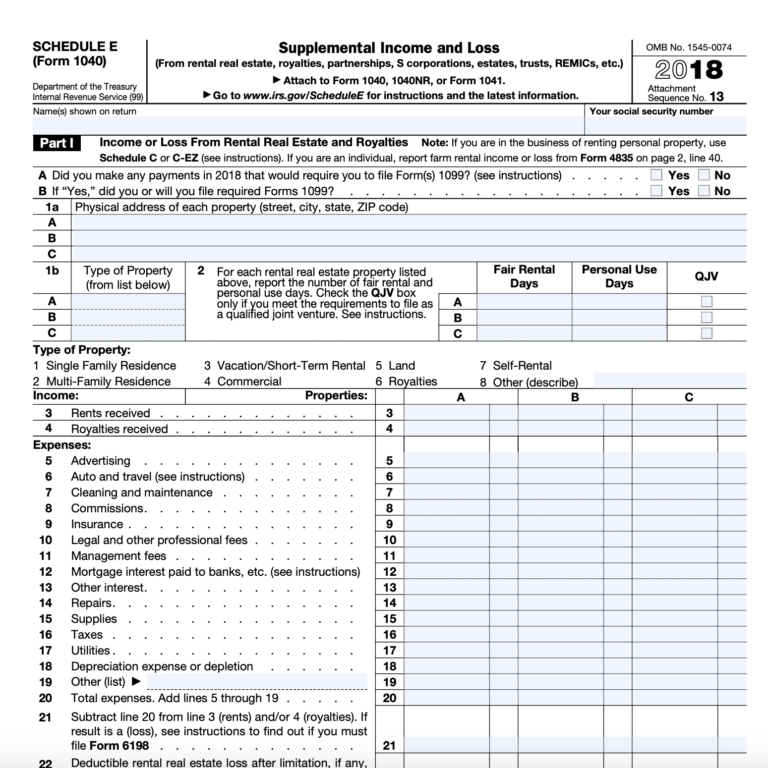

Louisiana Tax Form Schedule E

Louisiana Tax Form Schedule E - If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. These 2023 forms and more are available: Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas

33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. These 2023 forms and more are available: Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas

33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. These 2023 forms and more are available: Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual.

