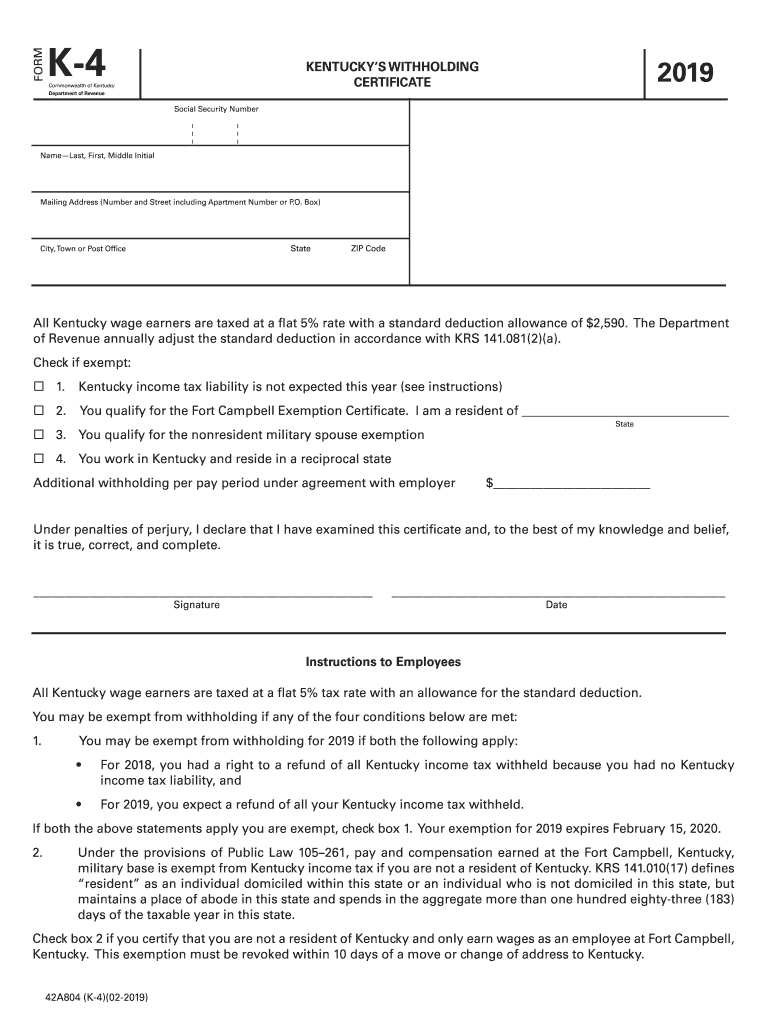

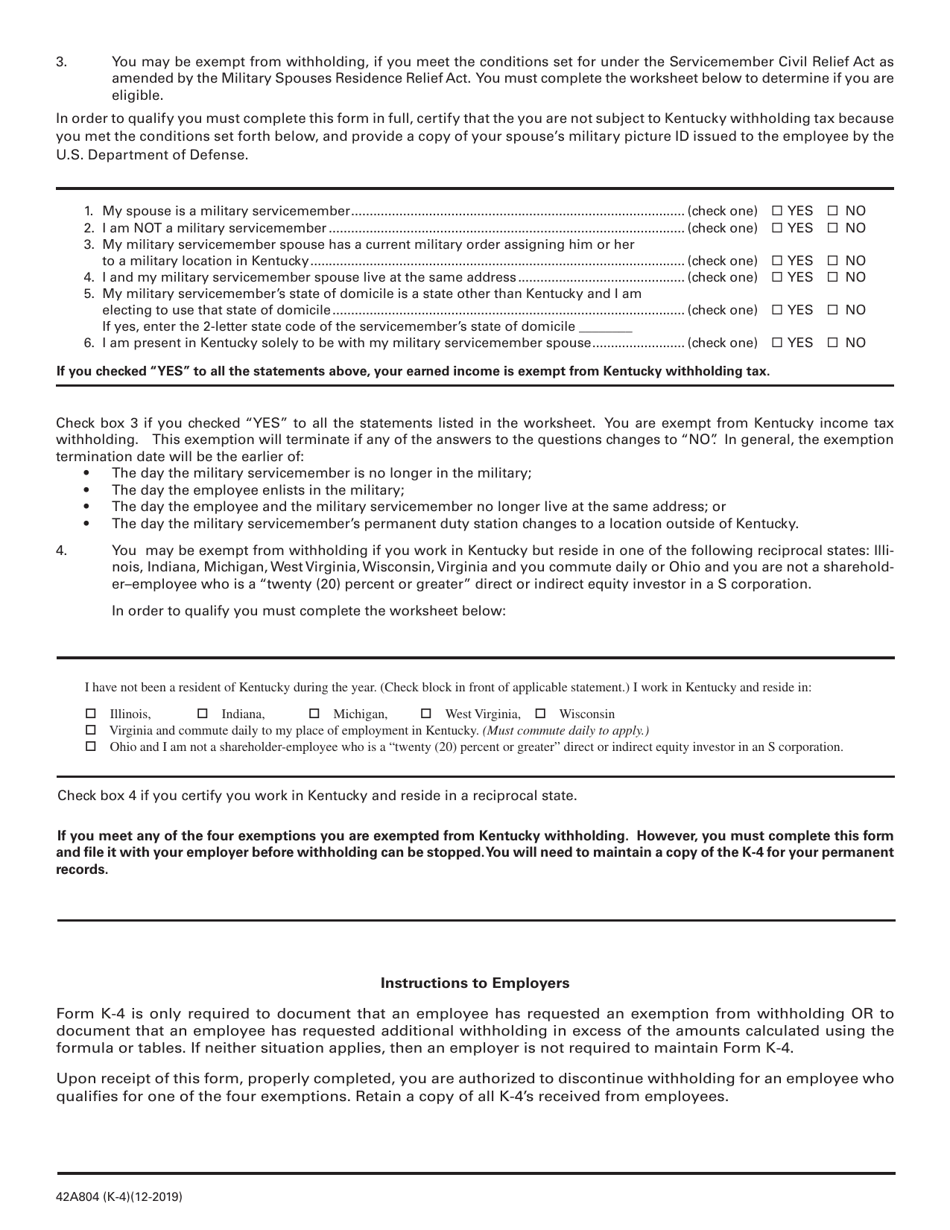

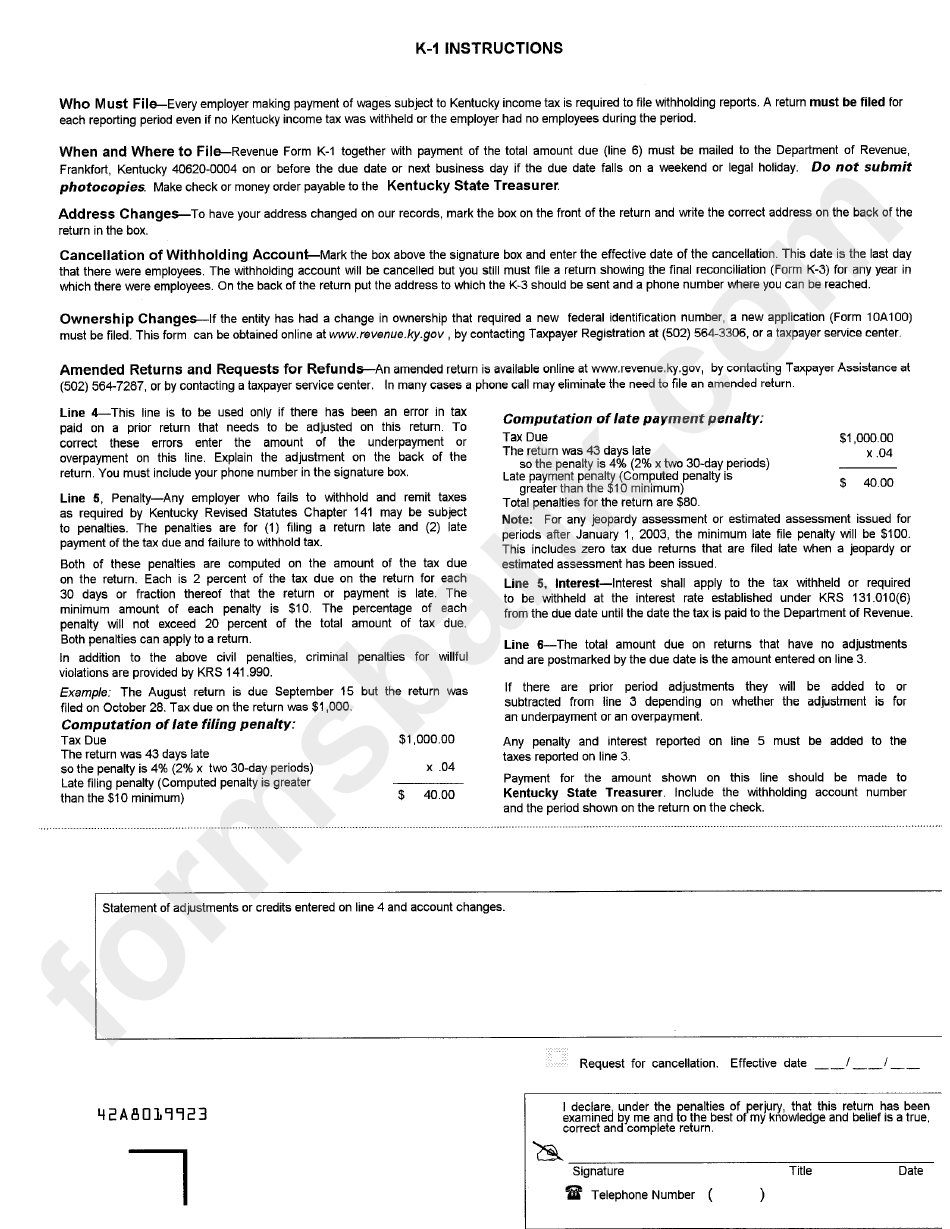

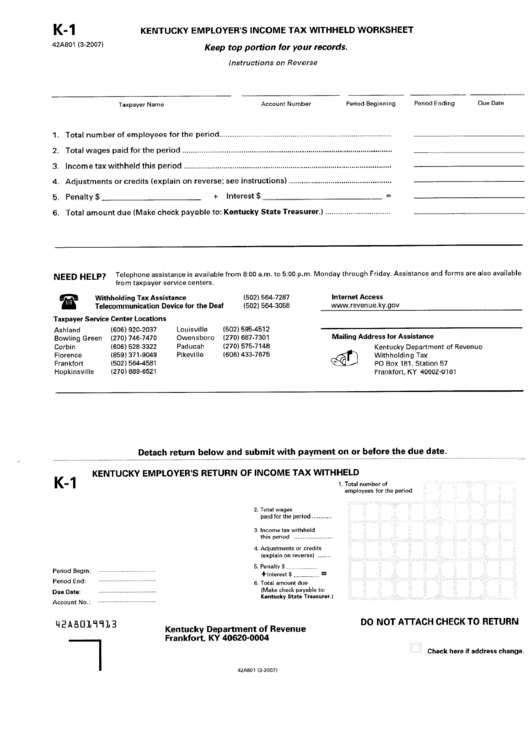

K 1 Kentucky Withholding Form

K 1 Kentucky Withholding Form - To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. You may be exempt from.

All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. You may be exempt from.

Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. You may be exempt from. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction.

2022 Wisconsin State Withholding Form

All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. You may be exempt from. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue.

Kentucky Withholding Tax Registration Form

To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. You may be exempt from. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance.

