Processing Fees For Credit Cards

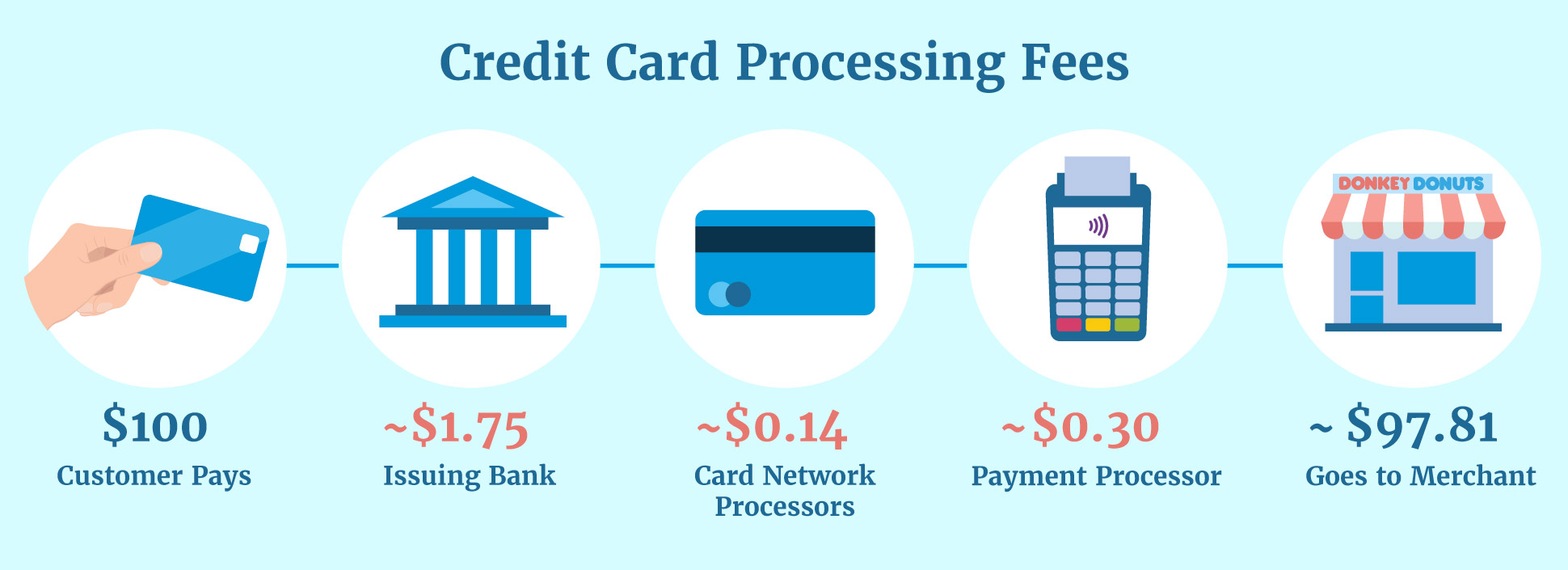

Processing Fees For Credit Cards - For example, you’d pay $1.50 to $3.50 in credit card fees for a sale of $100. Average credit card processing fees range from 1.5% to 3.5%. Credit card processing fees typically cost a business 1.5% to 3.5% of each transaction’s total. Credit card processing fees can add up to a big expense for merchants. Learn where these fees come from and how you can reduce your cost in our comprehensive guide. The typical fee for credit card processing in 2024 is 1.5% to 3.5% for transactions. Credit card processing fees typically range between 2%. The rate is dependent on the type. Here are the average fees and costs for many issuers and payment networks in 2024. What is the typical fee for credit card processing?

The typical fee for credit card processing in 2024 is 1.5% to 3.5% for transactions. The rate is dependent on the type. Here are the average fees and costs for many issuers and payment networks in 2024. Credit card processing fees typically cost a business 1.5% to 3.5% of each transaction’s total. For example, you’d pay $1.50 to $3.50 in credit card fees for a sale of $100. What is the typical fee for credit card processing? Credit card processing fees most commonly refer to the price merchants have to pay to accept credit card payments. Average credit card processing fees range from 1.5% to 3.5%. Learn where these fees come from and how you can reduce your cost in our comprehensive guide. Credit card processing fees typically range between 2%.