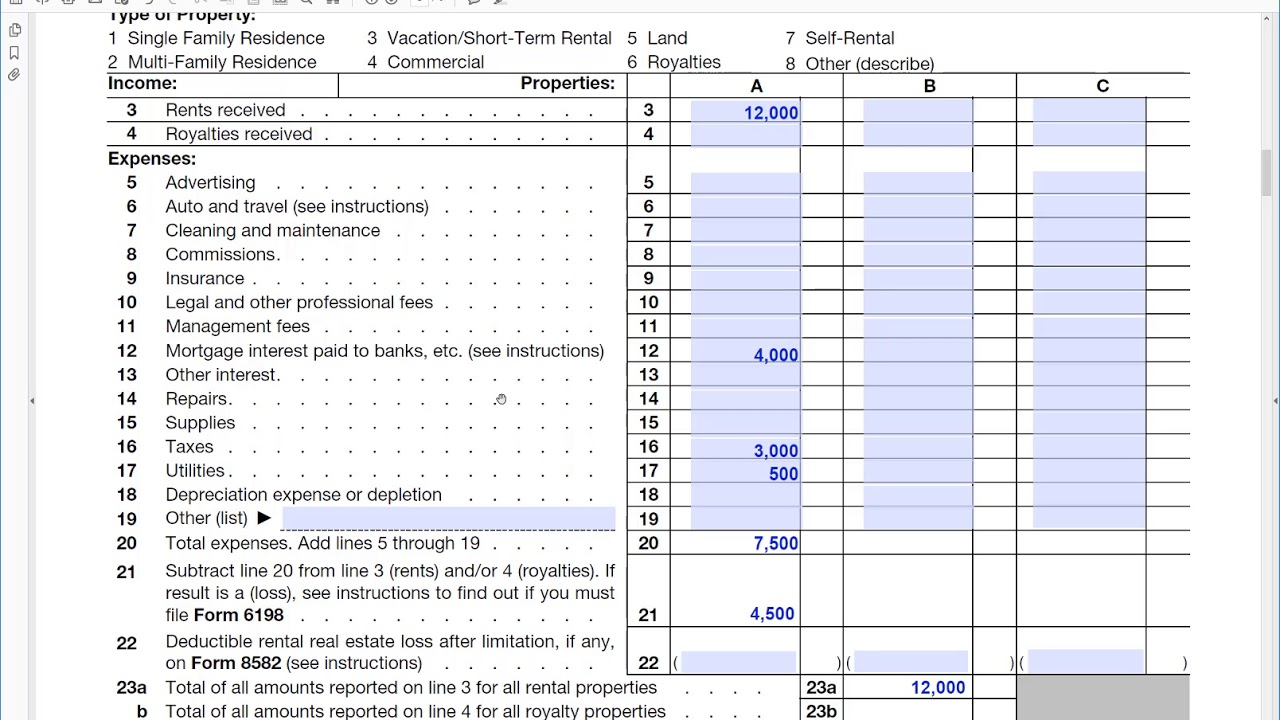

Schedule E Rental Expenses

If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. These 2023 forms and more are available: 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Schedule of ad valorem tax.

