Penalty For Not Filing Form 1099

Penalty For Not Filing Form 1099 - 6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs. Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file.

Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs. Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file. 6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect.

6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs. Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file.

What is Form 1099INT and Its Role to a Employer? BoomTax

Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs. 6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure.

All About The 1099 Late Filing Penalty (+ How To Avoid It)

Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs. 6721 and 6722 impose several penalties related to forms 1099, primarily for late.

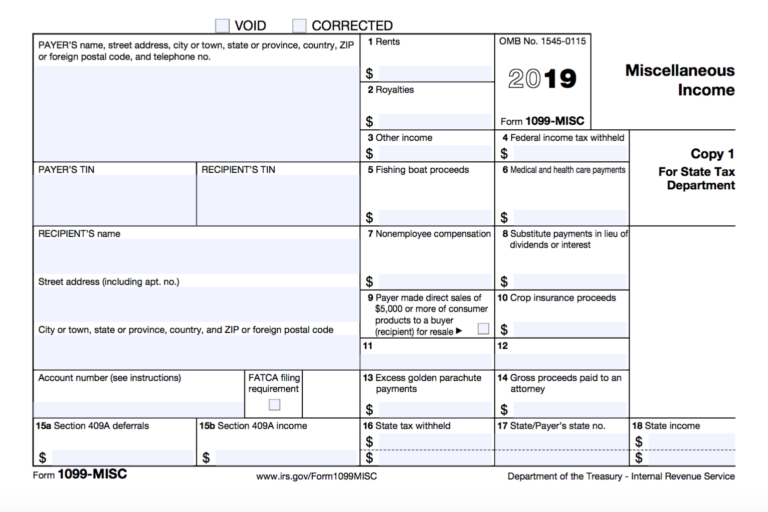

All That You Need To Know About Filing Form 1099MISC Inman

Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs. 6721 and 6722 impose several penalties related to forms 1099, primarily for late.

IRS Form 1099INT Early Withdrawal Penalties on CDs YouTube

Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs. Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file. 6721 and 6722 impose several penalties related to forms 1099, primarily for late.

Business Penalty Increase for Late or Not Filing 1099MISC DHJJ

6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of.

What Is The Penalty For Filing A 1099 Without A Social Security Number

6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs. Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure.

Sample IRS Penalty Abatement Request Letter PDF Internal Revenue

6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of.

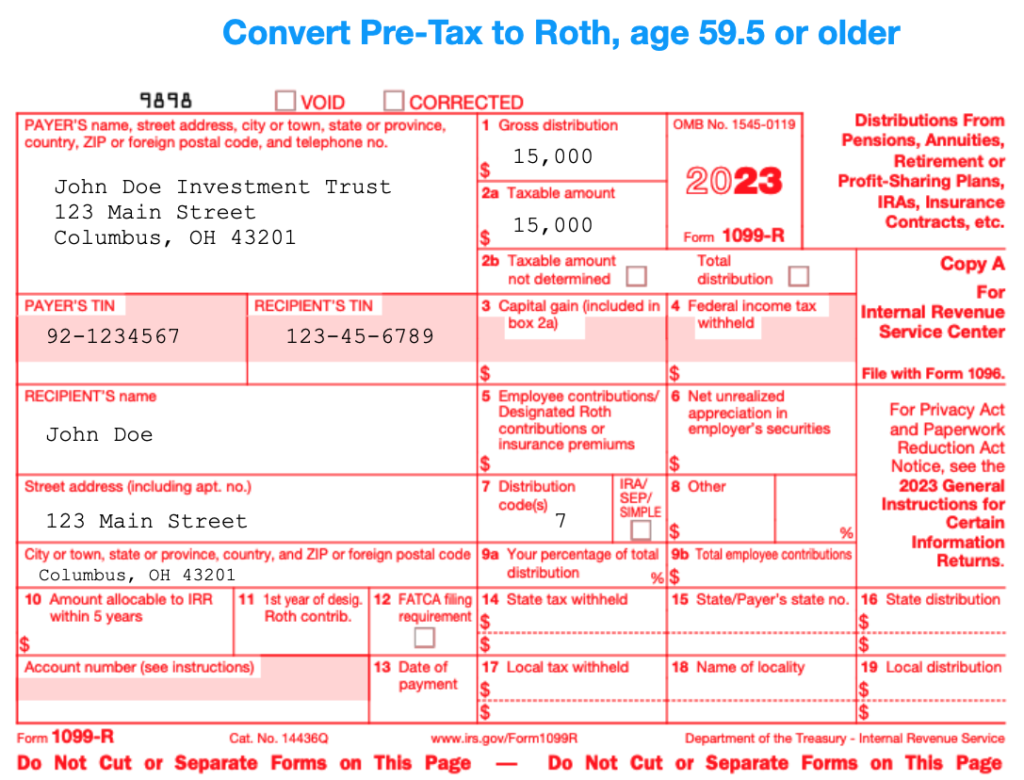

1099 Pension

6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs. Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure.

Neat What Is Non Standard 1099r A Chronological Report About Tigers

Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file. 6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of.

What Is The Penalty For Filing A 1099 Without A Social Security Number

Irs imposes substantial penalties for 1099, including penalties for late filing, failure to file, failure to file correct 1099, failure to file. 6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of.

Irs Imposes Substantial Penalties For 1099, Including Penalties For Late Filing, Failure To File, Failure To File Correct 1099, Failure To File.

6721 and 6722 impose several penalties related to forms 1099, primarily for late filing, failure to file, and filing incorrect. Filing a form 1099 after august 1st, 2023, or failure to file it entirely (except in cases of intentional disregard) will result in the irs.