The typical fee for credit card processing in 2024 is 1.5% to 3.5% for transactions. Credit card processing fees can add up to a big expense for merchants. What is the typical fee for credit card processing? Here are the average fees and costs for many issuers and payment networks in 2024. The rate is dependent on the type. Average credit card processing fees range from 1.5% to 3.5%. Credit card processing fees most commonly refer to the price merchants have to pay to accept credit card payments. Credit card processing fees typically cost a business 1.5% to 3.5% of each transaction’s total. Credit card processing fees typically range between 2%. Learn where these fees come from and how you can reduce your cost in our comprehensive guide.

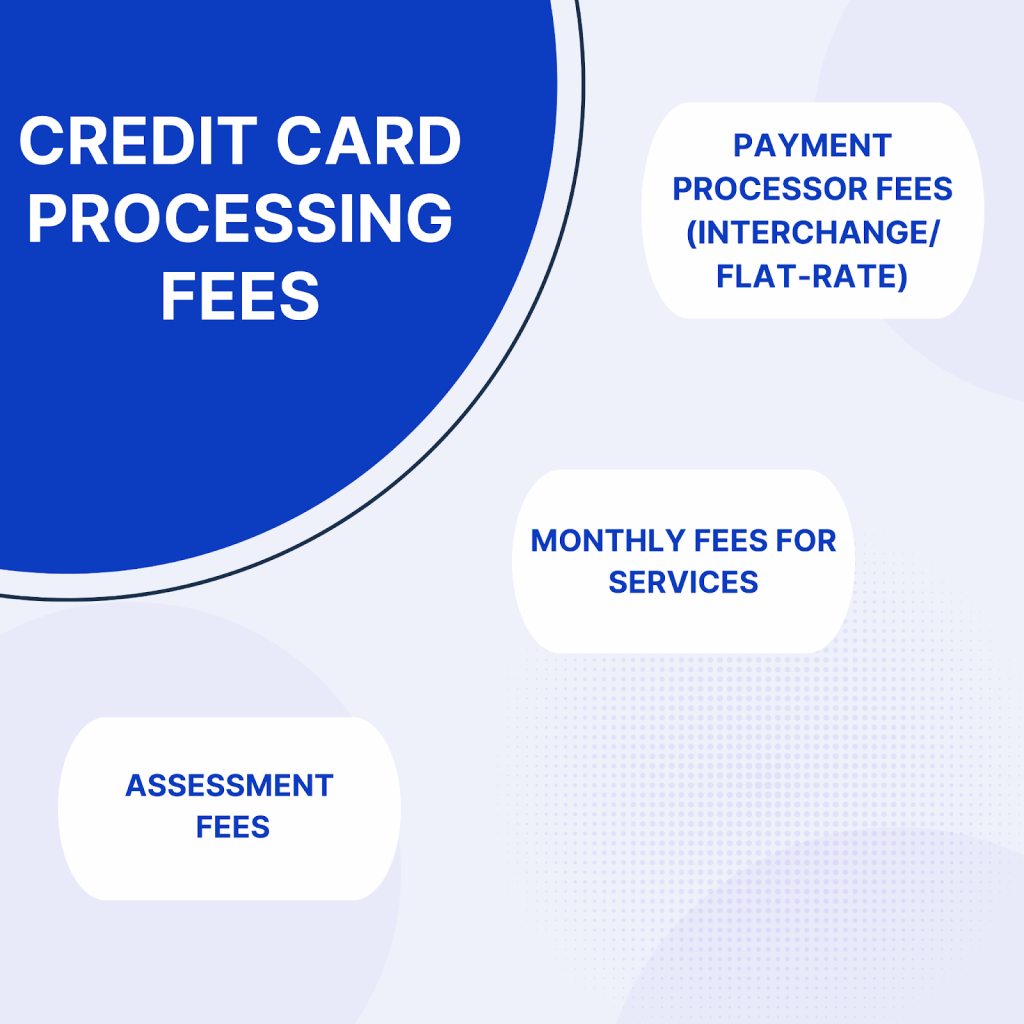

Credit Card Processing Fees Average Transaction and Merchant Fees

What is the typical fee for credit card processing? Credit card processing fees can add up to a big expense for merchants. Average credit card processing fees range from 1.5% to 3.5%. For example, you’d pay $1.50 to $3.50 in credit card fees for a sale of $100. The rate is dependent on the type.