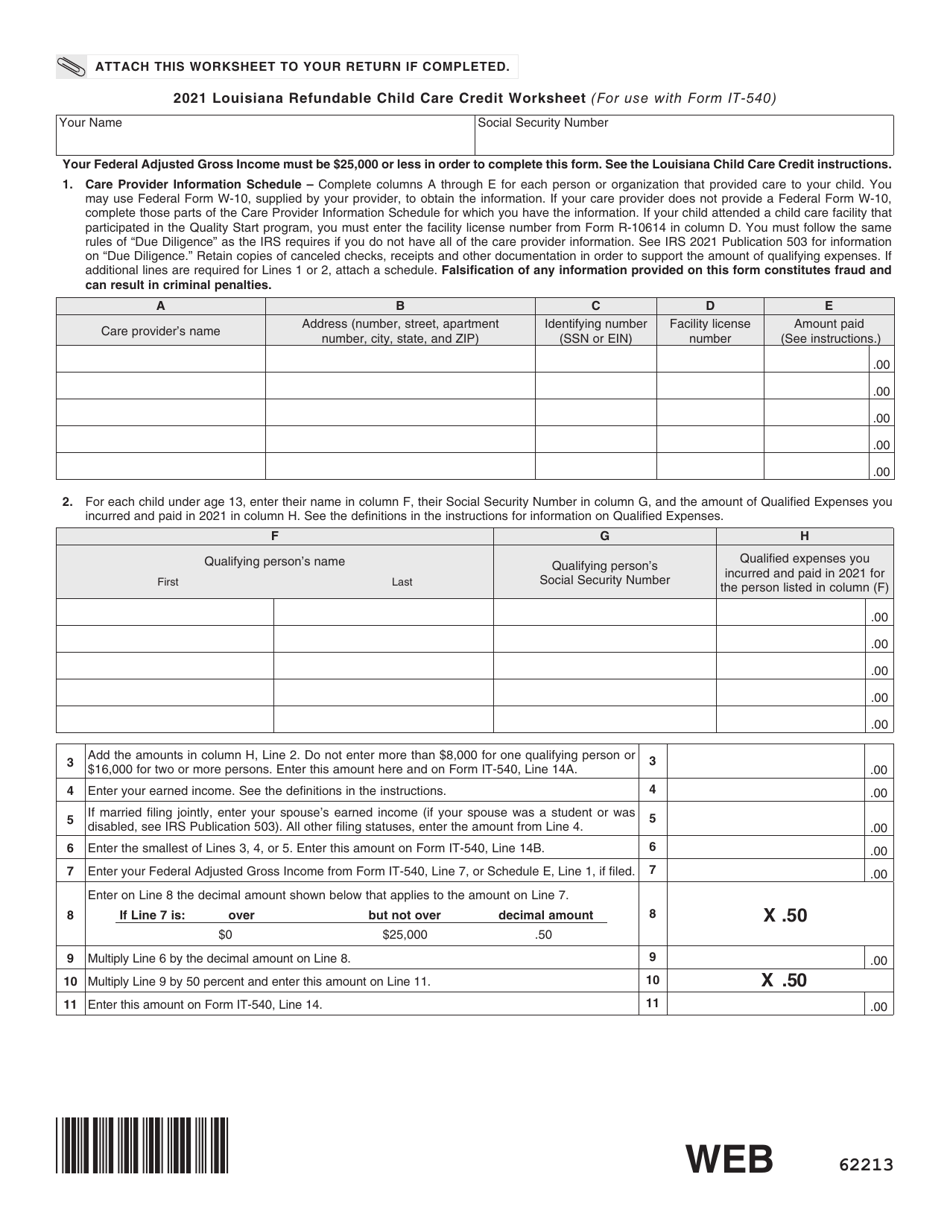

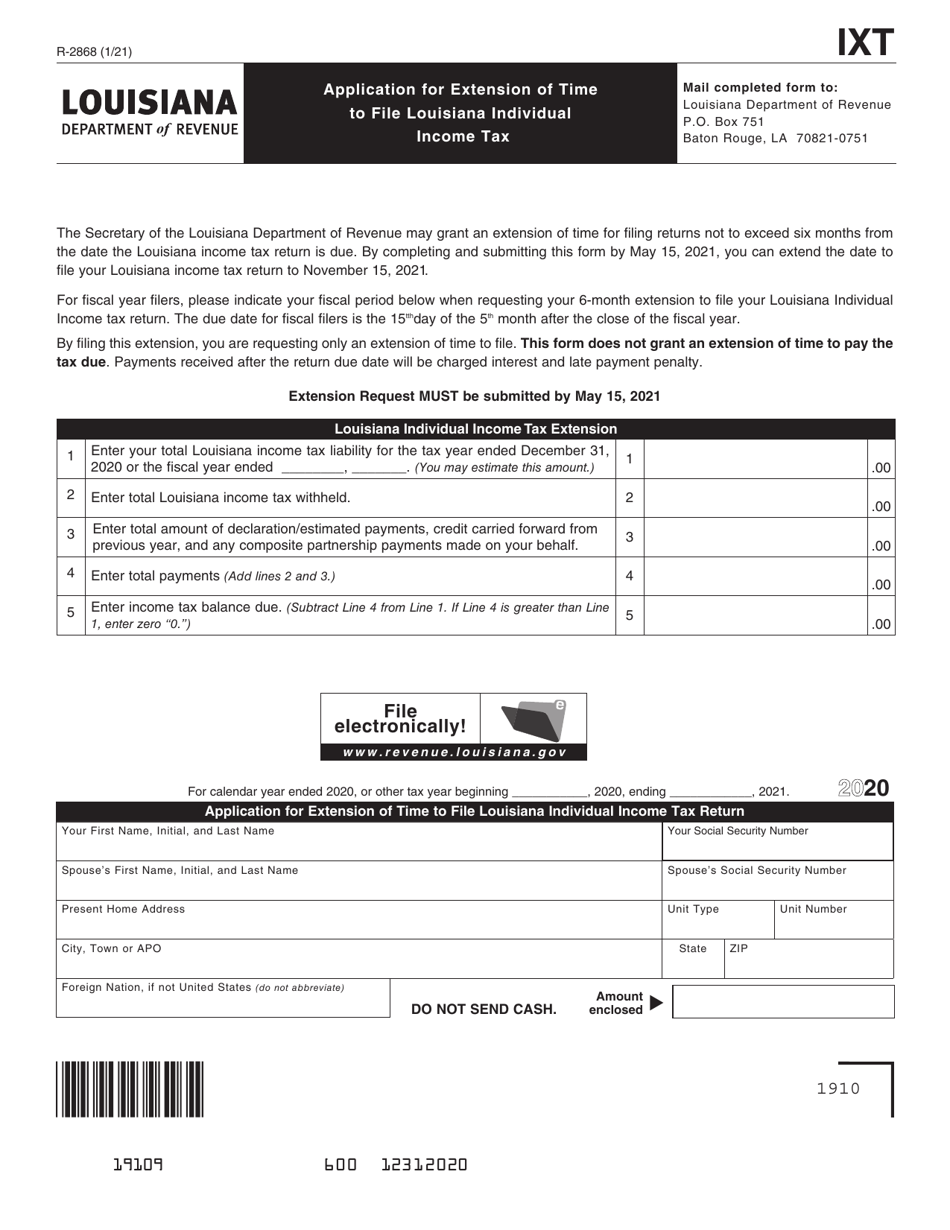

Form IT540 2021 Fill Out, Sign Online and Download Fillable PDF

If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers.

