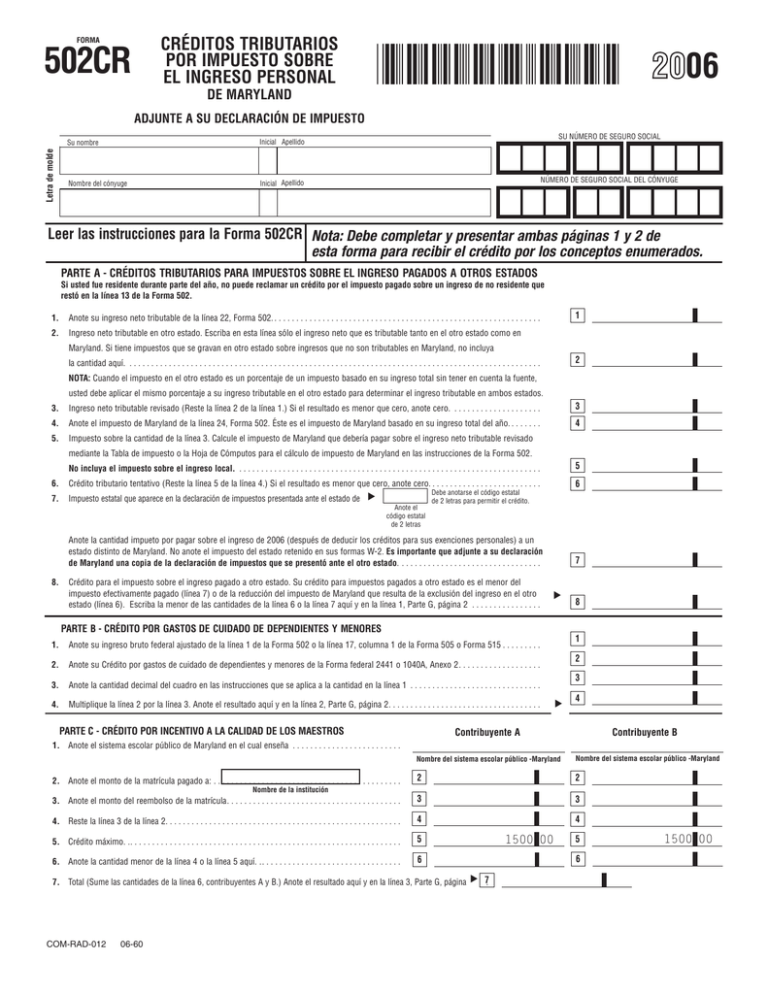

Maryland Form 502Cr 2022

Maryland Form 502Cr 2022 - You must complete and submit pages 1 through 4 of this form to receive credit. Enter your taxable net income from line 20, form 502 (or line 10, form 504). Taxable net income in other state. Instructions for filing personal state and. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Additional 502crs may be entered for parts a and e only. Attach to your tax return. Forms are available for downloading in the resident individuals income tax forms section below. All other areas must be entered on the first 502cr. Read instructions for form 502cr.

Taxable net income in other state. Attach to your tax return. Additional 502crs may be entered for parts a and e only. Enter your taxable net income from line 20, form 502 (or line 10, form 504). All other areas must be entered on the first 502cr. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. You must complete and submit pages 1 through 4 of this form to receive credit. Forms are available for downloading in the resident individuals income tax forms section below. Instructions for filing personal state and. Read instructions for form 502cr.

Forms are available for downloading in the resident individuals income tax forms section below. Read instructions for form 502cr. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Attach to your tax return. You must complete and submit pages 1 through 4 of this form to receive credit. Taxable net income in other state. Instructions for filing personal state and. All other areas must be entered on the first 502cr. Additional 502crs may be entered for parts a and e only. Enter your taxable net income from line 20, form 502 (or line 10, form 504).

