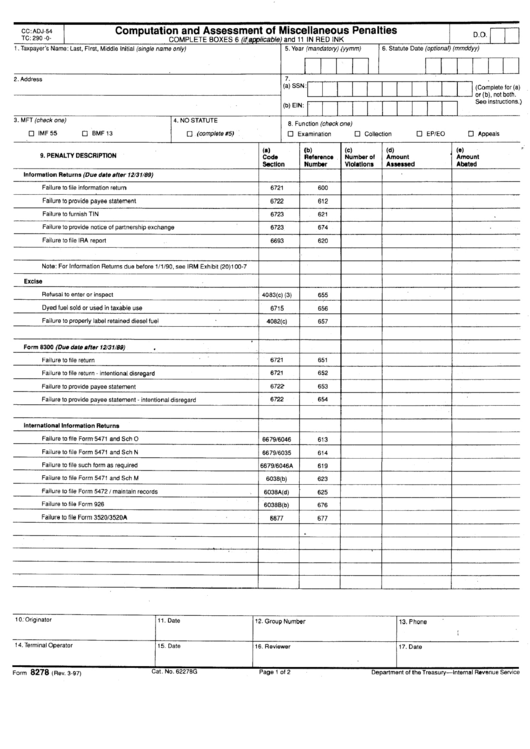

Irs Tax Form 8278

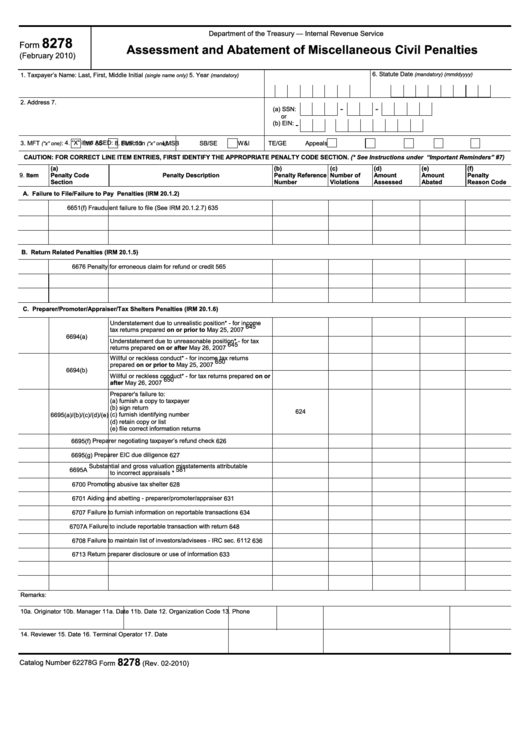

Irs Tax Form 8278 - Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs.

Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs.

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. It is essential for taxpayers seeking to resolve. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886.

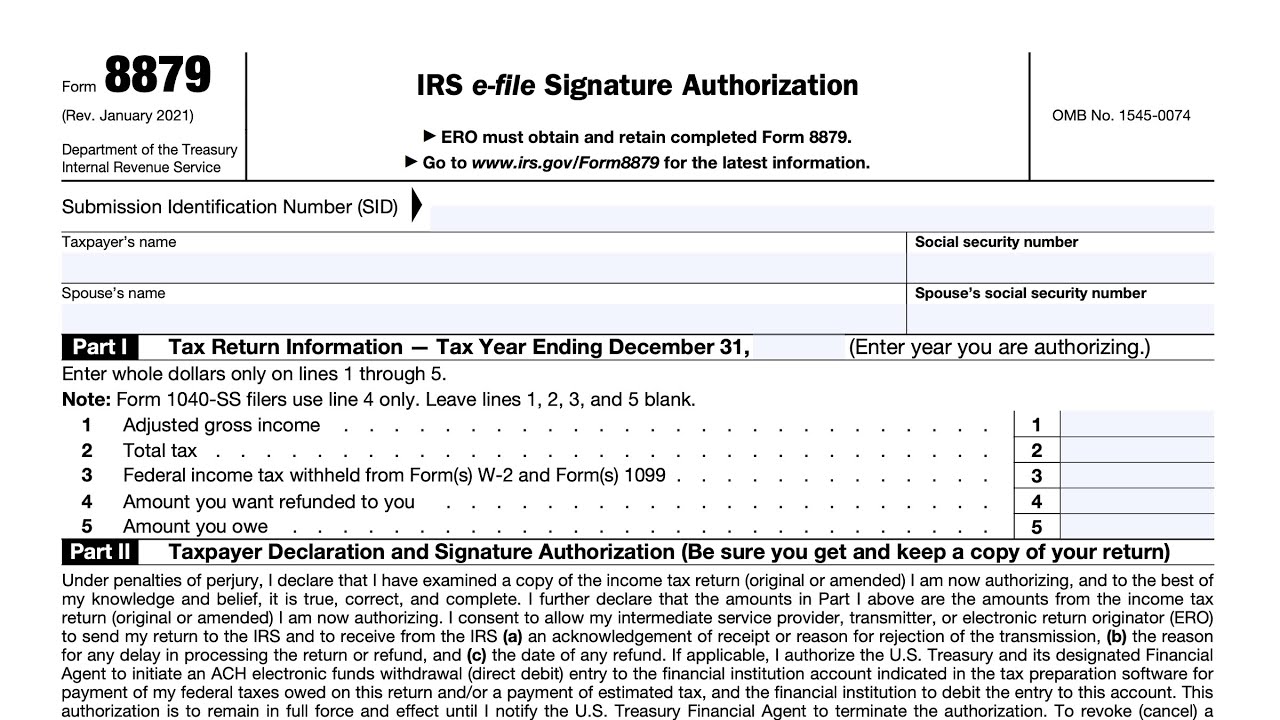

Downloadable Form 8879 IRS EFile Signature Authorization, 42 OFF

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278 —international penalties are assessed on form 8278, assessment.

Form 8278 Computation And Assessment Of Miscellaneous Penalties Form

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. It is essential for taxpayers seeking to.

IRS Tax Form 4506T Automation for Document Processing

It is essential for taxpayers seeking to resolve. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and.

TAX Refund Check Your IRS Tax Return Status, Refund Timetable & Date

It is essential for taxpayers seeking to resolve. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form.

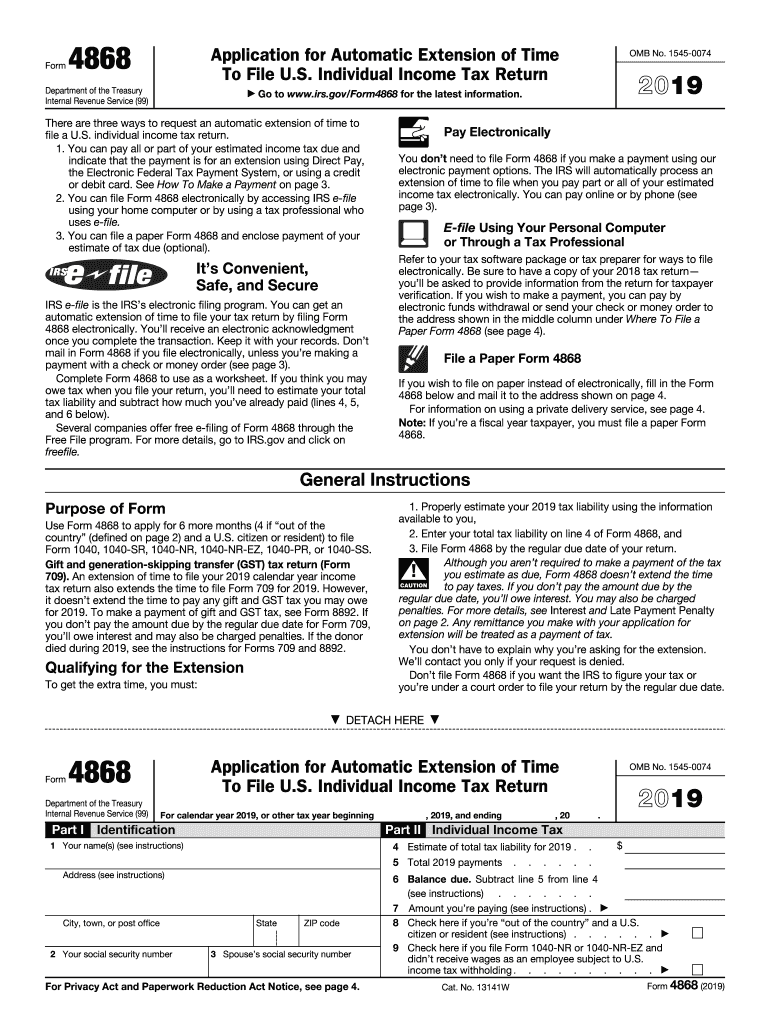

Irs Gov Printable Forms

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. It is essential for taxpayers seeking to.

Fillable Online irs irs Fax Email Print pdfFiller

Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. It is essential for taxpayers seeking to resolve. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form.

IRS Extends 2022 Tax Deadline to October 16 for CA Disaster Victims

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. It is essential for.

Fillable Form 8278 Assessment And Abatement Of Miscellaneous Civil

Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278.

A Frivolous Return Penalty Fraud

It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and.

IRS FORM 5498 Automated Systems, Inc.

It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form.

Form 8278 —International Penalties Are Assessed On Form 8278, Assessment And Abatement Of Miscellaneous Civil Penalties, With A Form 886.

Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date.