Pa Inheritance Tax Form

Pa Inheritance Tax Form - Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and. 1, 1962, can be obtained from the department of revenue,. Applicability of inheritance tax to estates of decedents who died before jan. Unnecessary paperwork, such as schedule o,. The new pennsylvania inheritance tax return for the estates of most resident decedents. 1, 1962, can be obtained from the department of revenue,. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Applicability of inheritance tax to estates of decedents who died before jan.

1, 1962, can be obtained from the department of revenue,. 1, 1962, can be obtained from the department of revenue,. Unnecessary paperwork, such as schedule o,. The new pennsylvania inheritance tax return for the estates of most resident decedents. Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and. Applicability of inheritance tax to estates of decedents who died before jan. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Applicability of inheritance tax to estates of decedents who died before jan.

Applicability of inheritance tax to estates of decedents who died before jan. The new pennsylvania inheritance tax return for the estates of most resident decedents. Unnecessary paperwork, such as schedule o,. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Applicability of inheritance tax to estates of decedents who died before jan. 1, 1962, can be obtained from the department of revenue,. Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and. 1, 1962, can be obtained from the department of revenue,.

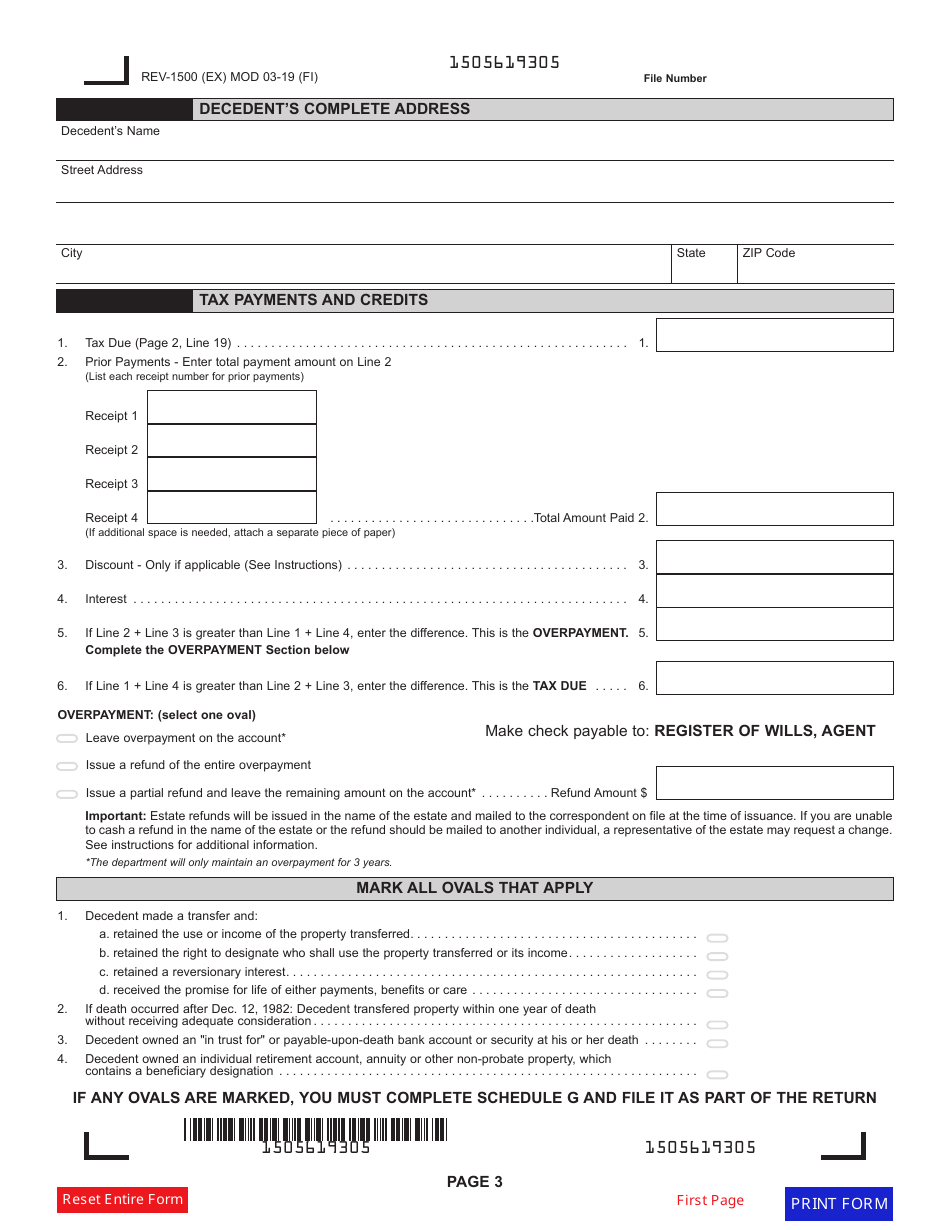

Form REV1500 Download Fillable PDF or Fill Online Inheritance Tax

1, 1962, can be obtained from the department of revenue,. The new pennsylvania inheritance tax return for the estates of most resident decedents. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Applicability of inheritance tax to estates of decedents who died before jan. Inheritance tax is imposed as a percentage of.

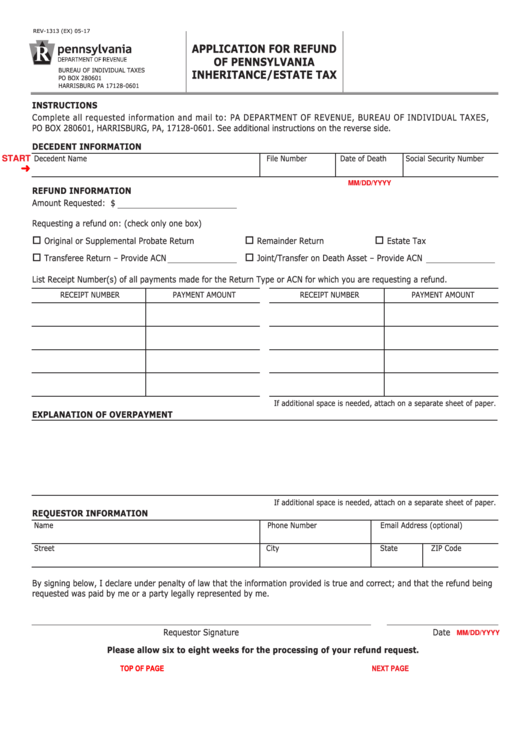

Fillable Form Rev1313 Application For Refund Of Pennsylvania

Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and. Applicability of inheritance tax to estates of decedents who died before jan. 1, 1962, can be obtained from the department of revenue,. 1, 1962, can be obtained from the department of revenue,. The new pennsylvania inheritance tax.

Instructions For Form Rev1500 Pennsylvania Inheritance Tax Return

The new pennsylvania inheritance tax return for the estates of most resident decedents. Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and. Applicability of inheritance tax to estates of decedents who died before jan. Unnecessary paperwork, such as schedule o,. 1, 1962, can be obtained from.

Pennsylvania Estate Tax Exemption 2025 Lorrai Nekaiser

The new pennsylvania inheritance tax return for the estates of most resident decedents. Unnecessary paperwork, such as schedule o,. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and. Applicability.

Rev 1543 Fill out & sign online DocHub

The new pennsylvania inheritance tax return for the estates of most resident decedents. Unnecessary paperwork, such as schedule o,. 1, 1962, can be obtained from the department of revenue,. Applicability of inheritance tax to estates of decedents who died before jan. 1, 1962, can be obtained from the department of revenue,.

Inheritance Tax Waiver Form Pa Form Resume Examples kLYrL0326a

Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. 1, 1962, can be obtained from the department of revenue,. Unnecessary paperwork, such as schedule o,. Applicability of inheritance tax.