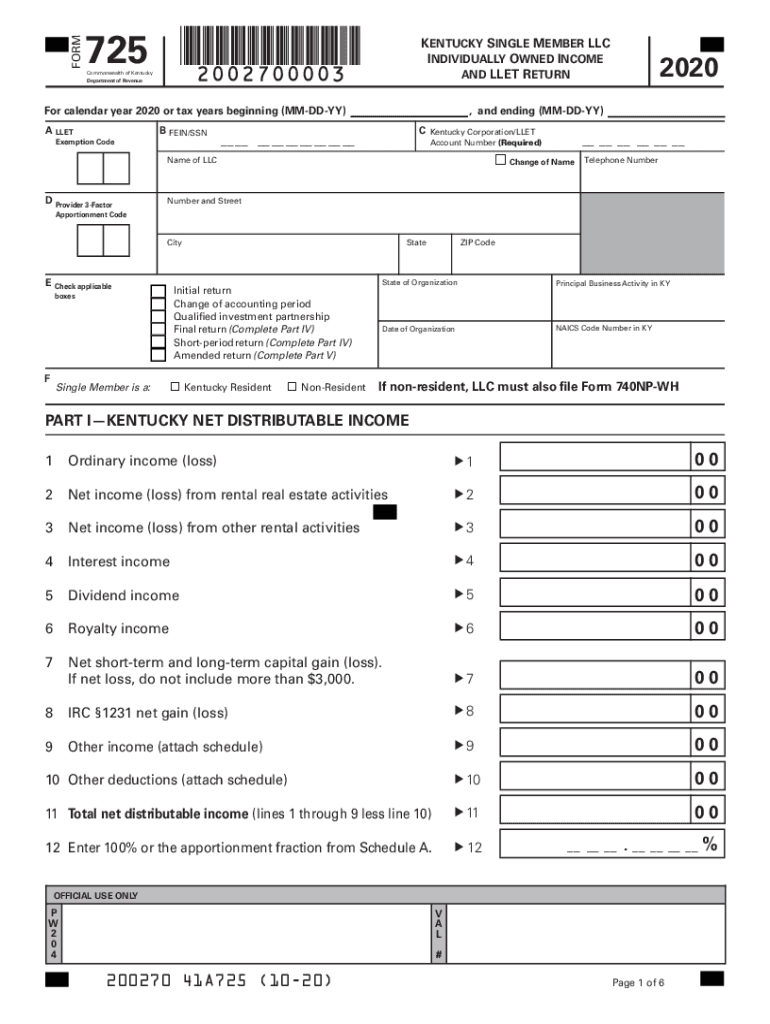

725 Kentucky 20202024 Form Fill Out and Sign Printable PDF Template

Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. You.

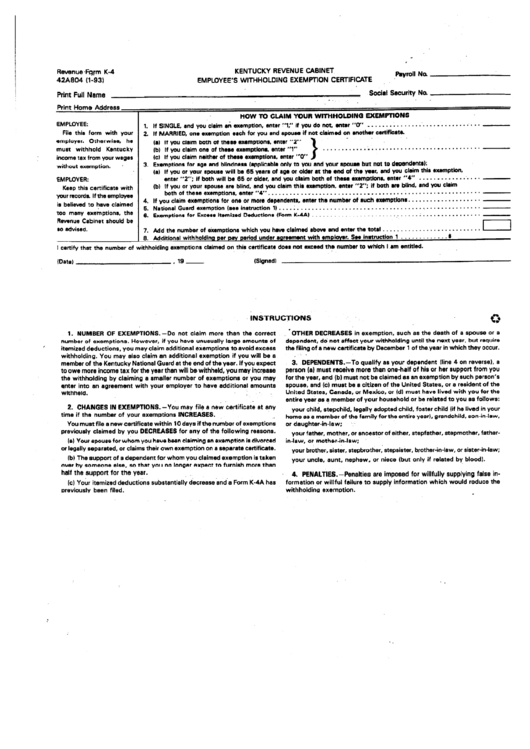

Form K4 (42A804) 2020 Fill Out, Sign Online and Download Printable

Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. You may be exempt from. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue.

Form K1 Kentucky Employer'S Tax Withheld Worksheet (Page 2 of

To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. You.

Fillable Form K4 (193) Employee'S Withholding Exemption Certificate

You may be exempt from. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue.

Kentucky Guardian Withholding Form US Legal Forms

To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. You may be exempt from. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance.

