Is Form 8332 Mandatory

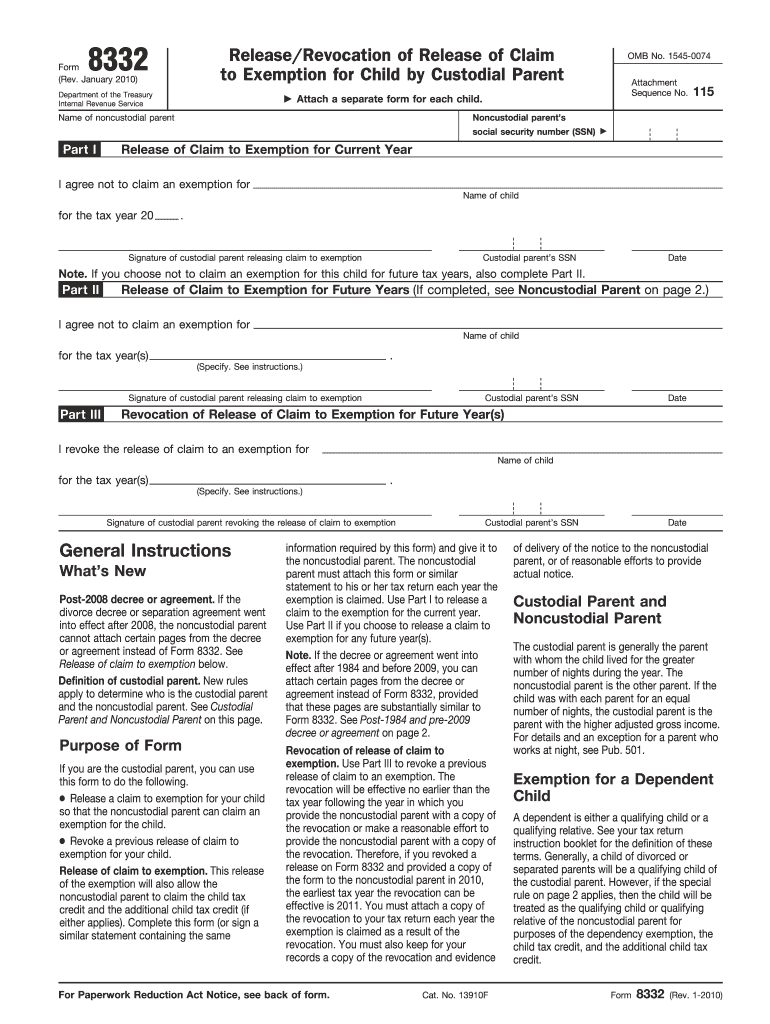

Is Form 8332 Mandatory - Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent.

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent.

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who.

8331 8332 HL 2 8767 Solo Tile Studio

Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial.

Form 8332 Edit, Fill, Sign Online Handypdf

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining.

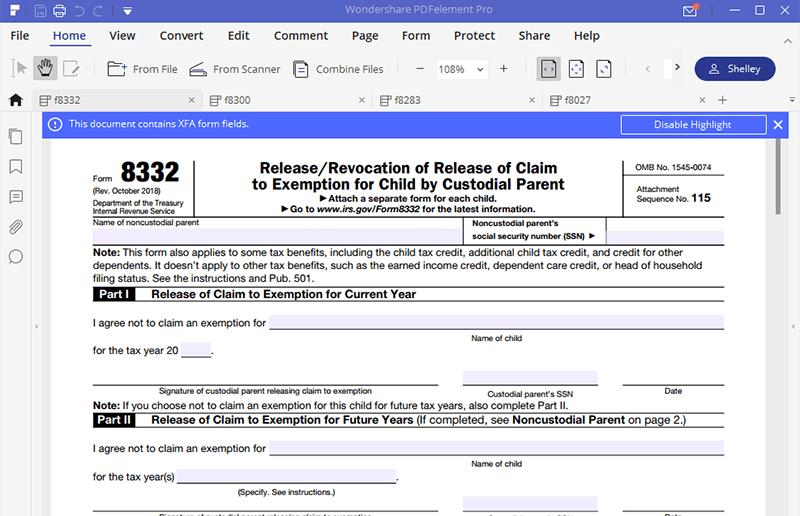

Irs Form 8332 Printable

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining.

IRS Form 8332 walkthrough ARCHIVED COPY READ COMMENTS ONLY YouTube

Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial.

A brief guide on filing IRS Form 8332 for release of dependency exemption

Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial.

IRS Form 8332 Fill it with the Best PDF Form Filler

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial.

Tax Form 8332 Printable

Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial.

Form 8332, Release of Claim to Exemption YouTube

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining.

IRS Form 8332 Explained Claiming Dependents and Benefits

Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial.

Form 8332 Fill out & sign online DocHub

Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial.

Form 8332 Is The Form Custodial Parents Can Use To Release Their Right To Claim A Child As A Dependent To The Noncustodial Parent.

Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent,.