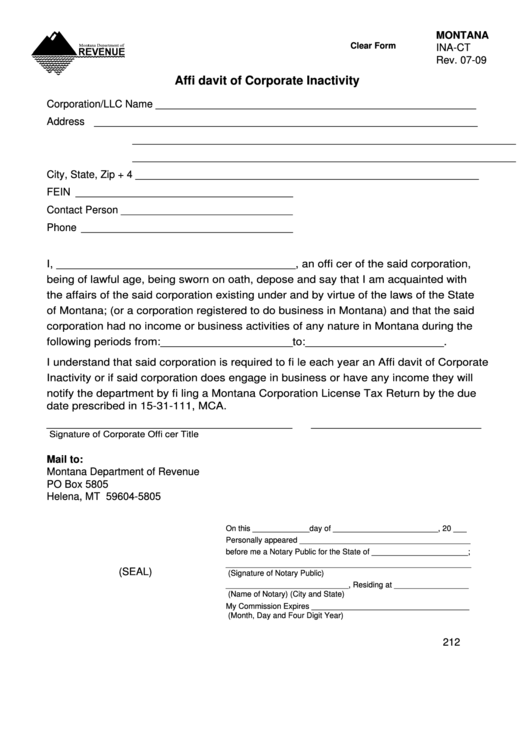

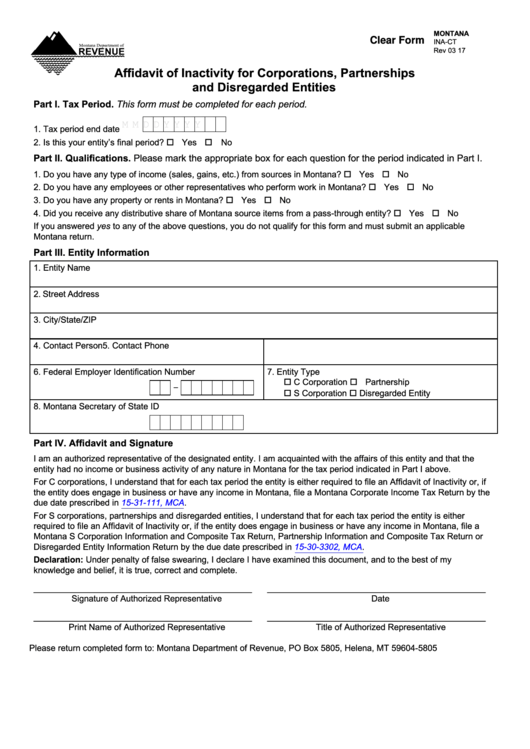

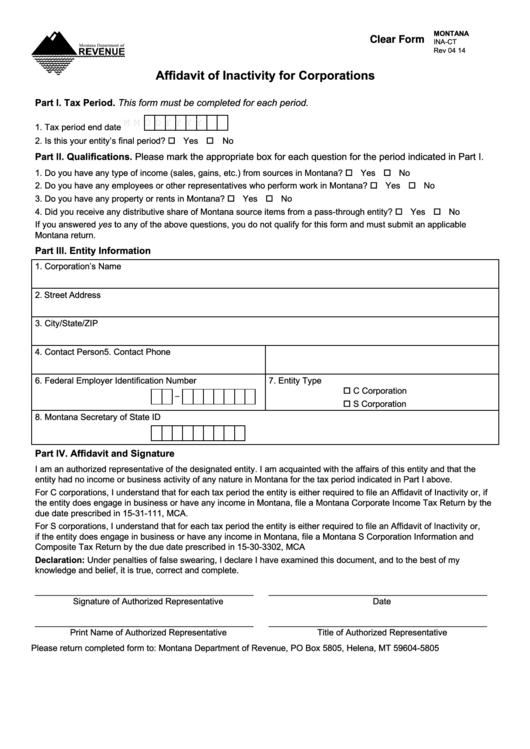

Montana Form Ina Ct

Montana Form Ina Ct - The entity does engage in business or have any income in montana, file a montana corporate income tax return by the due date prescribed. This form must be completed and signed by an authorized representative of the designated entity. Please send this form to: Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana, file a montana s. I understand that said corporation is required to file each year an afidavit of corporate inactivity or if said corporation does engage in business or.

Please send this form to: I understand that said corporation is required to file each year an afidavit of corporate inactivity or if said corporation does engage in business or. This form must be completed and signed by an authorized representative of the designated entity. Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana, file a montana s. The entity does engage in business or have any income in montana, file a montana corporate income tax return by the due date prescribed.

I understand that said corporation is required to file each year an afidavit of corporate inactivity or if said corporation does engage in business or. Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana, file a montana s. Please send this form to: The entity does engage in business or have any income in montana, file a montana corporate income tax return by the due date prescribed. This form must be completed and signed by an authorized representative of the designated entity.

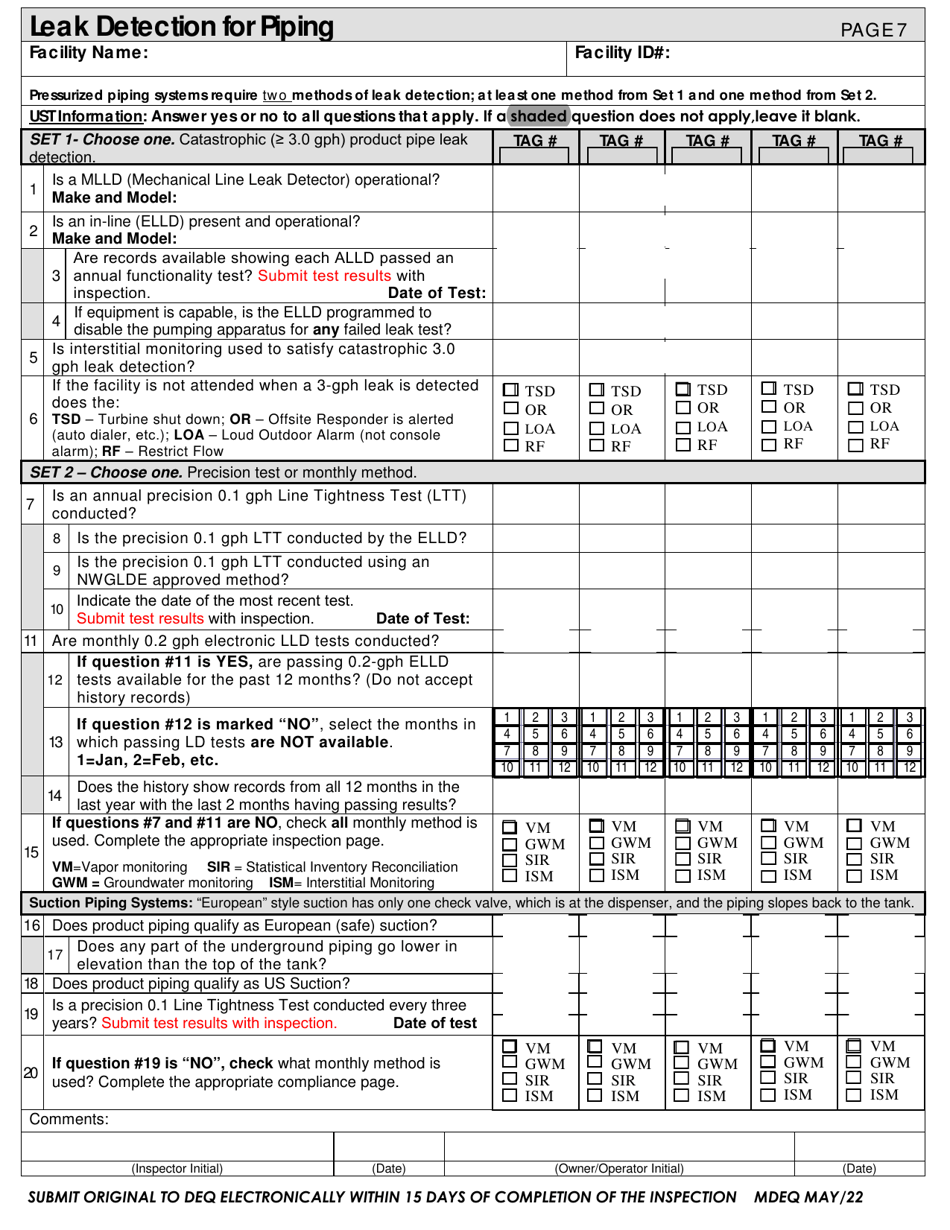

Montana Ust Compliance Inspection Form for up to 5 Tanks Fill Out

I understand that said corporation is required to file each year an afidavit of corporate inactivity or if said corporation does engage in business or. Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana, file a montana s. Please send this form to: The entity does engage in.

INA Full Form INA Full Form INA Meaning YouTube

Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana, file a montana s. The entity does engage in business or have any income in montana, file a montana corporate income tax return by the due date prescribed. This form must be completed and signed by an authorized representative.

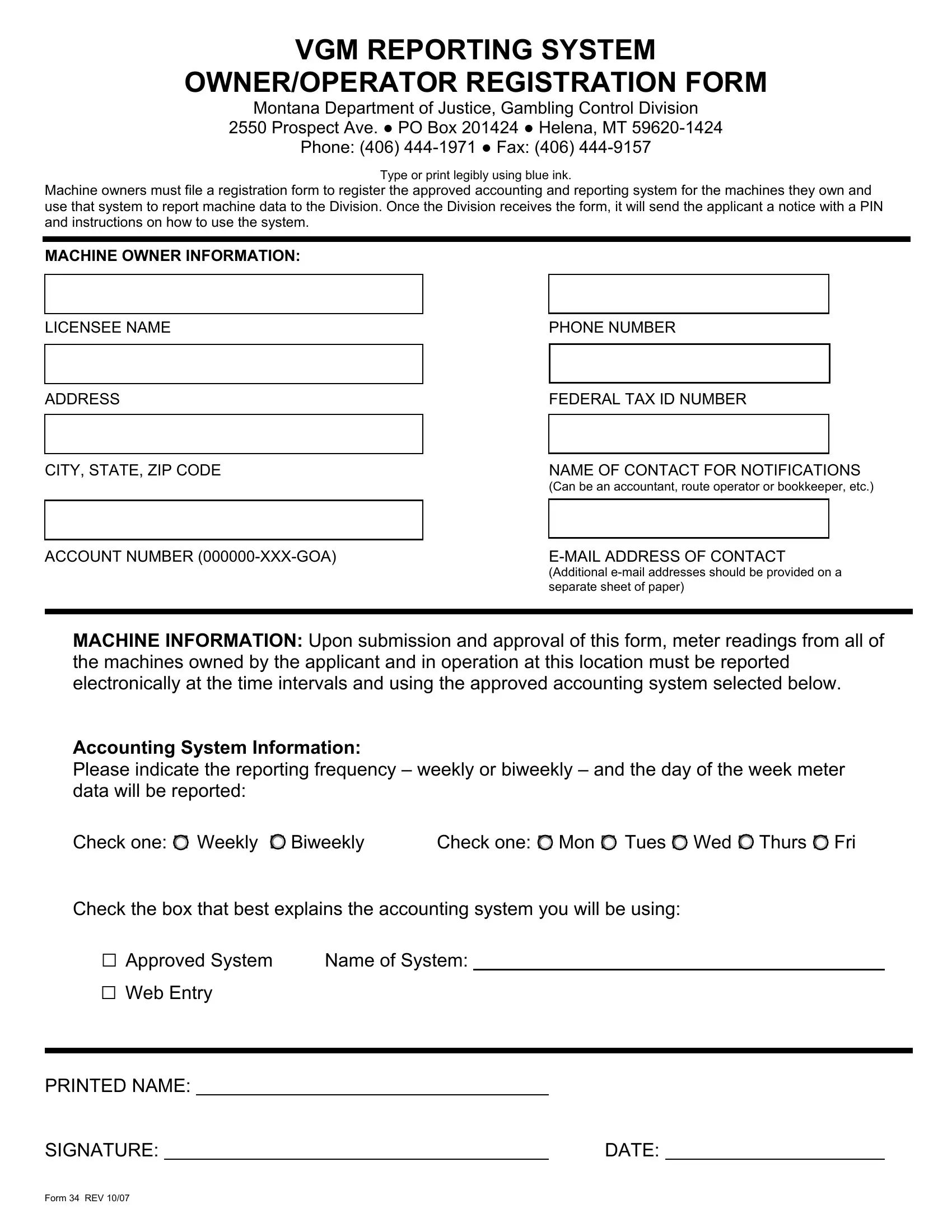

Montana Form 34 ≡ Fill Out Printable PDF Forms Online

The entity does engage in business or have any income in montana, file a montana corporate income tax return by the due date prescribed. I understand that said corporation is required to file each year an afidavit of corporate inactivity or if said corporation does engage in business or. Please send this form to: This form must be completed and.

Issue 10 Montana Secretary of State comdev mt Doc Template pdfFiller

Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana, file a montana s. The entity does engage in business or have any income in montana, file a montana corporate income tax return by the due date prescribed. I understand that said corporation is required to file each year.

Fillable Montana Form InaCt Affidavit Of Corporate Inactivity

Please send this form to: The entity does engage in business or have any income in montana, file a montana corporate income tax return by the due date prescribed. This form must be completed and signed by an authorized representative of the designated entity. Required to file an affidavit of inactivity or, if the entity does engage in business or.

1110 Montana Tax Forms And Templates free to download in PDF

This form must be completed and signed by an authorized representative of the designated entity. The entity does engage in business or have any income in montana, file a montana corporate income tax return by the due date prescribed. Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana,.

Fillable Form InaCt Affidavit Of Inactivity For Corporations

This form must be completed and signed by an authorized representative of the designated entity. I understand that said corporation is required to file each year an afidavit of corporate inactivity or if said corporation does engage in business or. Please send this form to: The entity does engage in business or have any income in montana, file a montana.

