Ownership Disclosure Form

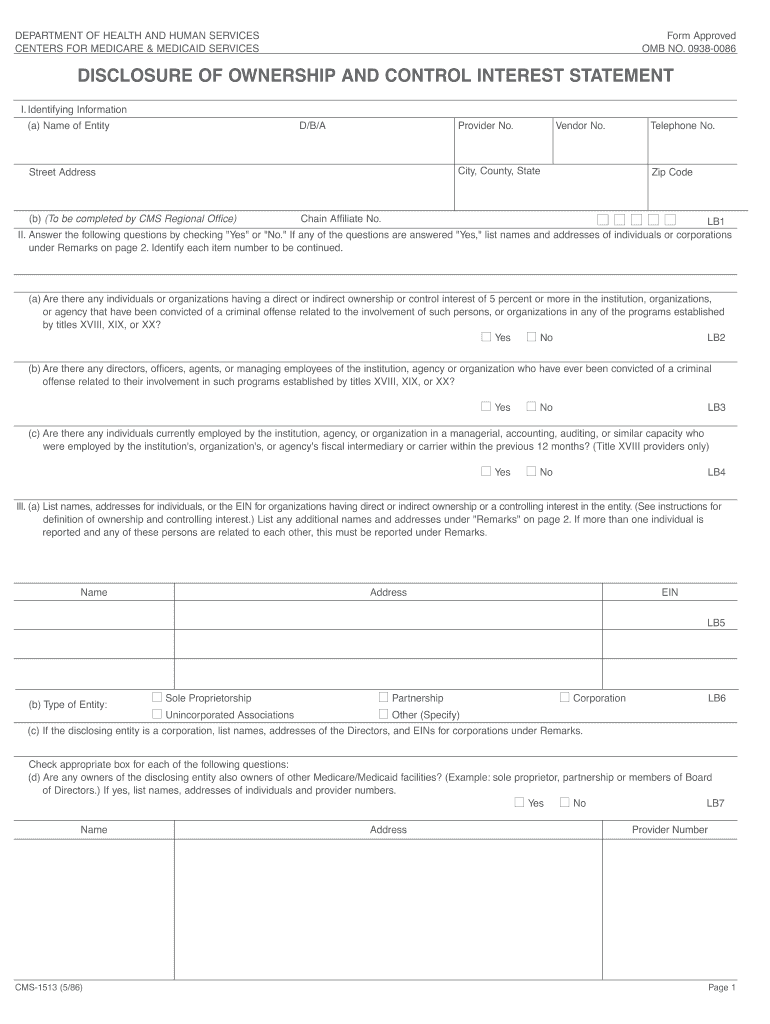

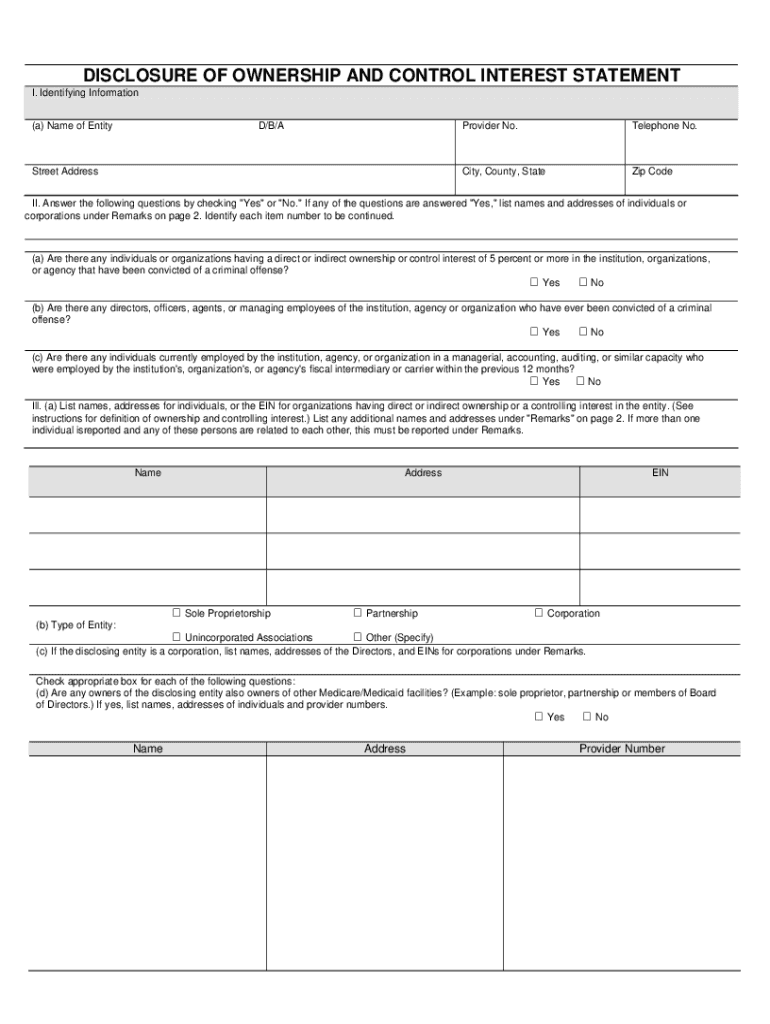

Ownership Disclosure Form - A form for providers/disclosing entities to disclose their ownership, control, and criminal history for medicaid and chip programs in new. The disclosure of key individuals who own or control a legal entity (i.e., the beneficial owners) helps law enforcement investigate and. Please note that beneficial ownership information reporting requirements have been affected by a recent federal court. Many companies are required to report information to fincen about the individuals who ultimately own or control them. Existing companies have one year to file; New companies must file within 90 days of creation or registration. Information on ownership and control. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states.

Information on ownership and control. New companies must file within 90 days of creation or registration. A form for providers/disclosing entities to disclose their ownership, control, and criminal history for medicaid and chip programs in new. The disclosure of key individuals who own or control a legal entity (i.e., the beneficial owners) helps law enforcement investigate and. Please note that beneficial ownership information reporting requirements have been affected by a recent federal court. Existing companies have one year to file; Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states. Many companies are required to report information to fincen about the individuals who ultimately own or control them.

