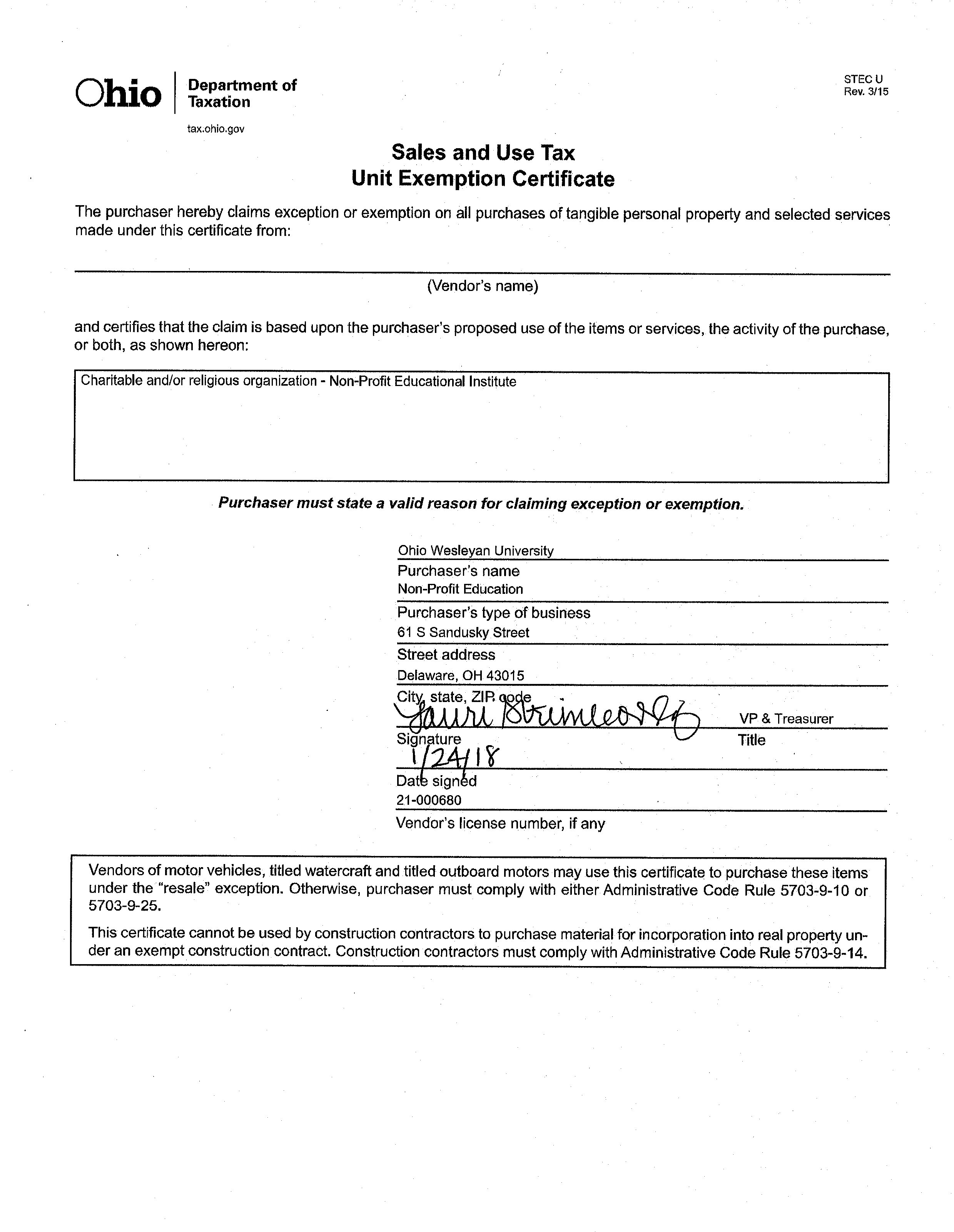

Ohio Sales Tax Exemption Form

Ohio Sales Tax Exemption Form - Download and complete this form to claim a sales tax exemption in multiple states, including ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Find out the types of exemptions, the application. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Learn how to apply for a sales tax exemption number in ohio and when you need to use it. Learn the requirements, reasons, and id. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. What purchases are exempt from the ohio sales tax?

What purchases are exempt from the ohio sales tax? Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Download and complete this form to claim a sales tax exemption in multiple states, including ohio. Learn the requirements, reasons, and id. Learn how to apply for a sales tax exemption number in ohio and when you need to use it. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Find out the types of exemptions, the application.

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Learn the requirements, reasons, and id. Download and complete this form to claim a sales tax exemption in multiple states, including ohio. What purchases are exempt from the ohio sales tax? While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Learn how to apply for a sales tax exemption number in ohio and when you need to use it. Find out the types of exemptions, the application.

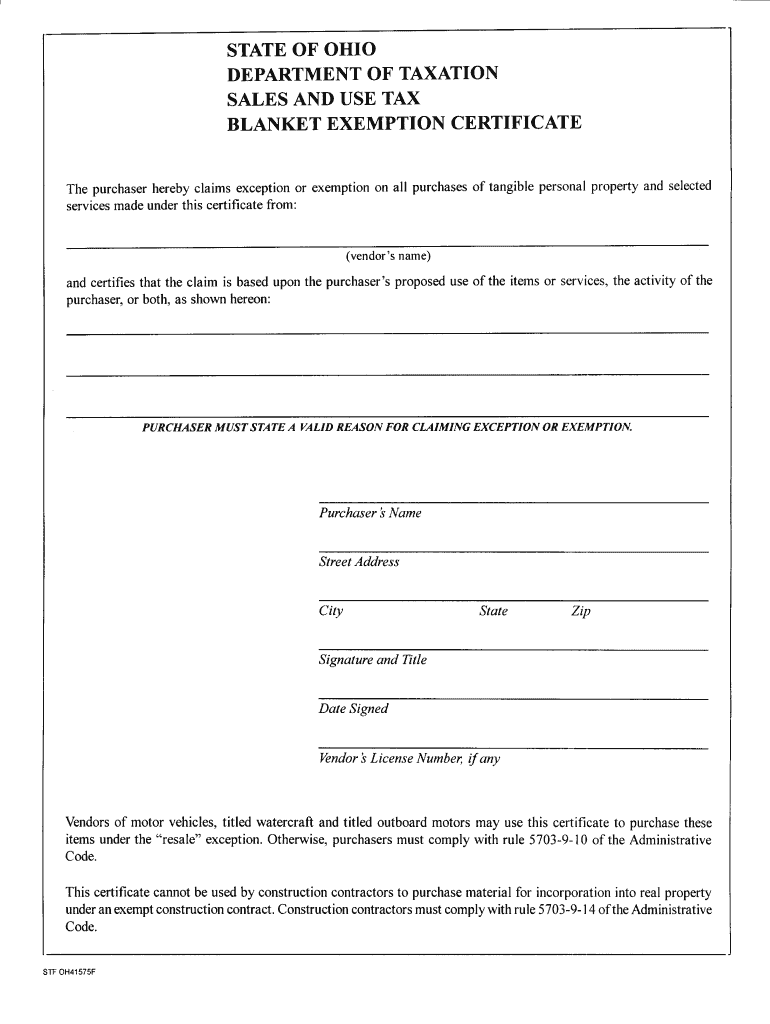

Ohio Sales And Use Tax Blanket Exemption Certificate Instructions

Find out the types of exemptions, the application. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Download and complete this form to claim a sales tax exemption in multiple states, including ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed.

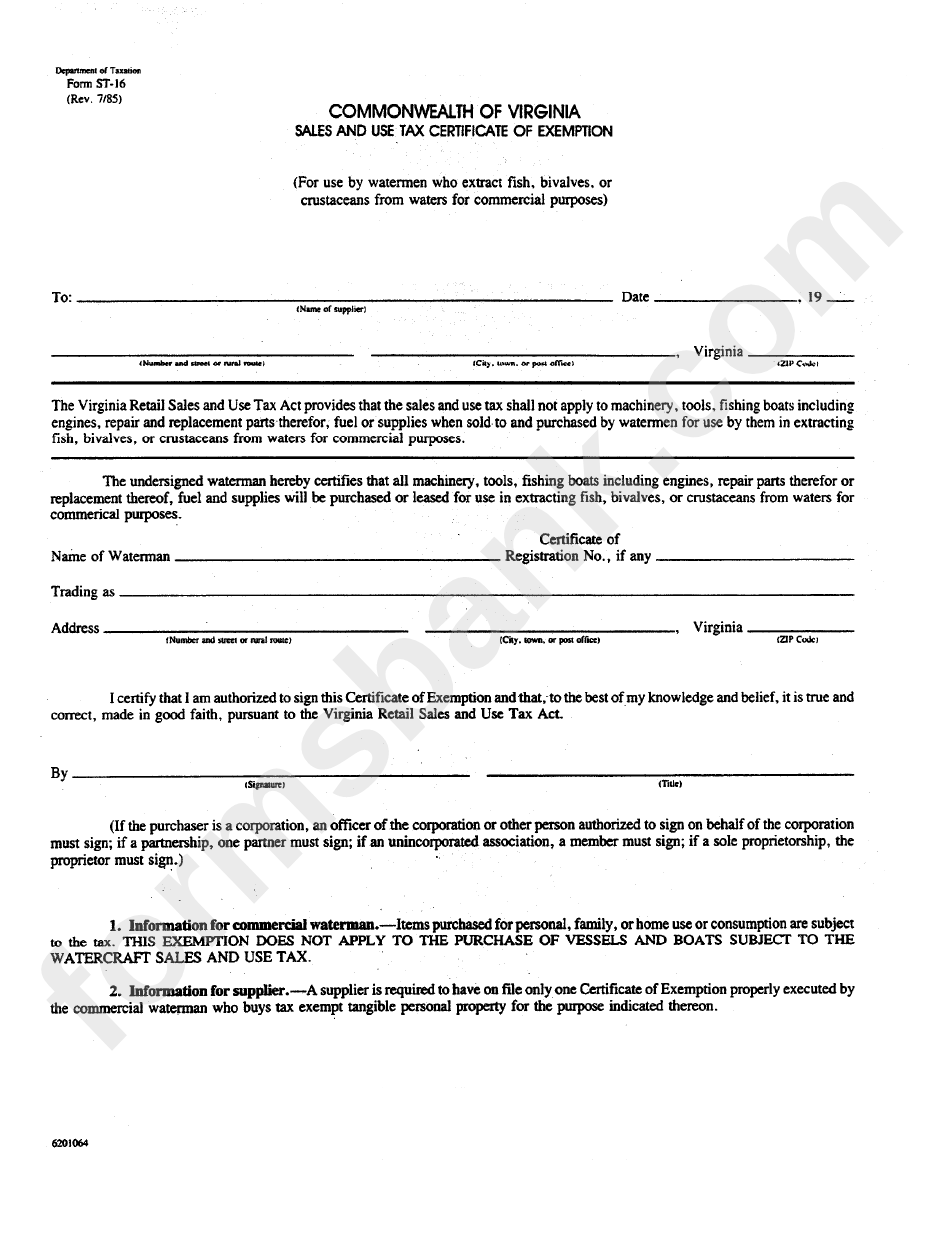

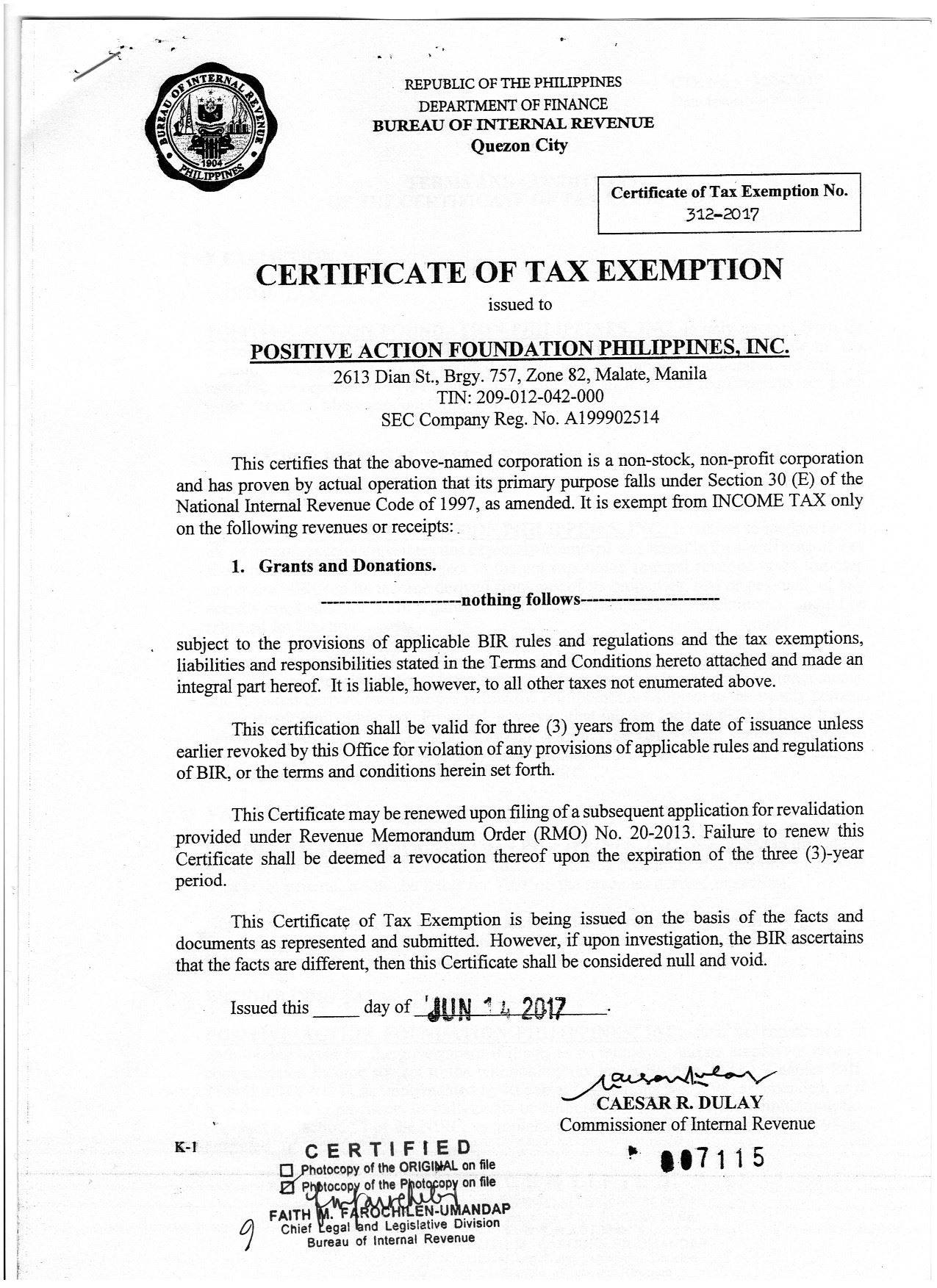

Form St16 Sales And Use Tax Certificate Of Exemption Commonwealth

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download and complete this form to claim a sales tax exemption in multiple states, including ohio. Learn how to apply for a.

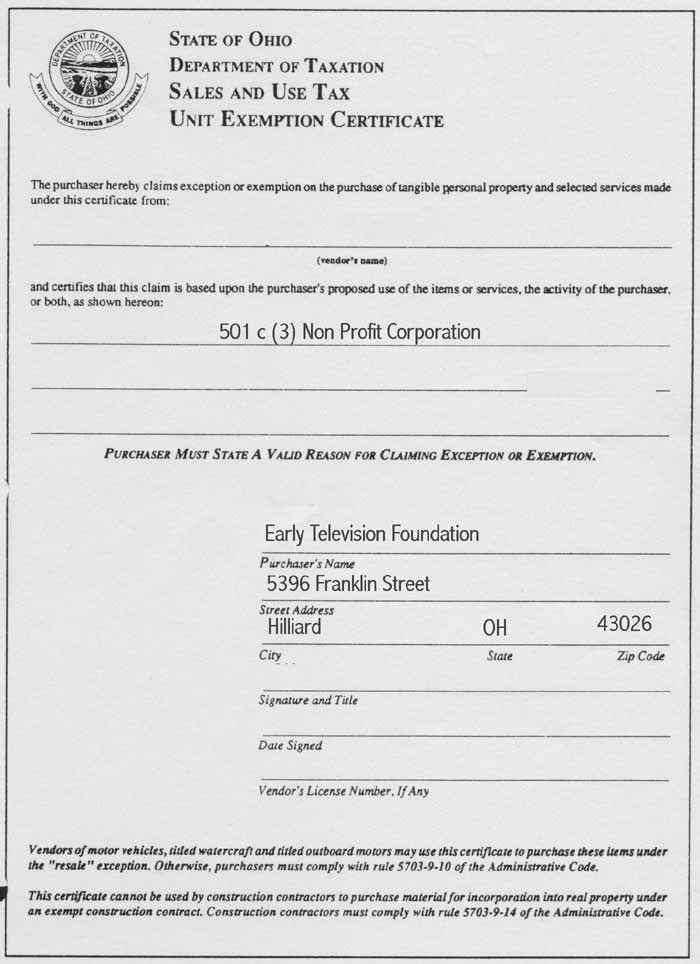

The Early Television Foundation

Learn the requirements, reasons, and id. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Find out the types of exemptions, the application. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download and fill out this form to claim exception or exemption on.

Ohio Sales Tax Exemption Form 2024 Pdf Ranee Casandra

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and complete this form to claim a sales tax exemption in multiple states, including ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Ohio accepts the uniform sales and.

Sales Tax Exempt Form 2024 Va

Find out the types of exemptions, the application. What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. While the ohio sales tax.

blanket certificate of exemption ohio Fill Online, Printable, Fillable

Learn the requirements, reasons, and id. Learn how to apply for a sales tax exemption number in ohio and when you need to use it. Find out the types of exemptions, the application. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Ohio accepts the uniform sales and use tax certificate.

Texas Sales And Use Tax Resale Certificate Example / 01 315 Form Fill

Find out the types of exemptions, the application. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. What purchases are exempt from the ohio sales tax? Ohio accepts the uniform sales and use tax certificate.

Icc Mc Sales Tax Exemption Form Ohio

Find out the types of exemptions, the application. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Download and complete this form to claim a sales tax exemption in multiple states, including ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed.

Ohio tax exempt form Fill out & sign online DocHub

Download and complete this form to claim a sales tax exemption in multiple states, including ohio. Learn how to apply for a sales tax exemption number in ohio and when you need to use it. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. What purchases are exempt from.

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Find out the types of exemptions, the application. What purchases are exempt from the ohio sales tax? Download and fill out this.

There Is A Special Contractor's Exemption Certificate And A Construction Contract Exemption Certificate Prescribed By The Tax Commissioner.

What purchases are exempt from the ohio sales tax? Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Find out the types of exemptions, the application.

Learn The Requirements, Reasons, And Id.

Download and complete this form to claim a sales tax exemption in multiple states, including ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Learn how to apply for a sales tax exemption number in ohio and when you need to use it.