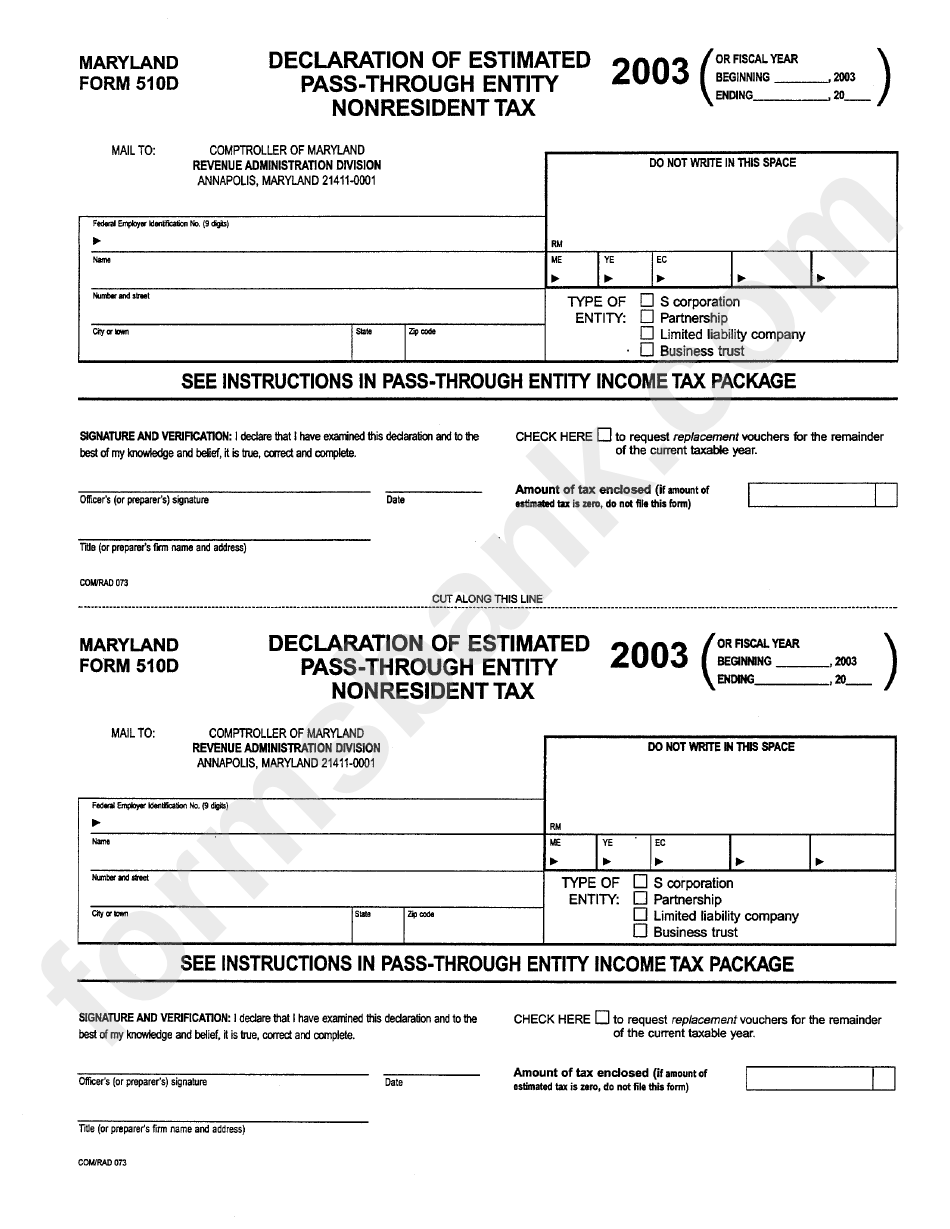

Maryland Tax Forms Printable Printable Forms Free Online

Forms are available for downloading in the resident individuals income tax forms section below. Additional 502crs may be entered for parts a and e only. All other areas must be entered on the first 502cr. Taxable net income in other state. Read instructions for form 502cr.