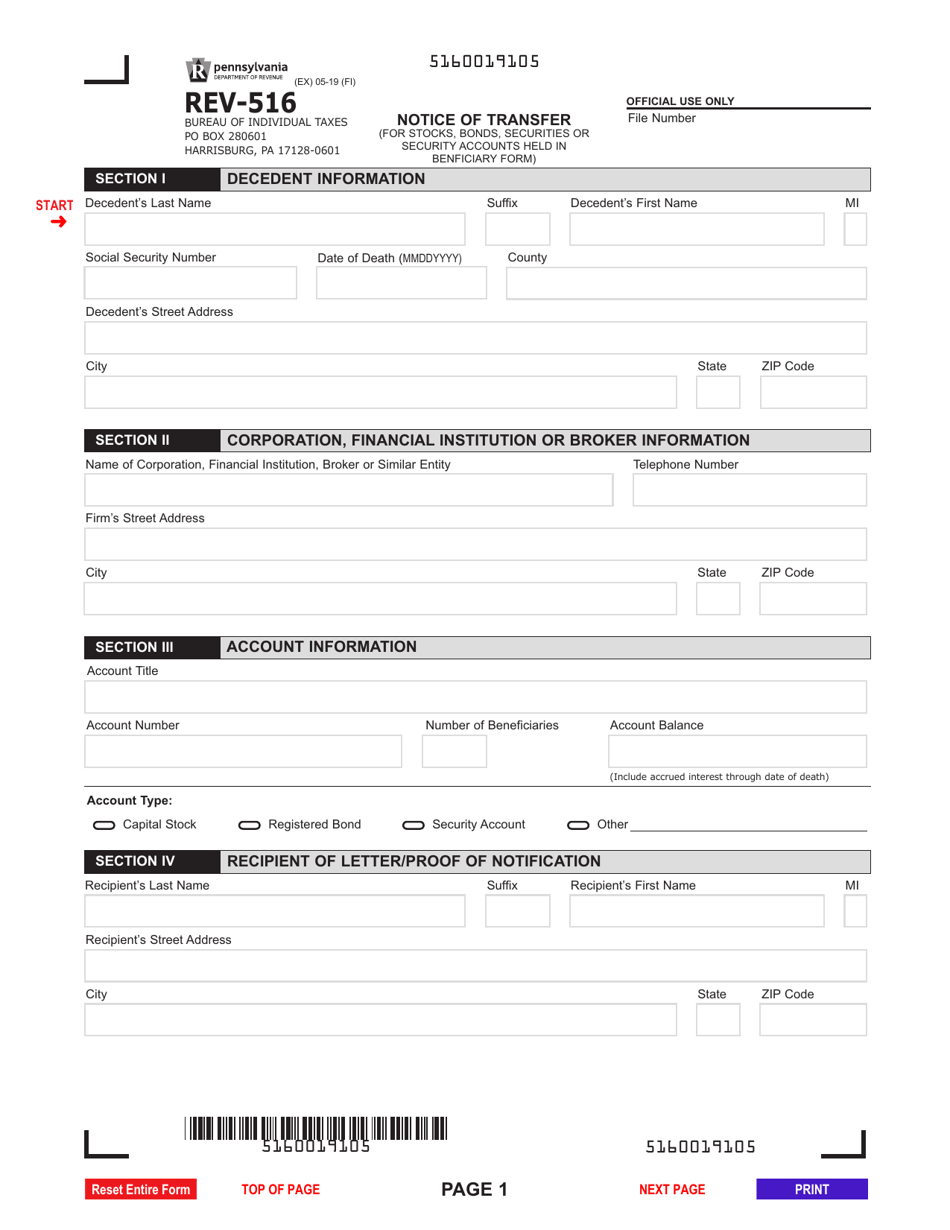

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

1, 1962, can be obtained from the department of revenue,. Applicability of inheritance tax to estates of decedents who died before jan. Applicability of inheritance tax to estates of decedents who died before jan. 1, 1962, can be obtained from the department of revenue,. Unnecessary paperwork, such as schedule o,.

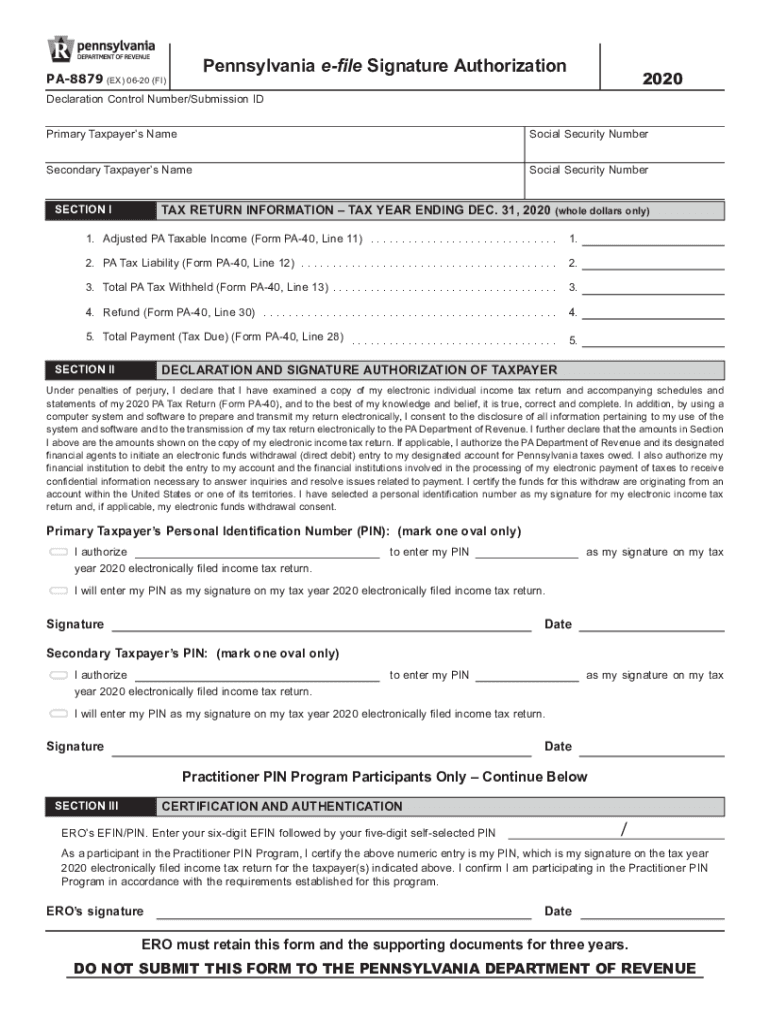

Form pa 8879 Fill out & sign online DocHub

Applicability of inheritance tax to estates of decedents who died before jan. Applicability of inheritance tax to estates of decedents who died before jan. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Unnecessary paperwork, such as schedule o,. 1, 1962, can be obtained from the department of revenue,.

Pennsylvania Inheritance Tax 5 Simple Ways to Minimize the Tax Burden

Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and. Unnecessary paperwork, such as schedule o,. 1, 1962, can be obtained from the department of revenue,. Applicability of inheritance tax to estates of decedents who died before jan. Applicability of inheritance tax to estates of decedents who.

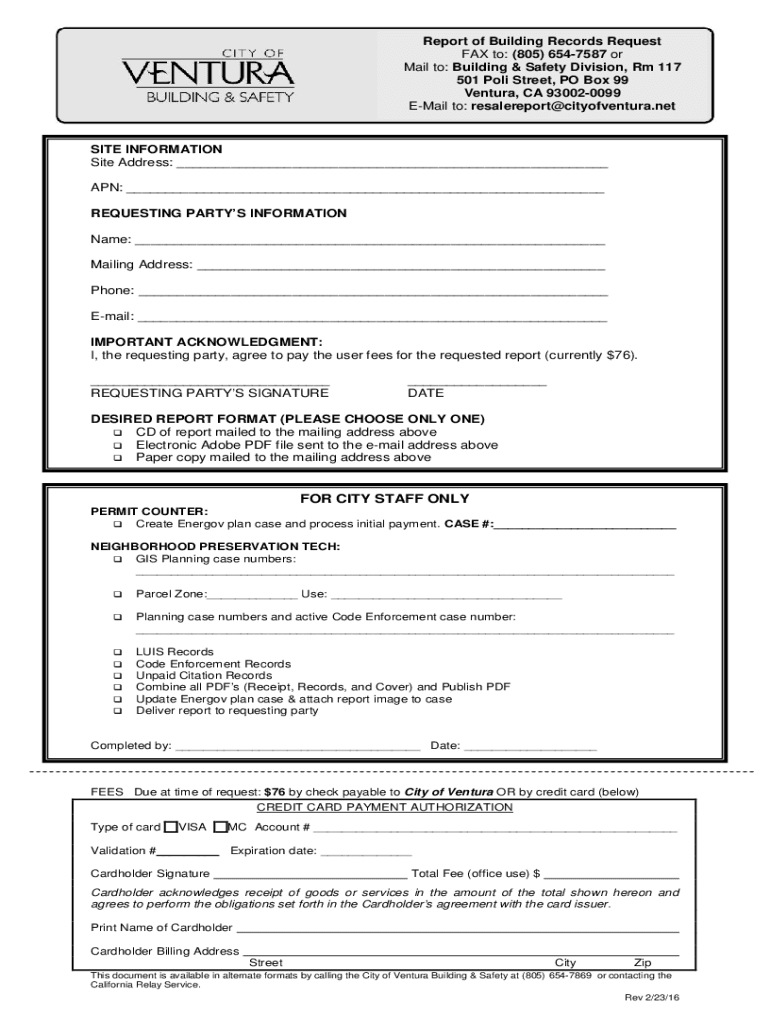

Fillable Online Fillable Online PA Inheritance Tax (REV584). Forms

Applicability of inheritance tax to estates of decedents who died before jan. Applicability of inheritance tax to estates of decedents who died before jan. The new pennsylvania inheritance tax return for the estates of most resident decedents. 1, 1962, can be obtained from the department of revenue,. 1, 1962, can be obtained from the department of revenue,.

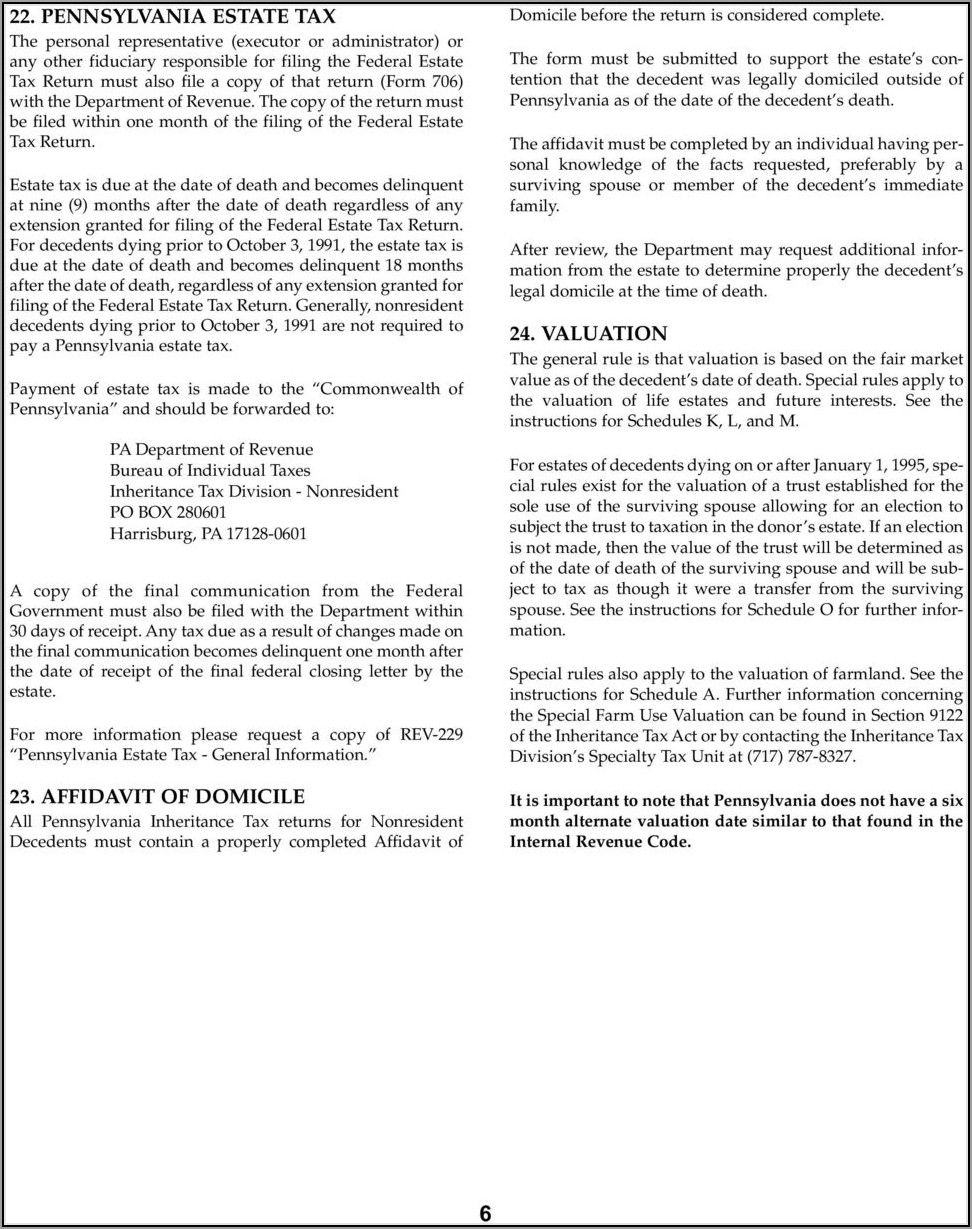

Applicability Of Inheritance Tax To Estates Of Decedents Who Died Before Jan.

Applicability of inheritance tax to estates of decedents who died before jan. Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and. Unnecessary paperwork, such as schedule o,. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania.

1, 1962, Can Be Obtained From The Department Of Revenue,.

1, 1962, can be obtained from the department of revenue,. The new pennsylvania inheritance tax return for the estates of most resident decedents.