Many companies are required to report information to fincen about the individuals who ultimately own or control them. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states. Information on ownership and control. A form for providers/disclosing entities to disclose their ownership, control, and criminal history for medicaid and chip programs in new. Existing companies have one year to file; New companies must file within 90 days of creation or registration. Please note that beneficial ownership information reporting requirements have been affected by a recent federal court. The disclosure of key individuals who own or control a legal entity (i.e., the beneficial owners) helps law enforcement investigate and.

Fillable Online ownership disclosure form Fax Email Print pdfFiller

Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states. Existing companies have one year to file; New companies must file within 90 days of creation or registration. The disclosure of key individuals who own or control a legal entity (i.e., the beneficial owners) helps law enforcement investigate.

Fillable Online 2 Beneficial Ownership Disclosure Form b.docx Fax Email

Information on ownership and control. Please note that beneficial ownership information reporting requirements have been affected by a recent federal court. Existing companies have one year to file; Many companies are required to report information to fincen about the individuals who ultimately own or control them. A form for providers/disclosing entities to disclose their ownership, control, and criminal history for.

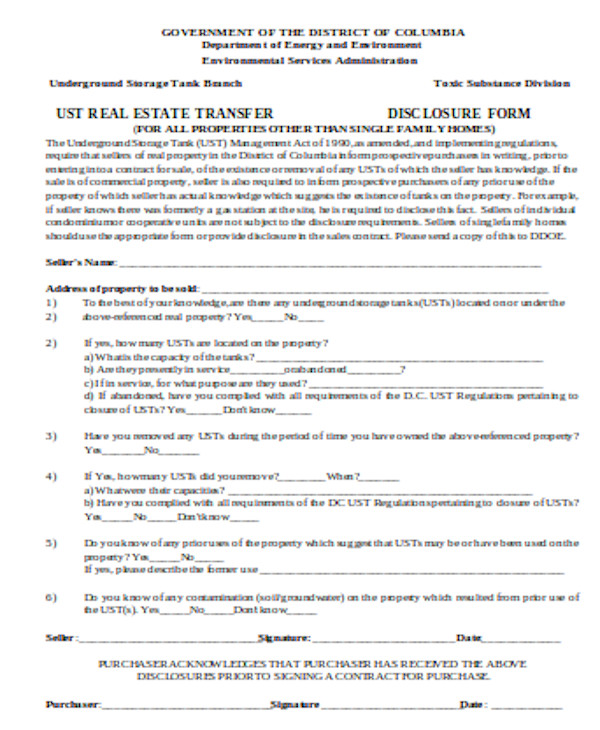

Real Estate Disclosure Form Fill Online, Printable, Fillable, Blank

Many companies are required to report information to fincen about the individuals who ultimately own or control them. The disclosure of key individuals who own or control a legal entity (i.e., the beneficial owners) helps law enforcement investigate and. Information on ownership and control. New companies must file within 90 days of creation or registration. Please note that beneficial ownership.