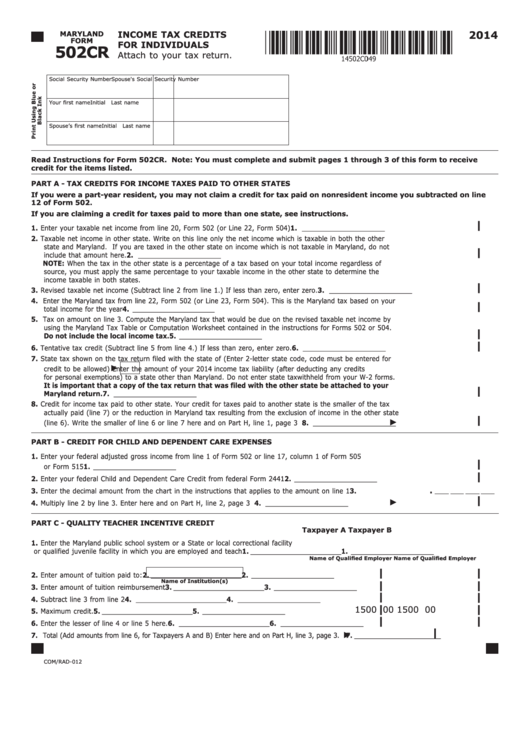

Fillable Online Maryland Form 502CR Tax Credits for Individuals

All other areas must be entered on the first 502cr. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Instructions for filing personal state and. Forms are available for downloading in the resident individuals income tax.

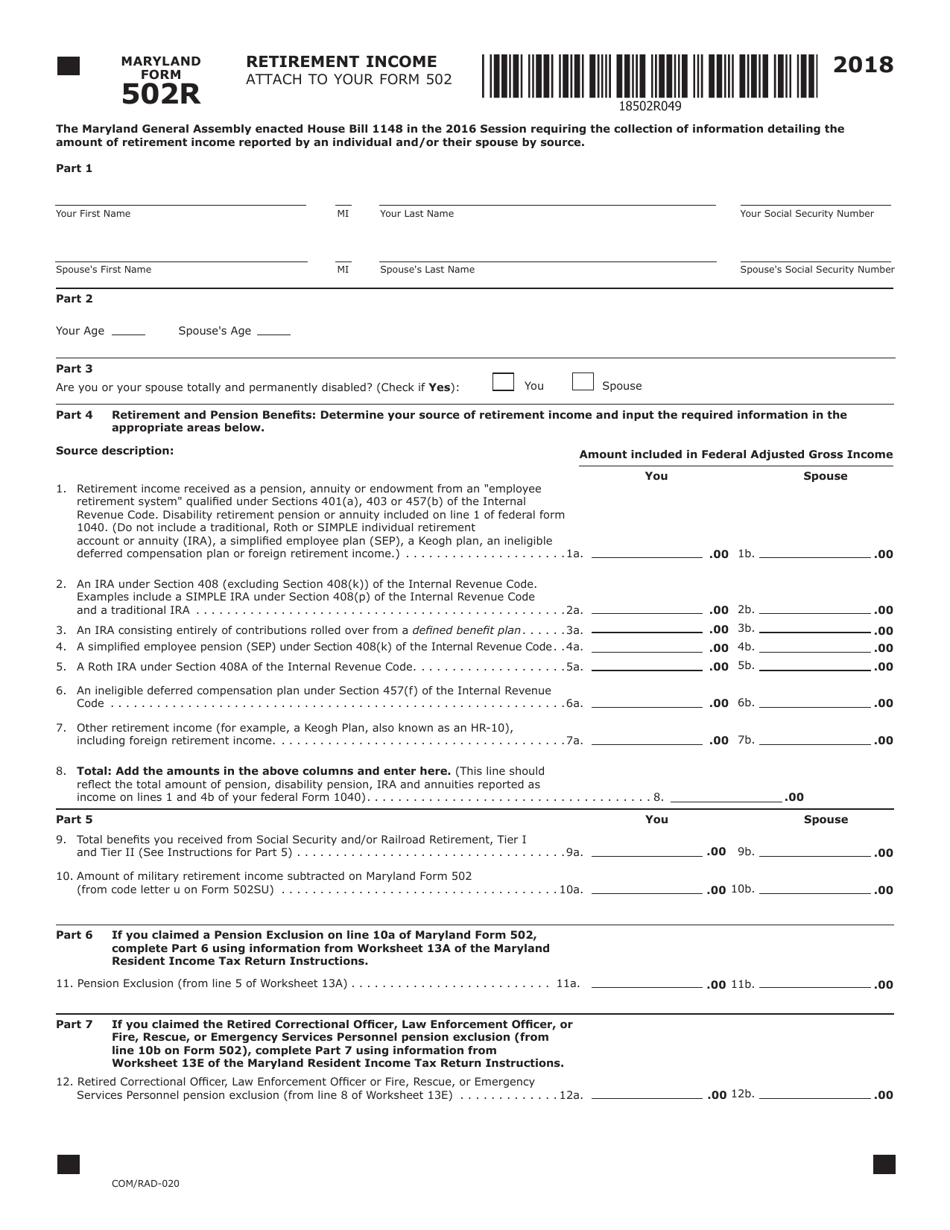

Form COM/RAD020 (Maryland Form 502R) 2018 Fill Out, Sign Online

Read instructions for form 502cr. Instructions for filing personal state and. Taxable net income in other state. Attach to your tax return. Forms are available for downloading in the resident individuals income tax forms section below.

Fillable Maryland Form 502cr Tax Credits For Individuals

Taxable net income in other state. Forms are available for downloading in the resident individuals income tax forms section below. Attach to your tax return. Instructions for filing personal state and. Enter your taxable net income from line 20, form 502 (or line 10, form 504).

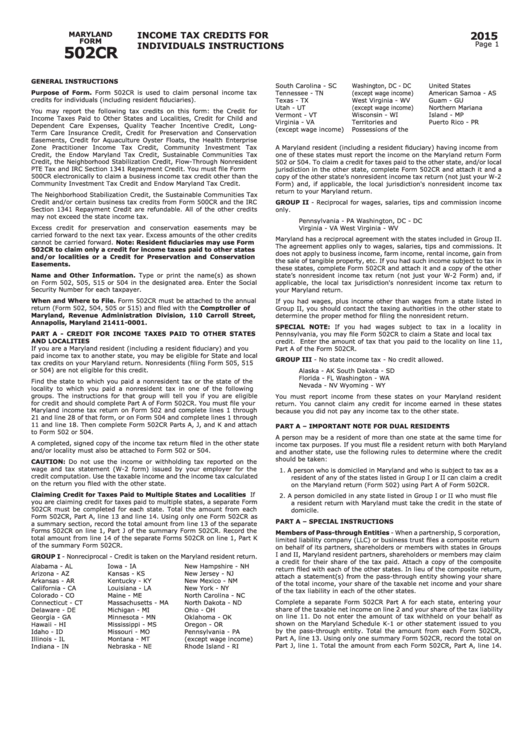

Instructions For Maryland Form 502cr Tax Credits For

You must complete and submit pages 1 through 4 of this form to receive credit. Instructions for filing personal state and. Forms are available for downloading in the resident individuals income tax forms section below. Additional 502crs may be entered for parts a and e only. Read instructions for form 502cr.

Fill Free fillable forms Comptroller of Maryland

Read instructions for form 502cr. Taxable net income in other state. Attach to your tax return. Instructions for filing personal state and. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the.

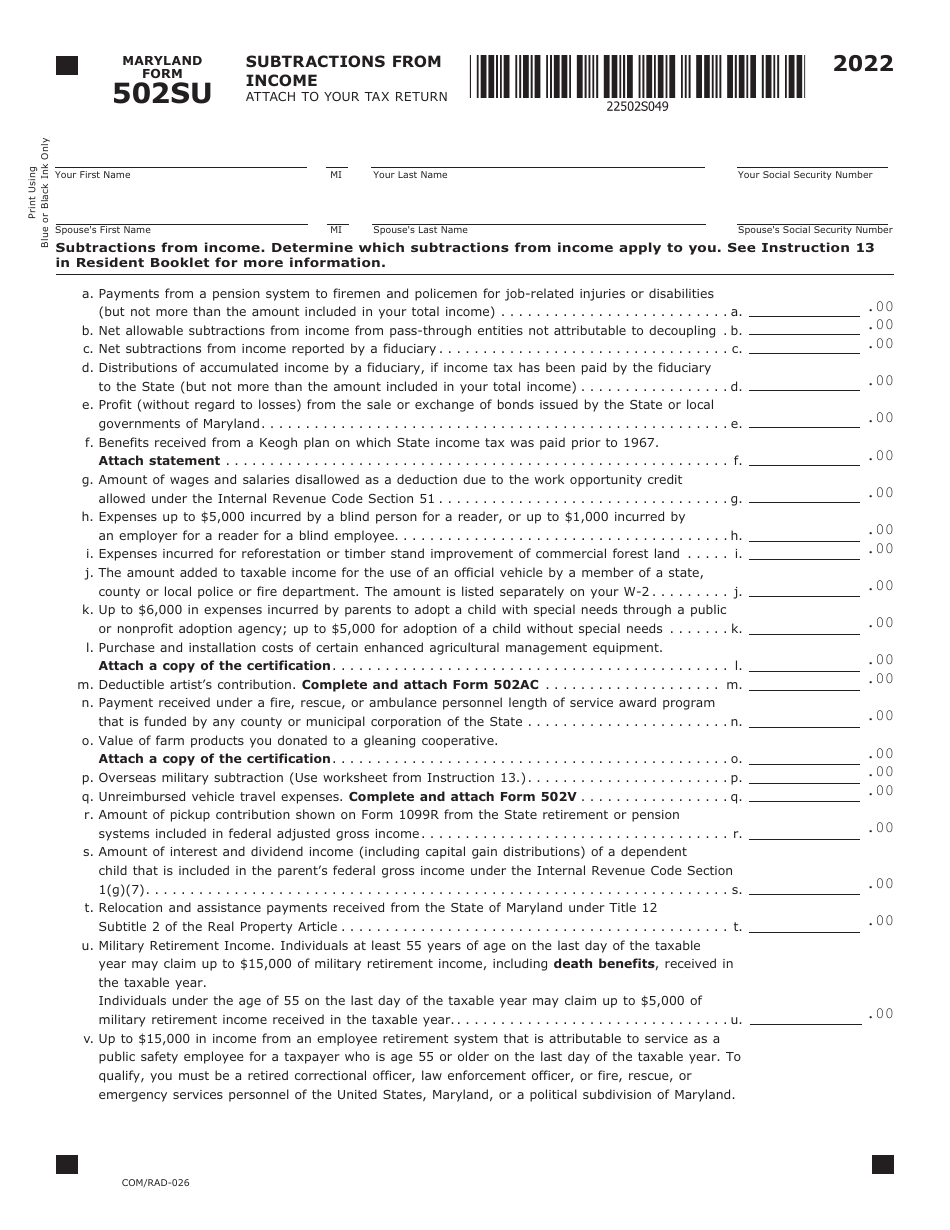

Maryland Form 502SU 2022 Fill Out, Sign Online and

All other areas must be entered on the first 502cr. Attach to your tax return. Additional 502crs may be entered for parts a and e only. Taxable net income in other state. Read instructions for form 502cr.

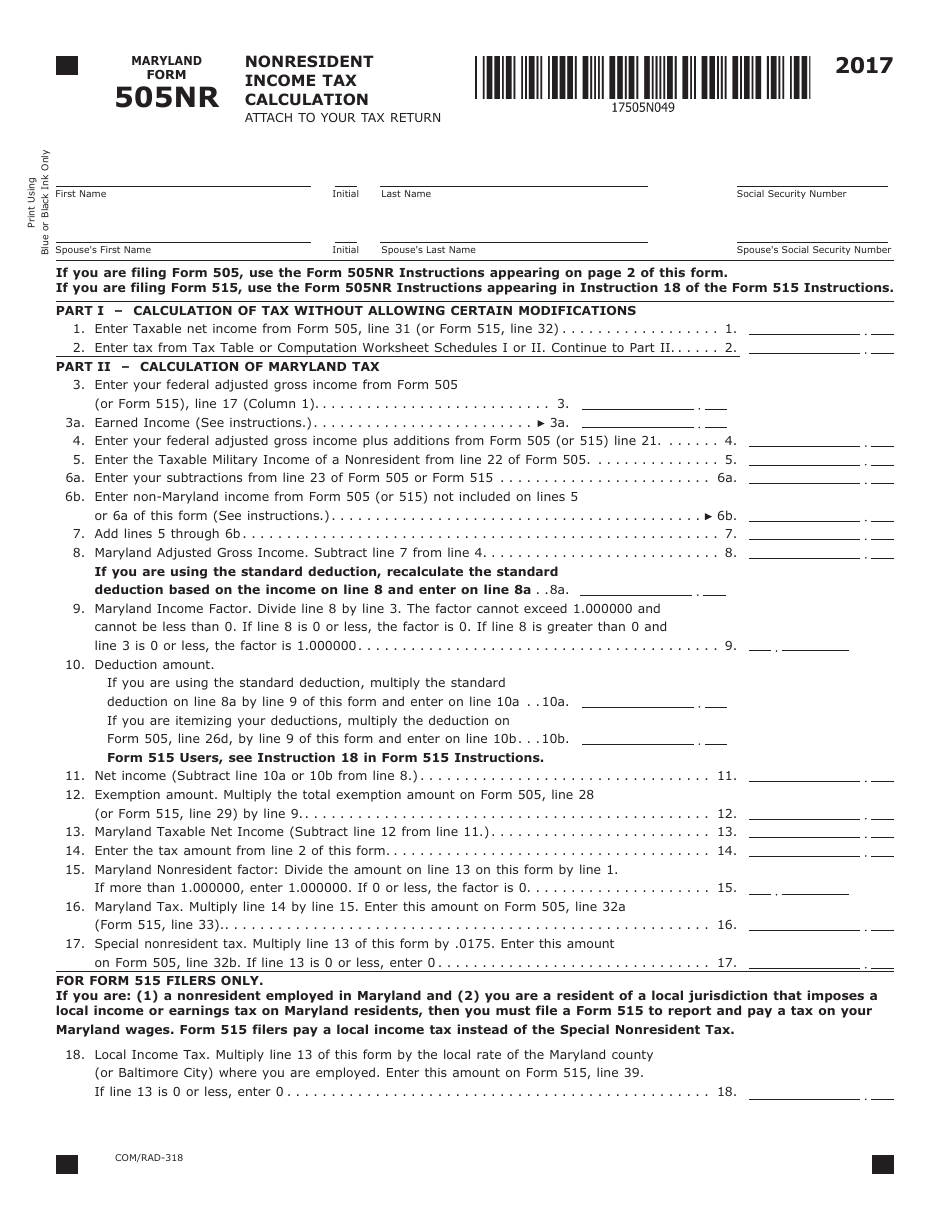

Maryland Form 505NR Download Fillable PDF or Fill Online

Additional 502crs may be entered for parts a and e only. You must complete and submit pages 1 through 4 of this form to receive credit. All other areas must be entered on the first 502cr. Forms are available for downloading in the resident individuals income tax forms section below. Attach to your tax return.

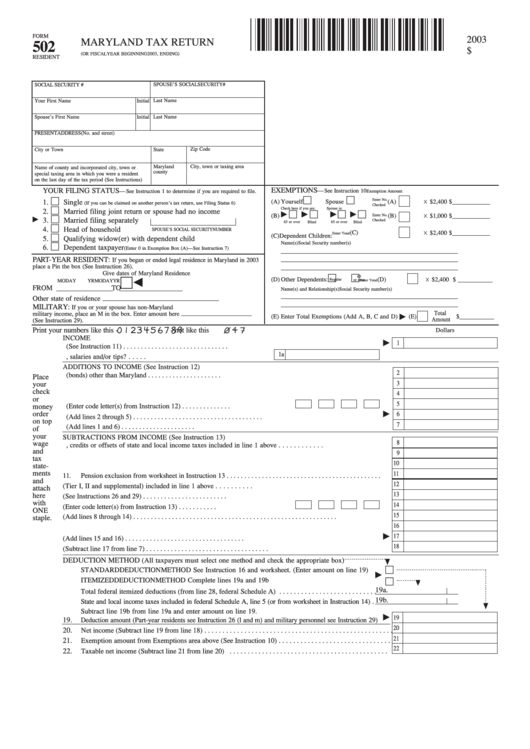

Blank Fillable Maryland Tax Return 502 Fillable Form 2024

Taxable net income in other state. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Forms are available for downloading in the resident individuals income tax forms section below. Read instructions for form 502cr. Enter your.

502CR Maryland Tax Forms and Instructions

Forms are available for downloading in the resident individuals income tax forms section below. Taxable net income in other state. Read instructions for form 502cr. You must complete and submit pages 1 through 4 of this form to receive credit. Instructions for filing personal state and.

Instructions For Filing Personal State And.

Additional 502crs may be entered for parts a and e only. Attach to your tax return. All other areas must be entered on the first 502cr. Enter your taxable net income from line 20, form 502 (or line 10, form 504).

You Must Complete And Submit Pages 1 Through 4 Of This Form To Receive Credit.

Taxable net income in other state. A person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim a credit on the. Read instructions for form 502cr. Forms are available for downloading in the resident individuals income tax forms section below.