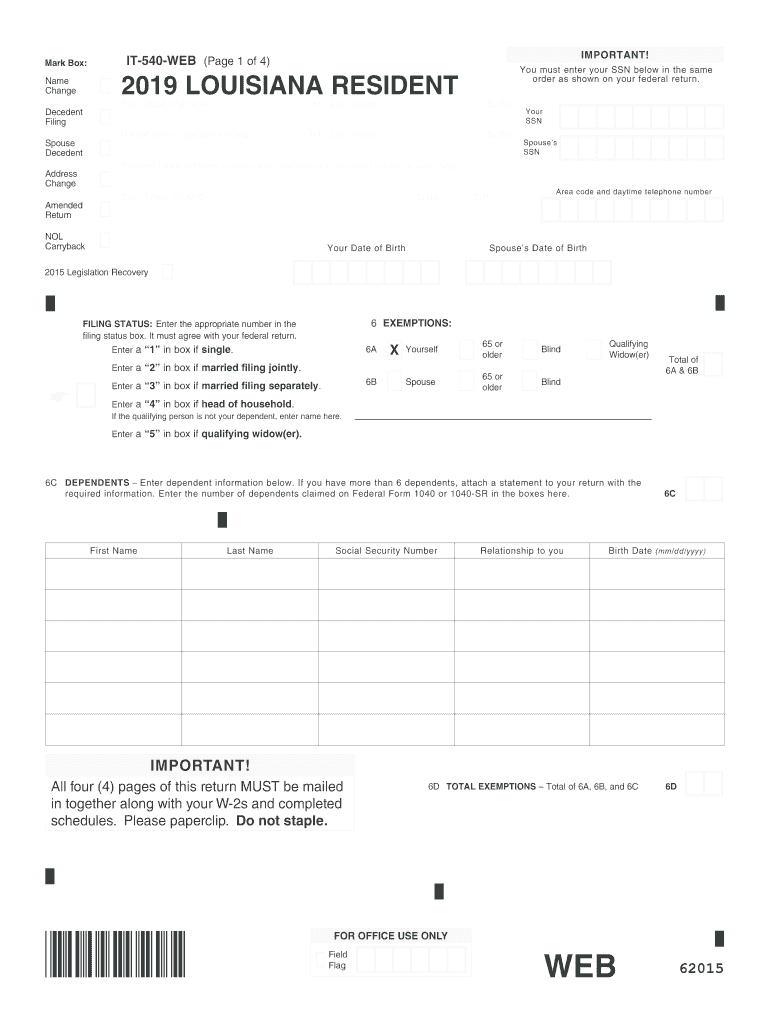

Louisiana Amendment it 540 20192024 Form Fill Out and Sign Printable

Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax.