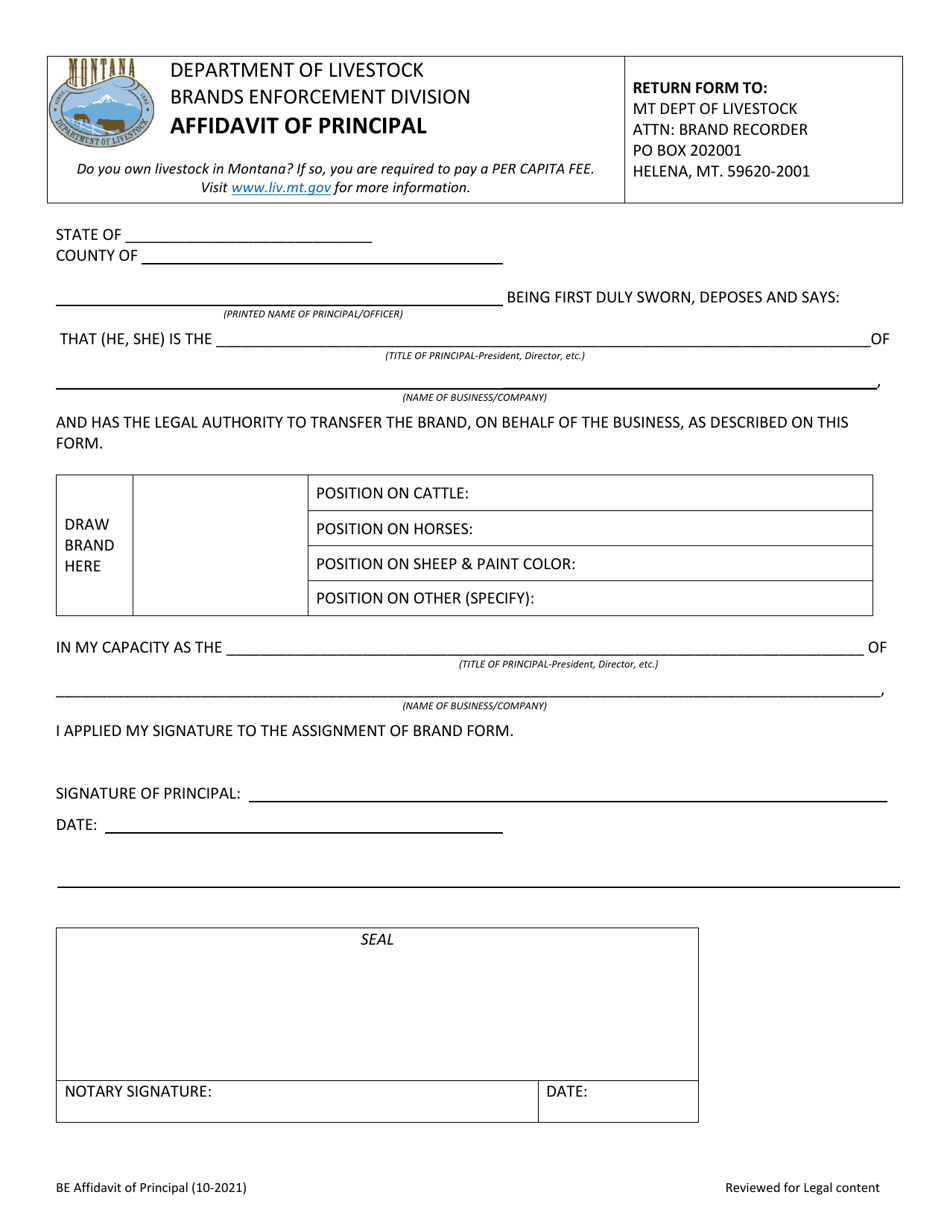

Montana Affidavit of Principal Fill Out, Sign Online and Download PDF

Please send this form to: Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana, file a montana s. This form must be completed and signed by an authorized representative of the designated entity. I understand that said corporation is required to file each year an afidavit of corporate.

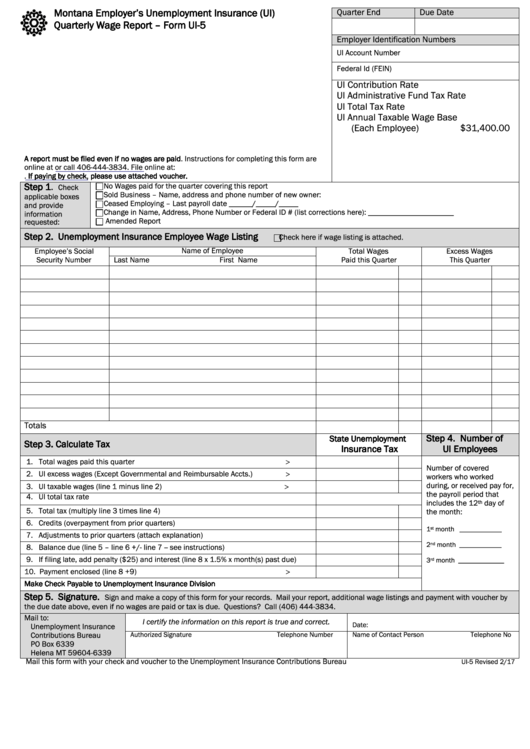

Form Ui5 Montana Employer'S Unemployment Insurance (Ui) Quarterly

This form must be completed and signed by an authorized representative of the designated entity. Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana, file a montana s. Please send this form to: The entity does engage in business or have any income in montana, file a montana.

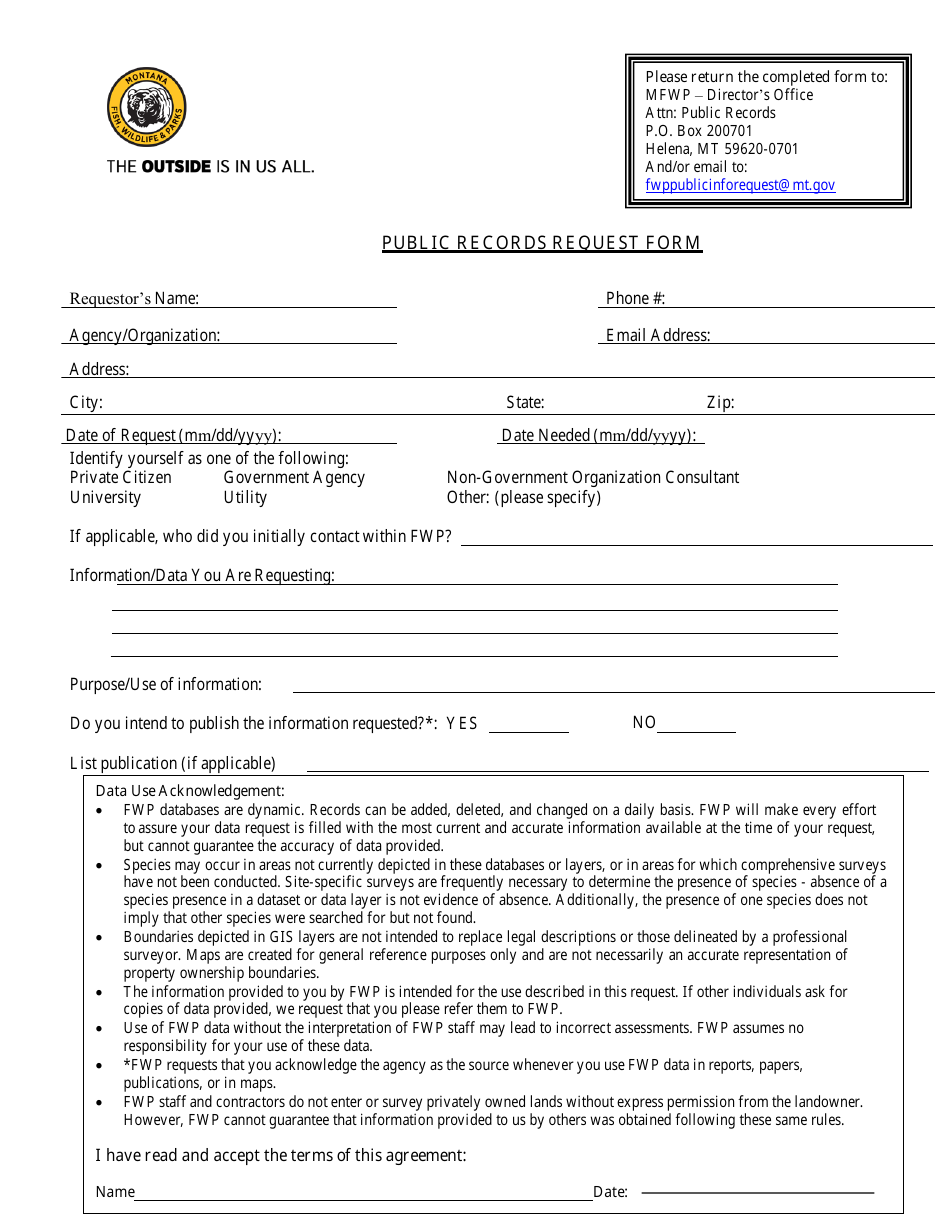

Montana Public Records Request Form Fill Out, Sign Online and

Please send this form to: This form must be completed and signed by an authorized representative of the designated entity. Required to file an affidavit of inactivity or, if the entity does engage in business or have any income in montana, file a montana s. The entity does engage in business or have any income in montana, file a montana.

Required To File An Affidavit Of Inactivity Or, If The Entity Does Engage In Business Or Have Any Income In Montana, File A Montana S.

I understand that said corporation is required to file each year an afidavit of corporate inactivity or if said corporation does engage in business or. The entity does engage in business or have any income in montana, file a montana corporate income tax return by the due date prescribed. This form must be completed and signed by an authorized representative of the designated entity. Please send this form to: