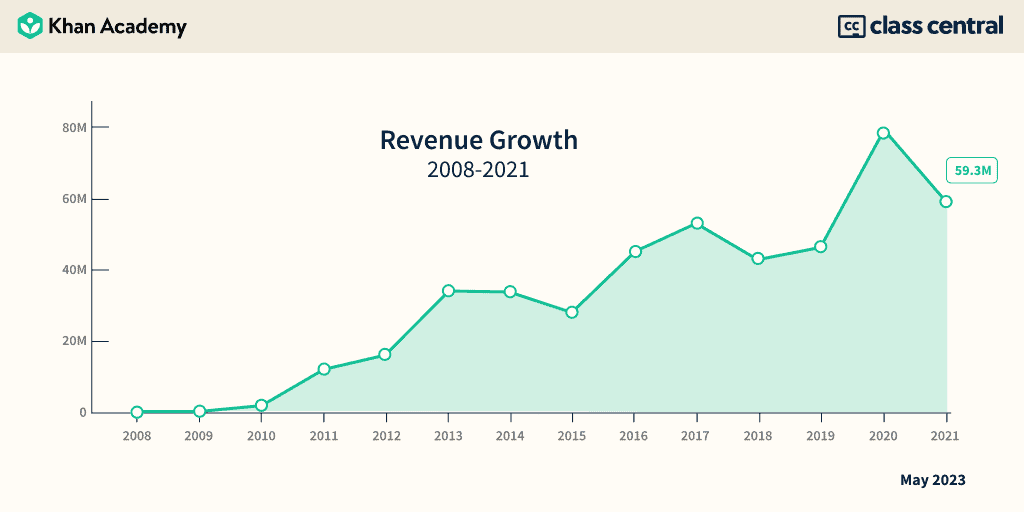

Khan Academy Revenue

Khan Academy Revenue - In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. (the academy), which comprise the consolidated. Children are born ready to. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. We have audited the consolidated financial statements of khan academy, inc. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Students—about 5 million learners—every year.

Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. Children are born ready to. We have audited the consolidated financial statements of khan academy, inc. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. (the academy), which comprise the consolidated. Students—about 5 million learners—every year. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s.

(the academy), which comprise the consolidated. We have audited the consolidated financial statements of khan academy, inc. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. Children are born ready to. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Students—about 5 million learners—every year. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher.

Khan Academy Tax Returns Analysis (20082020) 390M in Revenue, 118M

Children are born ready to. Students—about 5 million learners—every year. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. We have audited the consolidated.

Khan Academy Finding North

(the academy), which comprise the consolidated. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. In 2019, 2.7 million students.

o9 Solutions corporate yearend grant donation to Khan academy o9

In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. Children are born ready to. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. (the academy), which comprise the consolidated. We have audited the consolidated financial statements of khan academy, inc.

The Business of Online Education Khan Academy Tax Returns Analysis

Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. We have audited the consolidated financial statements of khan academy, inc. (the academy), which comprise the consolidated. Children are born ready to. Students—about 5 million learners—every year.

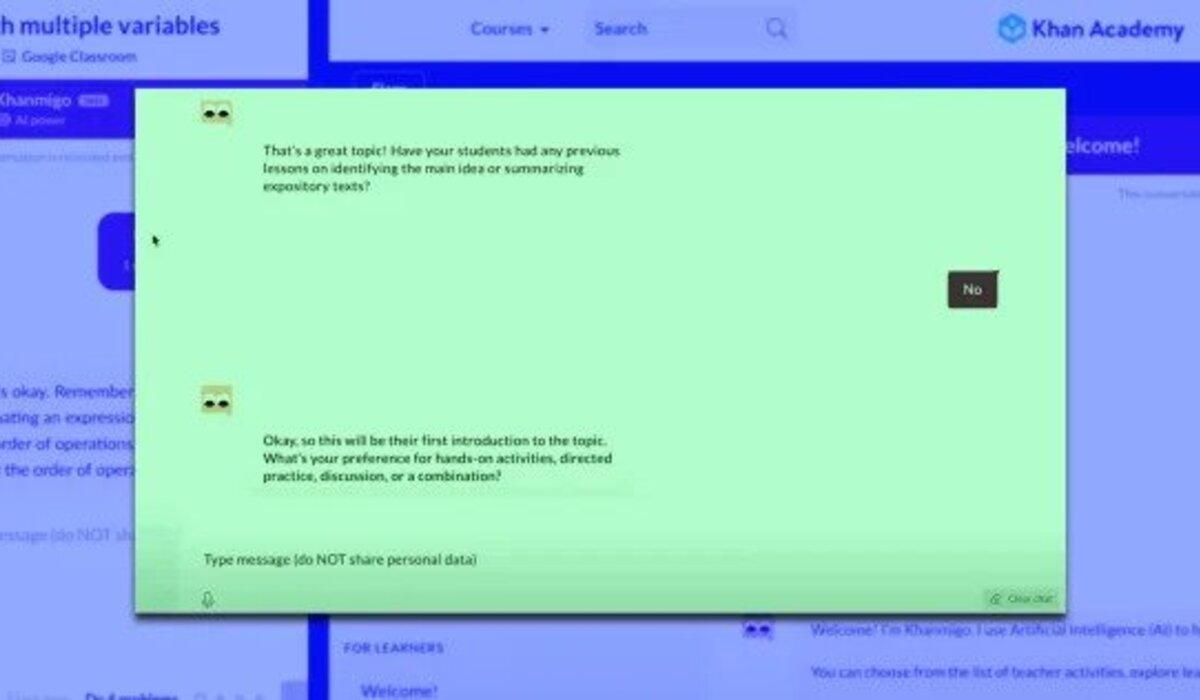

Khan Academy Is Working On A Version Of GPT Called Khanmingo

In 2019, 2.7 million students signed up for khan academy’s official sat practice—a 17% increase from the year before. (the academy), which comprise the consolidated. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. Khan academy has set an ambitious goal to accelerate.

Khan Academy Success Story How This Educational Platform Is Providing

Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. We have audited the consolidated financial statements of khan academy, inc. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher..

The Business of Online Education Khan Academy Tax Returns Analysis

(the academy), which comprise the consolidated. Children are born ready to. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Students—about 5 million learners—every year.

Exploring Khan Academy's Diverse Revenue Model How Much Money Does

Children are born ready to. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. (the academy), which comprise the consolidated. We have audited the consolidated financial statements of khan academy, inc.

How Does Khan Academy Make Money? Exploring the Business Model of the

Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Students—about 5 million learners—every year. Our latest study finds that using khan academy for 30+ minutes per week (18+ hours over the school year) leads to ~20% higher. We have audited the consolidated financial statements of khan academy, inc. Children are born ready to.

Khan Academy Tax Returns Analysis (20082020) 390M in Revenue, 118M

(the academy), which comprise the consolidated. Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in. In 2019, 2.7 million students signed up for khan academy’s official sat practice—a.

In 2019, 2.7 Million Students Signed Up For Khan Academy’s Official Sat Practice—A 17% Increase From The Year Before.

Khan academy has set an ambitious goal to accelerate the learning of 10% of u.s. (the academy), which comprise the consolidated. Children are born ready to. Every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless they make less than $200,000 in.

Our Latest Study Finds That Using Khan Academy For 30+ Minutes Per Week (18+ Hours Over The School Year) Leads To ~20% Higher.

Students—about 5 million learners—every year. We have audited the consolidated financial statements of khan academy, inc.