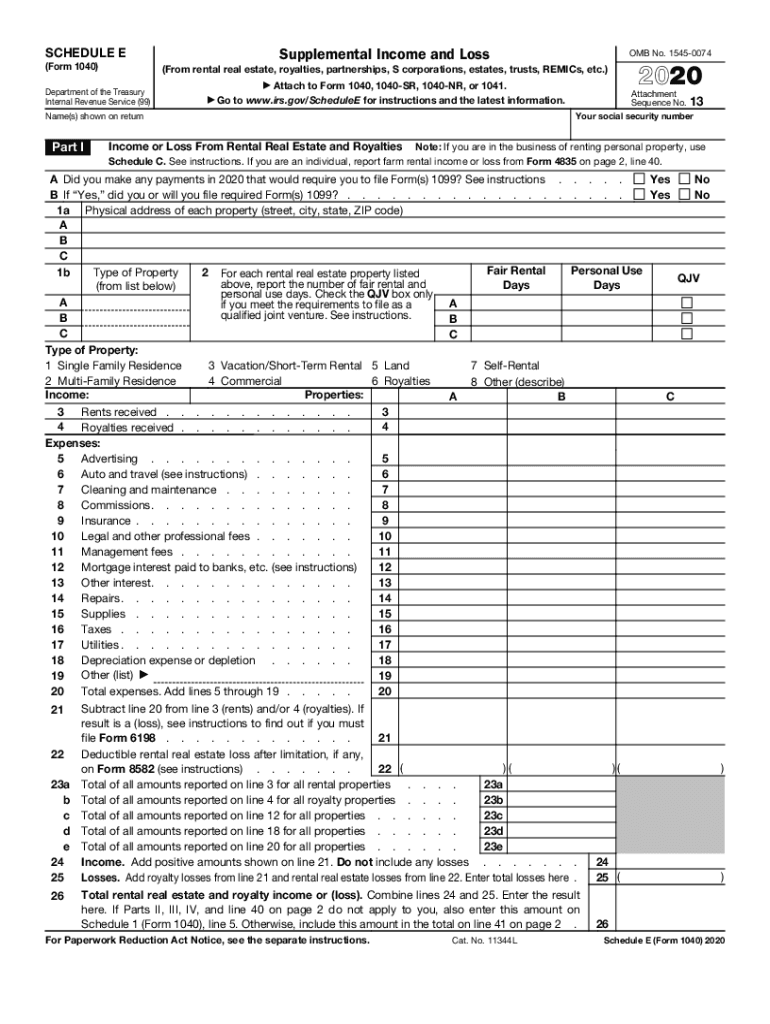

Schedule E 1040 20202024 Form Fill Out and Sign Printable PDF

These 2023 forms and more are available: Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas 33 rows louisiana has a state income tax that.

Schedule E Worksheet Property Description

33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. These 2023 forms and more are available: Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. If you have any exempt income or deductions other.