Disclosure of Ownership 19862024 Form Fill Out and Sign Printable

A form for providers/disclosing entities to disclose their ownership, control, and criminal history for medicaid and chip programs in new. Many companies are required to report information to fincen about the individuals who ultimately own or control them. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states..

Disclosure of Ownership Form PDF Editable template airSlate SignNow

Many companies are required to report information to fincen about the individuals who ultimately own or control them. A form for providers/disclosing entities to disclose their ownership, control, and criminal history for medicaid and chip programs in new. Information on ownership and control. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do.

FREE 10+ Sample Real Estate Disclosure Forms in PDF MS Word

Information on ownership and control. Existing companies have one year to file; Please note that beneficial ownership information reporting requirements have been affected by a recent federal court. Many companies are required to report information to fincen about the individuals who ultimately own or control them. Certain types of corporations, limited liability companies, and other similar entities created in or.

Contract Agreement Property Fill Online, Printable, Fillable, Blank

Many companies are required to report information to fincen about the individuals who ultimately own or control them. The disclosure of key individuals who own or control a legal entity (i.e., the beneficial owners) helps law enforcement investigate and. Existing companies have one year to file; New companies must file within 90 days of creation or registration. Please note that.

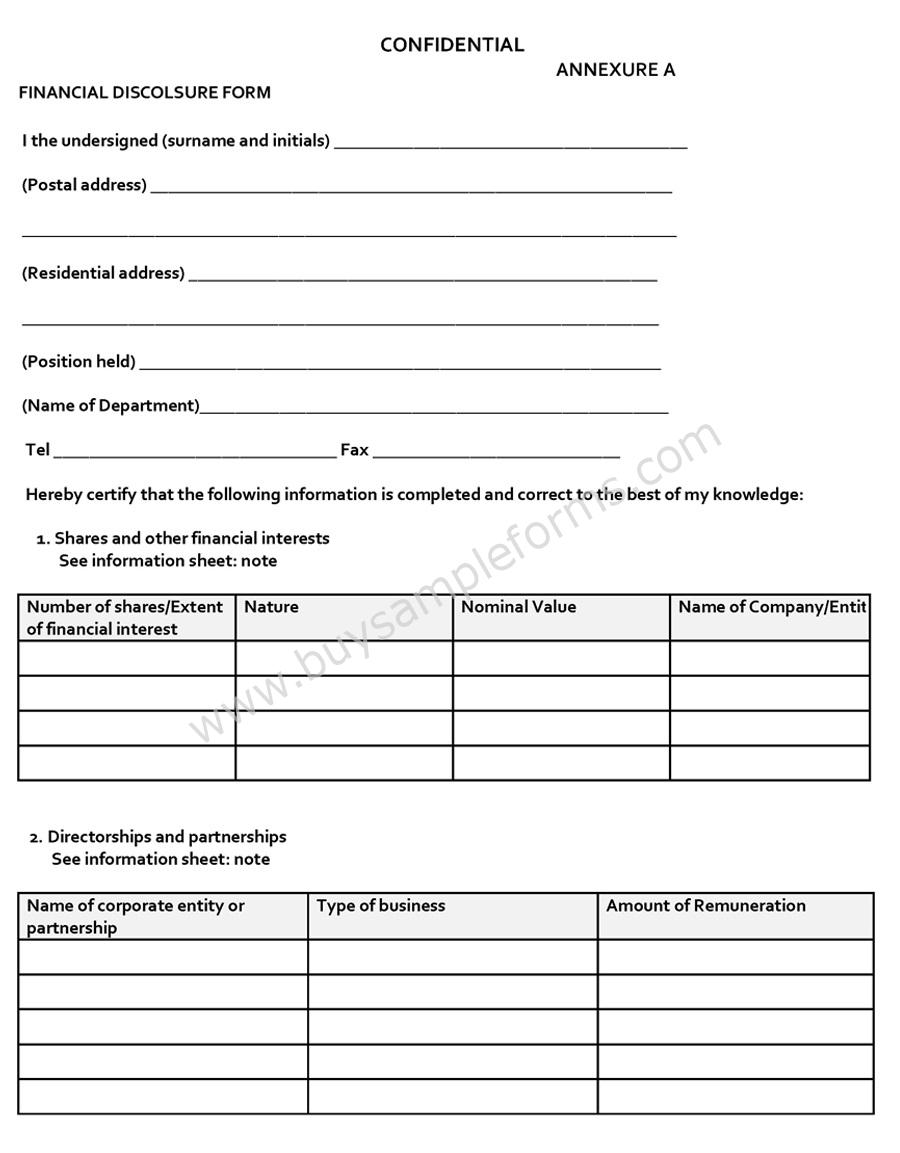

Beneficial Ownership at CIPC Everything you need to know.

Many companies are required to report information to fincen about the individuals who ultimately own or control them. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states. Information on ownership and control. New companies must file within 90 days of creation or registration. Existing companies have one.

Financial Disclosure Form Sample Forms

Information on ownership and control. The disclosure of key individuals who own or control a legal entity (i.e., the beneficial owners) helps law enforcement investigate and. New companies must file within 90 days of creation or registration. Please note that beneficial ownership information reporting requirements have been affected by a recent federal court. Existing companies have one year to file;

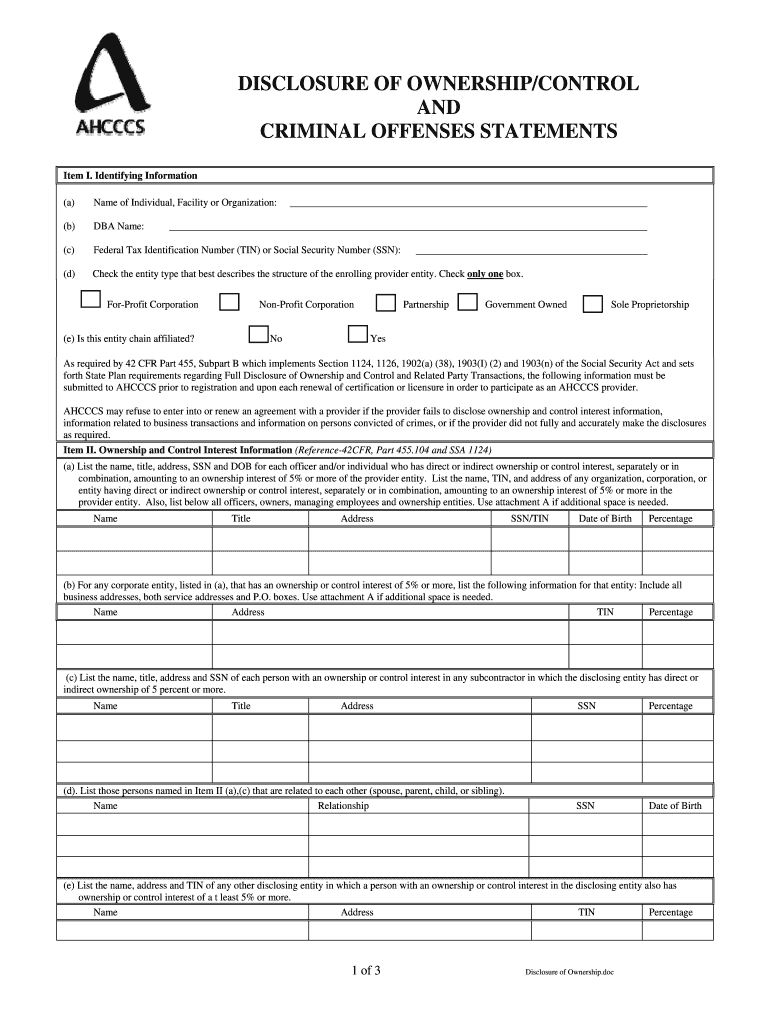

Ahcccs Control 20122024 Form Fill Out and Sign Printable PDF

A form for providers/disclosing entities to disclose their ownership, control, and criminal history for medicaid and chip programs in new. Many companies are required to report information to fincen about the individuals who ultimately own or control them. New companies must file within 90 days of creation or registration. The disclosure of key individuals who own or control a legal.

Many Companies Are Required To Report Information To Fincen About The Individuals Who Ultimately Own Or Control Them.

Existing companies have one year to file; Please note that beneficial ownership information reporting requirements have been affected by a recent federal court. A form for providers/disclosing entities to disclose their ownership, control, and criminal history for medicaid and chip programs in new. The disclosure of key individuals who own or control a legal entity (i.e., the beneficial owners) helps law enforcement investigate and.

Information On Ownership And Control.

Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states. New companies must file within 90 days of creation or registration.