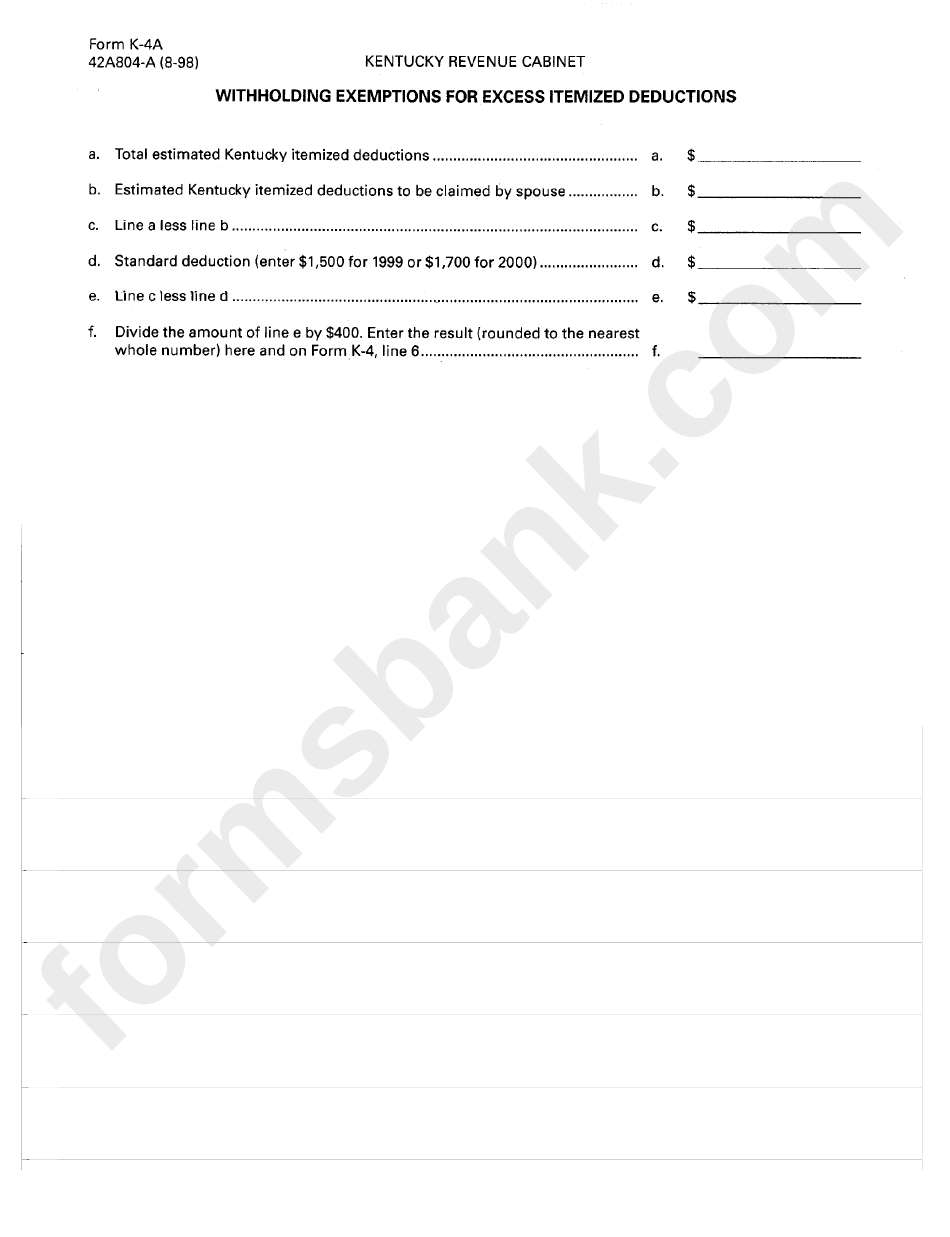

Form K4a Withholding Exemptions For Excess Itemized Deductions

Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. You may be exempt from. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance.

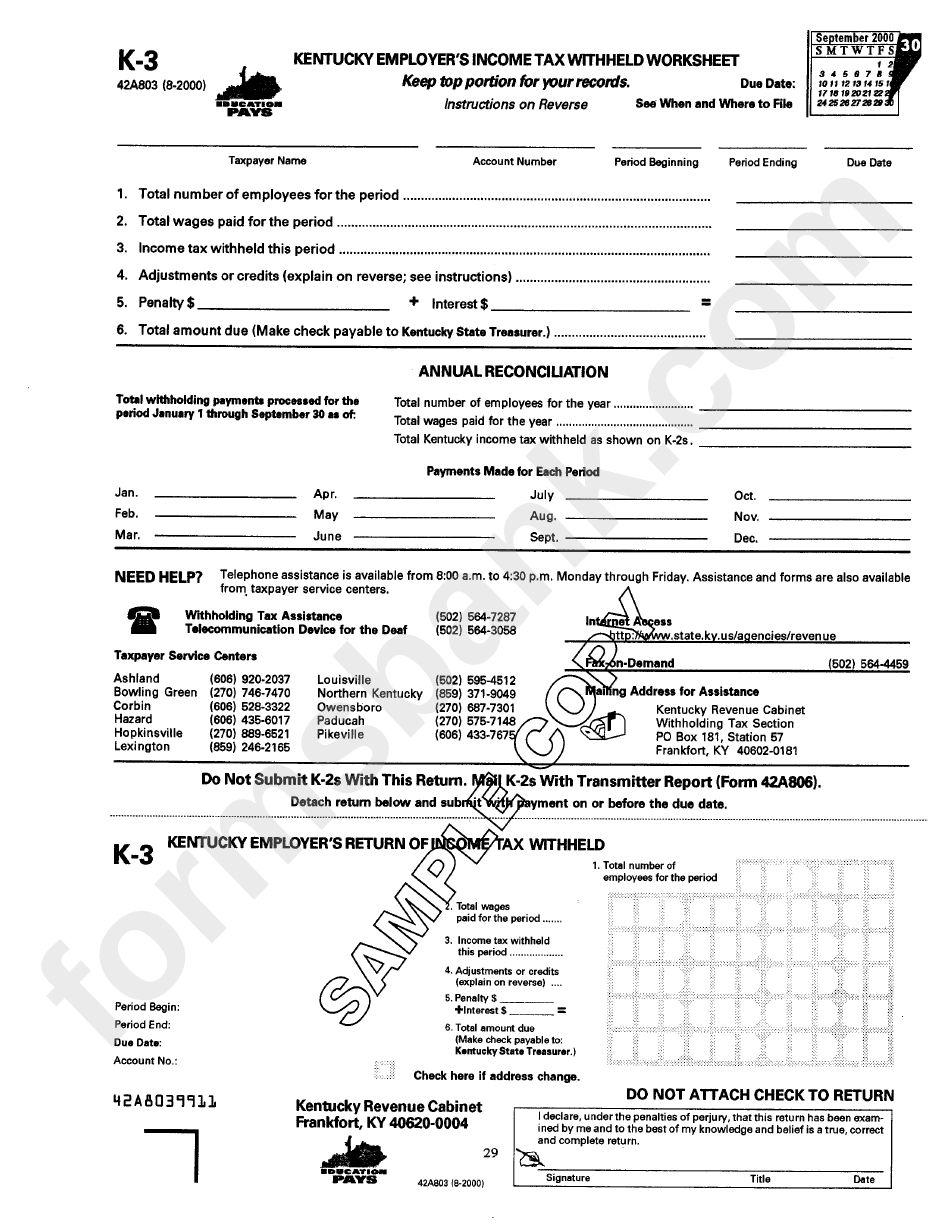

Form K3 Kentucky Employer'S Tax Withheld Worksheet printable

All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. You may be exempt from. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue.

Ky State Withholding Form 2024 Cordy Dominga

You may be exempt from. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports. All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue.

To Make Kentucky Withholding Tax Payments, You Must Be Registered With The Kentucky Department Of Revenue One Stop Business Portal.

All kentucky wage earners are taxed at a flat 4% tax rate with an allowance for the standard deduction. You may be exempt from. Who must file every employer making payment of wages subject to kentucky income tax is required to file withholding reports.