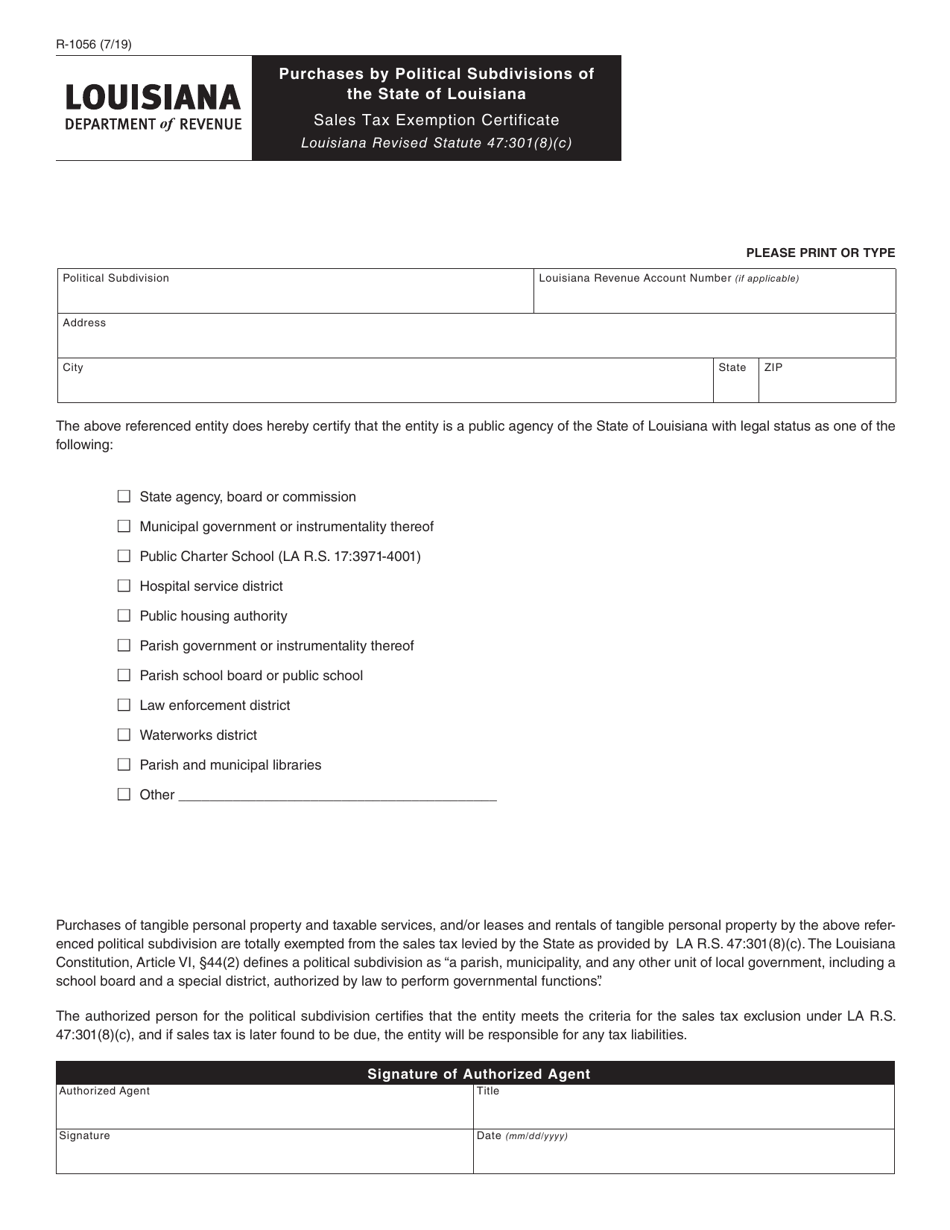

Form R1056 Download Fillable PDF or Fill Online Certificate of Sales

These 2023 forms and more are available: Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas If you have any exempt income or deductions other.

