Offer And Compromise Form 656

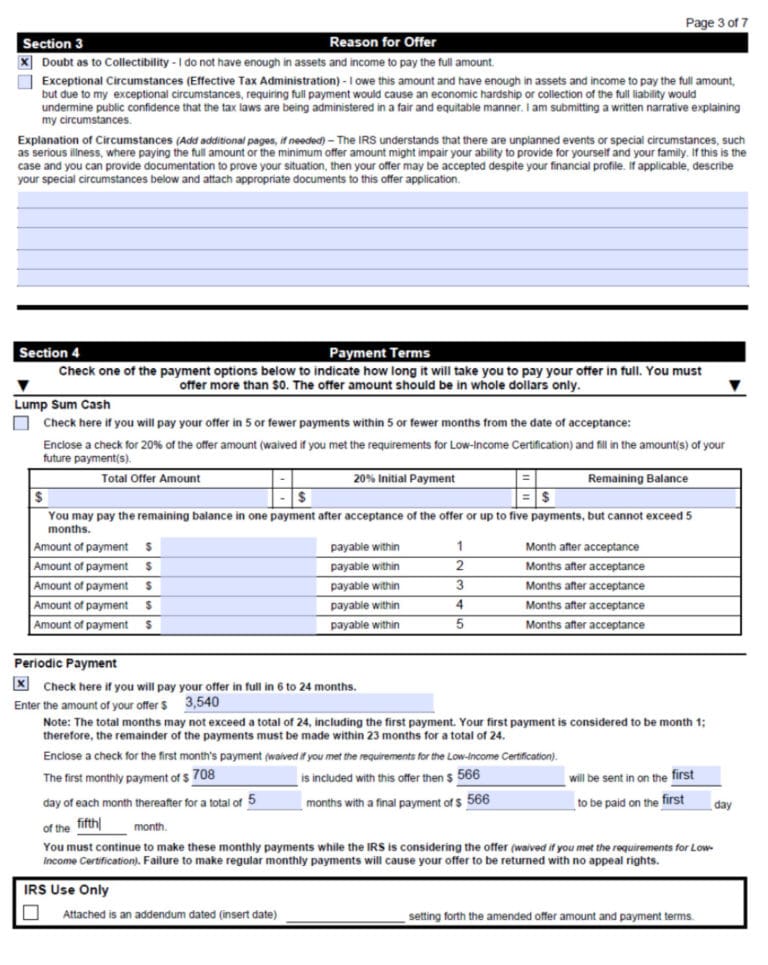

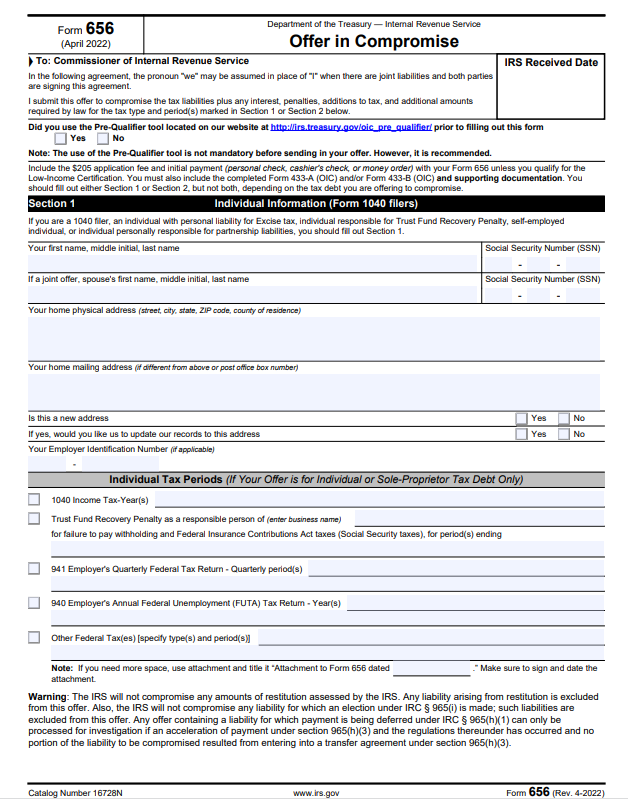

Offer And Compromise Form 656 - Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities.

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.

Offer in compromise How to Get the IRS to Accept Your Offer Law

Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities.

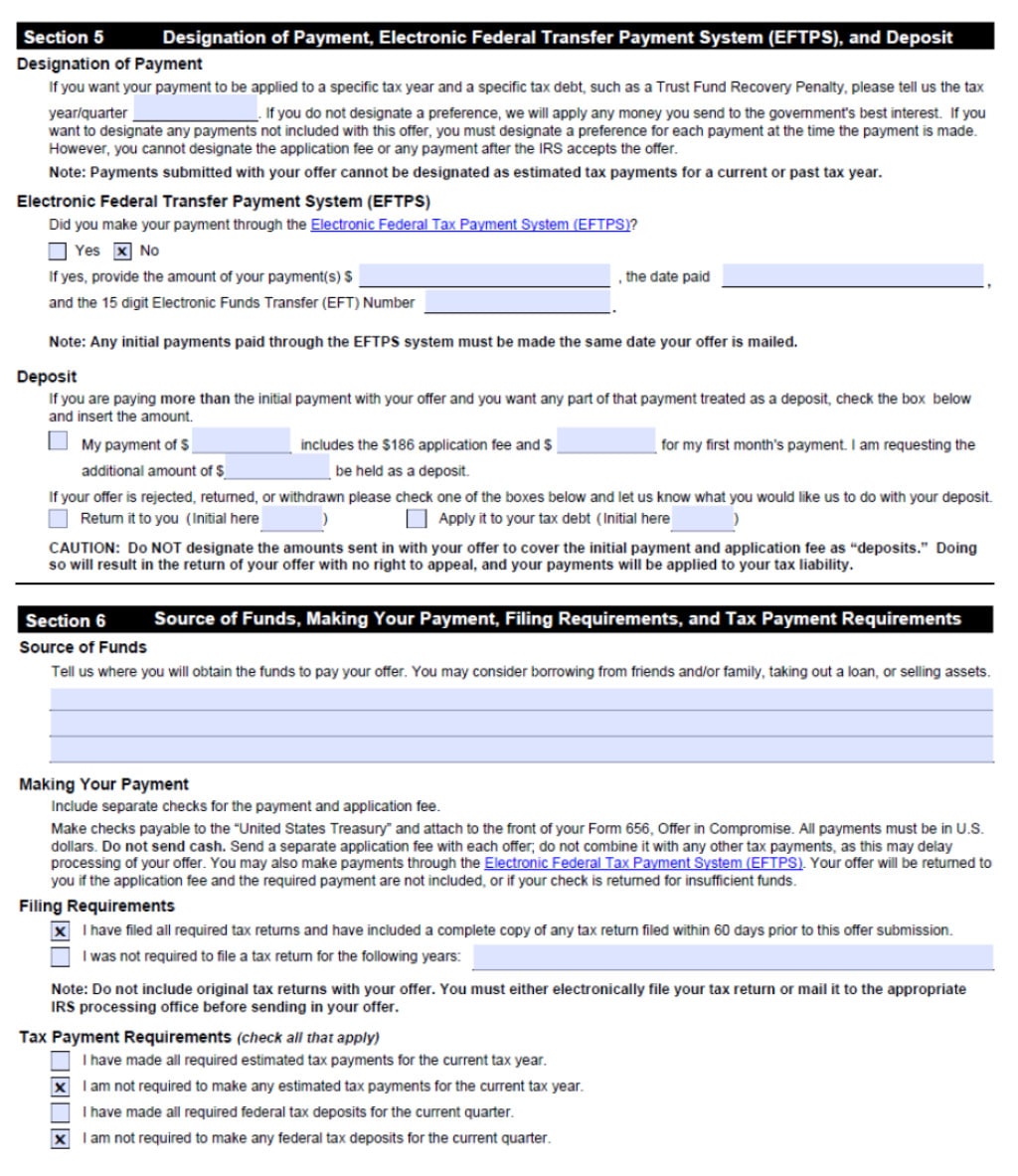

Form 656B, Offer in Compromise Booklet Internal Revenue Service

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.

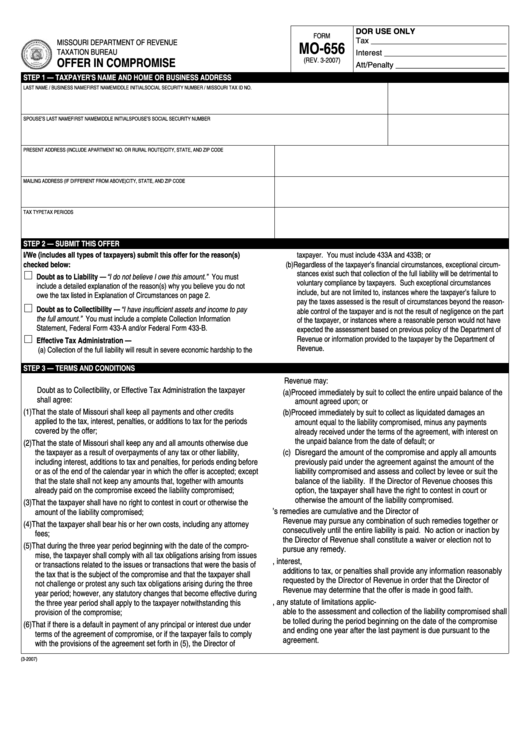

Form Mo656 Offer In Compromise printable pdf download

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.

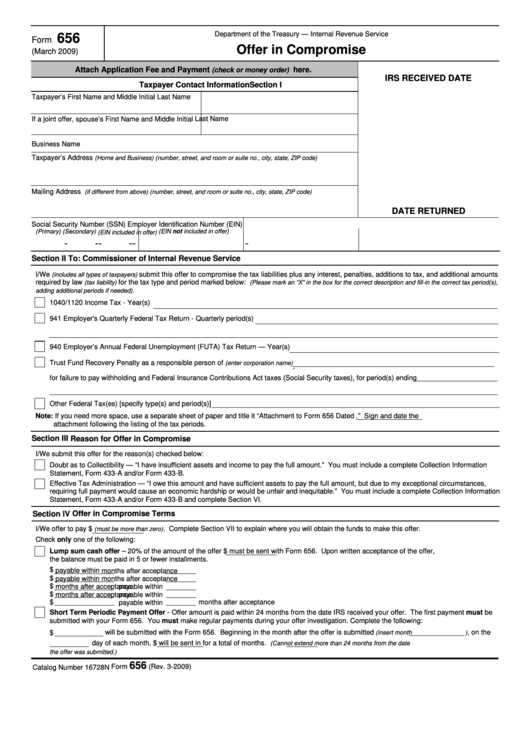

Fillable Offer In Compromise Form 656 (2009) printable pdf download

Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities.

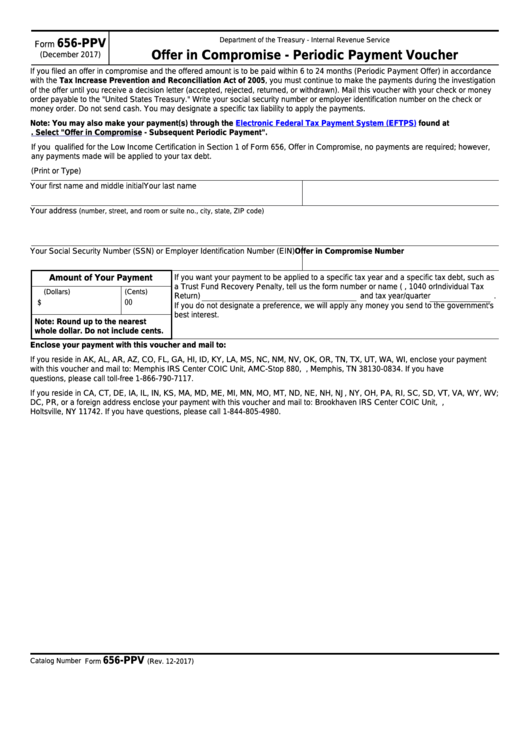

Fillable Form 656Ppv Offer In Compromise Periodic Payment Voucher

Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities.

IRS Form 656 Understanding Offer in Compromise YouTube

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.

Irs Offer In Compromise Form 656 Form Resume Examples 0g27jx0VPr

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.

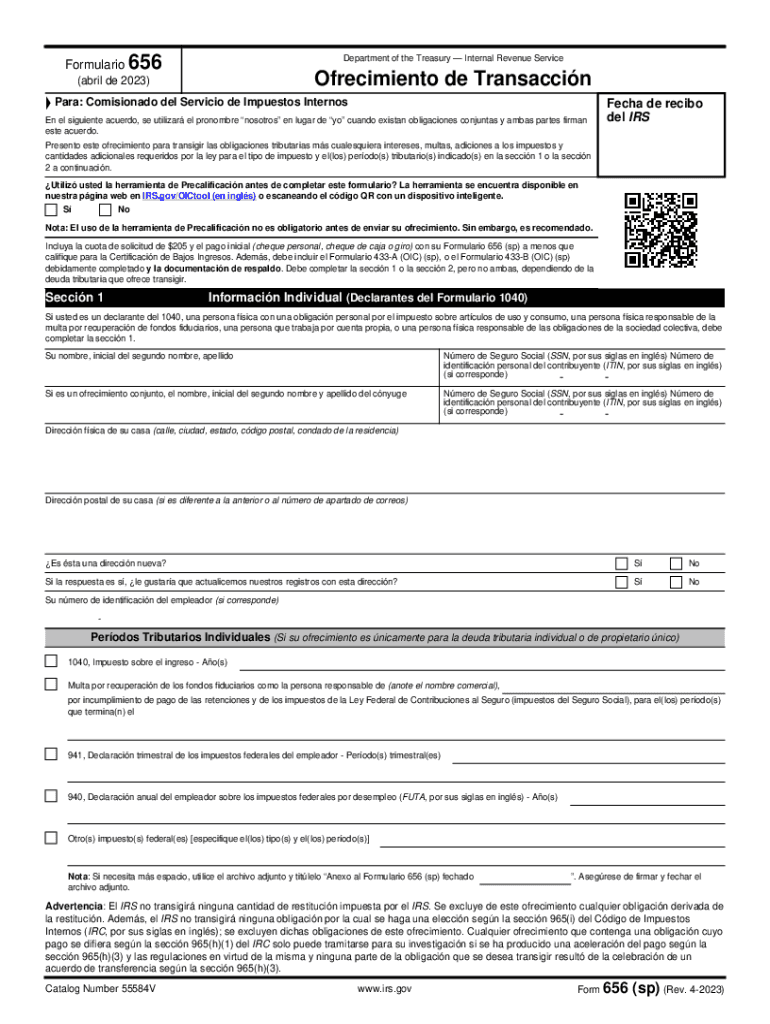

Form 656 Sp Rev 4 Offer in Compromise Spanish Version Fill Out and

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.

Offer in compromise How to Get the IRS to Accept Your Offer Law

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.

Form 656 Fillable Offer In Compromise Printable Forms Free Online

Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities.

Use Form 656 When Applying For An Offer In Compromise (Oic), An Agreement Between You And The Irs That Settles Your Tax Liabilities.

Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.