Businesses struggle with credit card processing fees

The typical fee for credit card processing in 2024 is 1.5% to 3.5% for transactions. For example, you’d pay $1.50 to $3.50 in credit card fees for a sale of $100. Here are the average fees and costs for many issuers and payment networks in 2024. Learn where these fees come from and how you can reduce your cost in.

What are Credit Card Processing Fees? What to Know for 2024

Average credit card processing fees range from 1.5% to 3.5%. The typical fee for credit card processing in 2024 is 1.5% to 3.5% for transactions. Credit card processing fees can add up to a big expense for merchants. Learn where these fees come from and how you can reduce your cost in our comprehensive guide. Credit card processing fees typically.

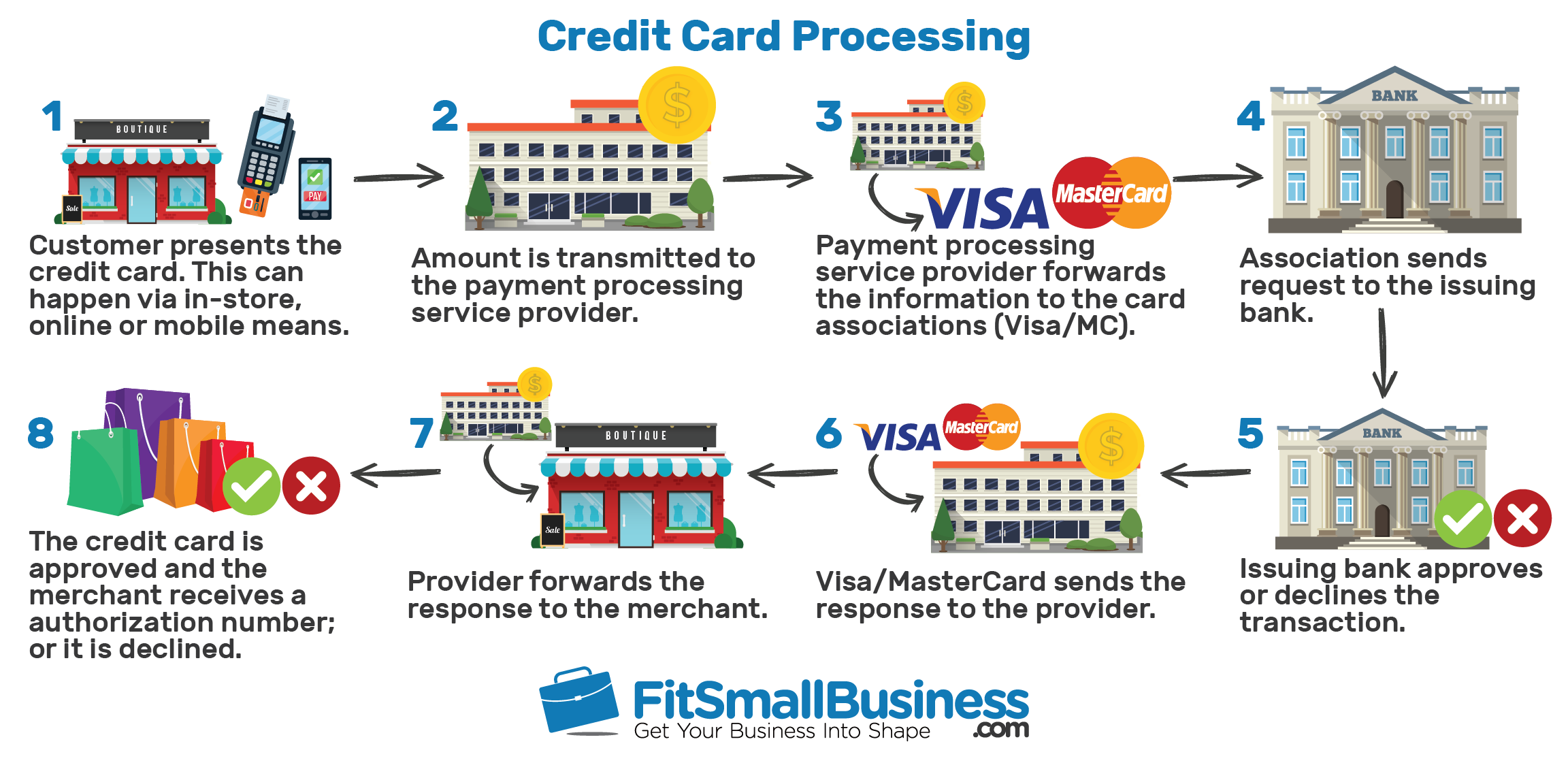

How Credit Card Processing Fees Work The Ultimate Guide

For example, you’d pay $1.50 to $3.50 in credit card fees for a sale of $100. Here are the average fees and costs for many issuers and payment networks in 2024. Average credit card processing fees range from 1.5% to 3.5%. Credit card processing fees typically cost a business 1.5% to 3.5% of each transaction’s total. Credit card processing fees.

How do I get around credit card processing fees? Leia aqui How do I

What is the typical fee for credit card processing? Learn where these fees come from and how you can reduce your cost in our comprehensive guide. Credit card processing fees typically cost a business 1.5% to 3.5% of each transaction’s total. Credit card processing fees can add up to a big expense for merchants. Credit card processing fees most commonly.

What are Processing Fees Processing Fee Definition

Credit card processing fees can add up to a big expense for merchants. What is the typical fee for credit card processing? Here are the average fees and costs for many issuers and payment networks in 2024. Credit card processing fees typically range between 2%. Average credit card processing fees range from 1.5% to 3.5%.

Credit Card Processing Fees How Much Does it Cost? Zaneym