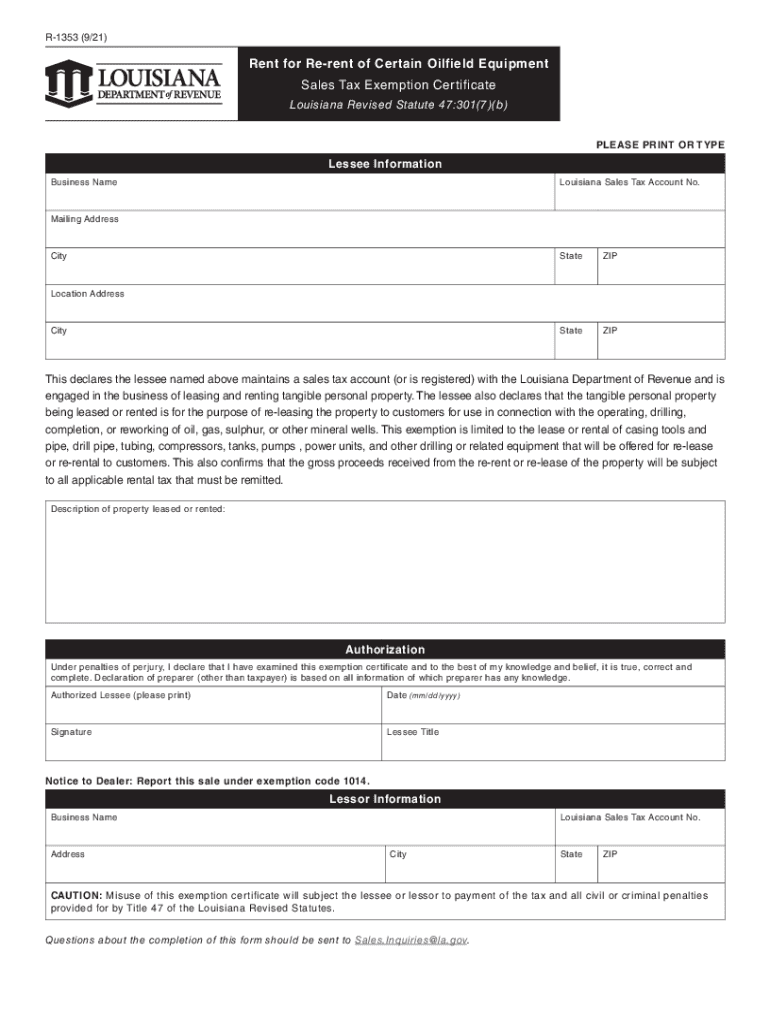

Lgst 9rr Complete with ease airSlate SignNow

33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships,.

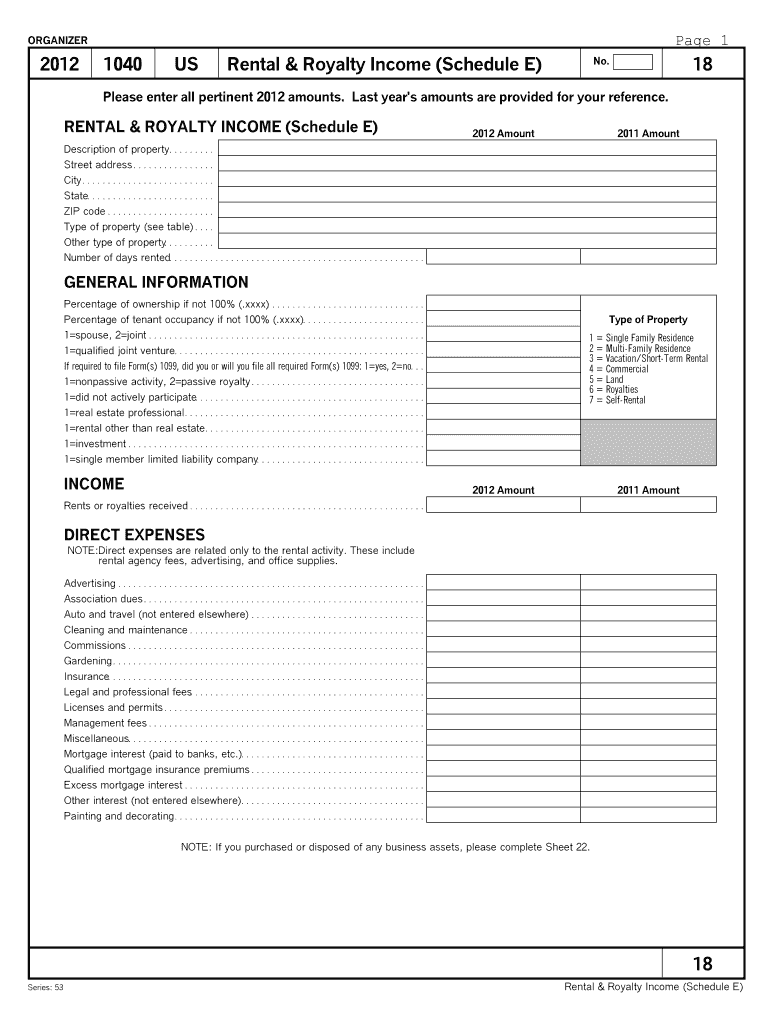

Printable Tax Schedule E 20122024 Form Fill Out and Sign Printable

Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. These 2023 forms and more are available: Use schedule e (form 1040).

louisiana inheritance tax return form Deluxe Web Log Navigateur

33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas These 2023 forms and more are available: If you have any exempt income or deductions other.

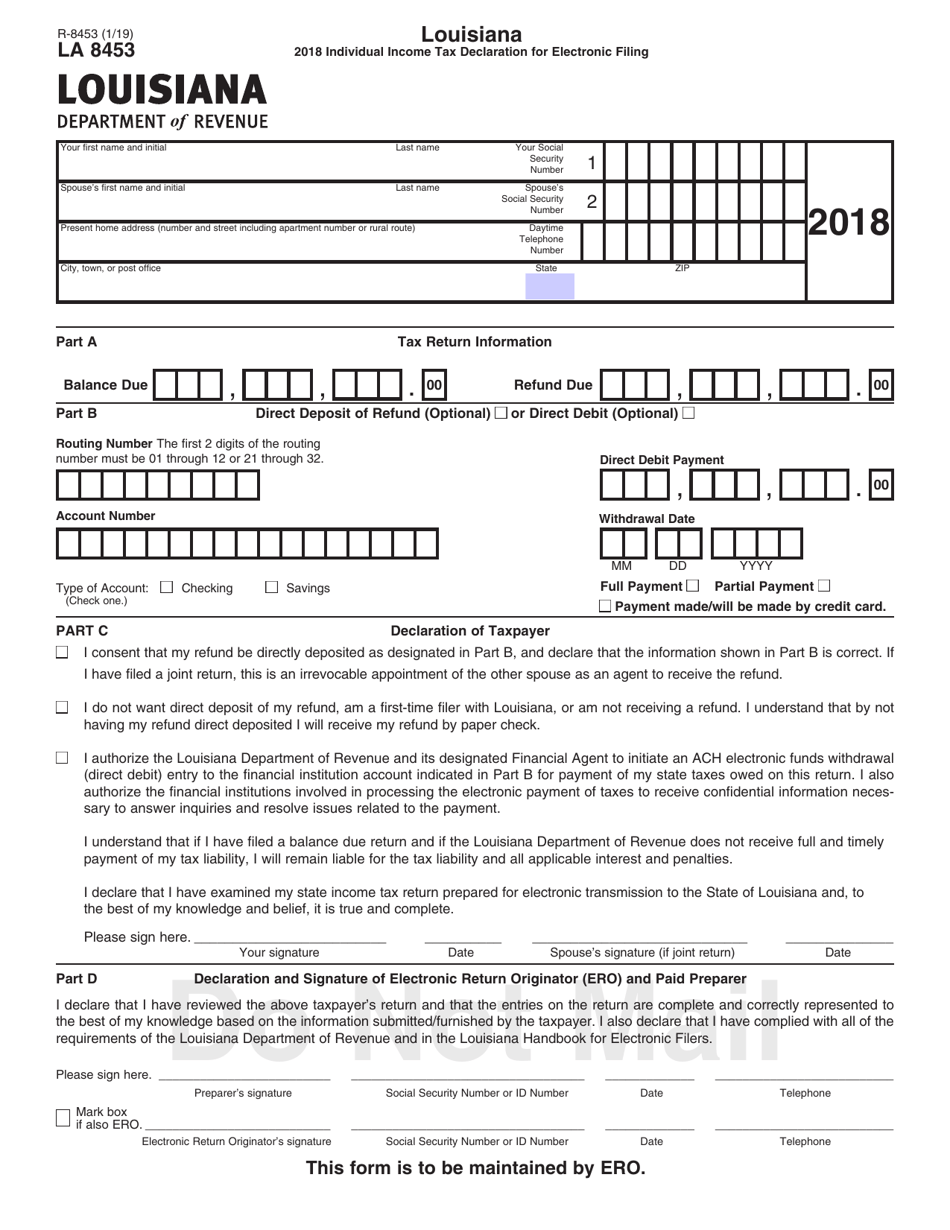

Form R8453 2018 Fill Out, Sign Online and Download Fillable PDF

33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. Schedule of ad valorem tax credit claimed by manufactures, distributors and retailers for ad valorem tax paid on inventory or natural gas If you have any exempt income or deductions other than what is reported on line 8d,.

Schedule Of Ad Valorem Tax Credit Claimed By Manufactures, Distributors And Retailers For Ad Valorem Tax Paid On Inventory Or Natural Gas

If you have any exempt income or deductions other than what is reported on line 8d, you need to complete schedule e to determine your louisiana. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. 33 rows louisiana has a state income tax that ranges between 1.85% and 4.25%, which is administered by the louisiana department of. These 2023 forms and more are available: