Michigan Veterans Property Tax Exemption Form

Michigan Veterans Property Tax Exemption Form - This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. Property tax information for veterans and military personnel. This form is for local eligible taxpayers to claim the disabled veterans exemption. This form is to apply for an exemption of property taxes for disabled veterans or their spouses who own and use a homestead in michigan. A property tax exemption for real property owned and used as a homestead by a. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. Complete all information carefully and accurately to avoid. To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form.

Complete all information carefully and accurately to avoid. This form is for local eligible taxpayers to claim the disabled veterans exemption. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. This form is to apply for an exemption of property taxes for disabled veterans or their spouses who own and use a homestead in michigan. Property tax information for veterans and military personnel. To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form. A property tax exemption for real property owned and used as a homestead by a.

This form is for local eligible taxpayers to claim the disabled veterans exemption. Complete all information carefully and accurately to avoid. This form is to apply for an exemption of property taxes for disabled veterans or their spouses who own and use a homestead in michigan. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. Property tax information for veterans and military personnel. To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. A property tax exemption for real property owned and used as a homestead by a.

How to File Your Disabled Veteran Property Tax Exemption in Texas YouTube

Complete all information carefully and accurately to avoid. Property tax information for veterans and military personnel. To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a..

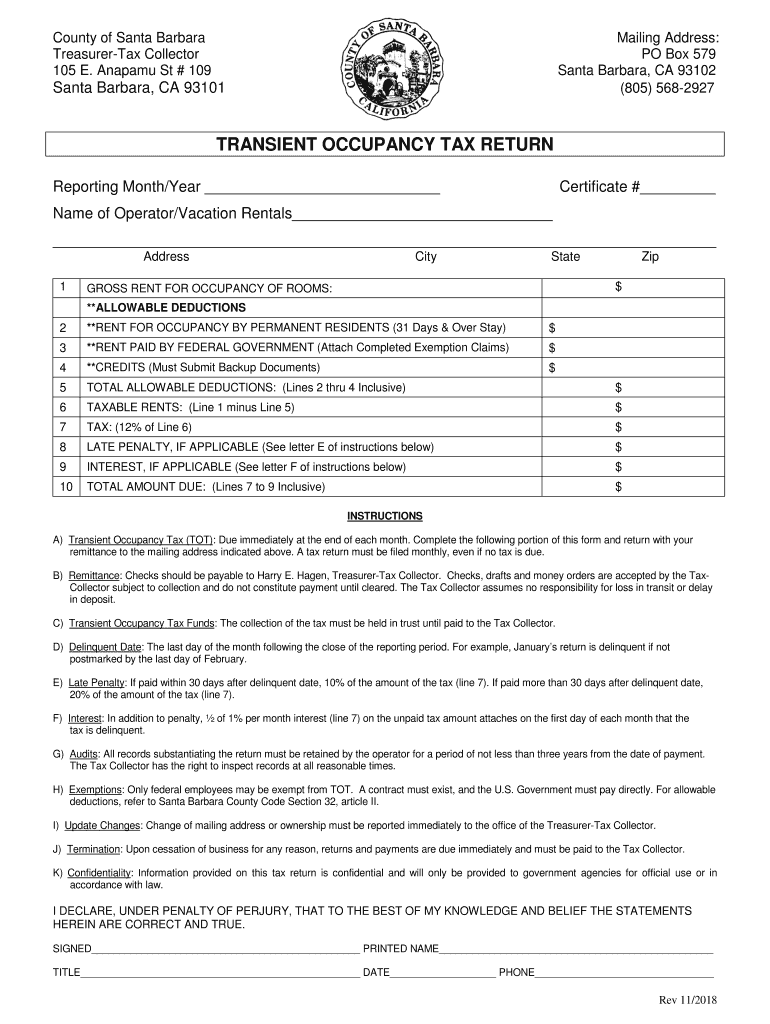

Property Tax Exemption for Veterans for Santa Barbara California 2018

A property tax exemption for real property owned and used as a homestead by a. This form is to apply for an exemption of property taxes for disabled veterans or their spouses who own and use a homestead in michigan. To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form. This.