The typical fee for credit card processing in 2024 is 1.5% to 3.5% for transactions. Credit card processing fees can add up to a big expense for merchants. For example, you’d pay $1.50 to $3.50 in credit card fees for a sale of $100. Credit card processing fees typically cost a business 1.5% to 3.5% of each transaction’s total. The.

Credit Card Processing Fees Average Transaction and Merchant Fees

What is the typical fee for credit card processing? The rate is dependent on the type. Credit card processing fees typically range between 2%. The typical fee for credit card processing in 2024 is 1.5% to 3.5% for transactions. Credit card processing fees can add up to a big expense for merchants.

What are the fees for credit cards? Leia aqui What fees are charged on

Credit card processing fees typically range between 2%. The typical fee for credit card processing in 2024 is 1.5% to 3.5% for transactions. Average credit card processing fees range from 1.5% to 3.5%. Learn where these fees come from and how you can reduce your cost in our comprehensive guide. Credit card processing fees most commonly refer to the price.

Credit Card Processing Fees and Rates Explained

Learn where these fees come from and how you can reduce your cost in our comprehensive guide. For example, you’d pay $1.50 to $3.50 in credit card fees for a sale of $100. What is the typical fee for credit card processing? The rate is dependent on the type. Here are the average fees and costs for many issuers and.

Credit Card Processing Fees Typically Range Between 2%.

Average credit card processing fees range from 1.5% to 3.5%. For example, you’d pay $1.50 to $3.50 in credit card fees for a sale of $100. Credit card processing fees most commonly refer to the price merchants have to pay to accept credit card payments. Credit card processing fees typically cost a business 1.5% to 3.5% of each transaction’s total.

The Typical Fee For Credit Card Processing In 2024 Is 1.5% To 3.5% For Transactions.

Here are the average fees and costs for many issuers and payment networks in 2024. Credit card processing fees can add up to a big expense for merchants. Learn where these fees come from and how you can reduce your cost in our comprehensive guide. The rate is dependent on the type.