Optum Financial Hsa Tax Form

Optum Financial Hsa Tax Form - You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). This checklist will help you to get ready for tax. Make the most of your health savings account (hsa) and understand all of the tax benefits. There are three tax forms associated with health savings accounts (hsas): Optum financial will help you to understand the tax benefits of your health savings account (hsa). There are 3 tax forms associated with. Which forms do i need to file my taxes? An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Learn the hsa contribution deadline, how to get tax.

You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). Make the most of your health savings account (hsa) and understand all of the tax benefits. An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. This checklist will help you to get ready for tax. Learn the hsa contribution deadline, how to get tax. Optum financial will help you to understand the tax benefits of your health savings account (hsa). There are three tax forms associated with health savings accounts (hsas): Which forms do i need to file my taxes? There are 3 tax forms associated with.

You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). Learn the hsa contribution deadline, how to get tax. Optum financial will help you to understand the tax benefits of your health savings account (hsa). There are 3 tax forms associated with. This checklist will help you to get ready for tax. An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Which forms do i need to file my taxes? There are three tax forms associated with health savings accounts (hsas): Make the most of your health savings account (hsa) and understand all of the tax benefits.

Formulário 1099SA Distribuições de um HSA, Archer MSA ou Medicare

An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Learn the hsa contribution deadline, how to get tax. There are three tax forms associated with health savings accounts (hsas): This checklist will help you to get ready for tax. Which forms do i need to file my.

Tips to live healthier and reduce your risk of disease Optum

There are 3 tax forms associated with. Make the most of your health savings account (hsa) and understand all of the tax benefits. An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Which forms do i need to file my taxes? There are three tax forms associated.

Fillable Online optumfinancialhealthfsaclaimform2022.pdf Fax

There are 3 tax forms associated with. There are three tax forms associated with health savings accounts (hsas): You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). Make the most of your health savings account (hsa) and understand all of the tax benefits. Optum financial will help.

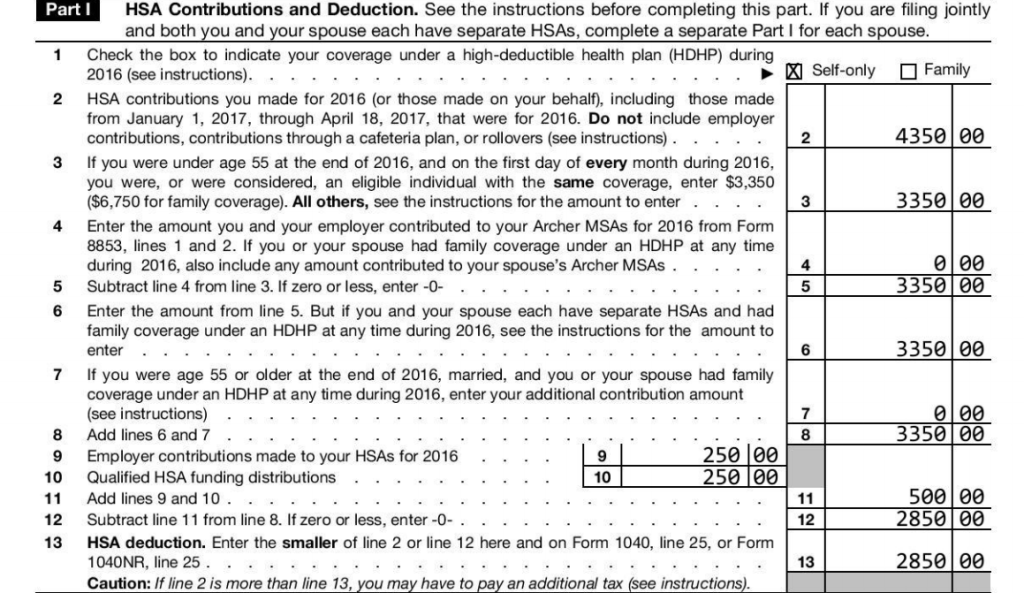

How to Handle Excess Contributions on HSA Tax Form 8889 HSA Edge

There are three tax forms associated with health savings accounts (hsas): Which forms do i need to file my taxes? An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Make the most of your health savings account (hsa) and understand all of the tax benefits. Optum financial.

Fillable Online Optum Financial HSA Designation of Beneficiary Form Fax

Optum financial will help you to understand the tax benefits of your health savings account (hsa). An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Which forms do i need to file my taxes? There are 3 tax forms associated with. You need to file irs form.

Health Savings Account HSA Benefit Services Division

There are three tax forms associated with health savings accounts (hsas): This checklist will help you to get ready for tax. Optum financial will help you to understand the tax benefits of your health savings account (hsa). Which forms do i need to file my taxes? Learn the hsa contribution deadline, how to get tax.

Using Your Health Payment Spending card HSAFSA Optum

You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). There are three tax forms associated with health savings accounts (hsas): Optum financial will help you to understand the tax benefits of your health savings account (hsa). Which forms do i need to file my taxes? This checklist.

Enhance Your Career with Optum as an Accounts Receivable / Financial

You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). Which forms do i need to file my taxes? An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and. Learn the hsa contribution deadline, how to.

Health Saving Accounts (HSA) via Optum Financial Justworks Help Center

There are three tax forms associated with health savings accounts (hsas): You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). This checklist will help you to get ready for tax. There are 3 tax forms associated with. An hsa provides triple tax savings — contributions are not.

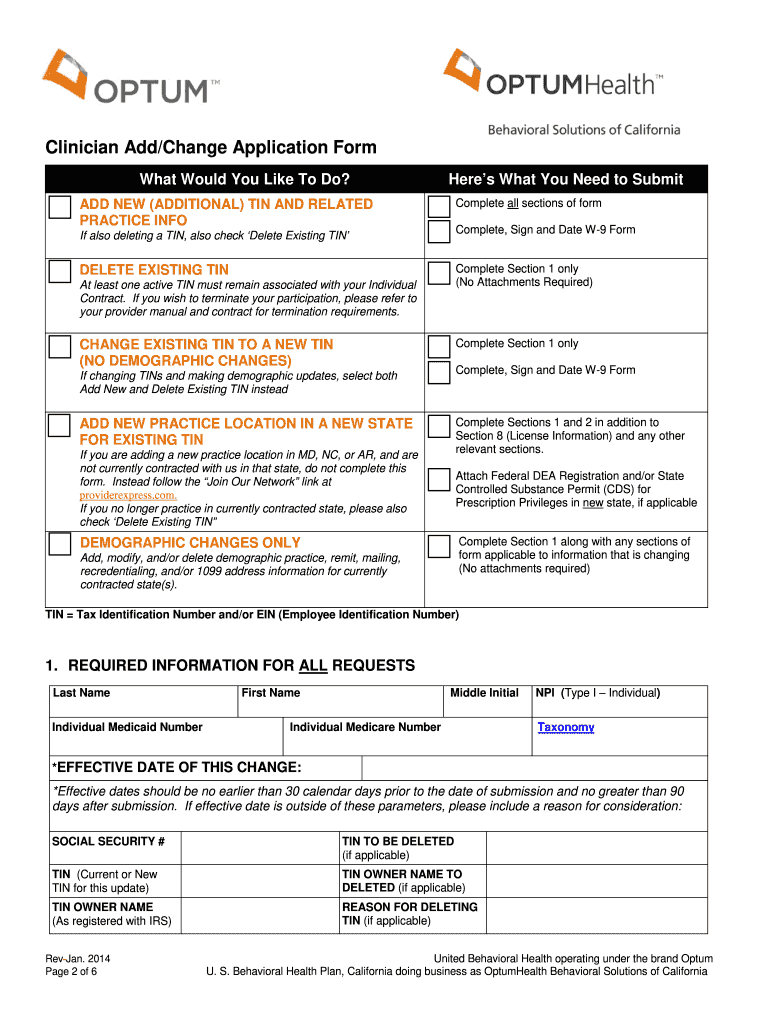

Optum forms Fill out & sign online DocHub

There are 3 tax forms associated with. Optum financial will help you to understand the tax benefits of your health savings account (hsa). Which forms do i need to file my taxes? There are three tax forms associated with health savings accounts (hsas): An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment.

There Are Three Tax Forms Associated With Health Savings Accounts (Hsas):

Optum financial will help you to understand the tax benefits of your health savings account (hsa). Learn the hsa contribution deadline, how to get tax. This checklist will help you to get ready for tax. An hsa provides triple tax savings — contributions are not taxed, account growth through interest and investment earnings are not taxed, and.

There Are 3 Tax Forms Associated With.

You need to file irs form 8889 with your income taxes to report contributions and distributions from your health savings account (hsa). Make the most of your health savings account (hsa) and understand all of the tax benefits. Which forms do i need to file my taxes?

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)