Fillable Form Mi 706 Michigan Estate Tax Return Printable Pdf Download

This form is for local eligible taxpayers to claim the disabled veterans exemption. A property tax exemption for real property owned and used as a homestead by a. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. Complete all information carefully and accurately to.

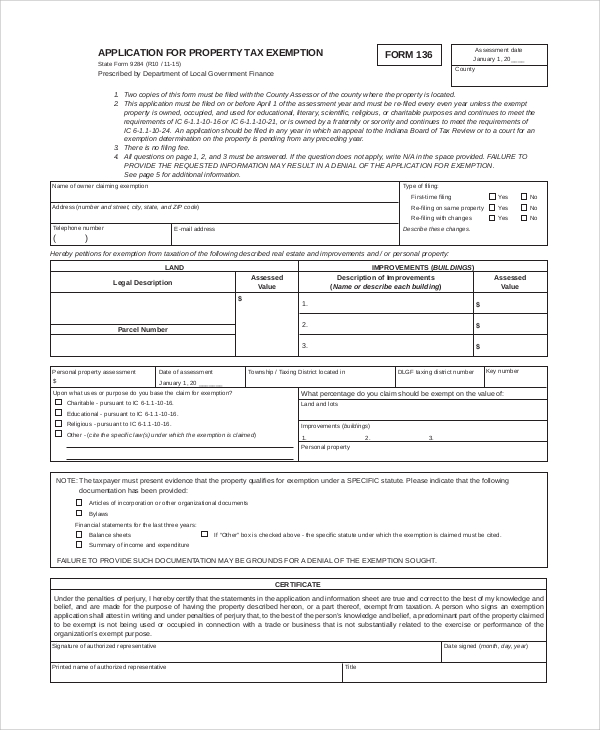

Tax Exempt Form 20202021 Fill and Sign Printable Template Online

This form is to apply for an exemption of property taxes for disabled veterans or their spouses who own and use a homestead in michigan. Property tax information for veterans and military personnel. To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form. This form is for local eligible taxpayers to.

