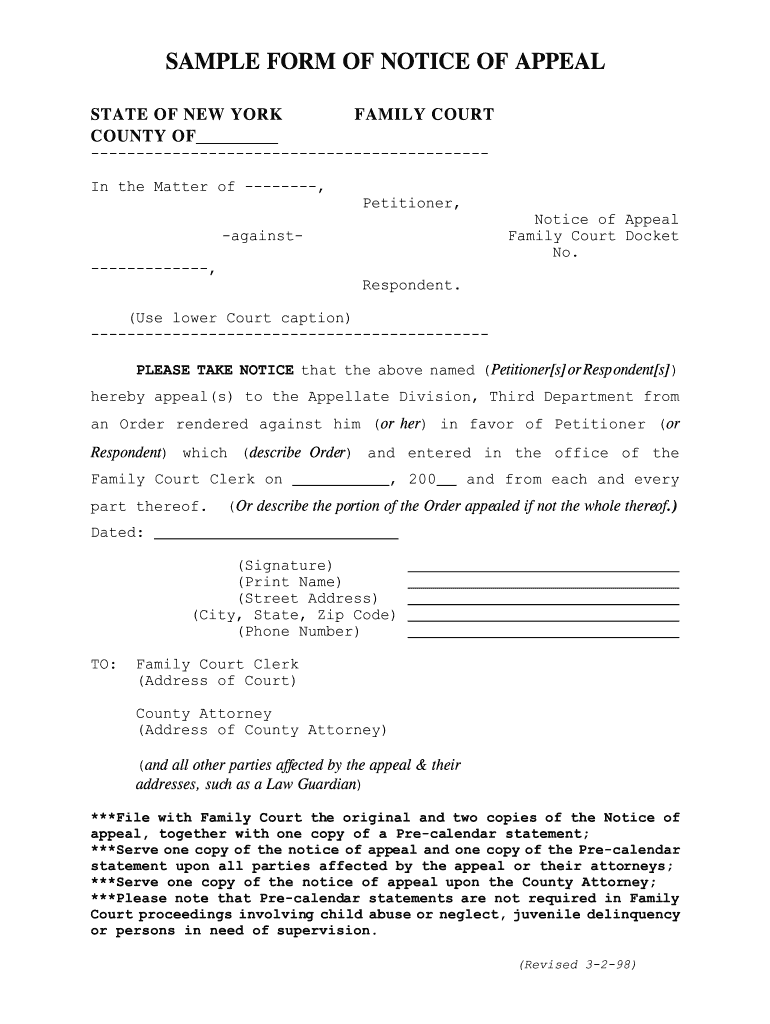

Notice Of Appeal Sample 20202021 Fill and Sign Printable Template

Property owners have the right to protest actions concerning their property tax appraisals. To begin an appeal application, click on the filing type below. This article explains what to do if you disagree with your property tax appraisal, how to prepare for a protest hearing,. Any action taken by the. A property owner or an owner’s designated agent can use.

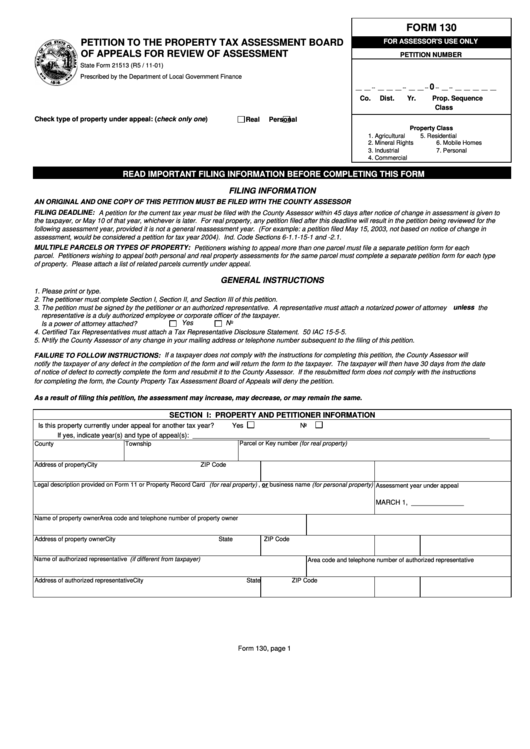

Fillable Form 130 Petition To The Property Tax Assessment Board Of

This article explains what to do if you disagree with your property tax appraisal, how to prepare for a protest hearing,. You may follow these appeal procedures if you have a concern about: To begin an appeal application, click on the filing type below. Learn about your right to protest property taxes in texas. Any action taken by the.

Submitting a Property Tax Appeal Letter How, When, and Why?

This article explains what to do if you disagree with your property tax appraisal, how to prepare for a protest hearing,. To begin an appeal application, click on the filing type below. Learn about your right to protest property taxes in texas. Property owners have the right to protest actions concerning their property tax appraisals. You may follow these appeal.

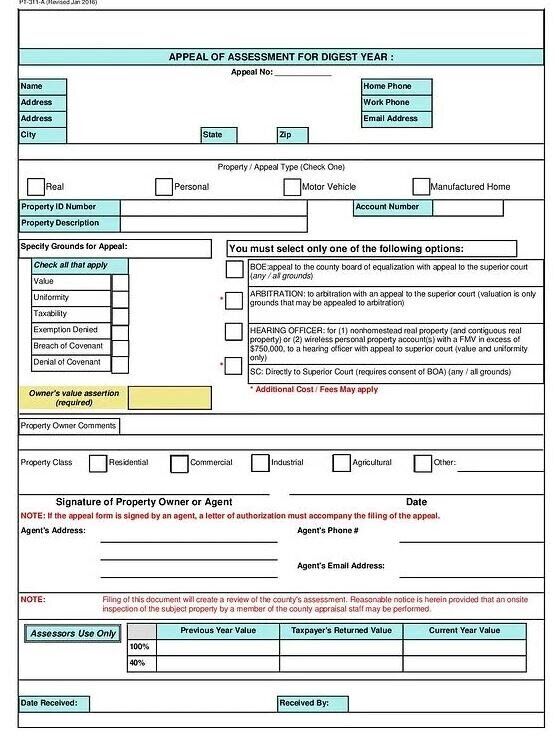

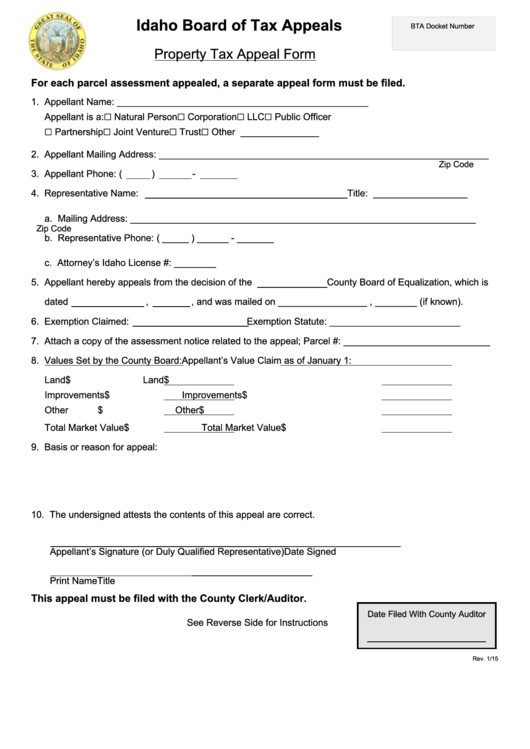

Fillable Property Tax Appeal Form Idaho Board Of Tax Appeals

Any action taken by the. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. To begin an appeal application, click on the filing type below. Property owners have the right to protest actions concerning their property tax appraisals. Learn about your.

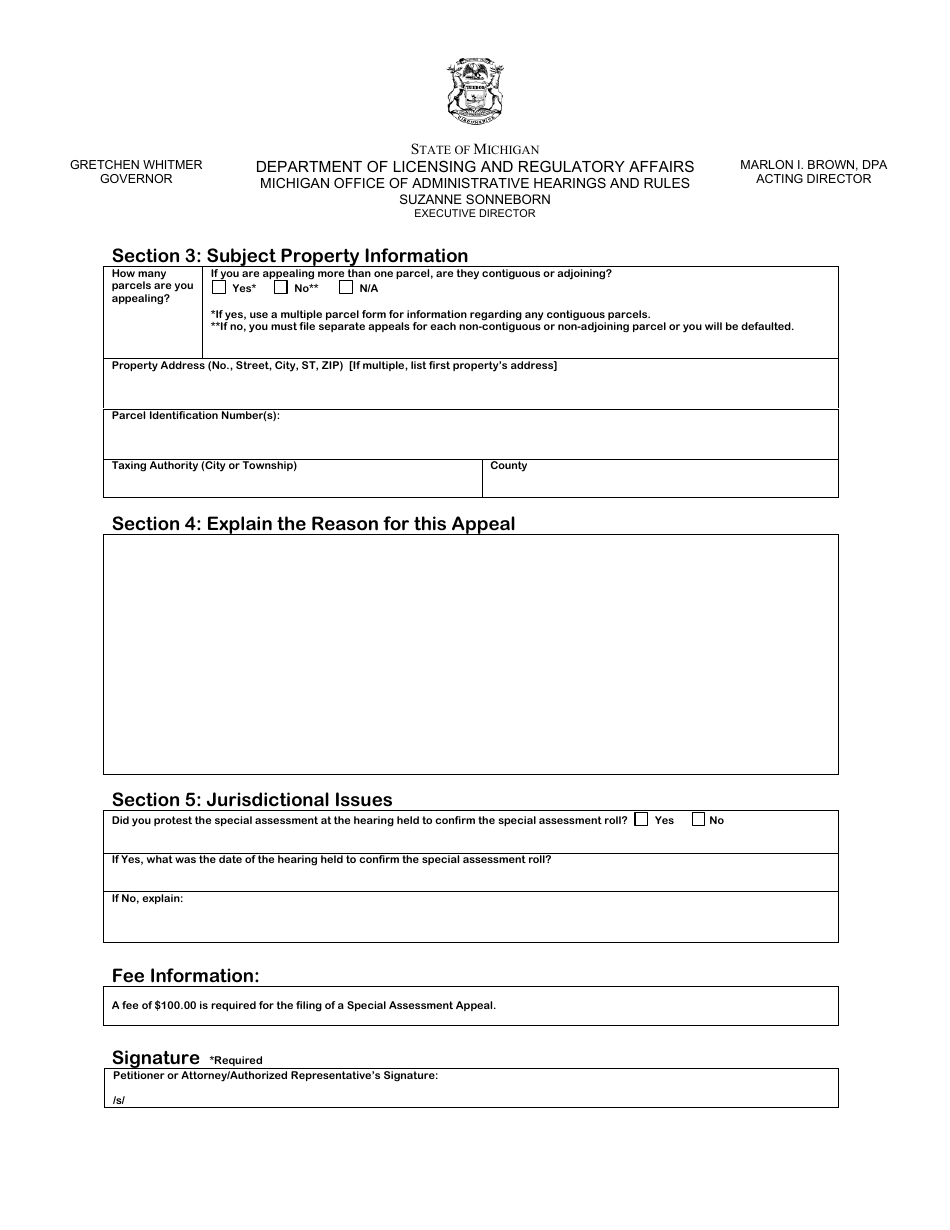

Michigan Property Tax Appeal Petition Form Special Assessment Fill

You may follow these appeal procedures if you have a concern about: This article explains what to do if you disagree with your property tax appraisal, how to prepare for a protest hearing,. Learn about your right to protest property taxes in texas. Property owners have the right to protest actions concerning their property tax appraisals. A property owner or.

This Article Explains What To Do If You Disagree With Your Property Tax Appraisal, How To Prepare For A Protest Hearing,.

To begin an appeal application, click on the filing type below. Property owners have the right to protest actions concerning their property tax appraisals. Learn about your right to protest property taxes in texas. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41.

Any Action Taken By The.

You may follow these appeal procedures if you have a concern about: