Modified Adjusted Gross Income

Modified Adjusted Gross Income - Keep in mind that there are income limits for those who deduct student loan interest. These amounts are raised each year. The deduction for single filers and heads of households phases out between $70,000 in. However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000 and other taxpayers with a modified agi greater than. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than $106,000 or joint filers with incomes more than $212,000. It’s levied only on people whose modified adjusted gross income (magi) is more than $85,000 or, in the case of married couples, $170,000. To set your medicare cost for 2025,.

However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000 and other taxpayers with a modified agi greater than. It’s levied only on people whose modified adjusted gross income (magi) is more than $85,000 or, in the case of married couples, $170,000. These amounts are raised each year. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than $106,000 or joint filers with incomes more than $212,000. The deduction for single filers and heads of households phases out between $70,000 in. To set your medicare cost for 2025,. Keep in mind that there are income limits for those who deduct student loan interest.

It’s levied only on people whose modified adjusted gross income (magi) is more than $85,000 or, in the case of married couples, $170,000. However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000 and other taxpayers with a modified agi greater than. Keep in mind that there are income limits for those who deduct student loan interest. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than $106,000 or joint filers with incomes more than $212,000. These amounts are raised each year. The deduction for single filers and heads of households phases out between $70,000 in. To set your medicare cost for 2025,.

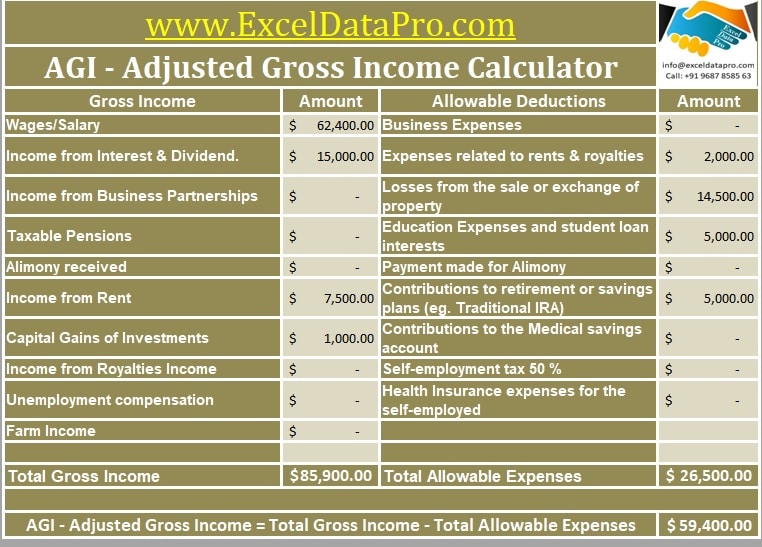

What is MAGI Modified Adjusted Gross ExcelDataPro

Keep in mind that there are income limits for those who deduct student loan interest. The deduction for single filers and heads of households phases out between $70,000 in. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than $106,000 or joint filers with incomes more than $212,000. However, it’s gradually phased out.

Modified Adjusted Gross (MAGI)

The deduction for single filers and heads of households phases out between $70,000 in. However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000 and other taxpayers with a modified agi greater than. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than.

What is Modified Adjusted Gross (MAGI)? Total Benefit

The deduction for single filers and heads of households phases out between $70,000 in. It’s levied only on people whose modified adjusted gross income (magi) is more than $85,000 or, in the case of married couples, $170,000. These amounts are raised each year. Keep in mind that there are income limits for those who deduct student loan interest. However, it’s.

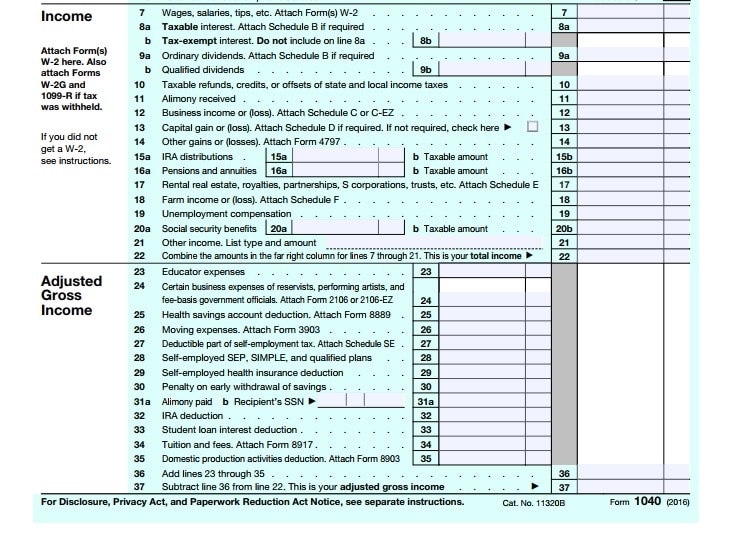

Modified Adjusted Gross Adjusted Gross Irs Tax Forms

The deduction for single filers and heads of households phases out between $70,000 in. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than $106,000 or joint filers with incomes more than $212,000. However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000.

Subsidy Eligibility eHealth Insurance Resource Center

It’s levied only on people whose modified adjusted gross income (magi) is more than $85,000 or, in the case of married couples, $170,000. However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000 and other taxpayers with a modified agi greater than. In 2025, the surcharge applies to single tax.

Modified Adjusted Gross

The deduction for single filers and heads of households phases out between $70,000 in. However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000 and other taxpayers with a modified agi greater than. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than.

How Is Modified Adjusted Gross Calculated?

These amounts are raised each year. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than $106,000 or joint filers with incomes more than $212,000. However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000 and other taxpayers with a modified agi greater.

Download Modified Adjusted Gross Calculator Excel Template

The deduction for single filers and heads of households phases out between $70,000 in. However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000 and other taxpayers with a modified agi greater than. These amounts are raised each year. In 2025, the surcharge applies to single tax filers whose modified.

What Is Modified Adjusted Gross (MAGI)? Entrepreneur

Keep in mind that there are income limits for those who deduct student loan interest. These amounts are raised each year. The deduction for single filers and heads of households phases out between $70,000 in. To set your medicare cost for 2025,. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than $106,000.

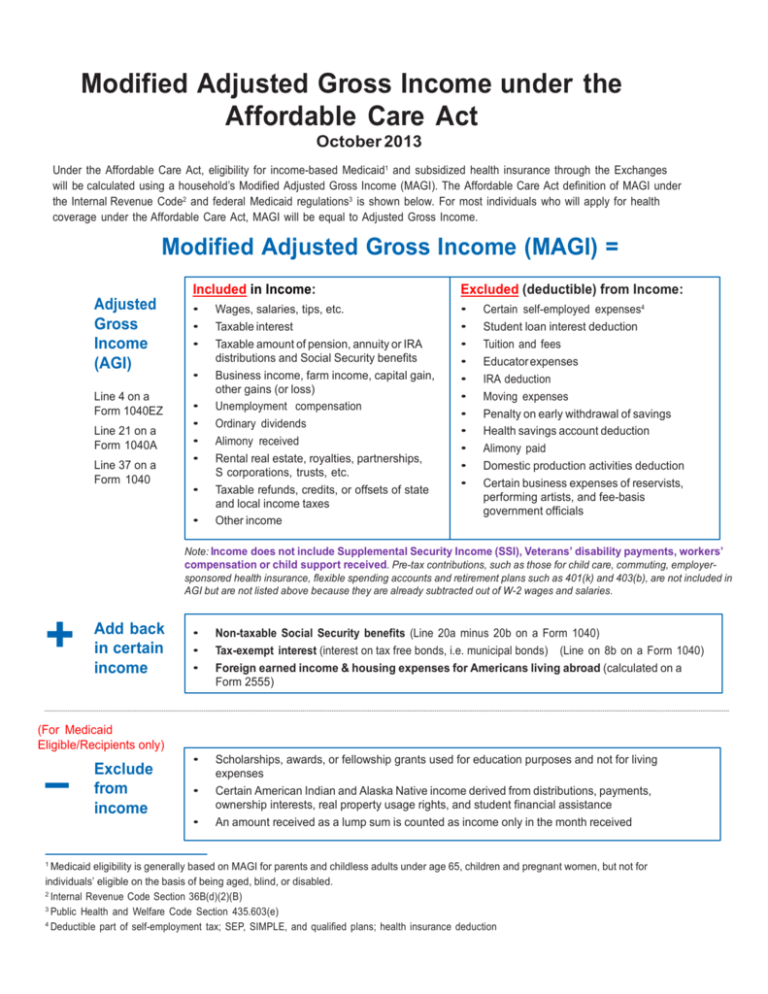

Modified Adjusted Gross under the Affordable Care Act

The deduction for single filers and heads of households phases out between $70,000 in. In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than $106,000 or joint filers with incomes more than $212,000. These amounts are raised each year. However, it’s gradually phased out (potentially to zero) for joint filers with a modified.

To Set Your Medicare Cost For 2025,.

However, it’s gradually phased out (potentially to zero) for joint filers with a modified adjusted gross income (agi) over $400,000 and other taxpayers with a modified agi greater than. It’s levied only on people whose modified adjusted gross income (magi) is more than $85,000 or, in the case of married couples, $170,000. The deduction for single filers and heads of households phases out between $70,000 in. These amounts are raised each year.

Keep In Mind That There Are Income Limits For Those Who Deduct Student Loan Interest.

In 2025, the surcharge applies to single tax filers whose modified adjusted gross income is more than $106,000 or joint filers with incomes more than $212,000.