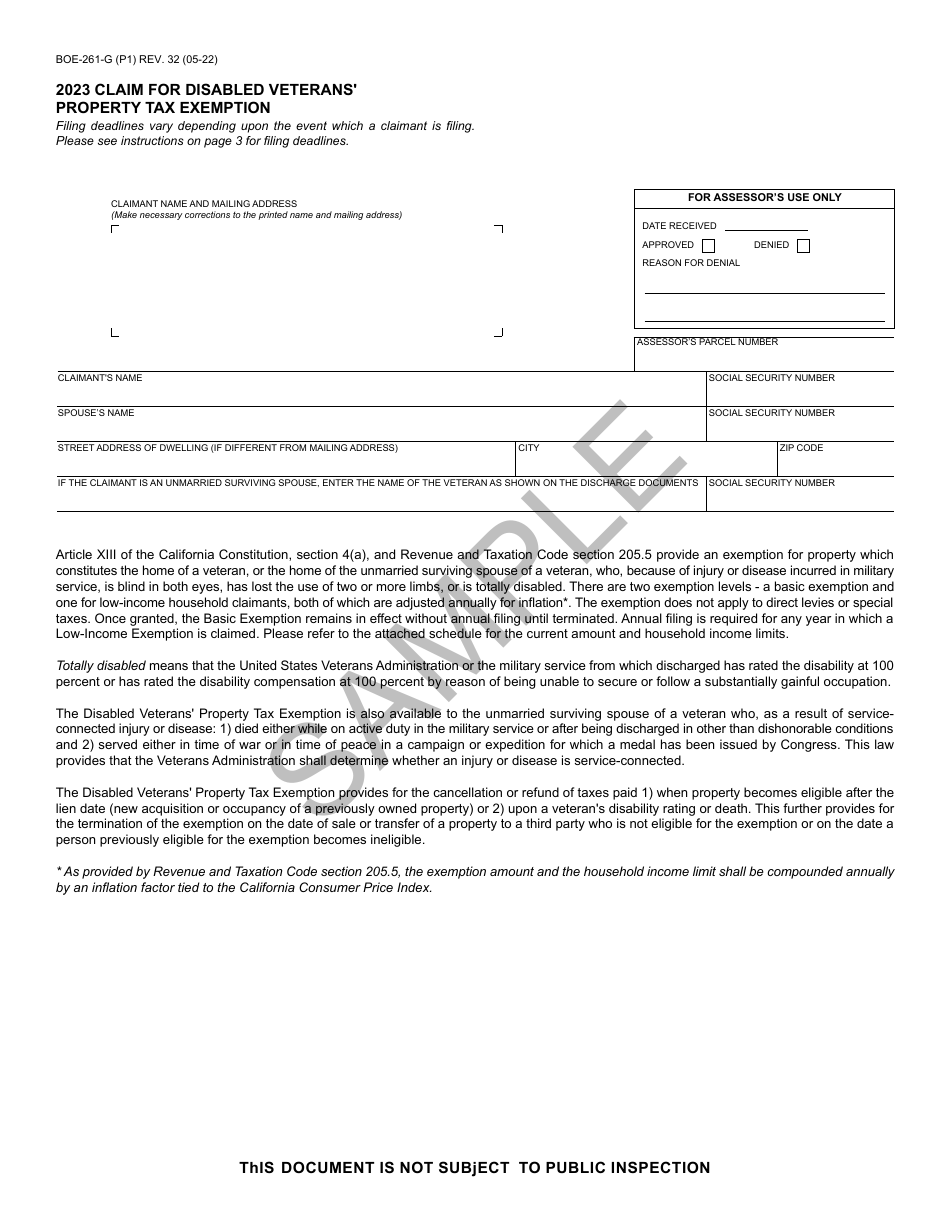

Form BOE261G Download Printable PDF or Fill Online Claim for Disabled

Property tax information for veterans and military personnel. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. This form is to apply for an exemption of property taxes for disabled veterans or their spouses who own and use a homestead in michigan. To apply.

What town in Texas has no property tax? Leia aqui What town in Texas

This form is to apply for an exemption of property taxes for disabled veterans or their spouses who own and use a homestead in michigan. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. To apply for the exemption, the disabled veteran, their unremarried.

Mi Tax Exempt Form 2023 Printable Forms Free Online

To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form. This form is for local eligible taxpayers to claim the disabled veterans exemption. Property tax information for veterans and military personnel. This form is to apply for an exemption of property taxes for disabled veterans or their spouses who own and.

Veterans Property Tax Exemption Application Form Printable Pdf Download

Complete all information carefully and accurately to avoid. A property tax exemption for real property owned and used as a homestead by a. This form is to apply for an exemption of property taxes for disabled veterans or their spouses who own and use a homestead in michigan. This form is to be used to apply for an exemption of.

What Is Disability Exemption at Maira Cook blog

Complete all information carefully and accurately to avoid. To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. This form is to be used to apply.

Download Instructions for Form BOE261G Claim for Disabled Veterans

This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. This form is for local eligible taxpayers to claim the disabled veterans exemption. To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form. Complete all information.

This Form Is To Apply For An Exemption Of Property Taxes For Disabled Veterans Or Their Spouses Who Own And Use A Homestead In Michigan.

This form is for local eligible taxpayers to claim the disabled veterans exemption. A property tax exemption for real property owned and used as a homestead by a. To apply for the exemption, the disabled veteran, their unremarried surviving spouse, or their legal designee must file form. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a.

Complete All Information Carefully And Accurately To Avoid.

This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a. Property tax information for veterans and military personnel.